Continuando a guerra de descontos: A controladora da RT-Mart relata uma perda de 378 Milhões em meio ano, com quase 100,000 Membros Pagantes

Continuando a guerra de descontos: A controladora da RT-Mart relata uma perda de 378 Milhões em meio ano, com quase 100,000 Membros Pagantes

Nos últimos seis meses, Varejo Gome (06808.Hong Kong), a empresa-mãe da RT-Mart, enfrentou desafios significativos ao se concentrar na expansão de suas lojas associadas e na resposta às guerras de preços.

Na noite de novembro 14, Gome Retail divulgou seu relatório financeiro provisório para o primeiro semestre do ano fiscal 2024, terminando em setembro 30. O relatório mostrou que a receita da empresa foi 35.768 bilhões de RMB, abaixo 11.9% ano após ano, enquanto registrou uma perda de 378 milhões de RMB, um aumento substancial em relação ao 87 perda de milhões de RMB no mesmo período do ano passado. O prejuízo líquido atribuível aos acionistas da empresa foi 359 milhões de RMB, em comparação com uma perda de 69 milhões de RMB no ano anterior.

Gome Retail atribuiu a perda ampliada a vários fatores, incluindo a contracção estratégica do seu negócio da cadeia de abastecimento, um declínio em seu negócio de garantia de fornecimento, e desempenho abaixo do esperado. Adicionalmente, este ano a empresa implementou diversos ajustes operacionais, como aumentar descontos e expandir novos formatos de varejo, que adicionou pressões significativas de custos a curto prazo.

Como comércio eletrônico de alimentos frescos, lojas de membros, e lojas de descontos crescem, empresas de supermercados enfrentam concorrência mais intensa. Depois que Freshippo iniciou a guerra de preços na indústria supermercadista em agosto, muitas empresas de supermercados responderam adotando uma estratégia “orientada para descontos”. No mesmo mês, RT-Mart lançou sua campanha “No Bargaining”, oferecendo preços de produtos como mochi, croissants, leite fresco, e salmão que eram inferiores aos do Sam's Club.

Em outubro, RT-Mart atualizou sua campanha “No Bargaining” para a promoção “Honest Prices”, cobrindo mais de 1,000 produtos em todas as categorias, incluindo laticínios, lanches, cuidados pessoais, limpeza doméstica, grãos, óleos, e bebidas. Gome Retail disse à Time Finance que a iniciativa “Preços Honestos” continuará, e a empresa aumentará a competitividade de preços através da consolidação de produtos e fornecedores e melhorando a eficiência digital.

No entanto, se o RT-Mart não puder reduzir os custos da cadeia de abastecimento e depender apenas da redução dos preços dos produtos, pode não resolver a questão do declínio dos lucros.

Atualmente, Os esforços da cadeia de abastecimento da RT-Mart refletem-se principalmente nos seus produtos de marca própria. Durante o período do relatório, a empresa lançou 170 SKUs sob sua marca própria RT100, que inclui produtos desenvolvidos exclusivamente pela RT-Mart ou em parceria com fabricantes. A promoção de marcas próprias trouxe novidades ao RT-Mart em outubro, com seu próprio pão de batata ganhando popularidade nas plataformas de mídia social.

Gome Retail afirmou que o desempenho do seu negócio principal no segundo trimestre mostrou uma redução significativa da diferença em relação ao período anterior.

Ao contrário das Superlojas Yonghui e do Supermercado Bubugao, que fechou lojas para reduzir perdas, Gome Retail continuou a acelerar a expansão das lojas, adicionando algumas pressões de custo. Durante o período do relatório, Gome Retail incorreu em despesas de capital de 440 milhões de RMB, acima de 258 milhões de RMB no mesmo período do ano passado, principalmente devido ao desenvolvimento de novas lojas, reformas de lojas, e atualizações digitais.

No primeiro semestre do ano fiscal 2024, Gome Retail abriu três novas lojas RT-Mart e acelerou a expansão de seu formato RT-Mart Super de gama média e lojas de membros M como parte da segunda estratégia de crescimento da empresa. RT-Mart Super abriu sete novas lojas em Jinan, Tangshan, Songyuan em Jilin, Changchun, Lanzhou, Dongguan, e outros locais, com mais sete previstos para serem inaugurados até o final do ano fiscal.

Depois de abrir sua primeira loja nacional de membros M em Yangzhou em abril deste ano, o número de membros pagantes atingiu quase 100,000. Novas lojas em Changzhou e Nanjing estão programadas para abrir em dezembro e janeiro do próximo ano, respectivamente. Para construir uma base de membros antecipadamente, os dois locais lançaram operações online durante o Double 11 festival de compras.

Gome Retail revelou que as lojas associadas M já iniciaram os preparativos para sua quarta e quinta lojas, incluindo recrutamento e contratação de novos membros, com três novas lojas previstas para abrir até o final do ano fiscal 2024. Atualmente, As lojas de membros M concentram-se principalmente no segundo- e cidades de terceiro nível, com localizações nos centros das cidades e um formato comunitário que evita a concorrência direta com o Sam's Club e a Freshippo X Membership Store durante a fase inicial de crescimento. No entanto, se a estratégia da Gome Retail de lojas associadas e preços “orientados para descontos” pode reverter suas perdas contínuas, levará algum tempo para provar.

No negócio B2C online, depois que o crescimento da receita ultrapassou 15% no ano fiscal 2023, o primeiro semestre do ano fiscal 2024 viu um crescimento contínuo de 4.7%, com o volume de pedidos aumentando em 8.9%. A proporção da receita deste segmento passou de 18.9% para 22.6%. Entre os canais online do RT-Mart, incluindo o APP RT-Mart Fresh, Ele.me, e Taoxianda, o APP RT-Mart Fresh agora representa mais de um terço das vendas.

Gome Retail afirmou que a alta temporada de receitas e lucros do grupo é no quarto trimestre do ano fiscal, que inclui feriados importantes, como o Ano Novo, Festival da Primavera, e o Ano Novo Lunar. A empresa planeja aprimorar suas ofertas de produtos diferenciados, otimizar a eficiência operacional, e aproveitar a temporada de férias para melhorar o desempenho.

Vale ressaltar que em março 28, depois que o Alibaba iniciou a reestruturação organizacional “1+6+N”, Gome Varejo foi integrado ao segmento “N” de outras unidades de negócios, enquanto Freshippo, que também atua no varejo offline, anunciou planos para buscar um IPO.

Quando questionado se o posicionamento estratégico e o status da Gome Retail dentro do Alibaba foram afetados, A Gome Retail respondeu à Time Finance dizendo que a Gome Retail sempre foi uma empresa listada independente, com Alibaba como acionista controlador, e a cooperação com outras unidades de negócios do Alibaba sempre seguiu os princípios do mercado.

No fechamento do pregão em novembro 15, O preço das ações da Gome Retail subiu 2.53%, fechando em HKD 1.62 por ação, com um valor total de mercado de HKD 15.454 bilhão.

Ziyan Foods aprofunda seu foco no conveniente segmento de jantar, Expande-se em alimentos pré-preparados, E alcança um crescimento inovador.

Como o ritmo da vida continua a acelerar, O estilo de vida dos jovens passou por uma série de mudanças. As pessoas estão procurando mais tempo para experimentar coisas diferentes, e portanto, Eles procuram aumentar a eficiência em todos os aspectos de suas vidas. Como jantar é uma parte essencial da vida cotidiana, Melhorar a eficiência das refeições tornou -se uma demanda comum entre o público. Comida Ziyan, uma marca bem conhecida na indústria de alimentos marinada, tem produtos que atendem a essa necessidade de jantar conveniente. A empresa inovou continuamente nesta área e no ano passado se aventurou em um novo segmento de jantar conveniente-alimentos preparados. Este movimento visa proporcionar aos consumidores uma maior tranquilidade e opções de refeições mais convenientes.

Profundamente enraizado na indústria de alimentos marinada

Comida Ziyan, Uma cadeia nacional especializada em alimentos prontos para comer, Originado em Sichuan, cresceu em Jiangsu, e agora está sediada em Xangai. Ao longo dos anos, A Ziyan Foods alavancou sua extensa linha de produtos, gestão da cadeia de abastecimento, e desenvolvimento de infraestrutura para estabelecer um sistema de gerenciamento padronizado. Este sistema cobre tudo, desde compras e rastreabilidade de matéria -prima, Controle do processo de produção, Gerenciamento crítico de ponto de perigo, Inspeção do produto, e distribuição da cadeia fria. Com ingredientes cuidadosamente selecionados, Receitas únicas, e artesanato meticuloso, Ziyan Foods criou mais de cem pratos especiais, incluindo seus pratos exclusivos como frango Baiwei, Fatias pulmonares do casal, Sichuan Pepper Frango, e Ziyan Goose. A marca estabeleceu uma forte reputação de qualidade, delícia, e saúde sob o nome "Frango Ziyan Baiwei".

Entrando no segmento de alimentos pré-preparado

Como uma marca que há muito tempo oferece opções de refeições convenientes, A Ziyan Foods observou a nova geração da crescente demanda e interesse dos consumidores em refeições pré-preparadas. Alavancando seu r&D pontos fortes e anos de insights do consumidor, A Ziyan Foods lançou 40 pratos pré-preparados. Esses pratos foram consistentemente elogiados pelo sabor e pela qualidade após serem testados pelo mercado e pelos consumidores. Por exemplo, O frango de folha de lótus da Ziyan Foods é feito de tamanho uniforme, galinhas de alta qualidade criadas em fazendas ecológicas. Após o abate, As galinhas são bem limpas para remover quaisquer impurezas e odores. Eles são então marinados com uma mistura cuidadosamente criada de mais de dez naturais, Especiarias autênticas, livre de aditivos e cores artificiais, preservando os sabores originais dos ingredientes. As galinhas estão marinadas para 12 horas para permitir que os sabores se desenvolvam completamente, embrulhado em grosso, folhas de lótus verdes vibrantes que selarão no aroma natural da carne, e depois cozido no vapor a altas temperaturas. Cada mordida do frango é macia, suculento, e saboroso, com a fragrância fresca da folha de lótus infundindo a carne até o osso, satisfazendo a busca dos consumidores pela excelência culinária.

Em um ambiente de vida em ritmo acelerado, Rantar conveniente é obrigado a atrair mais atenção. Como uma marca estabelecida há muito tempo na indústria, Espera -se que a Ziyan Foods continue inovando seus pratos, Aproveitando seus pontos fortes e rica experiência. A empresa pretende fornecer aos consumidores opções de alimentos pré-preparadas mais novas, garantindo que mesmo em um estilo de vida agitado, As pessoas podem desfrutar de comida que combina o gosto e a conveniência.

Magnum Ice Cream suporta iniciativa de "redução de plástico" com embalagens verdes, Prêmio de inovação de embalagens de vence

Desde que as paredes da marca da Unilever entraram no mercado chinês, Seu sorvete magnum e outros produtos foram consistentemente amados pelos consumidores. Além de atualizações de sabor, Empresa -mãe de Magnum, Unilever, implementou ativamente o conceito de "redução de plástico" em sua embalagem, atender continuamente as diversas demandas de consumo verde dos clientes. Recentemente, Unilever ganhou o prêmio Silver na conferência IPIF International Packaging Innovation e the CPIS 2023 Prêmio Lion no 14º Fórum de Inovação de Pacote e Desenvolvimento Sustentável da China (CPiS 2023) por sua inovação criativa de embalagem e esforços de redução de plástico que contribuem para a proteção ambiental.

A embalagem de sorvete da Unilever ganha dois prêmios de inovação em embalagens

Desde 2017, Unilever, a empresa controladora de paredes, tem transformado sua abordagem de embalagem plástica com foco em “Reduzir, otimizar, e eliminar o plástico ”para obter desenvolvimento sustentável e reciclagem de plástico. Esta estratégia produziu resultados significativos, incluindo a inovação de design de embalagens de sorvete que converteu a maioria dos produtos sob o magnum, Croissant, e marcas de paredes para estruturas baseadas em papel. Adicionalmente, Magnum adotou materiais reciclados como preenchimento em caixas de transporte, Reduzindo o uso de Over 35 toneladas de plástico virgem.

Reduzindo plástico na fonte

Os produtos de sorvete requerem ambientes de baixa temperatura durante o transporte e armazenamento, Tornando a condensação um problema comum. A embalagem de papel tradicional pode ficar úmida e amolecer, afetando a aparência do produto, o que requer alta resistência à água e resistência ao frio em embalagens de sorvete. O método predominante no mercado é usar papel laminado, O que garante um bom desempenho à prova d'água, mas complica a reciclagem e aumenta o uso de plástico.

A Unilever e a Upstream Supply Partners desenvolveram uma caixa externa não laminada adequada para transporte de cadeia de sorvete de sorvete. O principal desafio era garantir a resistência e a aparência da água da caixa externa. Embalagem laminada convencional, Graças ao filme plástico, impede a condensação de penetrar nas fibras de papel, preservando assim as propriedades físicas e melhorando o apelo visual. A embalagem não laminada, no entanto, teve que atender aos padrões de resistência à água da Unilever, mantendo a qualidade e a aparência da impressão. Após várias rodadas de testes extensos, incluindo comparações de uso real em freezers de exibição, A Unilever validou com sucesso o verniz hidrofóbico e os materiais de papel para esta embalagem não laminada.

Mini Cornetto usa verniz hidrofóbico para substituir a laminação

Promoção de reciclagem e desenvolvimento sustentável

Devido à natureza especial do sorvete Magnum (embrulhado em revestimento de chocolate), Sua embalagem deve oferecer alta proteção. Anteriormente, EPE (polietileno expansível) O preenchimento foi usado na parte inferior das caixas externas. Este material era tradicionalmente feito de plástico virgem, Aumento do desperdício de plástico ambiental. A transição do preenchimento EPE do plástico virgem para reciclado exigiu várias rodadas de teste para garantir que o material reciclado atenda aos requisitos de desempenho protetores durante a logística. Adicionalmente, Controlar a qualidade do material reciclado era crucial, exigindo uma rigoroso supervisão de matérias -primas e processos de produção a montante. A Unilever e os fornecedores realizaram várias discussões e otimizações para garantir o uso adequado de materiais reciclados, resultando em uma redução bem -sucedida de cerca de 35 toneladas de plástico virgem.

Essas conquistas estão alinhadas com o plano de vida sustentável da Unilever (USLP), que se concentra em “menos plástico, Melhor plástico, e sem "objetivos de plástico. Paredes está explorando mais instruções de redução de plástico, como usar filmes de embalagem de papel em vez de plástico e adotar outros materiais únicos facilmente recicláveis.

Olhando para trás nos anos desde que Walls entrou na China, A empresa sempre inovou para atender a gostos locais com produtos como o Magnum Ice Cream. Em alinhamento com a estratégia de transformação verde e de baixo carbono da China, Walls acelerou sua transformação digital enquanto continua a implementar estratégias de desenvolvimento sustentável. O recente reconhecimento com dois prêmios de inovação em embalagens é uma prova de suas realizações de desenvolvimento verde.

Feira de alta tecnologia | Estimulando a vitalidade da inovação, Melhorar a qualidade do desenvolvimento

Hoje, A 25ª Feira de Hi-Tech da China (Chtf) Oficialmente aberto em Shenzhen, trazendo um internacional, Evento profissional de alta tecnologia para a frente. O CHTF deste ano está hospedado em dois locais: o centro de convenções e exposição Shenzhen (Futian) e a exposição Shenzhen World & Centro de Convenção (Bao'an). O evento apresenta uma exposição abrangente, Exposições especializadas, conferências, Fóruns, e várias outras atividades. De acordo com os organizadores, o evento atraiu a participação de 100 países e regiões, com mais de 4,000 empresas que exibem em uma área total de 500,000 metros quadrados, tornando -o o maior da história da feira, com um número recorde de países e regiões participantes.

Imagem

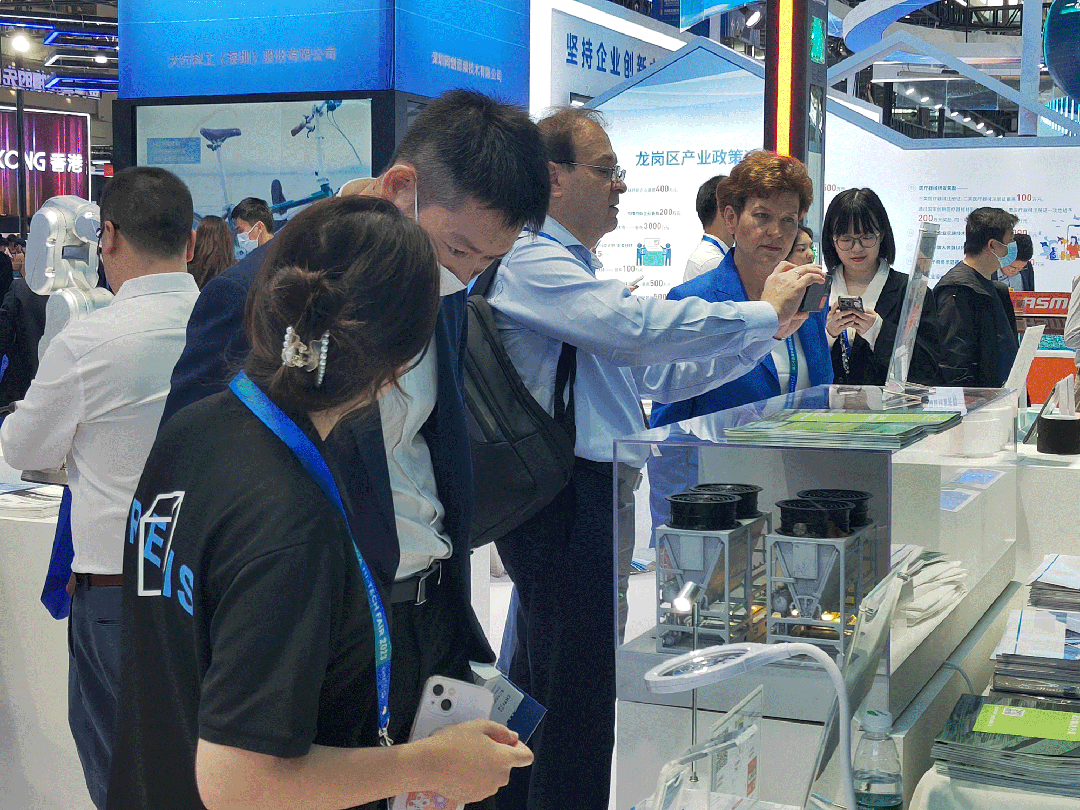

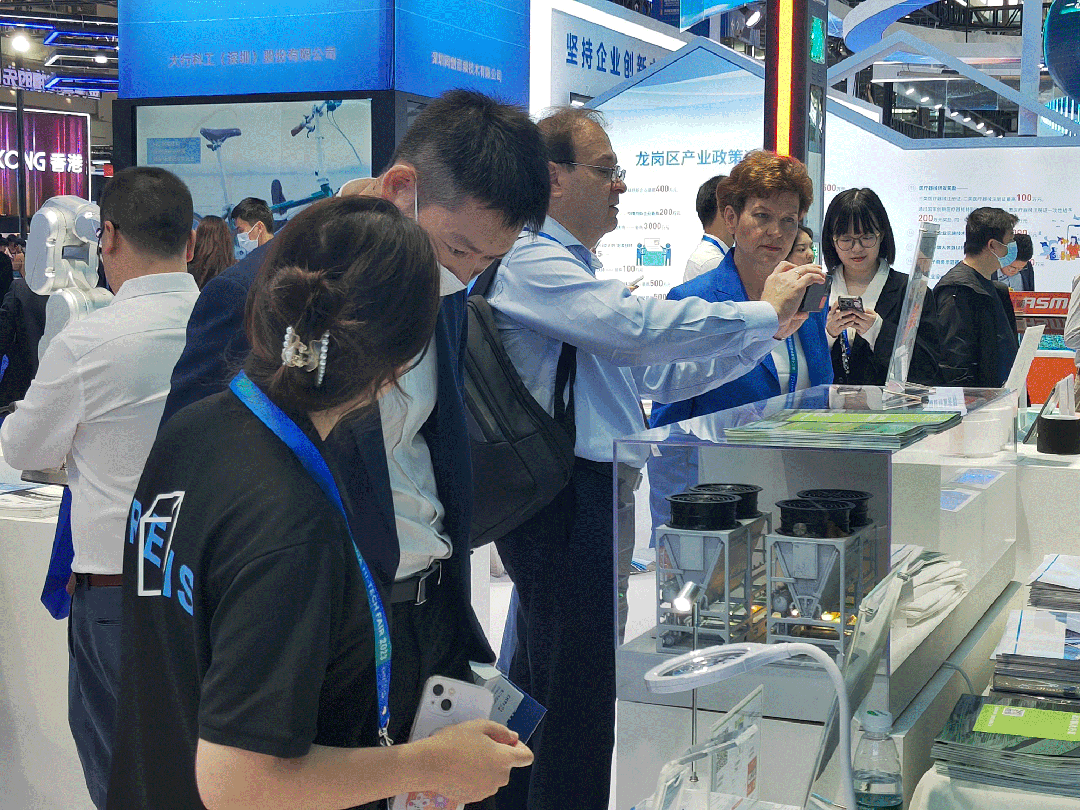

A convite do Bao'an District Science and Technology Innovation Bureau, Chun Jun Novos materiais (Shenzhen) Co., Ltda., Representando empresas especializadas e inovadoras do distrito de Bao'an, está participando da exposição. De 15 a 19 de novembro, Chun Jun New Materials está mostrando suas realizações de pesquisa de ponta no estande 1d38 em Hall 1 do centro de convenções e exposição Shenzhen (Futian).

Imagem

(Segundo da direita: O prefeito do distrito de Bao'an Wang lide; Primeiro da esquerda: Diretor do Departamento de Inovação de Ciência e Tecnologia do Distrito de Bao'an; Primeiro da direita: Diretor do Centro de Serviços de Inovação em Ciência e Tecnologia do Distrito de Bao'an, Visitando o estande de Chun Jun para obter orientação)

No Chtf deste ano, Chun Jun New Materials está exibindo seus produtos e soluções de controle de temperatura na cadeia de frio, resfriamento líquido, e campos TEC. A exposição atraiu vários líderes e colegas da indústria de casa e do exterior, que se envolveram em discussões sobre o desenvolvimento da tecnologia de controle de temperatura e suas aplicações inovadoras em vários campos.

Imagens

No campo do resfriamento líquido, Chun Jun apresentou sua solução imersiva de resfriamento líquido sob sua marca “Chun Jun Opti-Cool”. Nos últimos anos, A demanda por energia de computação aumentou, com o poder do gabinete único aumentando rapidamente. Ao mesmo tempo, os padrões nacionais para o Data Center Pue (Eficácia do uso de energia) tornou -se cada vez mais rigoroso, Pondo desafios significativos para data centers. A solução de resfriamento de líquido de imersão “Chun Jun Opti-Cool” aborda esses desafios da indústria, reduzindo o valor da PUE a tão baixo quanto 1.1 ao garantir uma excelente capacidade de computação por meio de controle de temperatura eficiente. Notavelmente, O refrigerante CJF1 de Chun Jun oferece alto desempenho de dissipação de calor e uma vantagem significativa de preço, reduzindo os custos de líquido de arrefecimento para os clientes por 40%.

Imagens

Tecnologia micro-Tec de Chun Jun, Ao contrário dos TECs comuns, pode ser miniaturizado para tamanhos de nível de milímetro, com requisitos de desempenho e processo de material extremamente exigentes. No lado dos materiais, A autodesenvolvimento de Chun Jun e o tipo N de Bismuth Telluride, do tipo P-Type entre os melhores do setor. No lado do produto, O micro-Tec de Chun Jun alcança avanços na miniaturização enquanto oferece alta eficiência de resfriamento e controle preciso da temperatura. O desempenho superior do micro-Tec de Chun Jun tem um grande potencial para substituir as importações em campos como módulos ópticos e lidar.

Imagens

A inovação é a principal força motriz do desenvolvimento. Com o tema “estimulando a vitalidade da inovação, Melhorar a qualidade do desenvolvimento,"O CHTF deste ano reúne recursos de inovação de alta qualidade. Ele serve como uma plataforma dinâmica para a profunda implementação da estratégia de desenvolvimento orientada à inovação, O cumprimento abrangente de tarefas de desenvolvimento de alta qualidade, e a melhoria contínua do ecossistema de inovação. O evento incorpora a crença de que “o foco na inovação está se concentrando no desenvolvimento, e buscar a inovação está buscando o futuro. ”

Chun Jun New Materials recebe calorosamente os colegas da indústria para visitar nosso estande de exibição, onde pretendemos demonstrar avanços tecnológicos, criar conexões de valor, e fortalecer a confiança nas tecnologias materiais da China.

Desejamos à 25ª Feira de Hi-Tech da China grande sucesso!

A China Life Investment Partners com o GLP para acelerar o lançamento do REITS Strategic Placement Fund.

Com o estabelecimento do primeiro fundo de colocação estratégica do REITS, O investimento da China Life está implementando rapidamente seus planos de investimento relacionados.

Em novembro 14, O investimento da China Life e o GLP atingiu uma parceria estratégica abrangente, com foco nas principais áreas da cadeia de suprimentos do GLP, grandes dados, e novo investimento em infraestrutura energética e desenvolvimento de ecossistemas industriais. Notavelmente, A colaboração envolverá explorar as principais oportunidades de investimento regional e de mercado, incluindo o uso de produtos financeiros inovadores, como REITs, Para expandir o escopo e a forma de investimento e cooperação de financiamento.

Esse movimento é visto dentro da indústria como um sinal positivo de que as duas partes podem estar se preparando para lançar novos REITs. Se implementado com sucesso, Pode se tornar o primeiro projeto sob o fundo de colocação estratégica do REITS Investment do China Life Investment.

Iniciativas de investimento de logística e armazenamento começam

De acordo com o plano do China Life Investment para o fundo de colocação estratégica do REITS, O fundo participará principalmente da emissão de REITs públicos em setores como a infraestrutura de consumidores, energia verde, e logística de ponta. Parece que o foco de investimento do fundo no setor de logística de ponta pode ser o primeiro a começar.

Logística e armazenamento têm sido tradicionalmente áreas de investimento ativo para capital de seguro. Entre os 29 REITs listados publicamente, GLP REIT, representando REITs de armazenamento, tornou -se o REIT público com a maior colocação estratégica por capital de seguro. Fundos de seguro são responsáveis por 30.17% de sua colocação estratégica, com seis dos dez principais detentores sendo entidades de seguro, incluindo Taikang Life, Vida de Hengqin, Dajia Holdings, Nova vida na China, Fundo de Investimento de Seguro da China, e propriedade Guoren & Seguro contra acidentes.

Os analistas acreditam que os REITs de logística e armazenamento são favorecidos pelo capital do seguro devido ao seu forte potencial de crescimento e estabilidade, que se alinham com as necessidades de investimento de longo prazo de fundos de seguro.

Com a recuperação econômica e o rápido desenvolvimento do mercado de comércio eletrônico, As perspectivas de imóveis de logística continuam a melhorar. Um relatório recente da CBRE observou que o Índice Nacional de Aluguel de armazém deve crescer 0.6% em 2023, subindo para 1.0% em 2024. Cidades de primeiro nível, bem como cidades de segundo nível com restrição de suprimentos como Dongguan, Hangzhou, e Wuxi, Espera -se que obtenha aumentos anuais de aluguel de 2%-4%. Enquanto isso, A taxa de vacância nacional de armazém deverá diminuir para 13.2% Até o final de setembro, comparado às taxas de vaga de 15%-20% Para imóveis comerciais, como edifícios de escritórios.

O aumento contínuo da receita operacional também trará retornos consideráveis aos investidores. Por exemplo, O GLP REIT concluiu cinco distribuições de dividendos desde a sua listagem, totalizando aproximadamente 580 milhões de RMB, com a quantidade de dividendos aumentando constantemente. Os dois primeiros dividendos por ação estavam por aí 0.05 RMB, subindo para superar 0.08 RMB da terceira distribuição em diante. Claramente, Vale a pena investir em armazenamento.

O investimento da China Life provavelmente se beneficiou de seu investimento no GLP REIT. Embora o investimento da China Life ou seu principal acionista, Vida na China, não está listado entre os titulares, O Fundo de Investimento de Seguros da China, Um dos detentores, foi estabelecido em conjunto pela China Insurance Investment Co., Ltda., Seguro de vida da China (Grupo) Empresa, China Life Insurance Co., Ltda., e resseguro da China (Grupo) Corporação.

A colaboração entre o China Life Investment e o GLP em REITs não é apenas se mudar de "nos bastidores" para "no centro do palco" ou garantir mais participações; Também pode envolver um planejamento estratégico mais profundo.

Por que escolher GLP?

Além de investir no GLP REIT, A China Life Investment já fez vários investimentos no setor de logística e armazenamento. Estes incluem:

● Estabelecer um 1.8 Bilhão RMB Private Equity Fund em parceria com CAIXIN LIFE, Manulife-sinochem, e cainiao post, focado em projetos de armazenamento modernos de alto padrão de alto padrão mantidos pela Cainiao Network e suas afiliadas.

● Colaborar com a China Merchants Capital e Baowan Logistics sobre aquisições e fusões de ativos logísticos.

● Configurando em conjunto um 10 Bilhão Fundo de Receita RMB com GLP para investir em ativos de logística de valor agregado nas principais cidades, participando de investimentos estratégicos no GLP, e promovendo projetos do Centro de Logística da Cadeia Fria.

No entanto, Nas colaborações acima mencionadas, O investimento da China Life participou principalmente de "investidor".

Em março deste ano, As bolsas de valores de Xangai e Shenzhen divulgaram os “Requisitos relevantes para empresas de gerenciamento de ativos de seguros que conduzem negócios de securitização de ativos (Julgamento),”Expandindo o escopo da securitização de ativos e fundo fiduciário de investimento imobiliário (Reit) entidades comerciais para incluir empresas de gerenciamento de ativos de seguros com boa governança corporativa, Controles internos padronizados, e excelentes recursos de gerenciamento de ativos. Desde então, O seguro de seguro passou de ser um investidor para também ser um gerente de securitização de ativos.

Esse desenvolvimento significa que o capital de seguro agora pode trabalhar com parceiros desde o início dos projetos REIT para identificar possíveis ativos de alta qualidade, incubá -los, e finalmente os traz ao mercado através de REITs. Esse processo também permite que o investimento da China Life desenvolva um plano estratégico centrado em REITs públicos.

Atualmente, A tarefa mais premente para o investimento da China Life é selecionar os parceiros certos e identificar ativos de alta qualidade adequados.

GLP China, Como o maior fornecedor de instalações de armazenamento no país, é um parceiro ideal, especialmente devido à cooperação de longa data entre as duas partes. O sucesso do primeiro GLP REIT também reforçou a confiança do China Life Investment nas capacidades operacionais do GLP.

De acordo com divulgações, Os ativos de infraestrutura do GLP REIT atualmente consistem em dez parques de armazenamento e logística localizados em regiões econômicas importantes, como a área de Pequim-Tianjin-Hebei, o delta do rio Yangtze, a borda Bohai, A área da baía de Guangdong-Hong Kong-Macao, e o círculo econômico de Chengdu-chongqing. Esses ativos cobrem uma área de construção total de aproximadamente 1.1566 milhões de metros quadrados.

Dados recentes mostram que o desempenho operacional desses ativos permanece estável. No final de setembro, A taxa média de ocupação no ponto-dia era 88.46%, e a taxa de ocupação, incluindo áreas arrendadas ainda para começar, era 90.78%. O aluguel médio efetivo por metro quadrado por mês para aluguel de contrato e taxas de serviço de gerenciamento de propriedades (excluindo impostos) era 37.72 RMB.

Além disso, GLP tem um vasto portfólio de logística e ativos de armazenamento, com mais 450 Instalações de logística e infraestrutura industrial na China, cobrindo mais de 50 milhões de metros quadrados. Este portfólio inclui ativos maduros, como parques tecnológicos, data centers, e infraestrutura energética, que pode ser candidatos para futuras listagens.

O desafio para o investimento da China Life e o GLP avançando será selecionar o melhor de um grande conjunto de recursos, incubar e operar com sucesso esses ativos, e trazê -los ao mercado através de REITs.

O ritmo das novas listagens do REIT acelerou recentemente. Atualmente, Oito produtos estão em revisão, com mais de 100 Projetos de reserva no pipeline. Espera -se que o mercado de REITs se expanda ainda mais em escala e escopo. O mercado já está antecipando outros avanços do GLP no espaço do REITS.

O SF Express lança o Serviço Internacional de Alimentos Fresh Food para indivíduos

“O SF Express lança o Serviço Internacional de Alimentos Fresh Food para indivíduos”

Em novembro 7, A SF Express anunciou oficialmente o lançamento de seu Serviço Internacional Express para remessas pessoais de alimentos frescos.

Anteriormente, A exportação de frutas era normalmente conduzida por meio de um modelo de negócios para negócios, exigindo que os exportadores tenham qualificações de exportação e forneçam uma gama de procedimentos de inspeção e quarentena, dificultando o envio de frutas para os indivíduos para o exterior. Para permitir que mais consumidores internacionais desfrutem de frutas chinesas, O SF Express simplificou o processo de remessas pessoais este ano. Ao implementar medidas de pré-decisão e outros procedimentos, O SF Express agora permite que frutas estáveis à temperatura sejam enviadas internacionalmente por meio de serviços expresso pessoal, Chegando a destinos internacionais em apenas 48 horas.

O SF Express garante a segurança e o frescor das frutas estáveis à temperatura por meio de embalagens profissionais, transporte da cadeia de frio, e monitoramento visual de processo completo, Construindo assim uma "ponte internacional do céu" para as exportações de alimentos frescos da China e atendendo a melhores necessidades de remessa internacionais.

SF Express Couriers embalando frutas

Fonte: SF Express International WeChat Official Conta

Este ano, A SF Express expandiu agressivamente suas operações internacionais, incluindo o lançamento de novas rotas aéreas globalmente. Em agosto 20, A SF Airlines abriu uma rota internacional de carga de Shenzhen para Port Moresby, a capital da Papua Nova Guiné, e planeja investir no desenvolvimento de infraestrutura local. A rota "Shenzhen = Port Moresby" é a primeira rota da SF Airlines para a Oceania.

Recentemente, O SF Express também abriu várias rotas de carga de Ezhou para outros países. Entre outubro 26 e 28, Novas rotas, incluindo “ezhou = Singapura,"" Ezhou = Kuala Lumpur,"E" Ezhou = Osaka "foram lançados oficialmente. O número total de rotas de carga internacional que operam no aeroporto de Ezhou Huahu agora excederam dez. Adicionalmente, O volume cumulativo de carga no aeroporto de Ezhou Huahu superou 100,000 toneladas, com carga internacional de contabilização de quase 20%.

O SF Express lança a rota “Shenzhen = Port Moresby”

Fonte: SF Express Group Official

Notavelmente, em maio deste ano, A SF Express descreveu sua estratégia de negócios internacional em uma atividade de relações com investidores. A empresa priorizou os mercados emergentes do sudeste da Ásia devido ao aumento dos investimentos da China na região e às vantagens do SF Express nas redes de transporte aéreo. A empresa planeja expandir ainda mais para o Oriente Médio e América do Sul.

O SF Express continua a se concentrar em melhorar sua logística expressa e transfronteiriça-comércio no sudeste da Ásia, enfatizando o desenvolvimento de “ar, alfândega, e redes principais de última milha. Atualizando operações de rota, Expandindo a rede de ar, investindo em recursos alfandegários principais, e integrar recursos de última milha, O SF Express pretende construir uma rede global estável e eficiente, aprimorando a experiência do cliente e fornecendo serviços confiáveis. A empresa está comprometida em criar um serviço de ponta a ponta sem costura, fortalecendo sua vantagem de serviço no sudeste da Ásia e na região da Ásia-Pacífico, e apoiar negócios transfronteiriços estáveis para empresas.

Zhongnong Modern recebeu o cargo de unidade de vice-presidente da China Pré-preparada para o Parque Indústria da Indústria da Aliança.

Em novembro 9, As "categorias definidoras · imaginando a Mindshare" Third China Conference de desenvolvimento de inovação da indústria de alimentos e a primeira seleção de prêmios de ouro do Delta do Ano Novo do Rio Novo Yangtze River & A China pré-preparada para a conferência inaugural do Parque Indústria de Alimentos inaugural inaugurada no Centro Internacional da Expo Internacional de Xangai. A conferência foi orientada pelo Instituto de Processamento de Agroprodutos, Academia Chinesa de Ciências Agrárias, e o Comitê Profissional de Alimentos Pré-preparados da Aliança Nacional de Inovação Científica e Tecnológica da Indústria de Processamento de Produtos Agrícolas, e organizado pelo Projeto de Desenvolvimento de Inovação do Parque da Indústria Alimentar Pré-preparado da China e pela Shanghai Bohua International Exhibition Co., Ltda. A conferência se concentrou no desenvolvimento de alta qualidade e na construção de padrões digitais na indústria de alimentos pré-preparados, compartilhando as últimas tendências do mercado, inovações tecnológicas, e necessidades do consumidor. Explorou a prática e os métodos do “desenvolvimento de alta qualidade + promoção do consumo + digitalização + modelo de cluster industrial” no parque da indústria de alimentos pré-preparados, com o objetivo de criar um novo ecossistema para o desenvolvimento de alimentos pré-preparados. O evento convidou centenas de empresas da indústria de alimentos pré-preparados e seus produtores, meio do caminho, a jusante, e setores relacionados para participar. Zhongnong moderno, como uma empresa dentro do ecossistema industrial, foi convidado para participar da conferência.

Na conferência, foi anunciado o estabelecimento da Aliança do Parque da Indústria de Alimentos Pré-preparados da China, que visa promover a iniciativa P500+ em todo o país, criação de uma rede de parques industriais de alimentos pré-preparados, composta por mais de 500 nós. Zhongnong moderno, com mais de uma década de profundo envolvimento na indústria agrícola, foi premiado com o cargo de “Vice-Presidente da Unidade da Aliança de Parques da Indústria de Alimentos Pré-preparados da China”. A empresa, junto com outras unidades participantes, iniciarão em conjunto o desenvolvimento de infraestrutura digital para a indústria de alimentos pré-preparados e construirão e compartilharão de forma colaborativa uma estrutura e plataforma de serviços da indústria digital.

Wang Zhen Yu, Vice-presidente do Zhongnong Modern Group e chefe da divisão de desenvolvimento da indústria de alimentos pré-preparados, fez uma apresentação intitulada “A Importância e o Impacto do Desenvolvimento a Longo Prazo de Parques da Indústria Alimentar Pré-preparados” e partilhou o layout industrial estratégico do grupo. Ele observou que o Não. 1 Documento Central define claramente os alimentos pré-preparados e a sua estratégia de desenvolvimento, enfatizando que a cadeia da indústria de alimentos pré-preparados envolve múltiplos segmentos, incluindo a produção agrícola, processamento e distribuição, Serviços de catering, e consumo de mercado. Representa um novo modelo de negócios para transformação e modernização agrícola, bem como um novo canal para aumentar o rendimento e a prosperidade dos agricultores. O desenvolvimento da indústria de alimentos pré-preparados desempenha um papel crucial no aumento da conveniência, expandindo as escolhas alimentares, e promover a industrialização agrícola. Também significa inovação na indústria alimentícia, transformação na indústria de catering, e ajuste na estrutura agrícola. Olhando para frente, o desenvolvimento da indústria de alimentos pré-preparados dará maior ênfase à segurança e saúde alimentar, com foco na personalização, personalizado, e crescimento da marca com base na demanda do consumidor. A indústria também alcançará níveis mais elevados de digitalização e dará maior ênfase à proteção ambiental para o desenvolvimento sustentável.

Na apresentação estratégica do grupo, foi destacado que Zhongnong Modern, como um dos dez principais operadores do mercado atacadista agrícola da China e um dos principais 100 empresas da cadeia de abastecimento de produtos agrícolas, tem uma cobertura abrangente desde a aquisição da cadeia de suprimentos a montante até vários canais de vendas e sistemas de suporte a jusante. Atualmente, o grupo estabeleceu 20 modernos parques industriais agrícolas em toda a China, cobrindo 4 milhões de metros quadrados, e está acelerando a construção de bases de parques da indústria alimentícia pré-preparados, formando gradualmente uma rede de parques industriais.

Atualmente, a construção e o desenvolvimento de parques industriais alimentares pré-preparados tornaram-se importantes veículos para a implementação de políticas nacionais. O desenvolvimento da divisão de alimentos pré-preparados do grupo é impulsionado pelo objetivo estratégico de se tornar “o principal operador abrangente da China na indústria de alimentos pré-preparados”. A empresa adere à inovação liderada pela tecnologia, construindo parques digitalizados, e opera com foco na marca, abordagem padronizada. Visa fortalecer a indústria de alimentos pré-preparados por meio de clusterização industrial, fornecendo um serviço completo e centralizado desde o fornecimento de matéria-prima, produção e processamento, configuração padrão, rastreabilidade de segurança, armazenamento na cadeia de frio, logística da cadeia de frio, para marketing de marca. O apoio industrial maduro nos parques permite que as empresas de alimentos pré-preparados melhorem a qualidade, reduzir custos, e aumentar a eficiência, enquanto a análise de big data capacita a produção, fornecer, e vendas de alimentos pré-preparados, criando um novo modelo para o desenvolvimento integrado da indústria. A empresa também colabora profundamente com o governo para incubar marcas públicas de alimentos pré-preparados e transformar vantagens regionais em vantagens industriais.

No futuro, A Zhongnong Modern aproveitará totalmente seu papel como “Vice-Presidente da Unidade da Aliança de Parques da Indústria de Alimentos Pré-preparados da China” para acelerar a construção de parques da indústria de alimentos pré-preparados em todo o país. A empresa integrará recursos da indústria, construir plataformas de desenvolvimento da indústria, definir categorias segmentadas, e incubar produtos alimentícios pré-preparados de grande sucesso, contribuindo para o desenvolvimento sustentável de empresas de alimentos pré-preparados, a integração do primário, secundário, e indústrias terciárias, revitalização industrial rural, e a conquista da prosperidade comum.

Foshan ganha outro powerhouse alimentar de ponta de alta qualidade doméstica.

Em novembro 13, Guangdong Haizhenbao Food Development Co., Ltda. (A seguir referido como "Haizhenbao") iniciou oficialmente as operações em Chencun, Jumor. A primeira fase da empresa cobre uma área de aproximadamente 2,000 metros quadrados, com uma capacidade de produção anual de 800 toneladas. Haizhenbao se concentra no processamento de alimentos pré-preparados de ponta, como abalone em molho de abalone, Poon Choi, pepino do mar, e peixe -peixe, Oferecendo refeições prontas para aquecer. A instalação pretende ser uma planta de processamento de frutos do mar moderna que integra o armazenamento da cadeia a frio, Pesquisa científica, Exibição do produto, transmissão ao vivo ao vivo do comércio eletrônico, e experiências imersivas.

Os dados mostram que o tamanho do mercado da indústria de alimentos pré-preparada da China tem crescido constantemente nos últimos anos. Em 2023, Espera -se que o mercado atinja 516.5 bilhões de RMB. Nos próximos três anos, O mercado deve crescer a uma alta taxa anual de cerca de 20%, potencialmente se tornando o próximo mercado trilhão-yuan.

Para integrar melhor os recursos, Xinguongong Group e Guangdong Tangxianglou estabeleceram em conjunto Haizhenbao. “Vamos melhorar ainda mais a cadeia de suprimentos, expanda -se para setores intermediários, e produzir meticulosamente de alta qualidade, produtos de frutos do mar saudáveis,”Disse Zhu Ang, Presidente de Guangdong Tangxianglou e Haizhenbao. Haizhenbao pretende se tornar uma empresa orientada pelo conhecimento, Construindo um sistema de pesquisa “três em um” que combina “pesquisa e indústria,”“ Médicos e chefs,"E" Laboratórios e cozinhas,”Para promover o desenvolvimento da indústria de frutos do mar de alta qualidade e levar adiante cultura culinária tradicional chinesa.

“Alguns alimentos pré-preparados de ponta que exigem habilidades avançadas de culinária, são demorados e intensivos em mão-de-obra, mas tenha alto valor nutricional - como abalone em molho de abalone, pepino do mar, e peixes - são cada vez mais populares no mercado,”Disse Zheng Jiayuan, Gerente Geral do Grupo Xinguongong. Ele acrescentou que as duas empresas trabalharão juntos para transformar Haizhenbao em uma das empresas de referência na indústria de alimentos pré-preparada da China na China, Contribuindo ativamente para o objetivo de Shunde de se tornar a "capital nacional da comida pré-preparada" e um modelo para o desenvolvimento de alta qualidade na indústria nacional de alimentos pré-preparada.

Tan Fengxian, Diretor do Departamento de Agricultura e Assuntos Rurais do Distrito de Shunde, observou que Shunde atualmente tem mais do que 40 Empresas em larga escala na indústria de alimentos pré-preparada, com as receitas atingindo 8.7 bilhões de RMB. Shunde está implementando totalmente os “centenas, Milhares, e dezenas de milhares ”de iniciativa, posicionando a indústria de alimentos pré-preparada como um setor-chave para fortalecer o distrito e enriquecer as pessoas, promovendo a integração do primário, secundário, e indústrias terciárias, e se esforçar para se tornar uma área de demonstração nacional para a indústria de alimentos pré-preparada.

Baozheng revela 'armazém de cadeia fria e solução de distribuição de laticínios' em 2023 CIIE

Como o novo desenvolvimento da China oferece novas oportunidades para o mundo, A sexta exposição de importação internacional da China (CIIE) está sendo mantido conforme programado no Centro Nacional de Exposições e Convenções. Na manhã de 6 de novembro, Baozheng (Xangai) Gerenciamento da cadeia de suprimentos Co., Ltda. Hospedou um novo lançamento de produto e cerimônia de assinatura de cooperação estratégica para sua solução de cadeia de laticínios no CIIE.

Os participantes incluíram líderes do Comitê da Cadeia Fria da Federação de Logística da China & Compras, Especialistas em cadeia fria da Escola de Ciência de Alimentos da Universidade Oceano de Xangai, bem como executivos de empresas como Arla Foods Amba, China Nongken Holdings Shanghai Co., Ltda., Produtos lácteos da Eudorfort (Xangai) Co., Ltda., Queijo médico (Xangai) Technology Co., Ltda., Alimentos Xinodis (Xangai) Co., Ltda., Bailaoxi (Xangai) Food Trading Co., Ltda., e G7 e-FLOW Plataforma aberta.

Senhor. Cao pode, Presidente da cadeia de suprimentos de Baozheng, entregue o discurso de abertura, Apresentando como a empresa aproveita suas próprias vantagens para ajudar os clientes a resolver seus problemas de cadeia de frio da perspectiva do cliente. Senhor. O CAO explicou que o Baozheng integra sua tecnologia digital, Equipe profissional, e extensa experiência de gerenciamento para construir seu próprio armazenamento a frio e desenvolver este novo produto - o armazém de cadeia fria e solução de distribuição de cadeia de laticínios, com o objetivo de garantir a perda de temperatura zero para os produtos lácteos dos clientes.

Durante o evento, Senhor. Liu Fei, Vice-secretário-geral executivo do Comitê da Cadeia Fria, deu uma palestra intitulada “Construção da cadeia de laticínios: Um longo caminho à frente. ” Senhor. Liu introduziu vividamente a indústria de laticínios, Análise de mercado de logística da cadeia fria, e características atuais das cadeias frias de laticínios da perspectiva de uma associação da indústria, Oferecendo várias recomendações para o desenvolvimento de cadeias frias de laticínios. Em uma entrevista na mídia, Senhor. Liu instou especialistas em cadeia fria como Baozheng a participarem ativamente do desenvolvimento de padrões de cadeia fria de laticínios e promover conceitos de cadeia de frio, Usando plataformas como a associação e o CIIE para avançar na indústria da cadeia de frio.

Professor Zhao Yong, Vice -Decano da Escola de Ciência de Alimentos da Universidade de Xangai Ocean, fez um discurso de palestras sobre "os principais pontos de controle em cadeias frias de laticínios". Professor Zhao discutiu a introdução, processo de produção, Características nutricionais, e consumo de produtos lácteos, descreveu o processo de deterioração, Pontos de controle de chave compartilhados para a qualidade e segurança da cadeia fria de laticínios, e destacou quatro grandes oportunidades para o futuro da indústria da cadeia de frio da China. Em uma entrevista na mídia, O professor Zhao enfatizou a necessidade urgente de talento profissional na indústria da cadeia fria e incentivou a colaboração mais próxima entre empresas e universidades a entender melhor as necessidades da indústria e treinar talentos adequados.

Senhor. Zhang Fuzong, Diretor de entrega de soluções da cadeia fria do leste da China no G7-FLOW, entregou uma palestra sobre “Transparência no gerenciamento de logística da cadeia fria,Explicando a transparência de qualidade, transparência de negócios, e transparência de custo na logística da cadeia fria, e compartilhamento de caminhos para gerenciamento transparente com base em cenários de negócios reais.

Senhor. Lei Liangwei, Diretor de vendas estratégicas da cadeia de suprimentos de Baozheng, entregou uma palestra sobre “especialistas em cadeia fria de laticínios - Baozheng Cold Chain: Garantir a temperatura!”Ele introduziu o armazém de cadeia fria e a solução de distribuição de laticínios lançados neste evento, destacando três produtos de serviço: Baozheng Warehouse - Proteção de temperatura; Baozhng Transporte-Zero Temperation Perda, Operação totalmente visualizada; e distribuição de Baozheng - guardando a última milha, Fresco como novo.

Finalmente, A cadeia de suprimentos de Baozheng realizou uma cerimônia de assinatura eletrônica com vários parceiros estratégicos, incluindo Arla, Nongken, Xinodis, Bailaoxi, Eudorfort, E queijo doutor. Essa assinatura de cooperação estratégica solidificou ainda mais as relações cooperativas amigáveis entre as partes. O CIIE forneceu uma plataforma valiosa para uma colaboração mais profunda e próxima entre as empresas. A cadeia de suprimentos de Baozheng agora é um expositor assinado para o sétimo CIIE e continuará a usar este evento de nível nacional para comunicação e exibição.

A Federação da China de Logística e Comitê de Cadeia de Coldes de Compra participa da cadeia de suprimentos Baozheng Dairy Cold Chain New Product Lanking Event.

A cadeia de suprimentos de Baozheng detém a cadeia fria de leite novo evento de lançamento de produtos

Na manhã de novembro 6, Baozheng (Xangai) Gerenciamento da cadeia de suprimentos Co., Ltda. Realizou um evento de lançamento de novos produtos da cadeia fria de laticínios na China International Import Expo (CIIE). Liu Fei, Secretário-Geral Adjunto Executivo da Federação de Logística e Comitê de Cadeia de Coldes da China, participou do evento e fez um discurso de palestra.

O evento também contou com vários convidados ilustres, incluindo o professor Zhao Yong, Vice -Decano da Escola de Ciência de Alimentos da Universidade de Xangai Ocean; FREDE JUUNSEN, Chefe global da categoria de fórmula infantil na Arla Foods Amba; Xu Li, Diretor da cadeia de suprimentos da China Agricultural Reclamation Holdings Shanghai Co., Ltda.; Zhu Yueqiong, Gerente Geral de Produtos de Laticínios Oldenburger (Xangai) Co., Ltda.; Ele Ziyun, Co-fundador do Cheese Doctor (Xangai) Technology Co., Ltda.; Zhu Yijie, Gerente de importação da Sinodis Food (Xangai) Co., Ltda.; EU, Gerente da cadeia de suprimentos na Bellco (Xangai) Food Trading Co., Ltda.; e Zhang Fuzong, Diretor de entrega de soluções da cadeia fria do leste da China no G7 Yiliu.

A longa estrada à frente para os padrões de cadeia fria de laticínios

Liu Fei, Vice-secretário-geral executivo do Comitê da Cadeia Fria

No evento, Liu Fei fez um discurso de palestra intitulada “A construção de cadeias frias de laticínios: Um longo caminho à frente. ” Falando da perspectiva de uma associação da indústria, Liu forneceu uma visão geral vívida da indústria de laticínios, Uma análise do mercado de logística da cadeia fria, e as características atuais da cadeia de laticínios. Ele também ofereceu várias recomendações para o desenvolvimento da cadeia de laticínios.

Durante a sessão de entrevista da mídia, Liu Fei instou especialistas em cadeia fria de laticínios como Baozheng a participarem ativamente da formulação de padrões de cadeia fria de laticínios e da promoção de conceitos de cadeia fria de laticínios. Ele enfatizou a importância de usar exposições de nível nacional como o CIIE para promover e se comunicar sobre a indústria da cadeia de frio, assim dirigindo seu desenvolvimento.

Promoção de desenvolvimento de alta qualidade na cadeia de laticínios

Cao pode, Presidente da cadeia de suprimentos de Baozheng, entregue o discurso de abertura, Apresentando como o Baozheng ajuda os clientes a abordar seus pontos problemáticos na cadeia de laticínios, aproveitando suas próprias vantagens.

O CAO enfatizou que Baozheng integra recursos usando sua tecnologia digital, equipes profissionais, e extensa experiência de gerenciamento para desenvolver um novo produto - a solução de armazenamento e distribuição da cadeia de laticínios - apontando para garantir desvios de temperatura zero para produtos de cadeia de laticínios dos clientes.

Cao pode, Presidente da cadeia de suprimentos de Baozheng

Zhang Fuzong, Diretor de entrega de soluções da cadeia fria do leste da China no G7 Yiliu, Deu um discurso de palestra intitulada “Controle transparente da logística da cadeia fria,”Onde ele discutiu a transparência da qualidade, operações, e custos na logística da cadeia fria. Ele compartilhou idéias práticas sobre a obtenção de transparência no gerenciamento de logística da cadeia fria com base em cenários de negócios reais.

Zhang Fuzong, Diretor de entrega de soluções da cadeia fria do leste da China no G7 Yiliu

Professor Zhao Yong, Vice -Decano da Escola de Ciência de Alimentos da Universidade de Xangai Ocean, Feda a uma palestra intitulada "Pontos de controle -chave em cadeias frias de laticínios". Professor Zhao abordou tópicos como uma visão geral de produtos lácteos, processos de produção, Características nutricionais, e tendências do consumidor. Ele discutiu o processo de deterioração de produtos lácteos, Pontos de controle de chave compartilhados para garantir a qualidade e segurança da cadeia de laticínios, e descreveu quatro oportunidades futuras para a indústria da cadeia de frio da China.

Durante a entrevista da mídia, O professor Zhao enfatizou a necessidade urgente de talento especializado na indústria da cadeia fria. Ele incentivou as empresas a fortalecer colaborações com universidades para entender melhor as necessidades da indústria e fornecer talentos que atendem aos requisitos da indústria.

Zhao Yong, Vice -Decano da Escola de Ciência de Alimentos da Universidade de Xangai Ocean

Lei Liangwei, Diretor de vendas estratégicas da cadeia de suprimentos de Baozheng, deu uma palestra intitulada “Especialistas em cadeia fria de laticínios - Baozheng Cold Chain: Garantindo a temperatura certa!"Ele forneceu uma introdução detalhada à recém -lançada solução e solução de distribuição de cadeia de laticínios de Baozheng, destacando três produtos de serviço -chave: Baozhng Warehouse-Temperature Assurance; Transporte de Baozheng - Desvio de temperatura de zero, operações totalmente visualizadas; e entrega de Baozheng - protegendo a última milha, tão fresco como sempre.

Lei Liangwei, Diretor de vendas estratégicas da cadeia de suprimentos de Baozheng

Finalmente, A cadeia de suprimentos de Baozheng e vários parceiros estratégicos participaram de uma cerimônia de assinatura digital. Os parceiros estratégicos incluíram seis empresas de laticínios conhecidas: Arla, Recuperação agrícola da China, Sinodis, Oldenburger, Bellco, e médico de queijo.

Essa cooperação estratégica fortalece ainda mais as relações amigáveis entre as partes!

São plataformas como o CIIE que oferecem oportunidades para trocas mais profundas e mais próximas e cooperação entre empresas.