El logística de cadena de frío sector has never been more critical. Si está enviando vacunas, fresh produce or plant based foods, maintaining temperature integrity across the supply chain is the difference between profit and waste. En 2025 the market is booming — analysts estimate the global cold chain logistics market will top 436 mil millones de dólares en 2025 y podría llegar a más de 1,3 billones de dólares por 2034. Al mismo tiempo, geopolitical disruptions, evolving consumer preferences and rapid technological advances are reshaping the industry. This guide explains what cold chain logistics is, why it matters in 2025 and how innovations like AI, IoT and sustainable practices are transforming the way temperature sensitive goods reach consumers.

¿Qué es la logística de la cadena de frío?, and why is it vital in 2025? Learn the basics and understand why the sector is growing so quickly.

How are technologies like AI, IoT and blockchain transforming cold chain logistics? Discover real world innovations such as AI powered route optimisation, Trazabilidad blockchain y almacenamiento con energía solar..

Which market trends and regional insights are shaping the future? Understand drivers like global food trade, comercio electrónico, energy efficiency and evolving regulatory landscapes.

How can businesses ensure sustainability, compliance and resilience? Explore strategies for reducing energy consumption, meeting regulations and managing disruption.

What challenges do cold chain operators face, and how can they overcome them? Gain practical tips to mitigate temperature excursions, infrastructure constraints and labour shortages.

What is cold chain logistics and why is it vital in 2025?

Cold chain logistics refers to the processes and technology used to handle, store and transport temperature sensitive products from origin to consumption while keeping them within strict temperature ranges. Examples include refrigerated food, productos farmaceuticos, vaccines and perishables. El sistema incluye almacenes frigoríficos., vehículos aislados, cooling equipment and sophisticated monitoring tools that work together to maintain product quality. En 2025 demand is accelerating because consumers expect fresh, productos seguros, regulators enforce stricter food and drug safety standards, and industries from plant based proteins to biologics require precise temperature control.

Why the surge in demand?

During the COVID 19 pandemic the cold chain proved indispensable for distributing vaccines and ensuring food security. Post pandemic, the sector continues to grow rapidly. Research shows the global cold chain logistics market is valued at US$436.30 billion in 2025 and is projected to exceed US$1.3 trillion by 2034, con una tasa de crecimiento anual compuesta (Tocón) de 13.46 %. Key drivers include:

Expansión del comercio mundial de alimentos: Increased demand for perishable food products and the globalisation of food supply chains are boosting cold chain investment.

Comercio electrónico y alimentación online: Cada vez más consumidores piden productos frescos y congelados online, necessitating reliable temperature controlled delivery networks.

Innovación tecnológica: Avances en refrigeración, IoT sensors and AI make it possible to monitor shipments in real time and respond quickly to temperature deviations.

Emerging markets and urbanisation: Growing incomes and changing diets in emerging economies create substantial new demand for cold chain infrastructure.

How does cold chain logistics work?

Cold chain operations involve multiple stages: pre cooling commodities, storing them at appropriate temperatures, transporting them in insulated vehicles, and delivering them to retailers or end users. Los rangos de temperatura varían según el producto.. According to industry guidelines, typical ranges include ambiente (59–86 °F), Frío (50–59 °F), refrigerado (32–50 °F), y congelado (–22–32 °F). Maintaining these ranges requires specialized equipment such as compressors, condensers, evaporators and insulation systems. Continuous monitoring ensures that any temperature excursion triggers corrective action, protecting quality and compliance.

| Rango de temperatura | Objetivo | Productos de ejemplo | Lo que significa para ti |

| Ambiente (59–86 °F) | Temperatura ambiente controlada para mercancías no perecederas o de bajo riesgo. | alimentos secos, ciertos productos farmacéuticos | Costos mínimos de refrigeración.; Asegúrese de que haya una ventilación adecuada para evitar la acumulación de calor. |

| Fresco (50–59 °F) | Enfriamiento suave para preservar el sabor y la textura. | Queso, productos frescos | Reduce el deterioro; requiere contenedores aislados y tiempos de transporte cortos |

| Refrigerado (32–50 °F) | Previene el crecimiento bacteriano y mantiene la frescura. | Vacunas, productos lácteos | Control estricto de la temperatura; Utilice sensores de IoT para monitoreo en tiempo real |

| Congelado (–22–32 °F) | Conservación a largo plazo de productos perecederos. | Carne, mariscos, postres congelados | Requiere equipos de ultracongelación y planes de redundancia para fallas eléctricas. |

Key components of a modern cold chain

Sistemas de refrigeración: Equipment such as compressors and evaporators lowers product temperatures to the desired range.

Almacenamiento con temperatura controlada: Refrigerated warehouses with insulation panels, sistemas automatizados de almacenamiento y recuperación (COMO/RS), and high density pallet racks reduce temperature fluctuations.

Infraestructura de transporte: Camiones aislados, reefer containers and refrigerated railcars maintain temperature during transit. Some companies deploy congeladores criogénicos portátiles capable of maintaining –80 °C to –150 °C for biologics.

Sistemas de seguimiento y control.: Los sensores y registradores de datos de IoT transmiten la temperatura en tiempo real, información de humedad y ubicación, Permitir una acción rápida si las condiciones se desvían..

Protocolos de aseguramiento de la calidad.: Procedures such as temperature mapping, emergency response plans and FIFO inventory management ensure continuous compliance and minimal waste.

Practical tips for businesses

Plan de contingencias: Desarrollar protocolos de respuesta de emergencia para fallas de equipos o cortes de energía para evitar daños..

Utilice sensores de IoT: Instale sensores inteligentes en unidades de almacenamiento y vehículos para rastrear la temperatura y la humedad.; automatizar alertas cuando se superan los umbrales.

Entrena a tu equipo: Educar periódicamente al personal sobre los procedimientos de manipulación., registro de datos y respuestas de emergencia para mantener la integridad del producto.

Ejemplo del mundo real: En 2024 CJ Logistics America announced a new cold storage facility near Kansas City designed to meet growing demand for reliable cold chain capacity. The facility features automated systems, refrigeración energéticamente eficiente y monitoreo de IoT, demonstrating how modern cold storage combines technology and sustainability.

How are technologies like AI, IoT and blockchain transforming cold chain logistics?

Advanced technologies are redefining cold chain logistics by improving visibility, eficiencia y sostenibilidad. En 2025, innovations range from AI powered route optimisation to blockchain traceability and sustainable refrigeration solutions. These tools allow businesses to respond to market pressures — such as rising energy costs and strict regulatory requirements — while maintaining product quality.

The role of AI and predictive analytics

AI is revolutionising cold chain logistics in several ways. Artificial intelligence can analyse historical and real time data to predict equipment failures, optimizar las rutas de entrega, demanda prevista, and even reroute vehicles in response to traffic or weather conditions. Predictive analytics helps operators anticipate temperature deviations and take corrective action before spoilage occurs. Según una investigación de mercado, AI enables demand forecasting and improves customer service, and is expected to reduce spoilage by automating alerts and maintenance schedules.

AI’s benefits include:

Optimización de ruta: Algorithms calculate the most efficient paths by analysing traffic, ventanas meteorológicas y de entrega, Reducir el consumo de combustible y garantizar que los productos permanezcan dentro de los rangos de temperatura específicos..

Mantenimiento predictivo: Analizando los datos del sensor, AI predicts when refrigeration units might fail, allowing proactive maintenance and preventing costly breakdowns.

Previsión de la demanda: AI helps businesses plan inventory more accurately by modelling seasonal demand and consumption patterns, reducing waste and inventory costs.

IoT permitió el monitoreo en tiempo real

Internet de las cosas (IoT) devices — including smart sensors, GPS trackers and data loggers — provide end to end visibility across the cold chain. Real time monitoring devices report temperature, humedad y ubicación, and send instant alerts when conditions drift outside the safe range. Según los informes de la industria, the hardware segment for cold chain tracking held encima 76 % de cuota de mercado en 2022. Los beneficios incluyen:

Prevenir el deterioro: Continuous monitoring allows operators to take immediate action if temperatures rise or fall unexpectedly.

Cumplimiento regulatorio: IoT devices provide a verifiable record of a product’s journey, helping companies meet stringent food safety and pharmaceutical regulations.

Transparencia del cliente: Real time data can be shared with customers, building trust and improving satisfaction.

Blockchain para la trazabilidad

La tecnología Blockchain crea registros a prueba de manipulaciones de los recorridos de los productos, habilitando trazabilidad de extremo a extremo and enhancing transparency. Por ejemplo, a pharmaceutical company can log temperature and location data on a blockchain ledger so that manufacturers, transporters and clinics share the same immutable record. Esto reduce el riesgo de manipulación de datos., helps meet regulatory requirements and improves patient safety.

Refrigeración con energía solar e innovaciones sostenibles

Energy consumption is a major cost driver in cold chain logistics. Unidades de refrigeración con energía solar., particularly in rural or energy scarce regions, are emerging as a sustainable solution. These systems use solar panels to power cold storage units, reducing reliance on grid electricity and lowering operational costs. En los Estados Unidos, commercial solar electricity rates can range from 3.2 a 15.5 centavos por kWh, offering potential savings compared to average utility rates.

Other notable innovations include congeladores criogénicos portátiles capable of maintaining ultra low temperatures for biologics and cell therapies, lightweight smart shipping containers equipped with IoT sensors, y Soluciones de embalaje sostenibles such as biodegradable thermal wraps and reusable cold packs.

| Innovación | Descripción | What it means for your business |

| Optimización de rutas impulsada por IA | Los algoritmos analizan el tráfico., Clima y horarios de entrega para encontrar rutas eficientes., lowering fuel use and maintaining temperature integrity | Entregas más rápidas, lower costs and reduced spoilage |

| Mantenimiento predictivo & analítica | La IA predice fallas en los equipos y tendencias de la demanda, permitiendo reparaciones proactivas y una mejor planificación de la capacidad | Less downtime, improved customer satisfaction |

| Sensores IoT y seguimiento en tiempo real | Los dispositivos monitorean la temperatura, humedad y ubicación, providing unbroken visibility and compliance documentation | Alertas inmediatas, Menos pérdidas de productos y mayor cumplimiento normativo. |

| Trazabilidad de la cadena de bloques | Distributed ledger records ensure tamper proof data on product movement and temperature | Transparencia, Reducción del fraude y auditorías simplificadas. |

| Refrigeración con energía solar | Solar panels power cold storage in remote or energy scarce areas | Menores costos de energía y reducción de la huella de carbono. |

| Congeladores criogénicos portátiles | Las unidades móviles mantienen de –80 °C a –150 °C para productos biológicos y terapias génicas | Enables flexible distribution of ultra cold products |

| Embalaje sostenible | Recyclable containers and biodegradable wraps decrease environmental impact | Apoya los objetivos de sostenibilidad corporativa y el cumplimiento normativo. |

Consejos prácticos y recomendaciones.

Integre la IA con la experiencia humana: Utilice la IA como herramienta de apoyo a las decisiones; combine algorithmic recommendations with operational experience to adapt to unforeseen conditions.

Invierta en infraestructura de IoT: Implementar sensores en todo el almacenamiento, transporte y entrega de última milla; ensure data flows into a central platform for analysis and alerts.

Explora las energías renovables: Assess the feasibility of solar panels for warehouses and refrigerated trucks; compare long term savings to up front costs.

Proyectos piloto de blockchain: Comience con una línea de productos limitada para evaluar los beneficios de blockchain en términos de transparencia y cumplimiento.; scale up after proof of concept.

Estudio de caso: Pharma supply chains in Southeast Asia are using blockchain based tracking systems to monitor vaccine shipments, temperatura de registro, humedad y tiempo de viaje en un libro mayor distribuido. Stakeholders access real time data, ensuring compliance and preventing tampering. Solar powered cold storage units and IoT sensors further ensure safe delivery of medicines to remote areas.

Which market trends and regional insights are shaping cold chain logistics in 2025?

The cold chain logistics market is undergoing rapid expansion, driven by macroeconomic forces and sector specific developments. Understanding these trends helps businesses plan investments, manage risk and seize opportunities.

Market growth and forecasts

Multiple research agencies project strong growth for the cold chain sector. Investigación de precedencia reports that the global market will grow from 436,30 mil millones de dólares en 2025 a US$ 1.359,78 mil millones por 2034, una CAGR de 13.46 %. The same report notes that Asia Pacific will experience the highest CAGR of approximately 14.3 %, with segments such as pre cooling facilities and refrigerated warehouses capturing significant market share. El North America market alone is projected to rise from 116.850 millones de dólares en 2024 a 289.580 millones de dólares EE.UU. 2034 en un 9.50 % Tocón, fuelled by pharmaceutical demand and e commerce.

Research by the Food Shippers of America (FSA) reveals that the global market was worth over US$321 billion in 2023 y se espera que supere los 1,245 billones de dólares en 2033, implying a CAGR of around 14.5 %. Such projections underscore the sector’s enormous growth potential.

Growth drivers and sector demand

Global trade and consumer demand: Expanding international trade of perishable goods and shifting consumer preferences — including increased demand for fresh produce and seafood — are primary growth drivers. Social media and global food trends expose consumers to new cuisines, expanding markets for temperature sensitive goods.

Comercio electrónico y alimentación online: Rapid growth of e commerce and meal kit delivery services amplifies the need for efficient cold chain logistics. Last mile delivery requires precise route planning and reliable temperature control.

Auge farmacéutico y biológico: La creciente demanda de productos biológicos, vaccines and personalised medicine drives investment in ultra cold storage and high precision logistics. Aproximadamente 20 % de los nuevos fármacos en desarrollo son terapias basadas en genes y células Requiere un control estricto de la temperatura..

Requisitos reglamentarios: Food safety regulations such as the US Food Safety Modernization Act (FSMA) and similar standards worldwide mandate strict temperature monitoring and documentation.

Presiones de sostenibilidad: Companies adopt energy efficient technologies and eco friendly packaging to meet regulatory expectations and reduce carbon footprints.

Perspectivas regionales y mercados emergentes

Asia-Pacífico: Urbanización rápida, rising incomes and expanding middle classes drive the region’s cold chain growth. MarketsandMarkets proyecta que la industria global de la cadena de frío alcanzará 372 mil millones de dólares por 2029, con Asia-Pacífico a la cabeza debido a la fuerte demanda de venta minorista organizada y alimentos procesados. India’s dairy consumption and the surge in quick service restaurants (QSR) create urgent demand for reliable cold chain logistics.

América del norte: With a robust biopharmaceutical sector and growing e commerce, North America is a mature yet expanding market. Operators invest in new storage facilities, cross border transportation and sustainable technologies.

Europa: Environmental consciousness and strict sustainability regulations push European operators to adopt eco friendly technologies and energy efficient practices. La infraestructura antigua se está modernizando para cumplir con los estándares actuales de eficiencia y sostenibilidad..

Mercados emergentes: Países del sudeste asiático, Africa and Latin America are investing in cold chain capacity to support expanding consumer markets and pharmaceutical needs. Innovations such as solar powered refrigeration and blockchain traceability are especially valuable in regions with unreliable power or regulatory challenges.

Market segmentation and opportunities

The cold chain market can be segmented by service type (transporte, servicios de almacenamiento y valor agregado), rango de temperatura (enfriado, congelado, helado, ambiente) and technology (vehículos frigoríficos, Soluciones de IoT, automatización). Por ejemplo, el dry ice technology segment garnered 55.16 % de cuota de mercado en 2024, while refrigerated warehouses represented 238.290 millones de dólares in value. Asia–Pacific’s pre cooling facilities generated 204.400 millones de dólares en ingresos en 2024. Understanding these segments helps businesses tailor strategies and identify growth areas.

Practical tips and strategies

Assess regional opportunities: Evaluate economic growth, regulatory conditions and consumer demand when deciding where to invest or expand.

Diversify services: Offer value added services such as packaging, labeling and last mile delivery to differentiate from competitors.

Colaborar con socios: Build strategic partnerships with manufacturers, retailers and technology providers to enhance resilience and share best practices.

Plan for geopolitical risks: Geopolitical events and tariffs can disrupt trade routes; develop contingency plans and diversify supply chains.

Estudio de caso: El 2025 North America Cold Chain Market report notes that environmental consciousness is prompting operators to adopt sustainable refrigeration systems and eco friendly packaging. New facilities in Kansas City and cross border transportation services are expanding capacity, while IoT monitors and RFID tracking refine operations.

How can businesses ensure sustainability, compliance and resilience?

The cold chain industry consumes significant energy and is under growing pressure to reduce its environmental impact. Eficiencia energética, energía renovable, waste reduction and compliance with food and pharmaceutical regulations are essential for sustainable growth.

Energy efficiency and renewable solutions

Energy accounts for one of the largest operating expenses in cold storage facilities, second only to labour. Para mejorar la eficiencia:

Upgrade insulation and sealing: Proper insulation and air locking reduce energy loss and maintain stable temperatures.

Modernise equipment: Replace outdated refrigeration units with high efficiency models and adopt automation to reduce energy consumption.

Monitor and analyse energy use: Implement energy data monitoring to identify wastage and optimise operations.

Invertir en energías renovables: Solar panels and other renewable systems can offset electricity costs and reduce carbon emissions.

Capacitar al personal: Provide regular energy efficiency training and embed sustainability into company culture.

These initiatives are paying off: más que 200 temperature controlled warehouses have earned an Energy Excellence award from the Global Cold Chain Alliance (AMCC) for improvements in efficiency.

Cumplimiento normativo y estándares

Food safety and pharmaceutical regulations require strict temperature monitoring, accurate documentation and traceability. Compliance measures include:

Implementing HACCP and FSMA controls: Análisis de riesgos y puntos de control críticos (HACCP) and Food Safety Modernization Act (FSMA) guidelines mandate preventive controls and verification procedures for temperature sensitive goods.

Validating temperature mapping: Conduct regular temperature mapping of storage facilities to identify hotspots and ensure compliance with validated ranges.

Adopting blockchain and IoT: Use tamper proof blockchain records and real time sensor data to satisfy regulators and provide transparent audit trails.

Training for compliance: Train drivers and warehouse staff on proper handling, documentation and contingency plans to avoid violations.

Building resilience to disruptions

The cold chain is vulnerable to disruptions such as power outages, fallas en el equipo, extreme weather and geopolitical events. Strategies to enhance resilience include:

Sistemas redundantes: Install backup generators and duplicate refrigeration units to maintain operation during power failures.

Flexible capacity: Partner with third party logistics providers and consider cross docking to manage volume spikes.

Strategic location planning: Position warehouses near production sites and consumer markets to reduce transit times and energy consumption.

Scenario planning: Model potential disruptions (p.ej., tariffs, pandemias) and develop contingency plans for rerouting or temporary storage.

Consejos prácticos y recomendaciones.

Realizar auditorías energéticas.: Regularly assess energy usage and upgrade equipment as needed.

Evaluate sustainable packaging: Switch to recyclable or biodegradable packaging materials to reduce waste and comply with environmental standards.

Engage with industry alliances: Join organisations like the GCCA to access training, certification and policy advocacy.

Communicate sustainability to customers: Highlight eco friendly practices and transparency measures to build trust and differentiate your brand.

Estudio de caso: Muchos EE.UU.. cold chain operators are transitioning to alternative fuels for transport refrigeration units (TRU) and adopting energy efficient practices. GCCA’s Energy Excellence Recognition Program has awarded Bronze status or higher to encima 200 almacenes for reducing energy consumption and carbon emissions. Operators are also investing in renewable energy generation and modern refrigeration technology to meet sustainability goals.

What challenges do cold chain operators face, and how can they overcome them?

Despite its growth, the cold chain industry faces significant challenges related to infrastructure, workforce, technology and market dynamics. Understanding these obstacles — and their solutions — prepares businesses for continued success.

Temperature control and monitoring challenges

Maintaining precise temperature across long supply chains is difficult, particularly in last mile delivery. Common issues include equipment failure, envíos retrasados, unexpected weather and human error. Las soluciones incluyen:

Monitoreo en tiempo real: Deploy IoT sensors with automated alerts to detect deviations and allow immediate corrective action.

Redundant cooling systems: Use backup refrigeration units and power sources to maintain temperature during equipment failures.

Optimización de ruta: Employ AI driven route planning to avoid traffic delays and minimise transit time.

Capacitación y procedimientos operativos estándar. (Sops): Teach personnel proper handling, recording and emergency response protocols.

Limitaciones de infraestructura y capacidad

Many cold chain facilities were built decades ago and struggle to meet current efficiency and sustainability standards. Upgrading aging infrastructure is expensive but essential. Las soluciones incluyen:

Modernising warehousing: Replace outdated insulation, refrigeration and control systems with energy efficient equipment.

Expanding capacity: Develop new facilities near production and consumption centres; use modular design for scalability.

Investing in automation: Implement automated storage and retrieval systems to increase throughput and reduce labour dependency.

Utilising alternative transportation modes: Consider rail and coastal shipping to alleviate congestion on roadways and reduce emissions.

Labour and skills shortages

The cold chain requires specialised skills for equipment operation, temperature monitoring and data analysis. A labour shortage, combined with the need for digital competencies, poses challenges. Las soluciones incluyen:

Training programs: Participate in industry training through organisations like the GCCA’s Cold Chain Institute, which celebrated its 60th anniversary in 2025.

Automatización y robótica.: Deploy robots for pallet handling and AS/RS systems to reduce reliance on manual labour.

Workforce development initiatives: Collaborate with local colleges and vocational schools to develop a pipeline of skilled workers.

External disruptions and global trade issues

Geopolitical tensions and protectionist trade policies can disrupt supply routes and increase costs. New tariffs on imports and exports may alter sourcing strategies. Para mitigar estos riesgos:

Diversify suppliers and routes: Avoid over reliance on a single region or transport mode.

Scenario planning: Model potential trade disruptions and develop alternative plans for sourcing and distribution.

Collaborate with policymakers: Engage with industry bodies to advocate for balanced trade policies that consider supply chain resilience.

| Desafío | Descripción | Potential solution |

| Mantener la integridad de la temperatura | Fallas de equipos, delayed deliveries and human error can cause temperature excursions | Implementar sensores de IoT, Optimización de rutas de IA, redundant cooling systems and regular training |

| Infraestructura envejecida | Many cold stores are decades old and inefficient | Modernise equipment and insulation, invest in automation, upgrade to energy efficient systems |

| Escasez de mano de obra | The sector requires specialised skills and faces recruitment challenges | Invest in training programs, automation and collaboration with educational institutions |

| Complejidad regulatoria | Stringent food safety and pharmaceutical regulations demand detailed temperature records | Implement HACCP/FSMA controls, blockchain traceability and automated compliance tools |

| Disrupciones geopolíticas | Tariffs and trade disputes alter supply routes and increase costs | Diversificar proveedores, develop contingency plans and engage with policymakers |

Consejos prácticos y recomendaciones.

Conduct regular facility audits: Identify gaps in infrastructure, equipos y procesos; prioritise upgrades based on ROI and risk.

Utilice datos para impulsar decisiones: Analyse temperature and energy data to uncover inefficiencies and plan targeted improvements.

Adopt a culture of continuous improvement: Fomentar la retroalimentación, implement best practices and update SOPs to reflect lessons learned.

Ejemplo del mundo real: La Alianza Global de la Cadena de Frío (AMCC) is working with government agencies to support the industry’s investment in talent, infrastructure and energy efficiency. Its programs help operators navigate regulations and develop sustainable, resilient cold chains.

2025 latest developments and trends in cold chain logistics

Descripción general de la tendencia

Tecnologías emergentes, evolving consumer preferences and policy changes are shaping the cold chain’s future. Los desarrollos clave incluyen:

Automatización y robótica.: Con escasez de mano de obra y costos crecientes, cold chain operators increasingly adopt automated storage and retrieval systems and robotic handling to enhance efficiency.

La sostenibilidad como valor fundamental: Refrigeración energéticamente eficiente, renewable power and eco friendly packaging are no longer optional. The cold chain’s carbon footprint is about 2 % de las emisiones globales de CO₂, prompting companies to prioritise emissions reduction.

Real time end to end visibility: Wider adoption of IoT devices and integrated software provides continuous monitoring and traceability.

Modernizando la infraestructura: Inversiones en automatización, upgraded insulation and on site renewable energy help address aging facilities and prepare for future demand.

IA y análisis predictivo: AI enables smarter decision making by forecasting demand, optimising routes and predicting maintenance needs.

Growth of the pharmaceutical cold chain: Demand for biologics and gene therapies requires ultra cold storage capacity and precise temperature control.

Inversión en logística de alimentos frescos y entrega de última milla: Rising consumer demand for high quality produce and prepared foods is driving investment in efficient last mile distribution.

Asociaciones estratégicas e integración de la cadena de suministro: Colaboración entre fabricantes de alimentos., packaging suppliers and tech providers enhances resilience and innovation.

Los últimos avances de un vistazo

Eco friendly packaging and renewable energy: Biodegradable insulation materials and recyclable containers reduce waste.

Almacenamiento en frío con energía solar: Solar installations lower energy costs and support rural distribution.

Congeladores criogénicos portátiles: Mobile units maintain ultra low temperatures for cell and gene therapies.

Optimización de rutas impulsada por IA: Algorithms use real time traffic and weather data to cut transit times and protect product integrity.

Trazabilidad de la cadena de bloques: Tamper proof ledgers record temperature and location for end to end transparency.

Data standardisation and smart containers: Standardised data formats and smart containers enable seamless supply chain integration.

Ideas del mercado

The cold chain market will continue to expand as consumer demand for fresh foods and biologics grows. Asia–Pacific and North America will remain growth engines, while Europe will lead sustainability efforts. Segments such as dairy and frozen desserts (36.1 % participación en los ingresos en 2024) e instalaciones de preenfriamiento (US$204.4 billion in value) represent lucrative opportunities. Growing e commerce and meal kit industries will accelerate investment in last mile solutions and real time tracking technologies. Para seguir siendo competitivo, operators must adopt new technologies, modernise facilities, build partnerships and invest in sustainability.

Preguntas frecuentes

What does “cold chain logistics” mean? Cold chain logistics is the process of storing and transporting temperature sensitive goods — such as vaccines, fresh produce and biologics — in a controlled environment to preserve quality and safety.

How can IoT improve cold chain performance? IoT sensors provide real time monitoring of temperature, humedad y ubicación, allowing operators to detect deviations instantly, take corrective action and maintain regulatory compliance.

¿Por qué es importante la sostenibilidad en la logística de la cadena de frío?? The cold chain’s energy consumption makes it a significant contributor to greenhouse gas emissions. Adopting energy efficient equipment, renewable power and eco friendly packaging reduces environmental impact, lowers costs and meets regulatory and customer expectations.

¿Qué papel juega la IA en la logística de la cadena de frío?? La inteligencia artificial optimiza las rutas de entrega, predicts equipment maintenance, forecasts demand and analyses large datasets to improve decision making, reduce spoilage and enhance customer satisfaction.

How is the cold chain market expected to grow? Analysts estimate the global market will grow from 436,30 mil millones de dólares en 2025 to US$1.3 trillion by 2034, driven by rising demand for perishable foods, pharmaceuticals and online grocery services.

Resumen y recomendaciones

La industria de la logística de la cadena de frío está experimentando un rápido crecimiento, fuelled by global trade, comercio electrónico, pharmaceuticals and technological innovation. Las conclusiones clave incluyen:

Rápida expansión del mercado: The global market is projected to grow at a CAGR of over 13 % a través de 2034, with Asia–Pacific and North America as leading regions.

Technological transformation: AI, IoT, blockchain and sustainable refrigeration are reshaping operations, mejorando la visibilidad, reducing waste and enabling new business models.

Sostenibilidad y cumplimiento: Eficiencia energética, renewable power and eco friendly packaging are essential to reduce costs and meet regulatory requirements.

Challenges require proactive strategies: control de temperatura, mejoras de infraestructura, labour shortages and geopolitical disruptions demand continuous investment, capacitación y planificación de contingencias.

Partnerships and integration: Collaboration among supply chain stakeholders enhances resilience, innovation and market reach.

Próximos pasos viables

Conduct a technology audit: Evaluate current systems and identify opportunities for AI integration, IoT deployment and renewable energy investments.

Modernizar la infraestructura: Prioritise upgrades to refrigeration, insulation and automation to improve efficiency and capacity.

Strengthen resilience: Desarrollar planes de contingencia, diversify suppliers and invest in staff training to handle disruptions and maintain compliance.

Adopte la sostenibilidad: Transition to eco friendly packaging, energías renovables y equipos energéticamente eficientes; communicate these efforts to customers.

Construir alianzas estratégicas: Colaborar con proveedores de tecnología, logistics partners and regulatory bodies to leverage shared expertise and resources.

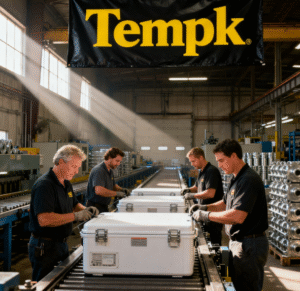

Acerca de Tempk

Tempk es una empresa tecnológica especializada en Soluciones logísticas con temperatura controlada.. Con décadas de experiencia en la industria, we design and manage cold chain systems for food, pharmaceutical and biotech clients worldwide. Our proprietary sensors and AI enabled platforms provide real time visibility and predictive analytics, allowing customers to maintain product quality, reduce waste and comply with regulatory standards. We continuously invest in energy efficient equipment and sustainable packaging, helping businesses meet environmental goals while staying competitive.

Llamado a la acción

Listo para optimizar su cadena de frío? Get in touch with Tempk’s specialists para una consulta personalizada. Evaluaremos tus operaciones, recommend the right technologies and help you implement a resilient, estrategia de cadena de frío sostenible. Contact us today to start protecting your temperature sensitive products and unlocking new efficiencies.