Ziyan Foods lança instituto de pesquisa em inovação para impulsionar o desenvolvimento de produtos

Ziyan Foods lança instituto de pesquisa em inovação para impulsionar o desenvolvimento de produtos

Estabelecendo um instituto de pesquisa para enfrentar o desafio de criar produtos de grande sucesso: Ziyan Foods acelera a “autorrevolução”

Comida R&D é diferente de outros campos e requer atenção aos detalhes. Nos últimos anos, pesquisa e desenvolvimento na indústria alimentícia tem recebido importância crescente.

Na manhã de novembro 17, a cerimônia de inauguração do Ziyan Food Innovation Research Institute foi realizada no condado de Guanyun, Lianyungang.

Como marca bem conhecida na indústria de refogados e participante de um setor relativamente maduro, por que a Ziyan Food estabeleceu seu próprio Instituto de Pesquisa em Inovação? Zhong Huaijun, o Diretor do Instituto de Pesquisa de Inovação Alimentar Ziyan, afirmou, “À medida que os padrões de vida das pessoas continuam a melhorar, os consumidores exigem cada vez mais maior qualidade e experiências alimentares. O estabelecimento de um instituto de pesquisa pela Ziyan Food é baseado nessas demandas de mercado e tendências de desenvolvimento.” Zhong Huaijun acrescentou que a Ziyan Food continuará a explorar e desenvolver a indústria de alimentos saudáveis, garantir que a investigação futura não se concentre apenas no sabor e na segurança, mas também na saúde.

É relatado que o Ziyan Food Innovation Research Institute realizará três funções principais: lançar mais produtos novos que se alinhem com as tendências do mercado e as demandas dos consumidores, garantindo alta qualidade do produto e segurança alimentar, e convertendo rapidamente os resultados da pesquisa em produtividade.

No evento, um repórter da Blue Whale Finance notou que o Ziyan Food Innovation Research Institute havia planejado várias áreas funcionais, incluindo uma área de exposição corporativa, área de degustação de produtos, área de pesquisa de tecnologia de sabores, área de avaliação sensorial, e área de análise de instrumentos. A Ziyan Food também otimizou e atualizou seu produto existente R&Centro D em termos de software e hardware, por exemplo, adquirindo uma série de equipamentos líderes nacionais e internacionais de processamento e teste de alimentos e trazendo pesquisadores profissionais de sabores e talentos de alta tecnologia.

De acordo com informações disponíveis, Ziyan Food é um produtor em grande escala de alimentos refogados na China, focando no R&D, produção, e vendas de produtos refogados. Os principais produtos da empresa incluem “Fatias de Pulmão para Marido e Mulher,”“Frango Baiwei,”E“Frango Tengjiao,”que são feitos de aves, como frango, pato, carne bovina, carne de porco, assim como vegetais, frutos do mar, e produtos de soja. Estes produtos são utilizados principalmente como acompanhamento de refeições, complementado pelo consumo casual, com a marca principal sendo “Ziyan”.

Apesar de ter uma linha de produtos diversificada, o principal produto “Husband and Wife Lung Slices” continua sendo um forte impulsionador de vendas. De acordo com Ziyan Food's 2023 relatório semestral, produtos frescos contribuíram 86.08% da principal receita comercial da empresa, com o produto “estrela” “Husband and Wife Lung Slices” gerando vendas de 543 milhão de yuans, contabilidade para 31.59%.

“Sempre tentamos criar produtos mais famosos, como ‘Husband and Wife Lung Slices’ e ‘Tengjiao Chicken’., este ano lançamos produtos como Carne Refrescante, Pés De Porco Refrescantes, Fatias de Frango Bobo, e pedaços crocantes. Mas na verdade é muito desafiador superar esses dois produtos, porque nossos clientes geralmente pensam primeiro em frango Tengjiao e fatias de pulmão de marido e mulher, e depois compre alguns outros. Nós quebramos a cabeça tentando nos superar, e muitas vezes as coisas não saem como planejado, mas devemos continuar lançando produtos com vitalidade,”Zhong Huaijun disse. “Costumo dizer que foi como o WeChat superou o QQ; podemos criar outro e nos revolucionar?”

É relatado que a Ziyan Food estabeleceu longo prazo, parcerias estáveis com grandes fornecedores como Wens Foodstuff Group, Grupo Nova Esperança, e o Grupo COFCO para o fornecimento de matérias-primas essenciais, como frangos inteiros, carne bovina, e subprodutos de pato. Isso permite que a empresa obtenha produtos frescos, ingredientes de alta qualidade desde a origem e, contando com suas cinco bases de produção, formar um sistema completo de cadeia de suprimentos com a distância ideal de entrega da cadeia de frio conforme o raio de radiação, fornecimento rápido, e máxima frescura. Os pedidos feitos no dia anterior são produzidos no mesmo dia e entregues nas lojas no mesmo dia ou no dia seguinte, garantindo o frescor dos produtos.

Vale ressaltar que a atualização da cadeia de abastecimento da Ziyan Food também otimizou seu lado de custos. A Ziyan Food afirmou em seu relatório financeiro que os preços das matérias-primas estão próximos da faixa dos anos anteriores, e a empresa fortaleceu a otimização da cadeia de suprimentos, processos de produção melhorados, e tecnologia atualizada, resultando em melhorias significativas no lucro líquido.

De acordo com Ziyan Food's 2023 relatório do terceiro trimestre, a empresa obteve receita operacional de aproximadamente 882 milhões de yuans nos primeiros três trimestres. A margem de lucro bruto da empresa foi 24.19%, acima 6.69 pontos percentuais ano a ano; a margem de lucro líquido foi 12.06%, acima 3.94 pontos percentuais ano a ano. Olhando para os indicadores trimestrais, no terceiro trimestre de 2023, a margem de lucro bruto da empresa foi 29.17%, acima 11.07 pontos percentuais em termos anuais e 6.18 pontos percentuais em termos trimestrais; a margem de lucro líquido foi 15.15%, acima 5.38 pontos percentuais em termos anuais e 1.67 pontos percentuais em termos trimestrais.

Além disso, expandir seu segmento de mercado é uma das estratégias de aumento de receita da Ziyan Food. Após seu investimento estratégico na Lao Han Bian Chicken em junho, A Ziyan Food deu outro passo em setembro ao investir estrategicamente na Jing Cui Xiang. O presidente da Ziyan Food, Ge Wuchao, afirmou que a firmeza e a exploração diversificada são dois aspectos inseparáveis do desenvolvimento empresarial. A firmeza é a base do desenvolvimento da empresa; desde a criação da empresa, estamos profundamente engajados no mercado de acompanhamentos refogados, comprometidos em consolidar nossa posição de liderança no setor. No entanto, com as mudanças no ambiente de mercado e a diversificação das necessidades dos consumidores, vemos também a necessidade de explorar novas oportunidades de desenvolvimento nas bases existentes. A empresa continua a explorar caminhos de desenvolvimento diversificados, lançando diversas submarcas, como “Feng Si Niang Qiaojiao Beef,”“Shaguo Zhuangyuan,”E“ Jiaoyan Jiaoyu,”Abrangendo categorias como jantares casuais e comida refogada casual, bem como parcerias estratégicas com marcas de alimentos como Lao Han Bian Chicken e Jing Cui Xiang. Esta estratégia abre oportunidades de crescimento mais amplas para a empresa. Através de um layout estratégico diversificado, a empresa pode responder rapidamente às mudanças do mercado, aumentar a competitividade geral, e consolidar ainda mais a sua posição de liderança na indústria para alcançar o desenvolvimento a longo prazo.

Por outro lado, com o forte impulso da recuperação da indústria da restauração, a competição também se tornou mais intensa. Ge Wuchao admitiu que depois da pandemia, a demanda do consumidor mudou, com maior foco na segurança alimentar e saúde. Adicionalmente, à medida que o poder de compra dos consumidores se recupera, pode atrair mais concorrentes para o mercado. Portanto, A Ziyan Food precisa fortalecer a construção da marca e os esforços de marketing para aumentar a influência da marca e a participação no mercado para manter sua posição de liderança no setor. Fortalecendo ainda mais o produto R&D e controle de qualidade para fornecer mais segurança, produtos mais saudáveis que melhor atendam às necessidades do consumidor é essencial.

Indústria de frango Qingyuan prospera: Quatro Empresas Recebem Placas de Indicação Geográfica

Recentemente, O distrito de Qingcheng sediou a reunião de promoção do desenvolvimento de alta qualidade da indústria “Frango Qingyuan”, onde quatro empresas foram galardoadas com a Marca Especial de Indicação Geográfica “Frango Qingyuan”. O vice-prefeito Lei Huankun entregou placas ao Guangdong Tian Nong Food Group, Criação de Frangos Qingyuan Sanyuan Qingyuan, Comida Ecológica Guangdong Tian Nong, e Desenvolvimento Agrícola de Guangdong Dongfeng.

Uma indicação geográfica significa a qualidade única de um produto relacionada com a sua origem. O Departamento de Supervisão de Mercado do distrito de Qingcheng forneceu apoio “individual” para garantir que as empresas atendiam aos critérios para usar a marca “Frango Qingyuan”, incluindo inspeções no local, verificação de origem, e testes de qualidade do produto. Adicionalmente, foi lançada uma campanha para proteger a indicação geográfica através de verificações aleatórias e colaboração interdepartamental, proteção contra uso não autorizado.

Em 2022, empresas marcadas com “Frango Qingyuan” no distrito de Qingcheng atingiram um valor de produção total de 3.015 Bilhão Yuan, um 130% Aumento ano a ano, com receitas atingindo 1.213 Bilhão Yuan. Distrito de Qingcheng concentra-se em uma estrutura de desenvolvimento abrangente, integrando o melhoramento genético de sementes, R tecnológico&D, Processamento profundo, logística, e vendas de marca para aprimorar a indústria de frango Qingyuan.

Olhando para frente, O distrito de Qingcheng pretende impulsionar a marca “Frango Qingyuan” como parte do “Projeto Cento e Dez Mil”. Os esforços incluirão o fortalecimento da proteção dos recursos genéticos, melhorando a gestão da qualidade, expandindo o processamento profundo, e promover o significado cultural do frango Qingyuan para alcançar um crescimento industrial de alta qualidade e solidificar seu status como um ícone da cidade.

HEMEI AGRICULTURA INVESTE 10 MILHÕES DE YUAN EM NOVA SUBSIDIÁRIA NA CIDADE DE CHONGZUO, PROVÍNCIA DE GUANGXI

Agricultura Hemei (833515) anunciou seu plano de estabelecer uma subsidiária integral na cidade de Chongzuo, Província de Guangxi, com um investimento de 10 milhão de yuans. Esta mudança está alinhada com a estratégia de desenvolvimento futuro da empresa para otimizar a alocação de recursos e aumentar a competitividade. A nova subsidiária terá como foco a produção, vendas, processamento, transporte, e armazenamento de produtos agrícolas, Junto com outros serviços, como vendas de alimentos, gestão da cadeia de abastecimento, e armazenamento.

Principais atividades de negócios:

A subsidiária se envolverá:

- Produção, vendas, e processamento de produtos agrícolas

- Atacado e varejo de produtos agrícolas comestíveis

- Serviços de consultoria de informações

- Vendas de máquinas agrícolas e necessidades diárias

- Importação e exportação de mercadorias

- Gestão da cadeia de abastecimento

- Distribuição urbana e transporte de frete rodoviário

Fins de investimento:

O investimento tem como objetivo expandir o layout da cadeia de suprimentos da Hemeei Agricultura, Melhorar compras e gerenciamento centralizadas, e melhorar a lucratividade e competitividade gerais. Essa mudança estratégica fortalecerá ainda mais as parcerias regionais de longo prazo e explorará novas oportunidades de mercado.

Avaliação de risco e impacto:

A Companhia afirma que esse investimento carrega um risco mínimo, Dado seu alinhamento com os objetivos estratégicos da Hemei Agricultura. Controles internos aprimorados, estratégias de negócios claras, e uma forte equipe de gerenciamento será estabelecida para proteger os interesses dos acionistas. Espera -se que o investimento impacte positivamente as demonstrações financeiras consolidadas da empresa e a condição financeira futura.

A Hemei Agriculture é especializada no fornecimento de “Logística da cadeia de frio e serviços de distribuição para produtos agrícolas e laterais frescos,”Servindo clientes, incluindo instituições educacionais, organizações militares, e instituições públicas.

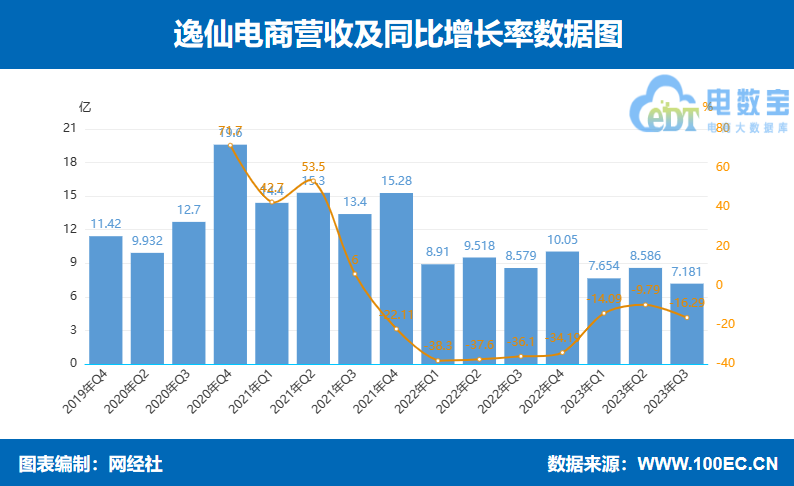

A RECEITA DO 3º T DA YATSEN HOLDING DECLINA EM 16.3% EI PARA 718.1 MILHÕES DE YUAN

Yatsen E-commerce divulgou seu relatório financeiro para o terceiro trimestre encerrado em setembro 30, 2023. A empresa relatou receita líquida total de RMB 718.1 milhão, marcando uma diminuição anual de 16.3%. Apesar da queda nas receitas, O prejuízo líquido de Yatsen foi reduzido em 6.1% ano a ano para RMB 197.9 milhão. Em uma base não-GAAP, no entanto, o prejuízo líquido expandido em 3.0% ano a ano para RMB 130.2 milhão. O lucro bruto do trimestre foi de RMB 512.8 milhão, abaixo 13.3% ano após ano, com uma margem bruta de 71.4%, comparado com 68.9% no mesmo período em 2022.

As despesas operacionais totais da Yatsen foram de RMB 744.3 milhão, um 13.1% diminuir ano a ano. As despesas de cumprimento foram reduzidas para RMB 56 milhões de RMB 63.8 milhões no mesmo período em 2022. As despesas com vendas e marketing também tiveram redução, caindo para RMB 511.7 milhões de RMB 564.8 milhão. Despesas gerais e administrativas diminuíram para RMB 151.8 milhão, enquanto R&Despesas D diminuíram para RMB 24.7 milhão. O prejuízo operacional diminuiu em 12.9% para RMB 231.5 milhão, embora em uma base não-GAAP, expandiu-se por 1.2% para RMB 164.6 milhão.

Fundador do comércio eletrônico Yatsen, Presidente, e CEO, Huang Jin Feng, afirmou: “No terceiro trimestre, as três principais marcas de cuidados com a pele da empresa tiveram um crescimento constante. Enquanto isso, A principal marca de Yatsen, Diário Perfeito, continuou a reforçar a força da sua marca através de uma nova identidade visual e do lançamento de novos produtos importantes. Estamos otimistas quanto ao futuro, e de acordo com a orientação de desempenho do quarto trimestre da empresa, espera-se que a receita total cresça ano a ano.

Fundado em 2016, Guangzhou Yatsen E-commerce Co., Ltda. foi reconhecida como uma empresa inovadora “Unicórnio” em Guangzhou em 2019, tornando-o o único unicórnio do comércio eletrônico da cidade na época.

Outras empresas de varejo digital listadas na China

- Comércio eletrônico abrangente: Alibaba, JD.com, Pinduoduo, Loja VIP, Suning. com, GOME Varejo, Todas as coisas novas, Seco, Yunji.

- Comércio eletrônico com transmissão ao vivo: Kuaishou, Tecnologia Yaowang, Eu posso, Seleção Oriental, Jiao Ge Peng Você.

- Comércio eletrônico de alimentos frescos: Dingdong Maicai, Missfresh, Pagode.

- Comércio eletrônico de automóveis: Você também, Uxin.

- Guia de compras E-commerce: SMZDM (O que vale a pena comprar), Fanli. com.

- Comércio eletrônico parcelado: Qudian, Lexina.

- Provedores de serviços de comércio eletrônico de varejo: Youzan, Weimob, Grupo Yueshan, Tecnologia Guangyun, E-commerce Baozun, Youquhui, Linda maquiagem de beleza, Ruoyuchen, Participações Qingmu.

- Comércio eletrônico vertical: Grupo Babytree, Kutesmart, Rede Wunong, Boqii Pet.

- Comércio eletrônico de marca: Grupo Xiaomi, Urso Eletrodomésticos, Gerenciou, Três esquilos, Yujiahui, E-commerce Yatsen, Participações Rongmei, Comércio eletrônico Nanjiren.

Ao focar no desenvolvimento estratégico da marca e aumentar sua presença no mercado, Yatsen pretende enfrentar os desafios do cenário competitivo do comércio eletrônico.

A rentabilidade pode salvar o preço das ações? Depois que Dingdong Maicai registrou lucros positivos por quatro trimestres consecutivos, o preço de suas ações caiu para $2.

A partir do fechamento em novembro 22, O preço das ações da Dingdong Maicai ficou em $2.07 por ação, representando um declínio acumulado no ano 51.52%, com um valor de mercado total atual de $491 milhão.

Pesquisador Zhuoma, Os tempos de investimento

Dingdong Maicai divulgou recentemente seus resultados financeiros não auditados para o terceiro trimestre de 2023, que terminou em setembro 30.

O relatório financeiro mostra que Dingdong Maicai alcançou a receita total de 5.14 Bilhão Yuan no terceiro trimestre deste ano, uma diminuição anual de 13.51%. O volume bruto de mercadoria (GMV) alcançado 5.67 Bilhão Yuan, um aumento de quarto a trimestre de 6.4%. A empresa publicou um lucro líquido de 2.1 milhão de yuans, em comparação com uma perda de 345 milhões de yuan no mesmo período do ano passado. O não-GAAP (Princípios contábeis não generalmente aceitos) O lucro líquido foi 16 milhão de yuans, em comparação com uma perda de 285 milhões de yuan no mesmo período do ano passado. Notavelmente, Isso marca o quarto trimestre consecutivo em que Dingdong Maicai alcançou lucratividade não-GAAP desde o quarto trimestre de 2022.

Fundador e CEO de Dingdong Maicai, Liang Changlin, declarou durante a chamada dos ganhos de que a lucratividade contínua se devia à estratégia da empresa de "priorizar a eficiência e manter uma escala moderada". Ele também mencionou que Dingdong Maicai era uma das primeiras empresas do setor a alcançar a lucratividade, descrevendo a jornada como "longa e desafiadora".

A lucratividade tem sido um desafio significativo para muitas plataformas de comércio eletrônico de alimentos frescos, e estabilizar a lucratividade é uma questão que muitas empresas devem abordar. Em meio ao pano de fundo da declínio de entradas de capital, aumento da concorrência do mercado, e custos crescentes, Dingdong Maicai adotou uma série de medidas, incluindo a retirada de certas cidades, reduzindo custos, e melhorar a eficiência, Escala de sacrifício para lucratividade sustentável. Esses esforços parecem estar dando frutos até agora.

No entanto, Em termos de preço das ações, O mercado ainda não reconheceu os esforços de Dingdong Maicai. A partir do fechamento em novembro 22, O preço das ações da Dingdong Maicai ficou em $2.07 por ação, representando um declínio acumulado no ano 51.52%, com um valor de mercado total atual de $491 milhão.

Desempenho do preço das ações de Dingdong Maicai desde a listagem (USD)

Fonte: Vento

A receita caiu ano a ano no terceiro trimestre

O relatório financeiro mostra que Dingdong Maicai alcançou a receita total de 5.14 Bilhão Yuan (RMB, o mesmo abaixo) No terceiro trimestre deste ano, comparado com 5.943 bilhão yuan no mesmo período do ano passado, uma diminuição de 13.51% ano após ano. GMV para o trimestre foi 5.67 Bilhão Yuan, um aumento de quarto a trimestre de 6.4%.

Dingdong maicai atribuiu o declínio da receita à sua retirada de várias cidades e locais em 2022 e o segundo trimestre deste ano. Adicionalmente, O aumento significativo das atividades de viagem ao consumidor e do consumo offline pós-pós-panorâmica contribuíram para o declínio ano a ano nas vendas do terceiro trimestre de Dingdong Maicai.

Em relação ao crescimento do GMV, A empresa afirmou que era devido a um aumento de quarto a trimestre no volume da ordem e valor médio da ordem (AOV) de 6.0% e 0.5%, respectivamente. O aumento no volume de pedidos foi impulsionado principalmente por uma frequência mensal de ordem e crescimento rápido das ordens das regiões de Jiangsu e Zhejiang.

Em termos de composição de receita, A renda de Dingdong Maicai é derivada da receita do produto e receita, com a receita do produto sendo a principal fonte.

No terceiro trimestre, O negócio de produtos de Dingdong Maicai gerado 5.083 bilhão de yuan em receita, comparado com 5.872 bilhão yuan no mesmo período do ano passado, uma diminuição anual de 13.45%. Esse declínio na receita do produto foi o principal motivo da queda geral da receita no terceiro trimestre. Durante o mesmo período, A receita dos negócios de serviço foi 57 milhão de yuans, comparado com 70 milhões de yuan no mesmo período do ano passado, uma diminuição anual de 18.45%, principalmente devido a um aumento temporário nos números de associação em 2022 Durante a pandemia.

O relatório financeiro também mostra que os custos operacionais e despesas operacionais totais de Dingdong Maicai no terceiro trimestre deste ano foram 5.164 Bilhão Yuan, uma diminuição anual de 17.62% de 6.268 bilhão yuan no mesmo período do ano passado. Especificamente, O custo das vendas da empresa para o trimestre foi 3.577 Bilhão Yuan, abaixo 13.94% ano a ano de 4.157 bilhão yuan no mesmo período do ano passado. O custo das vendas como uma porcentagem da receita total também diminuiu de 70.0% ano passado para 69.6% neste trimestre.

Enquanto isso, As despesas de entrega da empresa para o terceiro trimestre foram 1.199 Bilhão Yuan, comparado com 1.595 bilhão yuan no mesmo período do ano passado, uma diminuição anual de 24.82%. As despesas de entrega como porcentagem da receita total também caíram 26.8% no mesmo período do ano passado para 23.3%.

Adicionalmente, As despesas de vendas e marketing do terceiro trimestre de Dingdong Maicai foram 98 milhão de yuans, uma diminuição anual de 22.75% de 127 milhões de yuan no mesmo período do ano passado, principalmente devido à retirada da empresa de algumas cidades em 2022 e o segundo trimestre deste ano. Despesas gerais e administrativas foram 89 milhão de yuans, uma diminuição anual de 33.0% de 133 milhões de yuan no mesmo período do ano passado, principalmente devido à melhoria da eficiência dos funcionários. As despesas de desenvolvimento de produtos foram 199 milhão de yuans, uma diminuição anual de 21.84% de 255 milhões de yuan no mesmo período do ano passado, principalmente devido ao aumento da eficiência entre os r da empresa&Pessoal.

Em termos de lucratividade, Dingdong Maicai alcançou um lucro líquido de 2.1 milhões de yuan no terceiro trimestre deste ano, em comparação com uma perda de 345 milhões de yuan no mesmo período do ano passado. O lucro líquido não-GAAP foi 16 milhão de yuans, em comparação com uma perda de 285 milhões de yuan no mesmo período do ano passado. A margem de lucro bruta para o trimestre aumentou um pouco de 30.0% no mesmo período do ano passado para 30.4%.

Até o final de setembro deste ano, Dingdong Maicai tinha dinheiro e equivalentes em dinheiro e investimentos de curto prazo, totalizando 5.632 Bilhão Yuan, comparado com 6.493 Bilhão Yuan no final de dezembro 2022.

Quatro trimestres consecutivos de lucratividade não-GAAP

Dingdong Maicai foi fundado em 2017 e foi público na Bolsa de Valores de Nova York em junho 2021.

Relatórios financeiros anteriores e o prospecto mostraram que Dingdong Maicai estava em um estado de fusão de perdas a longo prazo. De 2019 para 2021, As receitas maiciai do Maiciai de 3.88 Bilhão Yuan, 11.336 Bilhão Yuan, e 20.121 Bilhão Yuan, respectivamente, com perdas líquidas correspondentes de 1.873 Bilhão Yuan, 3.177 Bilhão Yuan, e 6.429 Bilhão Yuan.

Em 2022, O ponto de serra de desempenho da maicai, com lucratividade não-GAAP de 116 milhões de yuan no quarto trimestre daquele ano. No primeiro e segundo trimestres deste ano, Dingdong Maicai obteve lucros líquidos não-GAAP de 6.1 milhões de yuan e 7.5 milhão de yuans, respectivamente. Com o terceiro trimestre incluído, Dingdong Maicai agora alcançou lucratividade não-GAAP por quatro trimestres consecutivos.

Durante a chamada de ganhos, Liang Changlin enfatizou que a lucratividade contínua da empresa se deveu à sua estratégia de "priorizar a eficiência e manter uma escala moderada". Ele também afirmou, “Foi uma jornada longa e desafiadora para chegar aqui, Mas nossa adesão aos nossos princípios e visão nos manteve no caminho certo. ” Adicionalmente, sobre o desempenho deste ano, Liang Changlin expressou confiança em alcançar a lucratividade não-GAAP no quarto trimestre e o ano inteiro de 2023.

Juewei Foods ajusta estrutura de capital, Adia temporariamente o plano de IPO de Hong Kong

Notícias sobre finanças da Pinecone: Em novembro 23, A Juewei Foods anunciou em sua plataforma de interação com investidores que seu plano de listagem em Hong Kong está atualmente suspenso. Anteriormente, A Juewei Foods anunciou publicamente sua intenção de realizar um IPO em Hong Kong, afirmando que a mudança teve como objetivo “acelerar a estratégia de internacionalização da empresa, Aumente suas capacidades de financiamento no exterior, e fortalecer ainda mais sua base de capital e competitividade geral. ”

Em sua resposta, Juewei Foods não forneceu uma explicação detalhada para o adiamento de seu plano de listagem de Hong Kong. No entanto, O secretário do Conselho da Companhia mencionou que a Juewei Foods continuará a avançar seu planejamento de investimentos com base em suas diretrizes estratégicas estabelecidas e objetivos de negócios. A empresa já teve sucesso inicial em suas iniciativas de ecossistema alimentar. Aproveitando sua experiência de longo prazo no setor, bem como sua experiência em redes de distribuição de cadeia fria e gerenciamento de lojas de cadeia, A Juewei Foods está apoiando totalmente suas empresas parceiras do ecossistema para padronizar a produção, melhorando a eficiência, e alcançar altos níveis de coordenação. Aderir aos princípios de “centrado no projeto, orientado por serviço, e layout industrial orientado a resultados, Juewei Foods pretende enfrentar desafios, buscar desenvolvimento, e criar valor junto com seus parceiros ecossistêmicos.

Benlai Life International abre um novo capítulo na cadeia de suprimentos “frescos”: Trazendo mais iguarias globais para as mesas dos consumidores chineses

Relatório do China Economic Herald e da Rede de Desenvolvimento da China por Pi Zehong: A variedade de ingredientes nas mesas de jantar das famílias chinesas hoje passou por uma transformação dramática em comparação com uma década atrás. Ingredientes importados como kiwis Zespri da Nova Zelândia, Azeite extra virgem italiano, e camarão branco equatoriano tornou -se componentes essenciais de refeições diárias para famílias chinesas. Essa mudança é impulsionada pelo rápido crescimento do comércio agrícola global fresco e pela ascensão das plataformas chinesas de comércio eletrônico.

Benlai Life foi uma das primeiras plataformas da China a vender alimentos frescos importados, como cerejas e durianos online. Como pioneiro em compras diretas de regiões de produção, Este modelo único também foi aplicado à construção de sua cadeia de suprimentos no exterior. Sobre o passado 11 anos, A plataforma otimizou e integrou continuamente sua cadeia de suprimentos global, Oferecendo aos consumidores domésticos uma variedade maior de produtos importados. Ao mesmo tempo, Ele alavancou a força do seu produto, força do canal, força da marca, e força de recursos para capacitar as marcas estrangeiras para expandir e se desenvolver no mercado chinês.

Hoje, bens importados de mais de 50 Países ao redor do mundo chegaram às mesas dos consumidores chineses através da vida de Benlai. Produtos como a Nova Zelândia Weebiz pasteurizados com leite fresco e cerejas que lutam pelo ar dos Estados Unidos tornaram-se as principais opções para usuários que buscam um estilo de vida de alta qualidade.

Por trás do “Freshness Ultimate” está o olho e o artesanato exigentes dos compradores, bem como o apoio de uma "cadeia de frio do ar" altamente eficiente. A cadeia internacional “fresca” que se estende de origens no exterior a mesas de jantar chinesas garante que os usuários da vida da vida de Benlai possam desfrutar de novos produtos globais com lag de tempo zero.

Nova Zelândia para a China: Jornada de 72 horas de Bordro de 72 horas de leite de alta qualidade

A marca de leite pasteurizada da Nova Zelândia, Weebiz, está disponível na vida de Benlai há oito anos. Como uma das primeiras marcas de leite fresco importado a entrar na China, tornou -se uma escolha de qualidade para milhões de famílias.

A Nova Zelândia é reconhecida globalmente como uma fonte premium de leite, Graças à sua localização geográfica única, que preserva um intocado, ambiente natural sem poluição e isola-o de doenças animais comuns encontradas em outras regiões. Os produtores de laticínios locais usam métodos de pastagem tradicionais, permitindo que as vacas se alimentem naturalmente de grama exuberante, garantindo o crescimento saudável das vacas e a pureza e segurança do leite.

O leite normalmente entra no mercado em duas formas: leite fresco e leite ambiente. Leite fresco sofre pasteurização, que mantém o valor nutricional máximo e o sabor natural do leite, mas também contém uma pequena quantidade de microorganismos inofensivos ou benéficos, resultando em uma vida útil mais curta e na necessidade de refrigeração.

Xing Yan, um comprador sênior de laticínios na Benlai Life, é bem versado na cadeia de suprimentos e marcas globais de laticínios. Ela cuidadosamente selecionou Weebiz, Uma marca premium co-produzida pela renomada fazenda de laticínios orgânicos da Nova Zelândia Marphona e Green Valley Dairies Limited, O segundo maior processador de leite do país. Este produto sofre pasteurização no padrão dourado de 72 ° C para 15 segundos e continua sendo atualizado em natural, Condições sem aditivos, com um teor de proteína do leite de 3,6g/100ml, superior ao padrão da UE.

Com uma vida útil de apenas 15 dias, O leite pasteurizado precisa ser armazenado em um ambiente de cadeia de frio, que impõe altas demandas aos recursos de logística. O serviço de entrega Weebiz da Benlai Life abrange cidades de primeira linha como Pequim, Xangai, Guangzhou, e Shenzhen, bem como várias outras cidades. Cada garrafa de leite pasteurizado com weebiz é produzido, embalado, esterilizado, e testado na Nova Zelândia antes de ser carregado em um voo de corrente fria diretamente para a China. Em seguida, é entregue às mãos dos usuários apenas depois de passar as rigorosas inspeções do Bureau Nacional de Inspeção e Quarentena da China, alfândega, e monitoramento rigoroso de controle de qualidade da Benlai Life.

“Para melhorar a eficiência logística, Capitamos a folga do canal verde para o leite weebiz. Após a produção no domingo na fazenda da Nova Zelândia, O leite é enviado pela primeira vez para inspeção local e depois voado para a China na segunda -feira. Funcionários aduaneiros mantêm quatro caixas de cada lote para inspeção, permitindo que o resto limpe a alfândega e seja armazenada,Xing Yan explicou.

Com o apoio do sistema de cadeia de suprimentos global altamente eficiente da Benlai Life, O leite pasteurizado com Weebiz pode ser atingido pela Nova Zelândia para as mesas de jantar da cidade chinesa em apenas pouco 72 horas.

Estados Unidos para a China: As regras de frescura de mil milhas para cerejas delicadas

Nos últimos anos, As cerejas se tornaram a "melhor tendência" no mercado de frutas domésticas. Benlai Life introduziu cerejas importadas o momento em que 2013.

Uma história interessante de seleção de produtos uma vez circulada dentro da empresa. Quando as cerejas se tornaram populares, Um grupo de usuários de longa data da Benlai Life desenvolveu uma preferência por "cerejas amarelas" (cerejas douradas) Devido ao seu gosto único, Apesar do preço mais alto em comparação com as "cerejas vermelhas" mais comuns. Esses usuários também tinham maiores expectativas para a vida de Benlai, exigindo que a plataforma selecione cuidadosamente as origens e as marcas das “cerejas amarelas” enquanto refinam ainda mais a seleção das melhores variedades e produtos de qualidade para as “cerejas vermelhas” globalmente.

Para atender às demandas de qualidade dos usuários por cerejas importadas, A vida de Benlai tem, desde 2016, Introduziu "cerejas amarelas" e "cerejas vermelhas" cuidadosamente selecionadas de regiões premium nos Estados Unidos. A empresa fez uma parceria com a China Eastern Airlines para lançar o primeiro modelo de voo charter de financiamento coletivo do setor. Depois de ser colhido, As cerejas são pré-resfriadas, classificado, e embalado nos EUA. pomares, Em seguida, a via aérea diretamente para a China pela China Eastern Airlines, entregando as cerejas mais frescas para usuários domésticos.

Para trazer essas cerejas delicadas para os usuários, Benlai Life adotou um modelo de ordem de pré-venda, onde o fornecimento é determinado por vendas. Este modelo de vendas pode parecer simples, mas exige extrema precisão no complexo processo de importação de produtos frescos.

O primeiro desafio é as condições climáticas. Geralmente, Benlai Life recebe dezenas de milhares de ordens de cereja uma semana antes da colheita. No entanto, Se chover durante a colheita, As cerejas não podem ser colhidas porque são propensas a moldar e apodrecer depois de escolher. Se as cerejas absorverem muita água, Eles podem quebrar e estourar quando expostos à luz solar após a chuva, reduzindo significativamente sua qualidade. Isso exige que a equipe de compra realize um trabalho preliminar completo, estudar cuidadosamente o clima local, e monitorar de perto as condições climáticas nas regiões em crescimento.

Adicionalmente, em todo o ar, desembaraço alfandegário, e transporte para o armazém, A temperatura deve ser "controlada com precisão". Se a temperatura flutua em mais de 5 ° C, A condensação se formará na superfície das cerejas, levando a um declínio na qualidade.

A fase final é entrega. Encontrar o produto certo é apenas o primeiro passo; Concluir o processo de entrega completamente é essencial. A vida de Benlai garante que diferentes especificações de cerejas sejam entregues através de diferentes métodos de cadeia de frio para impedir que eles percam o frescor. Adicionalmente, Para evitar danos ou deterioração, A vida de Benlai proíbe estritamente manuseio difícil durante o processo de entrega.

Esta série de etapas meticulosas está enraizada no compromisso da Benlai Life em construir a menor cadeia internacional "fresca". “Nosso objetivo é garantir uma nova qualidade usando a logística mais precisa e eficiente, Entregando as cerejas para usuários com hastes verdes e gordura, frutos macios, em vez de usar outros métodos para prolongar significativamente sua vida útil,”Disse Maomao, um comprador de frutas na vida de Benlai.

Hoje, Cerejas importadas dos Estados Unidos se tornaram uma fruta de verão obrigatória para usuários da vida de Benlai. Cerejas de outras principais regiões, como o Chile, também são entregues aos usuários no auge da frescura e eficiência em diferentes estações através de voos e remessas diretas de charter.

O ideal de "comprar globalmente e vender globalmente" está se tornando uma realidade mais uma vez. Cada vez mais as iguarias “feitas para a China” estão se tornando a nova tendência, Enquanto os produtos frescos “Made in China” também estão vendo novas oportunidades.

O Applet da Benlai Life lançou seções com temas nacionais, como o "Pavilhão da Nova Zelândia,“Pavilhão do Chile,“Pavilhão da Tailândia,"E" Pavilhão da Itália,”Permitindo que os usuários experimentem uma variedade de sabores internacionais e as diversas culturas de diferentes regiões em todo o mundo em um só lugar. À medida que a cadeia internacional "fresca" da Benlai Life continua a se desenvolver rapidamente, Com a plataforma expandindo seu “círculo de amigos” global e aprofundando a cooperação com parceiros de qualidade, Mais produtos premium de todo o mundo chegarão às mesas de jantar da cidade chinesa com melhor qualidade e preços mais competitivos.

MISSFRESH RECEBE AVISO DE EXCLUSÃO DA NASDAQ

Missfresh anunciou que a aquisição de negócios sob o acordo de financiamento de capital e compra de ações anunciado anteriormente em agosto 3, 2023, bem como a transação no âmbito do acordo de transferência de ações anunciada em agosto 7, 2023, foram encerrados. Em novembro 15, o Painel de Audiência da Nasdaq notificou a Missfresh que havia decidido retirar os títulos da empresa da Nasdaq Stock Market LLC e suspender a negociação desses títulos em vigor na abertura dos negócios na sexta-feira, novembro 17. Após o término do período de recurso aplicável, Nasdaq preencherá um formulário 25 notificação de exclusão com os EUA. Comissão de Valores Mobiliários para concluir o processo de fechamento de capital.

As empresas de Ningbo competem no “oceano azul” de produtos médicos da cadeia de frio

Recentemente, na entrada do armazém de uma empresa de tecnologia na cidade de Mazhu, Yuyao, Ningbo, sobre 3,000 armários frigoríficos médicos de vários modelos foram totalmente montados e prontos para envio, destinado a ser exportado para os EUA. mercado.

“Muitos produtos farmacêuticos e vacinas exigem transporte e armazenamento na cadeia de frio. Nossa empresa é especializada em pesquisas, desenvolvimento, e produção de produtos médicos de cadeia fria. Nos últimos anos, A indústria médica da cadeia de frio viu novas oportunidades de crescimento, e o valor anual de produção de nossa empresa manteve uma taxa de crescimento de 15%. Este ano, Esperamos que nosso valor de saída alcance 80 milhão de yuans,”Disse Sun Ming, o gerente geral da empresa.

A empresa esteve profundamente envolvida na produção do sistema de refrigeração e r&D Indústria para quase 40 anos, Inicialmente, concentrando -se na produção de componentes de refrigeração, como condensadores e evaporadores. Depois de reestruturar 1999, A empresa se tornou uma empresa de tecnologia integrando R&D, produção, vendas, e serviço, com uma capacidade de produção anual de over 100,000 Unidades de produtos especiais de cadeia fria. Estabeleceu bases de produção em lugares como Jiangxi.

Depois de anos de desenvolvimento, Os produtos da cadeia médica da empresa tornaram-se OEM bem conhecidos (Fabricante de equipamentos originais) fornecedores no campo, reconhecido por instituições médicas em países desenvolvidos como a Europa e os Estados Unidos. Com uma forte reputação de mercado e alta qualidade do produto, Os produtos são exportados para mais de 60 países e regiões. Ao manter seu foco no mercado da cadeia de frio médica, A empresa também se expandiu para a pesquisa, desenvolvimento, e produção de produtos comerciais e rurais da cadeia fria, melhorando continuamente seus benefícios econômicos.

Qualidade e integridade são os fundamentos da sobrevivência da empresa. Nos últimos anos, A empresa passou sucessivamente certificações como os EUA. Ul, ETL, CE europeu, e as certificações SG do Japão. Ele adere estritamente ao sistema de gerenciamento da qualidade ISO9001 e ao sistema de gerenciamento ambiental ISO14000 para gerenciamento da qualidade do produto.

“Em comparação com geladeiras domésticas e comerciais, Os produtos médicos da cadeia fria exigem controle de temperatura mais preciso, Flutuações de temperatura menores, e maior dificuldade técnica na qualidade do sistema de refrigeração e proporções de refrigerante,”Disse Sun Ming. Após a montagem, Cada produto passa por uma série de medidas rigorosas de controle de qualidade, incluindo extração a vácuo, adição de refrigerante, e mais de quatro horas de teste de energia, Garantindo que não há brechas em nenhum processo de produção. Notavelmente, A empresa desenvolveu uma geladeira médica que pode atingir temperaturas tão baixas quanto -86 ° C, usado principalmente em instituições e laboratórios de pesquisa. Este produto se tornou um best -seller em over 10 países e regiões.

Tecnologia e talento são fontes vitais da competitividade principal da empresa. Atualmente, A empresa mantém 60 Direitos de Propriedade Intelectual, incluindo patentes nacionais e internacionais e direitos autorais de software. Foi reconhecido como uma empresa nacional de alta tecnologia, uma PME nacional baseada em tecnologia, e um provincial “especializado, Refinado, e nova PME ". A empresa investe 6% para 10% de seu valor anual de produção em pesquisa e desenvolvimento tecnológico. Nos últimos três anos, investiu sobre 10 milhões de yuan em projetos de transformação tecnológica, alcançar a qualidade mais estável do produto e melhorar significativamente a eficiência da produção. A empresa também implementou um projeto fotovoltaico solar, que salva mais do que 40% da energia da empresa anualmente.

Na fundação de estabelecer uma equipe de inovação, A empresa continua a aumentar seus esforços para atrair talentos inovadores, Colaborar ativamente com universidades como a Universidade de Xangai Jiao Tong, Zhejiang Sci-Tech University, e China Jiliang University on Industry-University-Research Partnerships para estabelecer em conjunto instituições de pesquisa e centros de tecnologia de engenharia.

A empresa está comprometida em melhorar sua competitividade através da transformação digital. Seu próximo passo é investir sobre 3 milhões de yuans para implementar um projeto de transformação e atualização de fábrica inteligente 5G Green, Com o objetivo de criar uma fábrica inteligente moderna avançada que impulsionará o desenvolvimento da empresa com energia renovada.

SUZHOU É O ÚNICO! PRODUTO FRESCO SHIXIANG SELECIONADO COMO “EMPRESA NACIONAL DE DEMONSTRAÇÃO DE E-COMMERCE 2023”

Recentemente, o Departamento de Comércio Eletrônico e Informatização do Ministério do Comércio emitiu um documento reconhecendo as empresas selecionadas como “Empresas Nacionais de Demonstração de Comércio Eletrônico de 2023”. Produtos frescos Shixiang com sede em Suzhou (Jiangsu Suiyi Tecnologia da Informação Co., Ltda.) foi listado entre os homenageados. Em novembro 23, o 2023 Conferência de comércio eletrônico da China Jiangsu, com o tema “Aprofundando a Integração Digital-Física para Promover a Revitalização Industrial,”Que herói em Kunshan. Durante a conferência, foi realizada uma cerimônia de certificação 12 Empresas de Jiangsu, incluindo produtos frescos Shixiang, que também é a única empresa de Suzhou a ser nomeada no 2023 lista.

Esta seleção foi iniciada pelo Ministério do Comércio com o objetivo de identificar um grupo de “Empresas de Demonstração de Comércio Eletrónico” que tenham alcançado resultados notáveis na promoção da integração, melhorando o bem-estar público, impulsionando o desenvolvimento, revitalizando indústrias, melhorando o meio ambiente, e promovendo a abertura. Após avaliação, 132 empresas de demonstração de comércio eletrônico foram selecionadas e reconhecidas publicamente.

Este é o quarto ano consecutivo em que a Shixiang Fresh Produce foi nomeada Empresa Nacional de Demonstração de Comércio Eletrônico, destacando a sustentabilidade da empresa, estável, e rápido desenvolvimento no setor de comércio eletrônico e seu papel como líder na indústria. Este reconhecimento do Ministério do Comércio também afirma o compromisso da Shixiang Fresh Produce 11 anos de dedicação à gestão da cadeia de suprimentos, suas capacidades maduras de operação digital, e seu refinado sistema de entrega de cadeia de frio. Adicionalmente, Shixiang Fresh Produce serviu como um exemplo positivo na melhoria da qualidade do comércio eletrônico, serviços públicos inovadores, promovendo a revitalização rural, e contribuindo para o estabelecimento de padrões industriais nacionais.

Como operador abrangente de “cestas de legumes” digitais urbanas,” Shixiang Fresh Produce oferece aos cidadãos produtos diversificados, personalizado, e serviços de alimentos frescos de alta qualidade. O serviço de entrega de alimentos frescos da empresa cobre 3,000 locais comunitários em Suzhou, Wuxi, Nantong, e outras áreas, com um total de 190,000 armários inteligentes comunitários de alimentos frescos, tornando-se uma instalação conveniente dentro dos círculos de vida da comunidade. O modelo de entrega de armários inteligentes usado pela Shixiang Fresh Produce é atualmente considerado o primeiro modelo lucrativo de comércio eletrônico de alimentos frescos na China, oferecendo vantagens de replicabilidade, escalabilidade, e desenvolvimento sustentável.

Adaptando suas operações às características da vida urbana e às demandas dos consumidores, Shixiang Fresh Produce desenvolveu um sistema operacional abrangente de “cesta de vegetais” digital maduro. Este sistema integra cenários de serviço de consumo quadridimensionais: Varejo digital de produtos frescos C-end, Principais clientes B-end, lojas comunitárias off-line, e mercados agrícolas digitais. Através de plataformas digitais e instalações de cadeia de frio de ponta a ponta, a empresa superou a “última milha” na distribuição de produtos agrícolas frescos, melhorando a eficiência da circulação e a qualidade do fornecimento. A Comissão Nacional de Desenvolvimento e Reforma elogiou-a como uma “cesta de vegetais urbana verdadeiramente significativa”.

A plataforma Shixiang Fresh Produce oferece mais de 14,000 produtos em 23 categorias principais, incluindo vegetais, frutas, carne, aves, ovos, frutos do mar, laticínio, assados, grãos, óleos, e lanches, proporcionando aos consumidores uma ampla gama de opções. A plataforma digitalizou totalmente suas operações em compras, fornecer, comprar, vendas, e distribuição, oferecendo aos usuários uma experiência de compra de alimentos frescos de alta qualidade. Desde o seu estabelecimento em 2012, A Shixiang Fresh Produce manteve a sua missão de “garantir que todas as famílias possam comer alimentos seguros”. Na última década, a empresa tem qualidade e segurança rigorosamente controladas, melhorou seus sistemas de entrega da cadeia de frio e rastreabilidade de segurança, e construímos uma “cesta de vegetais” pública e confiável. Tornou-se a melhor escolha para os cidadãos de Suzhou ao comprar mantimentos através de dispositivos móveis.

Ser nomeada “Empresa Nacional de Demonstração de Comércio Eletrônico” é outro novo marco para Shixiang Fresh Produce. A empresa continuará a aproveitar as novas vantagens económicas do modelo Internet+Agricultura, aprofundar a cooperação com bases de produtos agrícolas, e melhorar continuamente as suas capacidades digitais para promover o desenvolvimento de alta qualidade. A Shixiang Fresh Produce também está comprometida em abraçar totalmente a supervisão do governo, sociedade, e seus usuários, melhorando constantemente seus níveis de qualidade e serviço, e fazer maiores contribuições para o desenvolvimento da “cesta de vegetais” do público.