Ziyan Foods lanza un instituto de investigación de innovación para impulsar el desarrollo de productos

Ziyan Foods lanza un instituto de investigación de innovación para impulsar el desarrollo de productos

Establecimiento de un instituto de investigación para abordar el desafío de crear productos exitosos: Ziyan Foods acelera la “autorrevolución”

Comida R&D es diferente de otros campos y requiere atención al detalle.. En los últimos años, Se ha dado cada vez más importancia a la investigación y el desarrollo en la industria alimentaria..

En la mañana de noviembre 17, la ceremonia de inauguración del Instituto de Investigación de Innovación Alimentaria Ziyan se llevó a cabo en el condado de Guanyun, Lianyungang.

Como marca conocida en la industria de los alimentos estofados y actor en un sector relativamente maduro., ¿Por qué Ziyan Food estableció su propio Instituto de Investigación de Innovación?? Zhong Huaijun, el Director del Instituto de Investigación de Innovación Alimentaria Ziyan, fijado, “A medida que el nivel de vida de la gente sigue mejorando, Los consumidores exigen cada vez más experiencias y calidad de los alimentos.. El establecimiento de un instituto de investigación por parte de Ziyan Food se basa en estas demandas del mercado y tendencias de desarrollo”. Zhong Huaijun agregó que Ziyan Food continuará explorando y desarrollando la industria de alimentos saludables., Garantizar que la investigación futura no sólo se centre en el sabor y la seguridad, sino también en la salud..

Se informa que el Instituto de Investigación de Innovación Alimentaria de Ziyan asumirá tres funciones principales: Lanzar más productos nuevos que se alineen con las tendencias del mercado y las demandas de los consumidores., Garantizar una alta calidad del producto y seguridad alimentaria., y convertir rápidamente los resultados de la investigación en productividad.

en el evento, Un periodista de Blue Whale Finance notó que el Instituto de Investigación de Innovación Alimentaria de Ziyan había planificado varias áreas funcionales., incluyendo un área de exposición corporativa, zona de degustación de productos, área de investigación de tecnología del sabor, área de evaluación sensorial, y área de análisis de instrumentos. Ziyan Food también ha optimizado y mejorado su producto existente R&Centro D en términos de software y hardware, por ejemplo, mediante la compra de una serie de equipos de prueba y procesamiento de alimentos líderes a nivel nacional e internacional y la incorporación de investigadores de sabores profesionales y talentos de alta tecnología..

Según la información disponible, Ziyan Food es un productor a gran escala de alimentos estofados en China, centrándose en la R&D, producción, y venta de productos estofados. Los principales productos de la empresa incluyen "Rebanadas de pulmón para marido y mujer".,“Pollo Baiwei,” y “Pollo Tengjiao,”que están hechos de aves como pollo, pato, carne de res, cerdo, así como verduras, mariscos, y productos de soja. Estos productos se utilizan principalmente como guarnición de las comidas., complementado con consumo ocasional, siendo la marca principal “Ziyan”.

A pesar de tener una línea de productos diversa, el producto estrella “Husband and Wife Lung Slices” sigue siendo un fuerte impulsor de ventas. Según Ziyan Food 2023 informe semestral, productos frescos aportados 86.08% de los principales ingresos del negocio de la empresa, con el producto “estrella” “Husband and Wife Lung Slices” generando ventas de 543 millones de yuanes, contabilidad de 31.59%.

“Siempre hemos intentado crear más productos estrella como 'Husband and Wife Lung Slices' y 'Tengjiao Chicken'., este año lanzamos productos como Carne Refrescante, Pies de Cerdo Refrescantes, Rebanadas De Pollo Bobo, y trozos crujientes. Pero en realidad es un gran desafío superar estos dos productos., porque nuestros clientes suelen pensar primero en el pollo Tengjiao y en las rebanadas de pulmón de marido y mujer, y luego comprar algunos otros. Nos hemos devanado los sesos tratando de superarnos a nosotros mismos, y muchas veces las cosas no salen según lo planeado, pero hay que seguir lanzando productos con vitalidad,'' Dijo Zhong Huaijun.. “A menudo digo que es como WeChat superó a QQ; ¿Podemos crear otro y revolucionarnos??"

Se informa que Ziyan Food ha establecido acuerdos a largo plazo, Asociaciones estables con grandes proveedores como Wens Foodstuff Group., Grupo Nueva Esperanza, y COFCO Group para el suministro de materias primas clave, como pollos enteros., carne de res, y subproductos de pato. Esto permite a la empresa obtener productos frescos, Ingredientes de alta calidad del origen y, apoyándose en sus cinco bases de producción, formar un sistema integral de cadena de suministro con la distancia óptima de entrega de la cadena de frío como radio de radiación, suministro rápido, y máxima frescura. Los pedidos realizados el día anterior se producen el mismo día y se entregan en las tiendas el mismo día o el siguiente., asegurando la frescura de los productos.

Cabe destacar que la mejora de la cadena de suministro de Ziyan Food también ha optimizado sus costos.. Ziyan Food afirma en su informe financiero que los precios de las materias primas se acercan al rango de años anteriores, y la empresa ha reforzado la optimización de la cadena de suministro, procesos de producción mejorados, y tecnología mejorada, resultando en mejoras significativas en el beneficio neto.

Según Ziyan Food 2023 informe del tercer trimestre, la empresa obtuvo unos ingresos operativos de aproximadamente 882 millones de yuanes en los primeros tres trimestres. El margen de utilidad bruta de la empresa fue 24.19%, arriba 6.69 puntos porcentuales interanual; el margen de beneficio neto fue 12.06%, arriba 3.94 puntos porcentuales interanual. Mirando los indicadores de un solo trimestre, en el tercer trimestre de 2023, El margen de utilidad bruta de la empresa fue 29.17%, arriba 11.07 puntos porcentuales interanuales y 6.18 puntos porcentuales intertrimestrales; el margen de beneficio neto fue 15.15%, arriba 5.38 puntos porcentuales interanuales y 1.67 puntos porcentuales intertrimestrales.

Además, ampliar su segmento de mercado es una de las estrategias de aumento de ingresos de Ziyan Food. Tras su inversión estratégica en Lao Han Bian Chicken en junio, Ziyan Food dio otro paso en septiembre al invertir estratégicamente en Jing Cui Xiang. El presidente de Ziyan Food, Ge Wuchao, afirmó que la firmeza y la exploración diversificada son dos aspectos inseparables del desarrollo empresarial.. La firmeza es la base del desarrollo de la empresa.; desde la creación de la empresa, Hemos estado profundamente comprometidos en el mercado de alimentos estofados como guarnición., comprometidos a consolidar nuestra posición de liderazgo en la industria. Sin embargo, con los cambios en el entorno del mercado y la diversificación de las necesidades de los consumidores, También vemos la necesidad de explorar nuevas oportunidades de desarrollo sobre la base existente.. La compañía continúa explorando caminos de desarrollo diversificados mediante el lanzamiento de varias submarcas., como “Feng Si Niang Qiaojiao Beef," "Shaguo Zhuangyuan,” y “Jiaoyan Jiaoyu,” que cubre categorías como cenas informales y comida estofada informal., así como alianzas estratégicas con marcas de alimentos como Lao Han Bian Chicken y Jing Cui Xiang. Esta estrategia abre mayores oportunidades de crecimiento para la empresa.. A través de un diseño estratégico diversificado, la empresa puede responder rápidamente a los cambios del mercado, mejorar la competitividad general, y consolidar aún más su posición líder en la industria para lograr un desarrollo a largo plazo.

Por otro lado, con el fuerte impulso de la recuperación de la industria de la restauración, La competencia también se ha vuelto más intensa.. Ge Wuchao admitió que después de la pandemia, la demanda de los consumidores ha cambiado, con mayor atención a la seguridad y la salud de los alimentos. Además, a medida que se recupera el poder adquisitivo de los consumidores, puede atraer más competidores al mercado. Por lo tanto, Ziyan Food necesita fortalecer los esfuerzos de marketing y creación de marca para mejorar la influencia de la marca y la participación de mercado para mantener su posición líder en la industria.. Producto de fortalecimiento adicional R&D y control de calidad para proporcionar más seguridad., Es esencial disponer de productos más saludables que satisfagan mejor las necesidades de los consumidores..

La industria del pollo de Qingyuan prospera: Cuatro empresas reciben placas de indicación geográfica

Recientemente, El distrito de Qingcheng organizó la reunión de promoción del desarrollo de alta calidad de la industria del "pollo Qingyuan", donde cuatro empresas recibieron la Marca Especial de Indicación Geográfica “Qingyuan Chicken”. El vicealcalde Lei Huankun entregó placas al Guangdong Tian Nong Food Group, Qingyuan Sanyuan Qingyuan Cría de pollos, Comida ecológica Guangdong Tian Nong, y Desarrollo Agrícola de Guangdong Dongfeng.

Una indicación geográfica significa la calidad única de un producto en relación con su origen.. La Oficina de Supervisión del Mercado del distrito de Qingcheng brindó apoyo "uno a uno" para garantizar que las empresas cumplieran con los criterios para utilizar la marca "Pollo Qingyuan", incluyendo inspecciones in situ, verificación de origen, y pruebas de calidad del producto. Además, Se lanzó una campaña para proteger la indicación geográfica mediante controles aleatorios y colaboración interdepartamental., protección contra el uso no autorizado.

En 2022, Las empresas marcadas con "Pollo Qingyuan" en el distrito de Qingcheng alcanzaron un valor de producción total de 3.015 mil millones de yuanes, a 130% Aumento interanual, con ingresos alcanzando 1.213 mil millones de yuanes. El distrito de Qingcheng se centra en un marco de desarrollo integral, integrando el mejoramiento de semillas, tecnológico R&D, procesamiento profundo, logística, y ventas de marcas para mejorar la industria del pollo Qingyuan.

Mirando hacia el futuro, El distrito de Qingcheng tiene como objetivo impulsar la marca "Pollo Qingyuan" como parte del "Proyecto Cien Mil Diez Mil". Los esfuerzos incluirán el fortalecimiento de la protección de los recursos genéticos., mejorar la gestión de la calidad, expandiendo el procesamiento profundo, y promover la importancia cultural de Qingyuan Chicken para lograr un crecimiento industrial de alta calidad y solidificar su estatus como ícono de la ciudad..

INVIERTAS EN AGRICULTURA DE HEMEI 10 MILLONES DE YUAN EN NUEVA SUBSIDIARIA EN LA CIUDAD DE CHONGZUO, PROVINCIA DE GUANGXI

Hemei Agricultura (833515) anunció su plan para establecer una filial de propiedad total en la ciudad de Chongzuo, Provincia de Guangxi, con una inversión de 10 millones de yuanes. Este movimiento se alinea con la estrategia de desarrollo futuro de la compañía para optimizar la asignación de recursos y mejorar la competitividad.. La nueva filial se centrará en la producción., ventas, tratamiento, transporte, y almacenamiento de productos agrícolas, junto con otros servicios como la venta de alimentos, gestión de la cadena de suministro, y almacenamiento.

Principales actividades comerciales:

La subsidiaria participará en:

- Producción, ventas, y procesamiento de productos agrícolas

- Al por mayor y minorista de productos agrícolas comestibles

- Servicios de consultoría de información

- Ventas de maquinaria agrícola y necesidades diarias

- Importación y exportación de bienes

- Gestión de la cadena de suministro

- Distribución urbana y transporte de carga de carretera

Fines de inversión:

La inversión tiene como objetivo expandir el diseño de la cadena de suministro de la agricultura de Hemei, Mejorar la adquisición y la gestión centralizadas, y mejorar la rentabilidad general y la competitividad. Este movimiento estratégico fortalecerá aún más las asociaciones regionales a largo plazo y explorará nuevas oportunidades de mercado.

Evaluación de riesgo e impacto:

La compañía afirma que esta inversión conlleva un riesgo mínimo, Dada su alineación con los objetivos estratégicos de la agricultura de Hemei. Controles internos mejorados, Estrategias comerciales claras, y se establecerá un equipo de gestión sólido para salvaguardar los intereses de los accionistas. Se espera que la inversión afecte positivamente los estados financieros consolidados de la Compañía y la situación financiera futura.

Hemei Agriculture se especializa en proporcionar "Logística de la cadena de frío única y servicios de distribución para productos agrícolas y de línea laterales frescos,"Servir a clientes, incluidas instituciones educativas, organizaciones militares, e instituciones públicas.

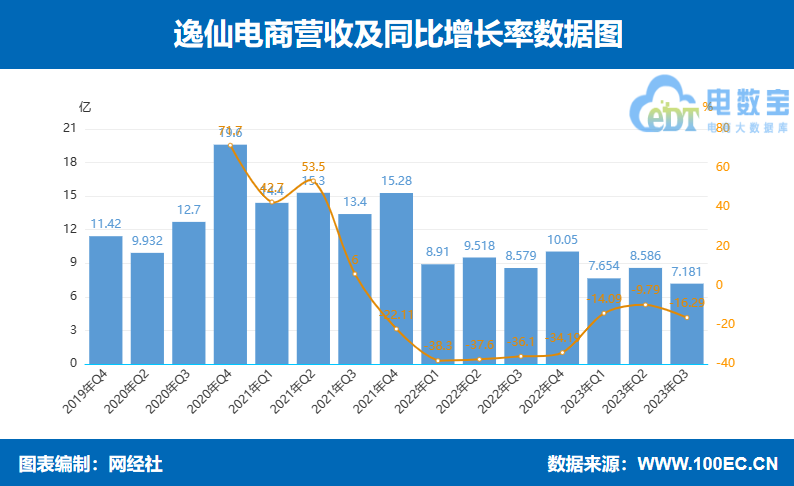

LOS INGRESOS DEL 3T DE YATSEN HOLDING DISMINUYEN EN 16.3% YOY A 718.1 MILLONES DE YUAN

Yatsen E-commerce ha publicado su informe financiero para el tercer trimestre que finaliza en septiembre. 30, 2023. La compañía reportó ingresos netos totales de RMB. 718.1 millón, marcando una disminución interanual de 16.3%. A pesar de la caída de los ingresos, La pérdida neta de Yatsen se redujo en 6.1% interanual a RMB 197.9 millón. Sobre una base no GAAP, sin embargo, la pérdida neta se expandió en 3.0% interanual a RMB 130.2 millón. El beneficio bruto del trimestre fue RMB 512.8 millón, abajo 13.3% año tras año, con un margen bruto de 71.4%, en comparación con 68.9% en el mismo periodo en 2022.

Los gastos operativos totales de Yatsen se situaron en RMB 744.3 millón, a 13.1% disminución año tras año. Los gastos de cumplimiento se redujeron a RMB 56 millones de RMB 63.8 millones en el mismo período en 2022. Los gastos de ventas y marketing también experimentaron una reducción., bajando al RMB 511.7 millones de RMB 564.8 millón. Los gastos generales y administrativos disminuyeron a RMB 151.8 millón, mientras R&Los gastos D se redujeron a RMB 24.7 millón. La pérdida operativa se redujo en 12.9% a RMB 231.5 millón, aunque sobre una base no GAAP, se expandió por 1.2% a RMB 164.6 millón.

Fundador de Yatsen E-commerce, Presidente, y director ejecutivo, Huang Jin Feng, fijado: “En el tercer trimestre, Las tres principales marcas de cuidado de la piel de la compañía experimentaron un crecimiento constante.. Mientras tanto, La marca insignia de Yatsen, Diario perfecto, Continuó mejorando la fuerza de su marca a través de una nueva identidad visual y el lanzamiento de nuevos productos importantes.. Somos optimistas sobre el futuro, y de acuerdo con la guía de desempeño del cuarto trimestre de la compañía, Se espera que los ingresos totales crezcan año tras año”.

Fundada en 2016, Comercio electrónico Co. de Guangzhou Yatsen., Limitado. fue reconocida como una empresa innovadora "Unicornio" en Guangzhou en 2019, convirtiéndolo en el único unicornio de comercio electrónico de la ciudad en ese momento.

Otras empresas minoristas digitales que cotizan en China

- Comercio electrónico integral: Alibaba, JD.com, Pinduoduo, tienda vip, Suning.com, GOME Venta al por menor, Todas las cosas nuevas, secoo, yunji.

- Comercio electrónico en vivo: Kuaishou, Tecnología Yaowang, Puedo, Selección Oriental, Jiao Ge Peng You.

- Comercio electrónico de alimentos frescos: Dingdong Maicai, señorita fresca, Pagoda.

- Comercio electrónico de automóviles: Tú también, uxín.

- Guía de compras Comercio electrónico: SMZDM (¿Qué vale la pena comprar?), Fanli.com.

- Comercio electrónico a plazos: Qudian, lexina.

- Proveedores de servicios de comercio electrónico minorista: Yuzan, Weimob, Grupo Yueshang, Tecnología Guangyun, Comercio electrónico Baozun, Youquhui, Precioso maquillaje de belleza, Ruoyuchen, Participaciones de Qingmu.

- Comercio electrónico vertical: Grupo Babytree, Kutesmart, Red Wunong, mascota boqii.

- Comercio electrónico de marca: Grupo Xiaomi, Electrodomésticos Oso, Administrado, Tres ardillas, Yujiahui, Comercio electrónico Yatsen, Participaciones de Rongmei, Comercio electrónico Nanjiren.

Centrándose en el desarrollo estratégico de la marca y mejorando su presencia en el mercado., Yatsen tiene como objetivo afrontar los desafíos del competitivo panorama del comercio electrónico.

¿Puede la rentabilidad salvar el precio de las acciones?? Después de que Dingdong Maicai registrara beneficios positivos durante cuatro trimestres consecutivos, el precio de sus acciones cayó a $2.

Al cierre de noviembre 22, El precio de las acciones de Dingdong Maicai se situó en $2.07 por acción, representando una disminución en lo que va del año de 51.52%, con un valor de mercado total actual de $491 millón.

Investigador Zhuoma, Los tiempos de la inversión

Dingdong Maicai publicó recientemente sus resultados financieros no auditados para el tercer trimestre de 2023, que finalizó en septiembre 30.

El informe financiero muestra que Dingdong Maicai logró unos ingresos totales de 5.14 mil millones de yuanes en el tercer trimestre de este año, una disminución interanual de 13.51%. El volumen bruto de mercancías (GMV) alcanzó 5.67 mil millones de yuanes, un aumento intertrimestral de 6.4%. La empresa obtuvo un beneficio neto de 2.1 millones de yuanes, comparado con una pérdida de 345 millones de yuanes en el mismo período del año pasado. Los no GAAP (Principios de contabilidad no generalmente aceptados) beneficio neto fue 16 millones de yuanes, comparado con una pérdida de 285 millones de yuanes en el mismo período del año pasado. Notablemente, Esto marca el cuarto trimestre consecutivo en el que Dingdong Maicai logra rentabilidad no GAAP desde el cuarto trimestre de 2022.

Fundador y director ejecutivo de Dingdong Maicai, Liang Changlin, afirmó durante la llamada de resultados que la rentabilidad continua se debía a la estrategia de la empresa de "priorizar la eficiencia y mantener una escala moderada". También mencionó que Dingdong Maicai fue una de las primeras empresas de la industria en lograr rentabilidad., describiendo el viaje como “largo y desafiante”.

La rentabilidad ha sido durante mucho tiempo un desafío importante para muchas plataformas de comercio electrónico de alimentos frescos., y estabilizar la rentabilidad es un tema que muchas empresas deben abordar. En un contexto de caída de las entradas de capital, mayor competencia en el mercado, y costos crecientes, Dingdong Maicai ha adoptado una serie de medidas, incluyendo retirarse de ciertas ciudades, Reducción de costos, y mejorar la eficiencia, sacrificar escala por rentabilidad sostenible. Estos esfuerzos parecen estar dando frutos hasta el momento..

Sin embargo, en términos de precio de las acciones, el mercado aún no ha reconocido los esfuerzos de Dingdong Maicai. Al cierre de noviembre 22, El precio de las acciones de Dingdong Maicai se situó en $2.07 por acción, representando una disminución en lo que va del año de 51.52%, con un valor de mercado total actual de $491 millón.

Desempeño del precio de las acciones de Dingdong Maicai desde su cotización (Dólar estadounidense)

Fuente: Viento

Los ingresos disminuyeron año tras año en el tercer trimestre

El informe financiero muestra que Dingdong Maicai logró unos ingresos totales de 5.14 mil millones de yuanes (RMB, lo mismo abajo) en el tercer trimestre de este año, en comparación con 5.943 mil millones de yuanes en el mismo período del año pasado, una disminución de 13.51% año tras año. El GMV del trimestre fue 5.67 mil millones de yuanes, un aumento intertrimestral de 6.4%.

Dingdong Maicai atribuyó la caída de ingresos a su retirada de múltiples ciudades y sitios en 2022 y el segundo trimestre de este año. Además, El aumento significativo de las actividades de viajes de los consumidores y el consumo fuera de línea después de la pandemia contribuyeron a la disminución interanual de las ventas del tercer trimestre de Dingdong Maicai..

Respecto al crecimiento de GMV, la empresa afirmó que se debía a un aumento intertrimestral en el volumen de pedidos y en el valor medio de los pedidos (AOV) de 6.0% y 0.5%, respectivamente. El aumento en el volumen de pedidos se debió principalmente a una mayor frecuencia de pedidos mensuales y al rápido crecimiento de los pedidos de las regiones de Jiangsu y Zhejiang..

En términos de composición de ingresos, Los ingresos de Dingdong Maicai se derivan de los ingresos por productos y servicios., siendo los ingresos por productos la fuente principal.

En el tercer cuarto, Se generó el negocio de productos de Dingdong Maicai 5.083 mil millones de yuanes en ingresos, en comparación con 5.872 mil millones de yuanes en el mismo período del año pasado, una disminución interanual de 13.45%. Esta disminución en los ingresos por productos fue la razón principal de la caída general de los ingresos en el tercer trimestre.. Durante el mismo período, Los ingresos del negocio de servicios fueron 57 millones de yuanes, en comparación con 70 millones de yuanes en el mismo período del año pasado, una disminución interanual de 18.45%, principalmente debido a un aumento temporal en el número de miembros en 2022 durante la pandemia.

El informe financiero también muestra que los costos y gastos operativos totales de Dingdong Maicai para el tercer trimestre de este año ascendieron a 5.164 mil millones de yuanes, una disminución interanual de 17.62% de 6.268 mil millones de yuanes en el mismo período del año pasado. Específicamente, El costo de ventas de la compañía para el trimestre fue 3.577 mil millones de yuanes, abajo 13.94% año tras año desde 4.157 mil millones de yuanes en el mismo período del año pasado. El costo de ventas como porcentaje de los ingresos totales también disminuyó de 70.0% el año pasado a 69.6% este trimestre.

Mientras tanto, Los gastos de entrega de la empresa para el tercer trimestre fueron 1.199 mil millones de yuanes, en comparación con 1.595 mil millones de yuanes en el mismo período del año pasado, una disminución interanual de 24.82%. Los gastos de envío como porcentaje de los ingresos totales también cayeron de 26.8% En el mismo período del año pasado a 23.3%.

Además, Los gastos de marketing y ventas del tercer trimestre de Dingdong Maicai fueron 98 millones de yuanes, una disminución interanual de 22.75% de 127 millones de yuanes en el mismo período del año pasado, principalmente debido a la retirada de la empresa de algunas ciudades de 2022 y el segundo trimestre de este año. Los gastos generales y administrativos fueron 89 millones de yuanes, una disminución interanual de 33.0% de 133 millones de yuanes en el mismo período del año pasado, principalmente debido a la mejora de la eficiencia de los empleados. Los gastos de desarrollo de productos fueron 199 millones de yuanes, una disminución interanual de 21.84% de 255 millones de yuanes en el mismo período del año pasado, principalmente debido a una mayor eficiencia entre los R de la empresa&personal.

En términos de rentabilidad, Dingdong Maicai obtuvo un beneficio neto de 2.1 millones de yuanes en el tercer trimestre de este año, comparado con una pérdida de 345 millones de yuanes en el mismo período del año pasado. La ganancia neta no GAAP fue 16 millones de yuanes, comparado con una pérdida de 285 millones de yuanes en el mismo período del año pasado. El margen de beneficio bruto para el trimestre aumentó ligeramente desde 30.0% En el mismo período del año pasado a 30.4%.

A finales de septiembre de este año., Dingdong Maicai tenía efectivo y equivalentes de efectivo e inversiones a corto plazo por un total de 5.632 mil millones de yuanes, en comparación con 6.493 mil millones de yuanes a finales de diciembre 2022.

Cuatro trimestres consecutivos de rentabilidad no GAAP

Dingdong Maicai fue fundada en 2017 y salió a bolsa en la Bolsa de Valores de Nueva York en junio 2021.

Los informes financieros anteriores y el folleto mostraban que Dingdong Maicai había estado en una situación de pérdidas a largo plazo.. De 2019 a 2021, Los ingresos de Maiciai de los Maiciai de 3.88 mil millones de yuanes, 11.336 mil millones de yuanes, y 20.121 mil millones de yuanes, respectivamente, con las correspondientes pérdidas netas de 1.873 mil millones de yuanes, 3.177 mil millones de yuanes, y 6.429 mil millones de yuanes.

En 2022, El rendimiento del punto de aserrado de Maicai, con una rentabilidad no GAAP de 116 millones de yuanes en el cuarto trimestre de ese año. En el primer y segundo trimestre de este año, Dingdong Maicai logró ganancias netas no GAAP de 6.1 millones de yuanes y 7.5 millones de yuanes, respectivamente. Con el tercer cuarto incluido, Dingdong Maicai ha logrado rentabilidad no GAAP durante cuatro trimestres consecutivos.

Durante la llamada de ganancias, Liang Changlin enfatizó que la rentabilidad continua de la empresa se debía a su estrategia de "priorizar la eficiencia y mantener una escala moderada". También afirmó, “Ha sido un viaje largo y desafiante hasta llegar aquí., pero nuestra adhesión a nuestros principios y visión nos ha mantenido en el camino correcto”. Además, sobre el desempeño de este año, Liang Changlin expresó su confianza en lograr la rentabilidad no GAAP en el cuarto trimestre y durante todo el año de 2023.

Juewei Foods ajusta su estructura de capital, Pospone temporalmente el plan de salida a bolsa de Hong Kong

Noticias financieras de piña: en noviembre 23, Juewei Foods anunció en su plataforma de interacción con inversores que su plan de cotizar en Hong Kong está actualmente en suspenso.. Previamente, Juewei Foods había anunciado públicamente su intención de realizar una oferta pública inicial en Hong Kong., afirmando que la medida tenía como objetivo “acelerar la estrategia de internacionalización de la empresa, Mejorar sus capacidades de financiación en el extranjero, y fortalecer aún más su base de capital y su competitividad general ".

En su respuesta, Juewei Foods no proporcionó una explicación detallada para el aplazamiento de su plan de listado de Hong Kong. Sin embargo, El Secretario de la Junta de la Compañía mencionó que Juewei Foods continuará avanzando en su planificación de inversiones en función de sus directrices estratégicas establecidas y objetivos comerciales.. La compañía ya ha visto el éxito inicial en sus iniciativas de ecosistema de alimentos. Aprovechando su experiencia en la industria a largo plazo, así como su experiencia en redes de distribución de cadena de frío y gestión de tiendas de cadenas, Juewei Foods apoya plenamente a sus empresas asociadas del ecosistema en la estandarización de la producción, Mejora de la eficiencia, y lograr altos niveles de coordinación. Adherirse a los principios de "centrado en el proyecto, impulsado por el servicio, y diseño industrial orientado a los resultados, Juewei Foods tiene como objetivo enfrentar desafíos, perseguir el desarrollo, y crear valor junto con sus socios del ecosistema.

Benlai Life International abre un nuevo capítulo en la cadena de suministro “fresco”: Llevando más delicias globales a las mesas de los consumidores chinos

Informe del Herald Económico de China y de la Red de Desarrollo de China por Pi Zehong: La variedad de ingredientes en las mesas de las familias chinas hoy ha sufrido una transformación dramática en comparación con hace una década.. Ingredientes importados como el kiwi Zespri de Nueva Zelanda, Aceite de oliva virgen extra italiano, y los camarones blancos ecuatorianos se han convertido en componentes esenciales de las comidas diarias para las familias chinas. Este cambio está impulsado por el rápido crecimiento del nuevo comercio agrícola mundial y el surgimiento de las plataformas de comercio electrónico chino.

Benlai Life fue una de las primeras plataformas en China en vender alimentos frescos importados como cerezas y durianos en línea. Como pionero en la adquisición directa de las regiones de producción, Este modelo único también se ha aplicado a la construcción de su cadena de suministro en el extranjero.. En el pasado 11 años, La plataforma ha optimizado e integrado continuamente su cadena de suministro global, Ofrecer a los consumidores nacionales una variedad más amplia de productos importados. Al mismo tiempo, ha aprovechado la fuerza de su producto, fuerza del canal, fuerza de la marca, y fortaleza de los recursos para empoderar a las marcas en el extranjero para expandirse y desarrollarse en el mercado chino.

Hoy, bienes importados de más de 50 países de todo el mundo han llegado a las mesas de los consumidores chinos a través de la vida de Benlai. Productos como la leche fresca pasteurizada de New Zealand Weebiz y las cerezas frenadas por el aire de los Estados Unidos se han convertido en las mejores opciones para los usuarios que buscan un estilo de vida de alta calidad.

Detrás de la "frescura final" se encuentra el ojo exigente y la artesanía de los compradores, así como el apoyo de una "cadena de aire de aire" altamente eficiente. La cadena internacional "fresca" que se extiende desde orígenes en el extranjero hasta mesas de comedor chinas asegura que los usuarios de Benlai Life puedan disfrutar de productos globales frescos con cero tiempo de retraso.

Nueva Zelanda a China: El viaje transfronterizo de 72 horas de leche pasteurizado de alta calidad

La marca de leche pasteurizada de Nueva Zelanda Weebiz ha estado disponible en Benlai Life durante ocho años. Como una de las primeras marcas de leche fresca importadas para ingresar a China, se ha convertido en una opción de calidad para millones de familias..

Nueva Zelanda es reconocida a nivel mundial como una fuente premium de leche, Gracias a su ubicación geográfica única, que conserva un vírgelo, Medio ambiente natural libre de contaminación y lo aísla de enfermedades animales comunes que se encuentran en otras regiones. Los productores de lácteos locales utilizan métodos de pastoreo tradicionales, Permitir que las vacas se alimenten naturalmente de exuberante hierba, Asegurar el crecimiento saludable de las vacas y la pureza y la seguridad de la leche.

La leche generalmente ingresa al mercado en dos formas: leche fresca y leche ambiental. La leche fresca sufre pasteurización, que conserva el valor nutricional máximo y el sabor natural de la leche, pero también contiene una pequeña cantidad de microorganismos inofensivos o beneficiosos, resultando en una vida útil más corta y la necesidad de refrigeración.

Xing Yan, Un comprador de lácteos en Benlai Life, está bien versado en la cadena de suministro de lácteos globales y las marcas. Ella seleccionó cuidadosamente a Weebiz, Una marca premium coproducida por la famosa granja de productos lácteos de Nueva Zelanda Marphona y Green Valley Dairies Limited, el segundo procesador de leche más grande del país. Este producto sufre pasteurización en el estándar dorado de 72 ° C para 15 segundos y continúa actualizándose bajo, Condiciones sin aditivos, con un contenido de proteína de leche de 3.6g/100 ml, más alto que el estándar de la UE.

Con una vida útil de 15 días, La leche pasteurizada debe almacenarse en un ambiente de cadena fría, que impone altas demandas sobre las capacidades logísticas. El servicio de entrega Weebiz de Benlai Life cubre ciudades de primer nivel como Beijing, Llevar a la fuerza, Guangzhou, y shenzhen, así como varias otras ciudades. Se produce cada botella de leche pasteurizada de Weebiz, empaquetado, esterilizado, y probado en Nueva Zelanda antes de cargarse en un vuelo de cadena de frío directamente a China. Luego se entrega a las manos de los usuarios solo después de pasar las estrictas inspecciones de la Oficina Nacional de Inspección y Cuarentena de China, aduanas, y el riguroso monitoreo de control de calidad de Benlai Life.

"Para mejorar la eficiencia logística, Solicitamos el espacio libre del canal verde para la leche Weebiz. Después de la producción del domingo en la granja de Nueva Zelanda, La leche se envía por primera vez para inspección local y luego se lleva a China el lunes.. Los funcionarios de aduanas retienen cuatro cajas de cada lote para su inspección, permitiendo que el resto borre la aduana y se almacene,"Xing Yan explicó.

Con el apoyo del sistema global de suministro global altamente eficiente de Benlai Life, La leche pasteurizada de Weebiz se puede enfrentar desde Nueva Zelanda hasta mesas de comedor de la ciudad china en tan solo 72 horas.

Estados Unidos a China: Las reglas de frescura de mil millas para cerezas delicadas

En los últimos años, Las cerezas se han convertido en la "tendencia principal" en el mercado nacional de frutas. Benlai Life introdujo cerezas importadas tan pronto como 2013.

Una interesante historia de selección de productos una vez circuló dentro de la empresa.. Cuando las cerezas se hicieron populares por primera vez, Un grupo de usuarios de Life Benlai de Benlai más exigentes desarrollaron una preferencia por las "cerezas amarillas" (Cerezas doradas) Debido a su gusto único, A pesar de su precio más alto en comparación con las "cerezas rojas" más comunes. Estos usuarios también tenían mayores expectativas para la vida de Benlai., exigiendo que la plataforma seleccione cuidadosamente los orígenes y las marcas de las "cerezas amarillas" al tiempo que refina la selección de las mejores variedades y productos de calidad para las "cerezas rojas" a nivel mundial.

Para satisfacer las demandas de calidad de los usuarios de cerezas importadas, La vida de Benlai tiene, desde 2016, introdujo "cerezas amarillas" cuidadosamente seleccionadas y "cerezas rojas" de regiones premium en los Estados Unidos. La compañía se asoció con China Eastern Airlines para lanzar el primer modelo de vuelo chárter de crowdfunding de la industria. Después de ser cosechado, Las cerezas están pre-enfriadas, ordenado, y empaquetado en EE. UU.. huertos, luego con el aire directamente a China por China Eastern Airlines, entregando las cerezas más frescas a los usuarios nacionales.

Para llevar estas delicadas cerezas a los usuarios, Benlai Life adoptó un modelo de orden de preventa, donde la oferta está determinada por las ventas. Este modelo de ventas puede parecer simple, pero exige una precisión extrema en el complejo proceso de importación de productos frescos.

El primer desafío son las condiciones climáticas. Generalmente, Benlai Life recibe decenas de miles de órdenes de cerezo una semana antes de la cosecha. Sin embargo, Si llueve durante la cosecha, Las cerezas no se pueden elegir porque son propensas a moldear y pudrirse después de recoger. Si las cerezas absorben demasiada agua, Pueden romperse y estallar cuando se exponen a la luz del sol después de la lluvia, reduciendo significativamente su calidad. Esto requiere que el equipo de compras realice un trabajo preliminar exhaustivo, Estudie cuidadosamente el clima local, y monitorear de cerca las condiciones climáticas en las regiones en crecimiento.

Además, a lo largo de la airfreight, despacho de aduana, y transporte al almacén, La temperatura debe ser "controlada con precisión". Si la temperatura fluctúa en más de 5 ° C, La condensación se formará en la superficie de las cerezas, conduciendo a una disminución en la calidad.

La etapa final es la entrega. Encontrar el producto correcto es solo el primer paso; Completar el proceso de entrega a fondo es esencial. Benlai Life asegura que se entreguen diferentes especificaciones de cerezas a través de diferentes métodos de cadena de frío para evitar que pierdan frescura. Además, Para evitar daños o deterioro, Benlai Life prohíbe estrictamente el manejo aproximado durante el proceso de entrega.

Esta serie de pasos meticulosos se basa en el compromiso de Benlai Life de construir la cadena internacional más corta "fresca". “Nuestro objetivo es garantizar una calidad fresca mediante el uso de la logística más precisa y eficiente., entregar las cerezas a los usuarios con tallos verdes y regordete, fruta tierna, en lugar de usar otros métodos para extender significativamente su vida útil,"Dijo Maomao, Un comprador de frutas en Benlai Life.

Hoy, Las cerezas importadas de los Estados Unidos se han convertido en una fruta de verano imprescindible para los usuarios de Benlai Life. Cerezas de otras regiones superiores, como Chile, También se entregan a los usuarios en la cima de la frescura y la eficiencia en diferentes estaciones a través de vuelos y envíos directos.

El ideal de "comprar a nivel mundial y vender a nivel mundial" se está convirtiendo en una realidad una vez más.. Cada vez más delicias "hechas para China" se están convirtiendo en la nueva tendencia, Mientras que los productos frescos "Hechos en China" también están viendo nuevas oportunidades.

El applet de Benlai Life ha lanzado secciones nacionales como el "Pavilio de Nueva Zelanda,"" Chile Pavilion,"" Pabellón de Tailandia,"Y" Italia Pavilion,"Permitir a los usuarios experimentar una variedad de sabores internacionales y las diversas culturas de diferentes regiones en todo el mundo en un solo lugar. A medida que la cadena "fresca" internacional de Benlai Life continúa desarrollándose rápidamente, con la plataforma expandiendo su "círculo de amigos" global y la cooperación de profundidad con socios de calidad, Más productos premium de todo el mundo llegarán a las mesas de comedor de la ciudad china con mejor calidad y precios más competitivos.

MISSFRESH RECIBE UN AVISO DE ELIMINACIÓN DEL NASDAQ

Missfresh anunció que la adquisición del negocio en virtud del acuerdo de financiación de capital y compra de acciones anunciado previamente en agosto 3, 2023, así como la transacción bajo el acuerdo de transferencia de acciones anunciado en agosto 7, 2023, han sido terminados. en noviembre 15, El Panel de Audiencias de NASDAQ notificó a Missfresh que había decidido eliminar los valores de la compañía de NASDAQ Stock Market LLC y suspender la negociación de esos valores efectivos a la apertura del negocio el viernes, Noviembre 17. Después del vencimiento del período de apelación aplicable, NASDAQ presentará un formulario 25 Delisting Notification con los EE. UU.. Comisión de Bolsa y Valores para completar el proceso de eliminación.

Las empresas de Ningbo compiten en el "océano azul" de los productos médicos de la cadena de frío

Recientemente, en la entrada del almacén de una empresa de tecnología en la ciudad de Mazhu, Yuyao, Ningbó, encima 3,000 Los gabinetes de frío médicos de varios modelos estaban completamente ensamblados y listos para su envío., destinado a ser exportado a los EE.UU.. mercado.

“Muchos productos farmacéuticos y vacunas requieren transporte y almacenamiento en cadena de frío.. Nuestra empresa se especializa en la investigación., desarrollo, y producción de productos médicos de cadena de frío.. En los últimos años, La industria de la cadena de frío médica ha visto nuevas oportunidades de crecimiento., Y el valor de producción anual de nuestra empresa ha mantenido una tasa de crecimiento de 15%. este año, Esperamos que nuestro valor de producción alcance 80 millones de yuanes," dijo Sun Ming, el gerente general de la empresa.

La empresa ha estado profundamente involucrada en la producción de sistemas de refrigeración y R.&industria D durante casi 40 años, Inicialmente se centró en la producción de componentes de refrigeración como condensadores y evaporadores.. Después de la reestructuración en 1999, la empresa se convirtió en una empresa de tecnología integrando R&D, producción, ventas, y servicio, con una capacidad de producción anual de más 100,000 unidades de productos especiales de cadena de frío. Ha establecido bases de producción en lugares como Jiangxi..

Después de años de desarrollo, Los productos de cadena de frío médica de la empresa se han convertido en OEM muy conocidos. (Fabricante de equipos originales) proveedores en el campo, Reconocido por instituciones médicas en países desarrollados como Europa y Estados Unidos.. Con una sólida reputación en el mercado y alta calidad del producto., Los productos se exportan a más de 60 países y regiones. Manteniendo su enfoque en el mercado de la cadena de frío médica, la empresa también se ha expandido hacia la investigación, desarrollo, y producción de productos de cadena de frío comerciales y rurales., mejorando continuamente sus beneficios económicos.

La calidad y la integridad son las bases de la supervivencia de la empresa.. En los últimos años, la empresa ha superado sucesivamente certificaciones como la de EE.UU.. UL, ETL, CE europea, y certificaciones SG de Japón. Se adhiere estrictamente al sistema de gestión de calidad ISO9001 y al sistema de gestión ambiental ISO14000 para la gestión de calidad del producto..

“En comparación con los refrigeradores domésticos y comerciales, Los productos médicos de cadena de frío requieren un control de temperatura más preciso., fluctuaciones de temperatura más pequeñas, y mayor dificultad técnica en la calidad del sistema de refrigeración y ratios de refrigerante," dijo Sun Ming. Después del montaje, Cada producto se somete a una serie de estrictas medidas de control de calidad., incluyendo extracción al vacío, adición de refrigerante, y más de cuatro horas de pruebas de encendido, Garantizar que no haya lagunas en ningún proceso de producción.. Notablemente, la empresa desarrolló un refrigerador médico que puede alcanzar temperaturas tan bajas como -86°C, Utilizado principalmente en instituciones de investigación y laboratorios.. Este producto se ha convertido en un éxito de ventas en más de 10 países y regiones.

La tecnología y el talento son fuentes vitales de la competitividad central de la empresa.. Actualmente, la empresa se mantiene 60 derechos de propiedad intelectual, incluyendo patentes nacionales e internacionales y derechos de autor de software. Ha sido reconocida como Empresa Nacional de Alta Tecnología, una Pyme Nacional de Base Tecnológica, y un “Especializado” Provincial, Refinado, y Nueva” PYME. La empresa invierte 6% a 10% del valor de su producción anual en investigación y desarrollo tecnológico. En los últimos tres años, ha invertido más 10 millones de yuanes en proyectos de transformación tecnológica, lograr una calidad del producto más estable y una eficiencia de producción significativamente mejorada. La compañía también ha puesto en marcha un proyecto solar fotovoltaico, lo que ahorra más de 40% de la energía de la empresa anualmente.

Sobre la base del establecimiento de un equipo de innovación, la compañía sigue incrementando sus esfuerzos para atraer talento innovador, colaborando activamente con universidades como la Universidad Jiao Tong de Shanghai, Universidad de ciencia y tecnología de Zhejiang, y la Universidad Jiliang de China sobre asociaciones entre la industria, la universidad y la investigación para establecer conjuntamente instituciones de investigación y centros de tecnología de ingeniería.

La compañía apuesta por mejorar su competitividad a través de la transformación digital. Su próximo paso es invertir más 3 millones de yuanes para implementar un proyecto de transformación y mejora de fábricas inteligentes ecológicas 5G, con el objetivo de crear una fábrica inteligente moderna y avanzada que impulse el desarrollo de la empresa con energía renovada.

EL ÚNICO DE SUZHOU! SHIXIANG FRESH PRODUCE SELECCIONADA COMO “EMPRESA DE DEMOSTRACIÓN NACIONAL DE COMERCIO ELECTRÓNICO 2023”

Recientemente, El Departamento de Comercio Electrónico e Informatización del Ministerio de Comercio emitió un documento reconociendo a las empresas seleccionadas como “Empresas Nacionales de Demostración de Comercio Electrónico 2023”. Productos frescos Shixiang con sede en Suzhou (Jiangsu Suiyi Tecnología de la Información Co., Limitado.) figuraba entre los homenajeados. en noviembre 23, el 2023 Conferencia de comercio electrónico de China Jiangsu, Tema “Integración de la integración digital-física para promover la revitalización industrial,"¿Qué héroe en Kunshan. Durante la conferencia, Se realizó una ceremonia de certificación para 12 Jiangsu Enterprises, incluyendo productos frescos de Shixiang, que también es la única empresa de Suzhou que se nombra en el 2023 lista.

Esta selección fue iniciada por el Ministerio de Comercio con el objetivo de identificar un grupo de "empresas de demostración de comercio electrónico" que han logrado resultados sobresalientes en la promoción de la integración, Mejorar el bienestar público, Desarrollo de conducción, Revitalización de industrias, Mejora del medio ambiente, y fomentar la apertura. Después de la evaluación, 132 Se seleccionaron las empresas de demostración de comercio electrónico y se reconocieron públicamente.

Esto marca el cuarto año consecutivo en que Shixiang Fresh Produce ha sido nombrado una empresa nacional de demostración de comercio electrónico, destacando el sostenible de la empresa, estable, y rápido desarrollo en el sector de comercio electrónico y su papel como líder en la industria. Este reconocimiento del Ministerio de Comercio también afirma los productos de Shixiang Fresh. 11 Años de dedicación a la gestión de la cadena de suministro, sus capacidades de operación digital madura, y su refinado sistema de entrega de cadena de frío. Además, Shixiang Fresh Produce ha servido como un ejemplo positivo en la actualización de la calidad del comercio electrónico, innovando servicios públicos, Promoción de la revitalización rural, y contribuyendo al establecimiento de estándares de la industria nacional.

Como operador integral de las "cestas de verduras urbanas digitales,"Shixiang Fresh Produce proporciona a los ciudadanos diversificados, personalizado, y servicios de alimentos frescos de alta calidad. El servicio de entrega de alimentos frescos de la compañía cubre 3,000 Sitios comunitarios en Suzhou, Wuxi, Nantong, y otras áreas, con un total de 190,000 Community Fresh Food Smart Lockers, convertirse en una instalación conveniente dentro de los círculos de vida comunitaria. El modelo de entrega de casilleros inteligente utilizado por Shixiang Fresh Produce se considera actualmente como el primer modelo de comercio electrónico de alimentos frescos rentables en China, ofreciendo ventajas de replicabilidad, escalabilidad, y desarrollo sostenible.

Adaptar sus operaciones a las características de vida urbana y las demandas de los consumidores, Shixiang Fresh Produce ha desarrollado un sistema de operación integral digital de "cesta de verduras" digital. Este sistema integra escenarios de servicio de consumo de cuatro dimensiones: C-END digital nuevo minorista minorista, Clientes principales de B-extremo, tiendas comunitarias fuera de línea, y mercados de agricultores digitales. A través de plataformas digitales e instalaciones de cadena de frío de extremo a extremo, La compañía ha unido la "última milla" en la distribución de productos agrícolas frescos, Mejorar la eficiencia de la circulación y la calidad del suministro. La Comisión Nacional de Desarrollo y Reforma lo ha elogiado como una "" cesta urbana de vegetales "verdaderamente significativa.

La plataforma Shixiang Fresh Product ofrece más 14,000 productos entre 23 categorías principales, incluyendo verduras, frutas, carne, aves de corral, huevos, mariscos, lácteos, productos horneados, granos, aceites, y bocadillos, proporcionar a los consumidores una amplia gama de opciones. La plataforma ha digitalizado completamente sus operaciones a través de la adquisición., suministrar, compra, ventas, y distribución, Ofrecer a los usuarios una experiencia de compra de alimentos frescos de alta calidad. Desde su establecimiento en 2012, Shixiang Fresh Produce ha confirmado su misión de "asegurarse de que cada familia pueda comer alimentos seguros". Durante la última década, La compañía ha controlado estrictamente la calidad y la seguridad., Mejoró su entrega de la cadena de frío y sistemas de trazabilidad de seguridad, y construyó un público "canasta de verduras" pública. Se ha convertido en la mejor opción para los ciudadanos de Suzhou al comprar comestibles a través de dispositivos móviles.

Ser nombrado una "empresa nacional de demostración de comercio electrónico" es otro hito nuevo para Shixiang Fresh Produce. La compañía continuará aprovechando las nuevas ventajas económicas de Internet+Modelo de Agricultura., profundizar la cooperación con las bases de productos agrícolas, y mejorar continuamente sus capacidades digitales para promover el desarrollo de alta calidad. Shixiang Fresh Produce también se compromete a adoptar por completo la supervisión del gobierno, sociedad, y sus usuarios, mejorando constantemente sus niveles de calidad y servicio, y haciendo mayores contribuciones al desarrollo de la "cesta de verduras" del público.