Kühlkettenlagerung und -verteilung: Wie sorgen Sie dafür, dass Ihre Produkte sicher und effizient bleiben??

Aktualisiert im November 2025

Aufrechterhaltung der Qualität der Impfstoffe, Frische Produkte und andere verderbliche Waren hängen von der Integrität der Kühlketten-Lagerungs- und Vertriebssysteme ab. Lagerung und Vertrieb in der Kühlkette bezieht sich auf alle Einrichtungen, Fahrzeuge und Verfahren, die erforderlich sind, um temperaturempfindliche Produkte vom Ursprung bis zum Endverbraucher innerhalb präziser Bereiche zu halten. In 2025 Der globale Markt für Kühlkettenlogistik hat einen Wert von rund 436 Milliarden US-Dollar und wird voraussichtlich bis zum Jahr 1,3 Billionen US-Dollar überschreiten 2034, Dies stellt eine durchschnittliche jährliche Wachstumsrate dar 13 %. Dieser Leitfaden gibt Ihnen Klarheit, Umsetzbare Ratschläge zur Auswahl des richtigen Speichers, Verwalten Sie den Vertrieb und bleiben Sie neuen Vorschriften und Technologien immer einen Schritt voraus.

Was Kühlkettenlagerung und -verteilung bedeuten – und warum sie für die Lebensmittelsicherheit von entscheidender Bedeutung sind, Pharmazeutische Wirksamkeit und Kundenzufriedenheit.

So wählen und optimieren Sie Kühllagereinrichtungen – einschließlich der Bedeutung von Temperaturzonen, Isolierung und Energieeffizienz.

So optimieren Sie Vertriebsnetze und die Zustellung auf der letzten Meile — mit praktischen Tipps zur Routenoptimierung, Fahrzeugdesign und Echtzeitüberwachung.

Welche Trends und Markteinblicke wichtig sind 2025 — Abdeckung des Marktwachstums, Regionale Dynamik, Automatisierung, Nachhaltigkeit und regulatorische Veränderungen.

Häufige Fragen – schnelle Antworten auf Suchanfragen mit hohem Suchvolumen zum Thema Kühlkettenlogistik, Temperaturanforderungen und Energiemanagement.

Was ist Kühlkettenlagerung und -verteilung?, und warum ist es wichtig??

Die Lagerung und Verteilung in der Kühlkette umfasst alle Prozesse und Infrastrukturen, die die Sicherheit temperaturempfindlicher Produkte in der gesamten Lieferkette gewährleisten. Der Schwerpunkt der Lagerung liegt auf der Aufrechterhaltung stabiler Temperaturen während der Fahrtpausen, während die Verteilung sicherstellt, dass die Produkte zwischen den Standorten transportiert werden, ohne die Temperaturkette zu unterbrechen. Das System umfasst Kühllager, Isolierte Verpackung, temperaturgesteuerte Fahrzeuge und digitale Überwachungstools.

Den Unterschied zwischen Lagerung und Verteilung verstehen

Stellen Sie sich die Kühlkettenlagerung als die Heimatbasis vor, in der Produkte zwischen Produktion und Lieferung ruhen. Die Einrichtungen sind wie Kühlschränke für mehrere Räume konzipiert, mit Tiefkühlkammern (unter –15 °C), gefroren (–20 °C bis –10 °C), gekühlt (0 ° C bis 10 °C) und spezialisierte Pharmasortimente (2 ° C bis 8 °C). Der Vertrieb deckt die Reise selbst ab: Laderampen, Kühlfahrzeuge, Triebwagen, Luftfracht und die letzte Meile bis zum Geschäft oder zur Haustür des Verbrauchers. Beide Stufen sind auf eine kontinuierliche Temperaturkontrolle angewiesen; Schon eine Abweichung von nur wenigen Grad kann zum Verderb oder zur Beeinträchtigung der Wirksamkeit führen.

Die Bedeutung der Kühlkettenlagerung und -verteilung hat stark zugenommen. Ein Anstieg der Lebensmittelverkäufe im E-Commerce, Der wachsende Biologika-Markt und die gestiegenen Erwartungen der Verbraucher an Transparenz haben Unternehmen dazu veranlasst, in intelligentere Produkte zu investieren, umweltfreundlichere Kühlketten. Zum Beispiel, Allein Indiens E-Food-Segment wird voraussichtlich 28 Milliarden US-Dollar übersteigen 2025. Auf der pharmazeutischen Seite, Das Segment der Kühlkettenlogistik für Biologika wird 2017 auf 6,7 Milliarden US-Dollar geschätzt 2025 und soll bis zum Jahr 9,3 Milliarden US-Dollar erreichen 2034. Diese Zahlen unterstreichen, warum Speicher- und Vertriebspraktiken robust und innovativ sein müssen.

Schlüsselkomponenten der Kühlkettenlagerung und -verteilung

| Komponente | Beschreibung | Was bedeutet dies für Sie |

| Lagerung | Spezielle Kühlräume und Lager sorgen für präzise Temperaturbereiche (Tiefkühltruhe, gefroren, gekühlt, Pharmazeutisch und Ambient) um die Produktqualität zu bewahren. | Die Auswahl einer Anlage mit den richtigen Zonen verhindert Verderb und stellt die Einhaltung der Temperaturvorgaben sicher. |

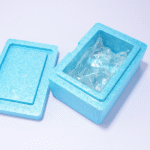

| Verpackung | Spezialmaterialien wie Isolierboxen, Gelpackungen, Trockeneis und Phasenwechselmaterialien stabilisieren die Temperaturen während des Transports. | Die Anpassung der Verpackung an die thermischen Anforderungen des Produkts reduziert Temperaturschwankungen und Schäden. |

| Transport | Kühlfahrzeuge, Triebwagen und Container, die mit aktiven Kühlsystemen ausgestattet sind, transportieren Güter zwischen Standorten. | Stellen Sie sicher, dass Transportunternehmen Fahrzeuge mit zuverlässiger Kühlung und angemessenen Temperatureinstellungen anbieten. |

| Überwachung und Analyse | IoT -Sensoren, RFID-Tags und Datenlogger verfolgen die Temperatur, Luftfeuchtigkeit und Standort in Echtzeit. | Durch die kontinuierliche Transparenz können Sie Probleme frühzeitig erkennen und die Einhaltung nachweisen. |

| Compliance und Dokumentation | Vorschriften wie gute Vertriebspraktiken (BIP), Gefahrenanalyse und kritische Kontrollpunkte (Haccp) und die USA. Gesetz zur Modernisierung der Lebensmittelsicherheit (FSMA) erfordern detaillierte Aufzeichnungen. | Das Führen genauer Aufzeichnungen und das Befolgen von Richtlinien trägt zur Vermeidung von Bußgeldern bei und gewährleistet die Produktsicherheit. |

Praktische Tipps und Ratschläge

Integrieren Sie Systeme für vollständige Transparenz: Wählen Sie Lager- und Transportpartner, die integrierte Überwachungs- und Warnsysteme anbieten, So können Sie Temperatur und Luftfeuchtigkeit vom Dock bis zur Tür verfolgen.

Trainiere dein Team: Der Mensch ist Teil der Kühlkette. Häufiges Türöffnen, Schlechte Ladepraktiken und verspätete Lieferungen können die Temperaturkette unterbrechen; Schulung verhindert menschliches Versagen.

Planen Sie Redundanz ein: Investieren Sie in Notstromgeneratoren und Kompressoren in Lagereinrichtungen und Fahrzeugen, um die Temperatur bei Stromausfällen aufrechtzuerhalten.

Nutzen Sie die KI-gestützte Routenplanung: Algorithmen, die Verkehr und Wetter berücksichtigen, können Lieferrouten optimieren, Reduzieren Sie den Kraftstoffverbrauch und minimieren Sie die Zeit ohne Kühlung.

Wie wählen und optimieren Sie eine Kühlanlage??

Um die richtige Kühllagereinrichtung auszuwählen, müssen die Produktanforderungen bekannt sein, Anlagendesign und Energieeffizienz. Das durchschnittliche Kühllager in 2025 ist vorbei 42 Jahre alt und verbraucht vier- bis fünfmal mehr Energie als ein herkömmliches Lagerhaus. Upgrade auf modern, Energieeffiziente Anlagen senken nicht nur die Kosten, sondern verringern auch die Umweltbelastung.

Bewerten Sie Temperaturzonen und das Alter der Anlage

Produkte erfordern bestimmte Temperaturbereiche, um ihre Qualität aufrechtzuerhalten. Gefrorene Lebensmittel benötigen möglicherweise –10 °F bis –20 °F (–23 °C bis –29 °C), während frische Produkte und Milchprodukte sicher bleiben 32 °F bis 50 ° F (0 ° C bis 10 °C). Impfstoffe und Biologika sind in der Regel erforderlich 36 °F bis 46 ° F (2 ° C bis 8 °C). Suchen Sie nach Einrichtungen, die mehrere Temperaturzonen bieten und über moderne Isolierung und Feuchtigkeitskontrolle verfügen. Denken Sie daran, dass die Kühlung ungefähr ausmachen kann 70 % des Energieverbrauchs einer Anlage – Sanierung von Wänden, Türen und Dächer mit Hochleistungsmaterialien können die Energiekosten um 20–30 % senken %.

Bewerten Sie Design- und Technologiefunktionen

Moderne Kühllager verfügen über automatisierte Lager- und Bereitstellungssysteme (AS/RS), Robotik und IoT-Sensoren zur Steigerung des Durchsatzes und zur Senkung der Arbeitskosten. Fortschrittliche Sensoren liefern kontinuierlich Temperatur- und Luftfeuchtigkeitsdaten, während prädiktive Analysen Geräteausfälle und -bedarf vorhersagen. Anlagen mit Solarpaneelen oder natürlichen Kältemitteln können die Energiekosten und den CO2-Fußabdruck weiter reduzieren.

Berücksichtigen Sie Standort und Skalierbarkeit

Die Nähe zum Kunden reduziert Lieferzeiten und den Energieverbrauch. Jedoch, Industrieflächen in Großstädten sind knapp und teuer, Daher investieren Betreiber häufig in Mikro-Fulfillment-Zentren in Vorstädten oder Lager für mehrere Kunden, um die Effizienz auf der letzten Meile zu verbessern. In wachstumsstarken Regionen wie Texas nimmt der spekulative Bau – der Bau von Kühlhäusern ohne Vormieter – zu, Florida und Georgia, welche ausmachen 47 % der neuen Kühllagerentwicklungen seither 2020.

Tisch: Temperaturkategorien und ihre Bedeutung

| Temperaturkategorie | Typische Reichweite & Beispiele | Praktische Bedeutung |

| Tiefes Einfrieren | Unter –15 °C (5 ° F); Wird zur Langzeitlagerung von Fleisch und Eis verwendet | Erfordert eine robuste Isolierung und minimale Temperaturschwankungen, um Gefrierbrand zu verhindern. |

| Gefroren | –10 °F bis –20 °F (–23 °C bis –29 °C); für Fleisch verwendet, Fisch und Fertiggerichte | Hält die Produkte fest und reduziert die mikrobielle Aktivität, Haltbarkeit verlängern. |

| Gekühlt / Gekühlt | 32 °F bis 50 ° F (0 ° C bis 10 °C); für Früchte verwendet, Gemüse und Milchprodukte | Verhindert den Verderb und vermeidet gleichzeitig Frostschäden, Erhaltung der Frische. |

| Pharmazeutisch | 36 °F bis 46 ° F (2 ° C bis 8 °C) | Hält strenge behördliche Richtlinien ein; erfordert Notstrom und Echtzeitüberwachung. |

| Cool / Ambient | 8 ° C bis 25 °C (46 °F bis 77 ° F); für Blumen verwendet, Snacks und Chemikalien | Unterstützt weniger empfindliche Waren und bietet umwandelbare Zonen für Lager mit mehreren Temperaturen. |

Tipps zur Speicheroptimierung

Ordnen Sie Ihr Inventar zu: Ordnen Sie Produkte geeigneten Temperaturzonen zu und vermeiden Sie Kreuzkontaminationen.

Investieren Sie in Isolierung und Türen: Hochleistungswände, Dächer und Hafenabdichtungen können den Energieverbrauch um 20–30 % senken %.

Implementieren Sie Redundanz- und Backup-Systeme: Schützen Sie Ihren Bestand bei Stromausfällen mit Standby-Generatoren und Backup-Kompressoren.

Schulung des Personals zum Temperaturmanagement: Häufiges Türöffnen und unsachgemäße Beladung können die Kühlkette gefährden.

Setzen Sie auf erneuerbare Energien: Sonnenkollektoren auf Dächern erzeugen Strom und senken die Betriebskosten.

Wie können Sie die Kühlkettenverteilung und die Zustellung auf der letzten Meile optimieren??

Um die Verteilung zu optimieren, muss die Geschwindigkeit ausgeglichen werden, Kosten- und Temperaturkontrolle auf jeder Meile – insbesondere auf der letzten. Der zunehmende Online-Lieferservice für Lebensmittel und Essenspakete bedeutet, dass Verbraucher erwarten, dass frische Lebensmittel schnell nach Hause geliefert werden. Im März 2025 UNS. Der Lebensmittelumsatz erreichte 9,7 Milliarden US-Dollar, mit $4.2 Allein für die Lieferung wurden Milliarden ausgegeben. Eine aktuelle Umfrage ergab rund 30 % der Haushalte nutzen einen Liefermix, Optionen zur Abholung und zum Versand nach Hause, Dies unterstreicht die Bedeutung einer effizienten Logistik auf der letzten Meile.

Verbessern Sie die Last-Mile-Logistik

Die Lieferung temperaturempfindlicher Produkte an die Haustür der Verbraucher ist einer der anspruchsvollsten Aspekte der Kühlkettenverteilung. Unternehmen nutzen mehrere Strategien, um dieses Problem anzugehen:

Kollaborative Lagerhaltung: Die gemeinsame Nutzung von Vertriebsflächen durch mehrere Betreiber verbessert die Netzwerkeffizienz und reduziert Leerfahrten.

Ältere Anlagen nachrüsten: Durch die Modernisierung bestehender Lager mit moderner Kühllagertechnologie wird die Kapazität erweitert, ohne dass ein kompletter Neubau erforderlich ist.

Arbeiten Sie mit externen Logistikanbietern zusammen (3Pls): Durch die Nutzung der 3PL-Expertise werden Liefernetzwerke optimiert und Sie können sich auf Ihr Kerngeschäft konzentrieren.

Investieren Sie in Lkw-Aufbauten aus Verbundwerkstoff: Neue LKW-Aufbaukonstruktionen verwenden schaumisolierte Verbundplatten, die leichter sind, stärker und thermisch effizienter als herkömmliche Metallstrukturen. Leichtere Fahrzeuge verbessern die Kraftstoffeffizienz und helfen Flotten, Nachhaltigkeitsziele zu erreichen.

Nutzen Sie Technologie für den Vertrieb

Neue Technologien können den Vertrieb verändern, indem sie für Transparenz sorgen, prädiktive Erkenntnisse und Nachhaltigkeit:

| Technologie | Beschreibung | Auswirkungen auf die Verteilung |

| KI-gestützte Routenoptimierung | Algorithmen analysieren den Verkehr, Wetter- und Lieferpläne, um die effizientesten Routen zu finden. | Schnellere Lieferungen, geringere Kraftstoffkosten und weniger Ausschuss. |

| Vorausschauende Wartung & Analytik | KI sagt Geräteausfälle und Nachfragetrends voraus. | Weniger Ausfallzeiten und höhere Kundenzufriedenheit. |

| IoT-Sensoren und Echtzeit-Tracking | Geräte überwachen die Temperatur, Luftfeuchtigkeit und Standort. | Sofortige Benachrichtigungen, weniger Produktverluste und bessere Compliance. |

| Rückverfolgbarkeit der Blockchain | Verteilte Hauptbücher zeichnen jede Bewegung und jeden Temperaturwert auf. | Mehr Transparenz, weniger Betrug und vereinfachte Prüfungen. |

| Solarbetriebene Kühlung | Sonnenkollektoren versorgen Kühllager in abgelegenen oder energiearmen Gebieten mit Strom. | Niedrigere Energiekosten und geringerer CO2-Fußabdruck. |

| Tragbare kryogene Gefriergeräte | Mobile Einheiten halten –80 °C bis –150 °C für Biologika und Gentherapien aufrecht. | Flexibler Vertrieb von ultrakalten Produkten. |

| Nachhaltige Verpackung | Biologisch abbaubare Wickel und wiederverwendbare Kühlakkus reduzieren den Abfall. | Unterstützt die Nachhaltigkeitsziele des Unternehmens und erfüllt die regulatorischen Erwartungen. |

Vertriebstipps und Ratschläge

Planen Sie die gesamte Reise: Konzentrieren Sie sich nicht nur auf das Lager; Jeder Berührungspunkt von der Herstellung bis zur Lieferung wirkt sich auf die Produktintegrität aus.

Verwenden Sie das richtige Fahrzeug für den Job: Passen Sie die LKW-Abteile an die Produkttemperaturanforderungen an und investieren Sie in Verbundwerkstoffe für eine bessere Isolierung.

Priorisieren Sie die Sichtbarkeit: Die Temperatur- und Standortüberwachung in Echtzeit stellt sicher, dass Sie wissen, wo sich Ihre Produkte befinden und wie es ihnen geht.

Verweildauer optimieren: Effiziente Be- und Entladeprozesse minimieren die Zeit, die Waren außerhalb der Temperaturkontrolle verbringen.

Behandeln Sie Ihren 3PL als Partner: Arbeiten Sie mit Logistikdienstleistern zusammen, die Ihre gesetzlichen Anforderungen verstehen und Cross-Docking anbieten können, Umladung und Mehrwertdienste.

Welche Herausforderungen bedrohen die Kühlkette?, und wie können Sie sie überwinden?

Die Aufrechterhaltung einer durchgängigen Kühlkette ist komplex. Zu den größten Herausforderungen gehört die Einhaltung gesetzlicher Vorschriften, Wetterstörungen, mangelnde Sicht und Geräteausfall. Die Bewältigung dieser Herausforderungen erfordert sowohl Technologie- als auch Prozessverbesserungen.

Vorschriftenregulierung

Weltweit verschärfen sich die regulatorischen Rahmenbedingungen. Zum Beispiel, die USA. FSMA-Regel 204, die im Januar in Kraft trat 2025, schreibt vor, dass Lebensmittel mit hohem Risiko im Inneren rückverfolgbar sein müssen 24 Std.. Die guten Vertriebspraktiken der EU (BIP) elektronische Aufzeichnungen für Arzneimittel verlangen, und die Weltgesundheitsorganisation besteht auf einer kontinuierlichen Überwachung der Impfstofflagerung. Um nachzukommen:

Pflegen Sie eine detaillierte Dokumentation: Notieren Sie die Temperaturwerte, Bearbeitung von Maßnahmen und Details zur Produktkette in jeder Phase.

Stellen Sie digitale Rückverfolgbarkeit bereit: Nutzen Sie Blockchain- und IoT-Geräte, um manipulationssichere Aufzeichnungen bereitzustellen.

Schulen Sie das Personal hinsichtlich der Vorschriften: Stellen Sie sicher, dass die Teams gute Vertriebspraktiken verstehen, HACCP und andere anwendbare Standards.

Wetter- und Umweltfaktoren

Hitzewellen, Kälteeinbrüche und Stürme können die Temperaturkontrolle stören. Zur Milderung:

Installieren Sie eine robuste Isolierung und Notstromversorgung: Verbesserte Gebäudehüllen und Standby-Generatoren sorgen dafür, dass die Produkte auch bei extremen Wetterbedingungen sicher sind.

Überwachen Sie Wetterdaten: Integrieren Sie meteorologische Vorhersagen in die Routenplanung, um Temperaturabweichungen zu vermeiden.

Verwenden Sie energieeffiziente Fahrzeugaufbauten: Verbundwerkstoffe reduzieren die Wärmeübertragung und sorgen für stabile Innentemperaturen.

Mangelnde Sichtbarkeit

Ohne Echtzeit-Sichtbarkeit, Kleine Temperaturabweichungen können unbemerkt bleiben. Zu den Lösungen gehören::

IoT-Sensoren und GPS-Tracking: Die kontinuierliche Überwachung löst sofortige Alarme aus und ermöglicht proaktive Interventionen.

Zentralisierte Datenplattformen: Integrieren Sie Daten aus dem Speicher, Transport und letzte Meile für eine ganzheitliche Betrachtung.

Prädiktive Analysen: Verwenden Sie KI, um Muster zu erkennen, die auf potenzielle Fehler hinweisen.

Gerätefehler

Kühlaggregate, Kompressoren und Sensoren können Fehlfunktionen aufweisen. Um das Risiko zu reduzieren:

Implementieren Sie vorausschauende Wartung: KI und Analysen prognostizieren Geräteausfälle, sodass Sie Komponenten reparieren oder austauschen können, bevor es zu Ausfällen kommt.

Regelmäßige Inspektionen: Planen Sie Routineprüfungen von Kompressoren, Isolier- und Kühlsysteme.

Haben Sie einen Notfallplan: Identifizieren Sie Ersatzfahrzeuge und Lagermöglichkeiten, um Sendungen umzuleiten, wenn Geräteprobleme auftreten.

2025 Marktübersicht: Wachstum, Segmente und regionale Einblicke

Der Markt für Kühlkettenlagerung und -verteilung erlebt ein rasantes Wachstum, das durch den E-Commerce vorangetrieben wird, Arzneimittel und regulatorische Anforderungen. Precedence Research berichtet, dass der weltweite Kühlkettenmarkt von 436,30 Milliarden US-Dollar im Jahr wachsen wird 2025 auf 1.359,78 Milliarden US-Dollar 2034, A 13.46 % CAGR. Die Region Asien-Pazifik wird voraussichtlich die höchste Wachstumsrate verzeichnen (≈14,3 %), während der nordamerikanische Markt voraussichtlich von 116,85 Milliarden US-Dollar im Jahr wachsen wird 2024 auf 289,58 Milliarden US-Dollar 2034.

Die Food Shippers of America schätzen, dass der Weltmarkt im Jahr 2017 ein Volumen von über 321 Milliarden US-Dollar hatte 2023 und könnte 1,245 Billionen US-Dollar überschreiten 2033. In der Zwischenzeit, Datoms berichtet, dass sich der Kühlkettenmarkt bis zum Jahr auf 1,63 Billionen US-Dollar beschleunigen könnte 2035 bei ~15 % CAGR. Diese Prognosen unterstreichen das langfristige Wachstumspotenzial der Kühlkettenlagerung und -verteilung.

Regionale Dynamik und Marktsegmente

Nordamerika: Ein reifer, aber expandierender Markt, der von einem starken Pharmasektor und der Nachfrage nach E-Commerce dominiert wird. Die USA. Allein der Kühllagermarkt wird im Jahr auf 39,6 Milliarden US-Dollar geschätzt 2025 und soll bis zum Jahr 91,4 Milliarden US-Dollar erreichen 2032. Die Betreiber investieren hier stark in die Modernisierung veralteter Anlagen und den Bau von Mikro-Fulfillment-Hubs.

Europa: Umweltvorschriften und Nachhaltigkeitsauflagen treiben die Einführung energieeffizienter Technologien voran. Die veraltete Infrastruktur vieler Länder bietet Möglichkeiten für Nachrüstungen und Neubauten.

Asien–Pazifik: Dank der Urbanisierung die am schnellsten wachsende Region, steigende Einkommen und die Ausweitung des organisierten Einzelhandels. Vorkühlanlagen erwirtschafteten 204,4 Milliarden US-Dollar Umsatz 2024. Staatliche Zuschüsse, Das Wachstum des E-Commerce und der steigende Konsum von Fleisch und Milchprodukten treiben weiterhin Investitionen an.

Schwellenländer: Länder in Südostasien, Afrika und Lateinamerika investieren in Kühlkettenkapazitäten, um wachsende Verbrauchermärkte und Arzneimittel zu unterstützen. Innovationen wie solarbetriebene Kühlung und Blockchain-Rückverfolgbarkeit sind besonders dort wertvoll, wo die Zuverlässigkeit der Stromversorgung eine Herausforderung darstellt.

Einblicke und Chancen in die Segmentierung

| Segment / Region | Wichtige Statistiken & Trends | Implikationen |

| Privat vs. Öffentliche Lagerhäuser | Private Einrichtungen statt 63.65 % des Marktanteils in 2024; Öffentliche Lagerhäuser wachsen schnell. | Der Besitz eines Lagers bietet Kontrolle und Mehrwertdienste, während öffentliche Optionen Flexibilität und Skalierbarkeit bieten. |

| Frozen vs. Gekühlt | Das eingefrorene Segment wurde generiert 77.95 % des Umsatzes in 2024; Kühlzonen für Frischwaren und Arzneimittel werden immer größer. | Tiefkühlware dominiert, Wachstumschancen bestehen jedoch in Kühl- und Wandelzonen. |

| Essen vs. Pharmazeutisch | Fisch, Fleisch und Meeresfrüchte entfielen 31.69 % der Einnahmen; Milchprodukte gefangen 12.09 %; Die pharmazeutische Nachfrage nach Ultra-Low-Zonen steigt. | Protein bleibt ein zentraler Treiber, aber Milchprodukte und verarbeitete Lebensmittel nehmen zu. Ultrakalte Lagerung wird für Biologika und Gentherapien immer wichtiger. |

| Regionale Entwicklung | Texas, Florida und Georgia entfallen 47 % der neuen Kühllagerentwicklungen seither 2020; Die Vorkühlanlagen im asiatisch-pazifischen Raum erwirtschafteten 204,4 Milliarden US-Dollar Umsatz 2024. | Wachstumsstarke Staaten und Regionen bieten Möglichkeiten für spekulatives Bauen, Während etablierte Märkte sich auf die Modernisierung bestehender Anlagen konzentrieren. |

Wachstumstreiber und Branchennachfrage

Wachsender globaler Handel und zunehmende Verbrauchernachfrage: Internationaler Handel mit verderblichen Gütern, zusammen mit der Nachfrage nach Frischem, gesunde Lebensmittel, ist ein Haupttreiber. Soziale Medien und globale Lebensmitteltrends machen Verbraucher mit neuen Produkten bekannt, steigende Nachfrage nach zuverlässiger Kühllagerung.

E-Commerce und Online-Lebensmittelhandel: Das schnelle Wachstum bei der Online-Lieferung von Lebensmitteln und Essenspaketen erhöht den Bedarf an einer effizienten Logistik auf der letzten Meile. Es wird erwartet, dass der Online-Lebensmittelverkauf einen Anteil davon ausmacht 21.5 % der USA. Lebensmittelverkauf von 2025.

Pharma- und Biologika-Boom: Personalisierte Medizin und fortschrittliche Therapien erfordern eine ultrakalte Lagerung. Etwa 20 % Bei den neuen Medikamenten in der Entwicklung handelt es sich um Gen- und Zelltherapien, die eine strenge Temperaturkontrolle erfordern.

Regulatorische Anforderungen: Lebensmittelsicherheitsstandards wie FSMA und globale GDP-Regeln schreiben eine strenge Temperaturüberwachung vor. Compliance treibt die Einführung digitaler Überwachungs- und Dokumentationssysteme voran

Nachhaltigkeitsdruck: Unternehmen setzen energieeffiziente Technologien und umweltfreundliche Verpackungen ein, um den CO2-Fußabdruck zu reduzieren und Umweltvorschriften einzuhalten.

Welche Trends werden die Lagerung und Verteilung in der Kühlkette prägen? 2025 und darüber hinaus?

Mehrere Makro- und Mikrotrends verändern die Kühlkettenlandschaft. Das Verständnis dieser Trends hilft Ihnen, Investitionen zu planen und der Konkurrenz einen Schritt voraus zu sein.

Sich weiterentwickelnde Verbraucherpräferenzen

Verbraucher verlangen immer mehr nach Frische, gesunde und regionale Lebensmittel. Konzepte wie „Vom Hof auf den Tisch“ und Essenssets haben während der Pandemie an Bedeutung gewonnen und werden weiter ausgebaut. Kühllager passen sich an, um mehr frische Produkte zu verarbeiten, Milch- und Essenssets, Dies erfordert eine präzise Temperaturkontrolle und Transparenz.

Automatisierung, Nachhaltigkeit und Energieeffizienz

Automatisierung und Nachhaltigkeit gehen Hand in Hand. Mikro-Fulfillment-Zentren in Städten und Vorstädten verfügen über automatisierte Kommissionierungssysteme und fortschrittliche Temperaturkontrollen, um der Nachfrage nach schnellerer Lieferung gerecht zu werden, Gleichzeitig wird der Energieverbrauch durch Technologien wie LED-Beleuchtung reduziert, Sonnenkollektoren und natürliche Kältemittel. Durch umweltfreundlichere Praktiken können die mit Arbeits- und Betriebskosten verbundenen Energiekosten nahezu gesenkt werden 50 %.

Spekulatives Bauen und Modernisieren

Entwickler bauen hochmoderne Kühllager ohne Vormieter, Wetten auf die zukünftige Nachfrage. Wachstumsstarke Regionen wie Texas, Auf Florida und Georgia entfällt seitdem fast die Hälfte aller Neuentwicklungen 2020. Gleichzeitig, Alternde Infrastruktur – das durchschnittliche Kühlhaus ist 42 Jahre alt – veranlasst Betreiber, Anlagen nachzurüsten und zu modernisieren.

Optimierung der letzten Meile

Die Lieferung verderblicher Waren an die Haustür der Verbraucher erfordert Präzision und Geschwindigkeit. Zu den Innovationen gehören kollaborative Lagerflächen, nachgerüstete Anlagen, Partnerschaften mit 3PLs, und Investitionen in Lkw-Karosserien aus Verbundwerkstoff. Mikro-Fulfillment-Center in der Nähe städtischer Gebiete unterstützen eine schnelle Lieferung und reduzieren den Energieverbrauch.

Digitale Transformation

Die Branche bewegt sich von reaktiven zu prädiktiven Abläufen. IoT-Sensoren ermöglichen eine Echtzeitüberwachung in Intervallen von 1–5 Minuten, KI hilft dabei, Routen zu optimieren und die Nachfrage vorherzusagen, und Blockchain sorgt für manipulationssichere Rückverfolgbarkeit. Diese Technologien sind für die Wettbewerbsfähigkeit von entscheidender Bedeutung, nicht optional.

FAQ

Frage 1: Wie groß ist der Markt für Kühlkettenlogistik? 2025?

Der weltweite Kühlkettenmarkt wird im Jahr auf rund 436 Milliarden US-Dollar geschätzt 2025 und wird voraussichtlich 1,3 Billionen US-Dollar übersteigen 2034, wächst um ca 13 % jährlich. Schätzungen variieren je nach Methodik; Einige Prognosen schätzen den Markt auf 393 bis 453 Milliarden US-Dollar 2025 und steigt bis auf 1,63 Billionen US-Dollar 2035.

Frage 2: Welchen Temperaturbereich benötigen Impfstoffe bei Lagerung und Transport??

Impfstoffe und Biologika müssen normalerweise dazwischen gehalten werden 2 °C und 8 °C (36 °F bis 46 ° F). Ultra-Low-Therapien, wie einige Gen- und Zelltherapien, Möglicherweise sind Temperaturen von bis zu –80 °C erforderlich. Die Einhaltung dieser Bereiche schützt die Wirksamkeit und stellt die Einhaltung gesetzlicher Vorschriften sicher.

Frage 3: Wie kann ich die Energiekosten in einem Kühlhaus senken??

Durch eine verbesserte Isolierung können die Energiekosten gesenkt werden, mittels LED-Beleuchtung, Einbau von Hochleistungstüren und Torabdichtungen, und die Integration erneuerbarer Energiequellen wie Sonnenkollektoren. Automatisierung und energieeffiziente Geräte können die Arbeits- und Betriebskosten um bis zu senken 50 %.

Frage 4: Was sind die größten Herausforderungen bei der Kühlkettenverteilung??

Zu den größten Herausforderungen gehört die Einhaltung gesetzlicher Vorschriften, Wetterstörungen, mangelnde Sicht und Geräteausfall. Um diese zu bewältigen, ist eine kontinuierliche Überwachung erforderlich, vorausschauende Wartung, Starke Dokumentation und proaktive Planung.

Anregung

Die Lagerung und Verteilung in der Kühlkette ist für die Lebensmittelsicherheit von grundlegender Bedeutung, öffentliche Gesundheit und Verbrauchervertrauen. In diesem Artikel wird erläutert, wie Sie moderne Lagereinrichtungen mit mehreren Temperaturzonen auswählen, Investieren Sie in Isolierung und erneuerbare Energien, und schulen Sie das Personal, um die Integrität der Kühlkette aufrechtzuerhalten. Es bietet Strategien zur Rationalisierung des Vertriebs durch kollaborative Lagerhaltung, Verbundfahrzeuge und digitale Werkzeuge. Endlich, es unterstreicht das Marktwachstum, regionale Dynamik und aufkommende Trends wie Automatisierung, Nachhaltigkeit und Optimierung der letzten Meile.

Um eine belastbare Kühlkette aufzubauen 2025:

Auditieren Sie Ihre Einrichtungen und Ihren Fuhrpark: Identifizieren Sie veraltete Geräte und investieren Sie in moderne, energieeffiziente Systeme.

Implementieren Sie eine Echtzeitüberwachung: Nutzen Sie IoT-Sensoren, KI und Blockchain, um vollständige Transparenz zu erlangen und Probleme vorherzusagen, bevor sie auftreten.

Arbeiten Sie mit Experten zusammen: Arbeiten Sie mit vertrauenswürdigen 3PLs zusammen, Technologieanbieter und Partner, um Compliance und Effizienz zu verbessern

Konzentrieren Sie sich auf die letzte Meile: Investieren Sie in Mikro-Fulfillment-Center und fortschrittliche LKW-Aufbauten, um der wachsenden E-Commerce-Nachfrage gerecht zu werden.

Bleib informiert: Überwachen Sie regulatorische Änderungen und Branchentrends, um sich schnell anzupassen und wettbewerbsfähig zu bleiben.

Um Tempk

Tempk ist ein führender Anbieter von Kühlkettenlösungen, die Unternehmen dabei helfen, temperaturempfindliche Produkte vom Ursprung bis zum Bestimmungsort sicher aufzubewahren. Wir sind auf Isolierboxen spezialisiert, Gelpackungen, Palettenabdeckungen und wiederverwendbare Verpackungen für Arzneimittel, frische Lebensmittel und Biologika. Unsere Produkte werden aus modernsten Materialien entwickelt, um eine dauerhafte Leistung und Energieeffizienz zu bieten. Wir bieten auch digitale Überwachungstools an, die sich in Ihre bestehenden Systeme integrieren lassen, Bietet Echtzeittransparenz und stellt die Einhaltung globaler Standards sicher. Mit langjähriger Erfahrung und einem Engagement für Nachhaltigkeit, Wir helfen Ihnen beim Aufbau einer belastbaren Kühlkette.

Nächste Schritte: Kontaktieren Sie unser Team für eine persönliche Beratung und erfahren Sie, wie die Produkte und das Fachwissen von Tempk Ihre Lager- und Vertriebsabläufe in der Kühlkette optimieren können.