Cómo evolucionará la logística de suministro de la cadena de frío 2025

el mundo de cold chain supply logistics is undergoing rapid change, impulsado por las nuevas tecnologías, stricter regulations and shifting consumer expectations. In this comprehensive guide you’ll discover how automation, inteligencia artificial (AI), sustainable packaging and regional market dynamics are reshaping the way temperature sensitive products are stored, transported and delivered. The global cold chain logistics market is valued at Dólar estadounidense 436.30 mil millones en 2025 y se prevé que alcance alrededor de USD 1,359.78 mil millones por 2034 con un 13.46 % Tocón. Understanding these shifts now will help you make smarter decisions and keep your goods safe and profitable.

What cold chain supply logistics involves – from storage and transportation to handling and final delivery, including core components and packaging systems.

How automation and AI transform operations – including robotics adoption, predictive analytics and real time monitoring that reduce costs and errors.

Why sustainability and waste reduction matter – examining energy efficient solutions, biodegradable packaging and the economic benefits of cutting waste.

How sectors like pharmaceuticals and fresh foods drive growth – highlighting gene therapy temperature needs, market forecasts and emerging products.

What regional trends and challenges to expect in 2025 – exploring Asia–Pacific’s growth, Europe’s infrastructure investments and U.S. dominance.

Preguntas frecuentes – clear answers on packaging choices, regulatory requirements and selecting suppliers.

What does cold chain supply logistics involve and why is it important?

Cold chain supply logistics refers to the interconnected processes of packaging, almacenamiento, handling and transporting temperature sensitive goods under controlled conditions. These processes keep products within a safe temperature range from production to consumption, garantizando la seguridad y la calidad. Without robust cold chain systems, alimentos perecederos, vacunas, biologics and chemicals would spoil or lose efficacy during transit. Demand for effective cold chain packaging is growing rapidly—the global cold chain packaging market was about US$20.08 billion in 2020 y se prevé que alcance US$36.65 billion by 2026; some analyses foresee it surpassing US$100 billion by the mid 2030s.

Understanding cold chain logistics is crucial across industries. Pharmaceuticals and biologics require strict temperature ranges (típicamente 2–8 ° C) Para mantener la potencia; the World Health Organization estimates that over 25 % de las vacunas pierden eficacia por fallos en la cadena de frío. Fresh produce and meal kits comprise around 75 % del mercado de envases de cadena de frío, where maintaining texture, flavour and nutritional value is essential. quimicos, productos cosméticos, agriculture and horticulture also rely on precise temperature control to protect product integrity. Effective cold chain logistics therefore safeguard public health, reduce waste and support global trade.

Core components of cold chain supply logistics packaging

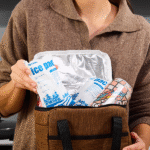

Cold chain logistics integrates several elements working together to maintain temperature control throughout the shipment. Key components include insulation materials, temperature control mechanisms, tailored packaging design, coolants or phase change materials (PCM), and sensors or data loggers. Materiales aislantes como poliestireno expandido (EPS), polyurethane foam and vacuum insulated panels (VIP) create a thermal barrier, reducing heat transfer and allowing longer transit times. Temperature control mechanisms can be active (using refrigeration units or dry ice) o pasivo (relying on pre conditioned gel packs or PCMs); choosing the right system influences cost, complexity and performance. Tailored packaging design ensures products fit snugly and minimises void space to maintain temperature uniformity.

The following table summarises typical temperature ranges and packaging choices for common products:

| categoría de producto | Rango de temperatura seguro | Typical packaging | Importancia práctica |

| Productos farmacéuticos | 35.6 °F–46.4 °F (2–8 ° C) | Insulated containers with PCMs or gel packs; sellos a prueba de manipulaciones | Maintains drug efficacy and reduces microbial growth. |

| Productos perecederos (producir, lácteos, carne) | ≤ 40 °F (4.4 °C) | Cajas de EPS o PUR con packs de gel; forros transpirables | Prevents spoilage and preserves texture or flavour. |

| Chocolate | Softening at 85 °F (29 °C), melting at 93 °F (34 °C) | Sobres térmicos con aislamiento reflectante.; enfriamiento moderado | Mantiene la apariencia y previene la proliferación de grasa.. |

| Alimentos congelados | –30 ºC a 0 °C | Polyurethane containers with dry ice or –20 °C PCMs; transportistas de paletas reutilizables | Evita la descongelación de mariscos y helados durante el tránsito prolongado. |

| Biológicos ultrafríos (Vacunas de ARNm, terapias génicas) | ≤ –80 °C | VIPs combined with dry ice; reusable rigid containers | Esencial para productos ultrafríos.; provides reliable –80 °C conditions. |

Consejos y consejos prácticos

Map product requirements: Classify items into temperature zones (p.ej., cool 10–15 °C, refrigerated 0–10 °C, frozen –30–0 °C or ultra cold ≤ –80 °C) to select appropriate packaging.

Refrigerantes preacondicionados: Freeze or pre condition PCMs and gel packs to the correct temperature before packing to achieve optimal thermal performance.

Minimizar el espacio vacío: Fill empty areas with cushioning to reduce heat transfer and prevent shifting during transit.

Controlar la humedad: Leafy greens may require up to 95 % humedad relativa; use absorbent liners or moisture regulating materials accordingly.

Etiqueta y documento: Mark packages with handling instructions (p.ej., “Mantener congelado”) and keep temperature records to meet regulatory requirements.

Ejemplo del mundo real: When COVID 19 vaccines were first distributed in the United States, engineers at IPS Packaging & Automation helped design cold chain shipping materials that maintained extremely low temperatures while meeting regulatory standards, garantizar la integridad de la vacuna. This highlights the importance of well designed packaging in safeguarding public health.

How are automation and AI transforming cold chain supply logistics?

Automation and AI are emerging as core technologies that address labour shortages, optimise routes and improve decision making in cold chain supply logistics. Many warehouses remain unautomated—studies show that about 80 % de los almacenes carecen de automatización—leaving significant room for efficiency gains. Sistemas automatizados de almacenamiento y recuperación. (COMO/RS) and robotic handling reduce labour costs, operate continuously and minimise errors. By controlling temperature and humidity automatically, these systems also improve product quality.

AI and predictive analytics further enhance cold chain operations. Artificial intelligence can analyse historical data and real time sensor readings to forecast demand, optimizar rutas y predecir las necesidades de mantenimiento de equipos. According to Inbound Logistics’ 2025 encuesta, 71 % of logistics technology vendors now offer AI solutions, a sharp rise from 50 % en 2024. AI enablement ranked among the top five challenges for shippers, con 47 % of technology vendors indicating customers viewed AI adoption as critical. These statistics underscore that AI has moved from experimentation to mainstream adoption.

AI and predictive analytics in route optimisation

AI powered route optimisation uses real time traffic data, weather information and historical performance to chart the most efficient paths for shipments. This reduces transit times and prevents quality degradation by avoiding congestion or extreme environmental conditions. Predictive analytics also identify upcoming temperature excursions through continuous monitoring, triggering immediate alerts for corrective action. The integration of AI with IoT sensors—small devices attached to shipments that measure temperature, humidity and location—allows logistics providers to intervene proactively before spoilage occurs.

The benefits of AI extend beyond route planning. AI driven demand forecasting helps organisations allocate resources efficiently and maintain inventory levels, reduciendo el desperdicio. Predictive maintenance algorithms monitor equipment health and schedule servicing before breakdowns occur, preventing costly product losses. In the inbound logistics survey, cost reduction remains the top customer challenge, yet vendors note that AI enablement now ranks highly, indicating broad recognition of AI’s value.

Robotics and end to end visibility

Robotic systems are increasingly deployed to handle pallets, sort packages and manage inventory. These machines can operate 24/7, accelerating throughput and reducing manual errors. Por ejemplo, robotic forklifts navigate warehouses using sensors and machine vision, minimising product damage and improving safety. Mientras tanto, seguimiento en tiempo real with IoT devices provides end to end visibility; en 2022 el segmento de hardware mantenido encima 76.4 % del mercado de seguimiento y monitoreo de la cadena de frío. This visibility enables logistics companies to optimise routes, ensure regulatory compliance and enhance customer satisfaction.

Why are sustainability and waste reduction key priorities?

Environmental sustainability is no longer optional for cold chain operations. The food cold chain is responsible for roughly 2 % de las emisiones globales de CO₂, y more than one billion tonnes of food are wasted every year—equivalent to 8–10 % de las emisiones globales de gases de efecto invernadero. Sustainable practices can help reduce this footprint while preserving product integrity. Regulatory pressures and consumer expectations are pushing companies to adopt energy efficient refrigeration systems, renewable energy sources and biodegradable or recyclable packaging.

Sustainable materials and eco friendly innovations

Green logistics focuses on reducing emissions and resource consumption throughout the supply chain. In packaging, there is growing interest in paper and paperboard materials, which are biodegradable and account for 42 % of the cold chain packaging materials market in 2025. Insulated containers dominate by providing 40.4 % cuota de mercado because of their durability and ability to protect goods from physical damage. Mientras tanto, companies are innovating in refrigerants: Cryopak introduced Eco Gel, a biodegradable gel pack that maintains consistent temperatures and can withstand repeated use, offering a sustainable alternative to traditional gels.

Another eco friendly innovation is unidades de almacenamiento en frío con energía solar. These units provide reliable cooling in regions with inconsistent electricity grids and reduce energy costs. Commercial solar rates vary between 3.2 y 15.5 centavos por kWh, offering significant savings compared with the average commercial utility cost of 13.10 centavos por kWh en 2024. Solar installations thus bridge gaps in rural healthcare and food distribution across Southeast Asia.

Sustainability also extends to Materiales de cambio de fase (PCM) y reusable rigid containers. The PCM segment was valued at 3.600 millones de dólares en 2024, indicating growing adoption. Reusable rigid containers and pallet shippers are expected to grow from 4.970 millones de dólares en 2025 a 9.130 millones de dólares EE.UU. 2034. Despite higher upfront costs, these systems lower total cost of ownership and reduce waste over time.

Economic benefits of waste reduction

Reducing spoilage saves money and lessens environmental impact. Wasted perishable food can lose up to 50 % of its value sin control de temperatura adecuado. Effective cold chain logistics minimise returns, protect brand reputation and maximise each shipment’s value. Además, sustainable practices help companies comply with environmental regulations and avoid penalties. As energy prices become more volatile, investments in efficient refrigeration and renewable energy can provide a competitive advantage.

How do pharmaceuticals and fresh food drive cold chain supply logistics growth?

The pharmaceutical sector is a major driver of cold chain expansion. Durante la pandemia de COVID 19, the need for ultra cold storage to distribute vaccines highlighted gaps in infrastructure and accelerated investment. Aproximadamente 20 % de los nuevos fármacos en desarrollo son terapias genéticas y celulares, que requieren temperaturas ultra frías and precise handling. Se espera que el mercado mundial de la cadena de frío farmacéutica alcance 1.454 mil millones de dólares por 2029 con un 4.71 % Tocón de 2024 a 2029, underscoring long term demand for robust logistics.

Fresh foods also fuel growth. Se prevé que el mercado de logística de la cadena de frío de alimentos de América del Norte alcance 86.670 millones de dólares en 2025. Rising demand for plant based and organic certified foods creates new supply chain requirements. Según Maersk, Los alimentos de origen vegetal podrían representar 7.7 % del mercado mundial de proteínas por 2030, vale la pena $162 mil millones, and these products require specialised refrigerated transportation. Online ordering has increased direct to consumer sales, pushing warehouses and retailers to rethink last mile delivery strategies. Investments in fresh food logistics and last mile delivery infrastructure will continue to grow to satisfy consumer expectations.

Pharmaceutical logistics and ultra cold requirements

Vacunas, insulin and gene therapies must stay within strict temperature ranges. For mRNA vaccines and certain biologics, temperaturas as low as –80 °C son requeridos; VIPs combined with dry ice or reusable rigid containers provide the necessary conditions. El dry ice segment held 55.16 % of the technology market share in 2024, illustrating its importance in ultra cold transportation. Pre cooling facilities—used to remove field heat from produce and pharmaceuticals before storage—were valued at 204.400 millones de dólares en 2024, reflecting the infrastructure needed to maintain product quality across the supply chain.

Comida fresca, meal kits and last mile delivery

Productos frescos, lácteos, meat and meal kits represent about 75 % del mercado de envases de cadena de frío. Temperature thresholds vary across products—perishables should stay at or below 40 °F (4.4 °C), while chocolates soften at 85 °F (29 °C). Meal kit delivery benefits from multi zone shippers that can combine cool (10–15 ºC) and refrigerated (0–10 ºC) compartments to improve load utilisation by arriba a 30 %. Last mile delivery strategies emphasise automation, route optimisation and consumer visibility; según Trackonomy, companies are investing in real time tracking devices and software to provide up to date information and enhance customer satisfaction.

What regional trends and challenges will shape cold chain supply logistics in 2025?

Regional dynamics influence both opportunities and challenges. In the cold chain logistics market, Asia–Pacific is expected to grow at a 14.3 % CAGR de 2025 a 2034, driven by rising demand for fresh foods, pharmaceuticals and improved infrastructure. Asia also leads in adopting innovations such as blockchain for traceability, solar powered cold storage and IoT sensors, particularmente en el sudeste asiático. Europe holds over 30 % of the cold chain packaging materials revenue in 2025, boosted by strong pharmaceutical production and strict regulatory compliance. Germany accounts for 17.87 % of Europe’s cold chain packaging market, reflecting its large dairy industry. En América del Norte, advanced logistics infrastructure and high perishable demand give the region the largest revenue share of 33.10 % en 2025.

Regional growth and infrastructure investments

Investments in infrastructure will continue. en el reino unido, cold storage provider Magnavale announced a £130 million (US$161.3 million) inversión to build a 101,000 pallet cold store. Such projects expand capacity and modernise aging facilities. Regulatory pressures also drive change; Maersk señala que ageing cold storage infrastructure (40–50 años) and the phase out of environmentally harmful refrigerants like HCFCs and HFCs require modernisation and compliance with sustainability goals. Disrupciones geopolíticas, like restrictions on the Panama Canal or black swan events, underscore the need for resilient and diversified supply routes.

Economic partnerships and trade policies will influence supply chains. The United States introduced new tariffs in 2025 that increased costs for critical components in temperature controlled packaging. Companies are responding by exploring near shoring and diversifying vendor strategies to mitigate cost pressures. Mientras tanto, manufacturers are expanding into emerging markets; por ejemplo, Walmart operates more than 10,526 outlets across 24 países, illustrating how global retail expansion drives demand for cold chain logistics.

Market size comparisons and growth outlook

Below is a comparison of regional market sizes and growth rates drawn from industry analyses:

| Región | Estadísticas clave | Implications for your business |

| Logística global de la cadena de frío | Market size US$436.30 billion in 2025, projected to reach US$1,359.78 billion by 2034 con una CAGR de 13.46 %. | Rapid global expansion suggests robust demand; investing now positions you ahead of competitors. |

| Asia-Pacífico | Highest CAGR at about 14.3 % de 2025 a 2034; fastest growing packaging materials region with a 7.2 % Tocón. | Opportunities in logistics infrastructure, e commerce groceries and pharmaceutical distribution. |

| Europa | Sostiene >30 % of packaging materials revenue share; major investments in modern cold stores like Magnavale’s £130 million facility. | High regulation and sustainability standards require compliance; partnerships with European providers can facilitate market entry. |

| América del norte | Largest revenue share (33.10 %) of cold chain packaging market; significant seafood harvests (US$6.3 billion dockside value) driving demand for chilled logistics. | Mature infrastructure and strong pharma industry make this a stable market for growth. |

| América Latina & Mercados emergentes | Growing demand due to expansions in retail chains like Walmart and increasing e commerce. | Businesses should consider localized partnerships and regulatory compliance to serve new consumers. |

What challenges and opportunities define the future of cold chain supply logistics?

Several challenges confront the industry. High costs of advanced packaging solutions—such as VIPs, PCMs and reusable systems—can be prohibitive for small and medium sized companies. Rising raw material prices further squeeze margins. Infraestructura envejecida remains a critical issue; many cold storage facilities are 40–50 years old and rely on refrigerants that are being phased out. Escasez de mano de obra persist, pushing operators to embrace automation and robotics. Complejidad regulatoria—for example, A NOSOTROS. Ley de modernización de la seguridad alimentaria (FSMA) Regla 204, Ley de seguridad de la cadena de suministro de medicamentos (DSCSA) serialization requirements and EU sustainability directives—add compliance burdens.

A pesar de estos desafíos, abundan las oportunidades. Embalaje ecológico is a major growth area as consumers and regulators demand sustainable options. Integración tecnológica—from AI and IoT to blockchain and solar energy—enables proactive management, reduces waste and enhances transparency. Alianzas estratégicas among food manufacturers, packaging suppliers and tech providers can streamline supply chains and broaden market reach. There is also room for consolidation and collaboration; por 2025, 74 % Se espera que los datos logísticos estén estandarizados., facilitating seamless integration across supply chains.

2025 latest cold chain supply logistics developments and trends

Descripción general de la tendencia

The cold chain landscape in 2025 continues to evolve with technological, environmental and market driven changes. Los desarrollos clave incluyen:

Advanced IoT sensors and real time tracking: IoT devices with GPS and temperature monitoring capabilities provide continuous visibility, permitiendo acciones correctivas inmediatas y reduciendo el deterioro. El segmento de hardware representó encima 76.4 % del mercado de seguimiento y monitoreo de la cadena de frío en 2022.

Blockchain para una trazabilidad de extremo a extremo: Distributed ledgers make shipment records transparent and tamper proof; companies can share real time temperature, humidity and transit data with stakeholders to ensure compliance and build trust.

Solar powered cold storage and renewable energy integration: Solar units provide reliable cooling in remote locations and reduce energy costs, aligning with corporate sustainability goals and supporting rural healthcare.

AI powered route optimisation and predictive maintenance: AI analyses real time and historical data to forecast demand, plan efficient routes and schedule maintenance before breakdowns. This improves reliability and reduces operating costs.

Congeladores criogénicos portátiles: Emerging devices maintain temperatures as low as –80 °C to –150 °C, critical for biologics and cell therapies.

Sustainable refrigerants and packaging materials: Innovations like Eco Gel and biodegradable PCMs offer alternatives to traditional gel packs, while paper and paperboard solutions reduce environmental impact.

Tariff driven supply chain adjustments: Nuevos Estados Unidos. aranceles introducidos en 2025 aumentar los costos de los componentes de embalaje con temperatura controlada, prompting companies to explore near shoring and diversify suppliers.

Ideas del mercado

Industry surveys reveal that 91 % of logistics technology vendors serve supply chain and transportation companies, y manufacturing usage of logistics IT increased to 81 % en 2025. AI adoption skyrocketed: 71 % of vendors offer AI solutions, and AI enablement emerged as a top customer challenge. Despite strong interest in technology, underutilisation remains—many logistics operations still rely on manual processes, indicating a large opportunity for digital transformation.

The cold chain packaging materials market stands at 9.500 millones de dólares en 2025 y se prevé que alcance US$15.7 billion by 2032 con un 7.6 % Tocón. Papel & paperboard products lead the segment, contabilidad de 42 % de ingresos, while insulated containers hold 40.4 % compartir. The food sector accounts for 65 % of end user demand, and the pharmaceutical sector shows high growth due to personalised medicine and biologics.

Preguntas frecuentes

Q1: How do I choose the right packaging for cold chain supply logistics in 2025?

Select packaging based on your product’s temperature requirements, shipment duration and regulatory obligations. Por ejemplo, EPS foam boxes with gel packs work for perishable foods needing temperatures around 0–10 °C, while VIPs and dry ice are necessary for ultra cold biologics at –80 °C. Evaluate insulation performance, peso y sostenibilidad; consider reusable containers to reduce long term costs.

Q2: What regulations affect cold chain supply logistics?

Major regulations include the U.S. Ley de modernización de la seguridad alimentaria (FSMA) Regla 204, requiring traceability records; la Ley de Seguridad de la Cadena de Suministro de Medicamentos (DSCSA) serialization for pharmaceuticals; and EU sustainability directives focusing on eco friendly materials. Compliance demands accurate temperature monitoring and record keeping.

Q3: How can automation reduce costs in my cold chain operation?

Automation reduces labour costs and minimises human error. Robotic handling and automated storage systems operate continuously, aumentar el rendimiento y reducir los tiempos de ciclo. AI based predictive maintenance prevents equipment failures, while route optimisation algorithms cut fuel costs and improve delivery reliability.

Q4: ¿Por qué es importante la sostenibilidad en la logística de la cadena de frío??

Sustainability reduces environmental impact and improves profitability. La cadena de frío alimentario contribuye aproximadamente 2 % de las emisiones globales de CO₂; adopting renewable energy and biodegradable packaging lowers this footprint. Reducing food waste (more than one billion tonnes globally) can cut greenhouse gas emissions by up to 8–10 % and improve margins.

Q5: ¿Qué debo buscar al seleccionar un socio logístico de la cadena de frío??

Assess potential partners for regulatory compliance (PIB, FSMA, DSCSA), integración tecnológica (seguimiento en tiempo real, AI, cadena de bloques), sustainable practices and geographic reach. Check whether they offer end to end visibility and customised solutions for your specific product requirements.

Sugerencia

para prosperar en 2025, businesses must embrace the transformation sweeping cold chain supply logistics. Automation and AI enhance efficiency, predictive analytics optimize routes and prevent breakdowns, and real time tracking provides end to end visibility. Sustainable packaging and renewable energy reduce environmental impact and compliance risks, while robust infrastructure and regional investments support global growth. The pharmaceutical and fresh food sectors drive demand for ultra cold storage and precise delivery, making innovation essential.

Próximos pasos viables:

Audita tu cadena de frío: Map product temperature requirements, packaging systems and transport routes to identify gaps and upgrade opportunities.

Invertir en tecnología: Implementar sensores de IoT, AI driven analytics and automated handling systems to improve visibility, reduce errors and cut costs.

Adoptar soluciones sostenibles: Transition to eco friendly packaging materials and explore renewable energy sources such as solar powered storage units.

Fortalecer alianzas: Colaborar con proveedores, logistics providers and customers to standardize data, share resources and increase resilience.

Monitor regulations and markets: Stay updated on global trends, tariffs and regional investments to adapt strategies and seize new opportunities.

Al tomar estos pasos, you’ll position your organisation to deliver temperature sensitive products safely, sustainably and profitably in the coming years.

Acerca de Templ

Tempk es un proveedor líder de soluciones logísticas y de embalaje para la cadena de frío.. We specialize in reusable and recyclable insulated containers, phase change materials and IoT enabled monitoring systems designed to keep your products within their target temperature ranges. With our research and development centre and decades of industry experience, we deliver solutions tailored to pharmaceuticals, alimentos, chemicals and more. Our commitment to innovation and sustainability helps clients reduce waste and operational costs while meeting regulatory standards.