The world of Pharma-Kühlkettenlogistik is evolving quickly. In 2025 the cold chain pharma market is estimated to grow from about USD 8.85 Milliarden in 2024 auf über USD 10 Milliarde. This trajectory reflects wider growth across healthcare logistics: the healthcare cold chain logistics market was valued at USD 57.18 Milliarden in 2024 und wird voraussichtlich USD erreichen 139.14 Milliarden von 2034. You’ll discover why biologics, vaccines and digital technologies are driving this expansion, and how you can prepare your organisation for the future.

Why is pharma cold chain logistics growing so rapidly in 2025? – Understand market size projections and the impact of biologics and vaccines.

How do emerging technologies like AI, IoT and blockchain enhance cold chain efficiency? – Explore innovations that reduce waste and ensure compliance.

What regulatory trends should you watch? – Learn how tariffs, Gute Vertriebspraxis (BIP) Richtlinien und andere Vorschriften beeinflussen den Betrieb.

Warum ist Verpackung wichtig?? – Entdecken Sie, wie temperaturgesteuerte Verpackungslösungen Nachhaltigkeit und Zuverlässigkeit unterstützen.

Was sind die neuesten Marktentwicklungen?? – Get insights into job growth, Patente, funding rounds and regional hotspots.

Why Is Pharma Cold Chain Logistics Growing Rapidly in 2025?

The pharmaceutical cold chain is expanding because biologics, advanced therapies and global supply chains are growing. The cold chain pharma market increased from USD 8.85 Milliarden in 2024 in USD 10.04 Milliarden in 2025 und wird voraussichtlich USD erreichen 18.20 Milliarden von 2030 with a CAGR of ~12.7 %. In der Zwischenzeit, the wider healthcare cold chain logistics market is expected to grow at a CAGR of 9.3 % zwischen 2025 Und 2034, USD erreichen 139.14 Milliarde. Dieses Wachstum wird durch mehrere Faktoren angetrieben:

Biologics boom: Laut Recherche, mehr als 40 % der neu zugelassenen Medikamente in 2023 waren Biologika. Biologics and cell based therapies require storage between 2 °C and –80 °C, necessitating sophisticated cold chain infrastructure.

Expansion of vaccine distribution: Growth in global vaccine programmes and personalised medicine increases demand for ultra cold logistics. Portable cryogenic freezers now maintain temperatures as low as –80 °C.

Global trade and e commerce: International trade of pharmaceuticals and perishable goods is rising. StartUs Insights reports that the cold chain sector employed more than 576 000 people in 2025 and added over 26 800 jobs in the past year, signalling a surge in industry activity.

Investition und Innovation: The cold chain sector attracted more than 1 880 funding rounds with an average investment of USD 56.2 Million. Over 2 800 patents have been filed, showing rapid innovation.

Market Drivers and Forecast Data

The table below summarises key market forecasts and what they mean for your operations.

| Metrisch | 2024–2025 Value | Forecast/Trend | Was es für Sie bedeutet |

| Pharma cold chain market size | USD 8.85 B (2024)→USD 10.04 B (2025) | Wird voraussichtlich USD erreichen 18.20 B von 2030 | Plan capacity expansion and invest in regulatory compliance. |

| Markt für Kühlkettenlogistik im Gesundheitswesen | USD 57.18 B (2024) | USD 139.14 B von 2034 | Strong demand underscores need for scalable warehouses and temperature controlled fleets. |

| Temperature controlled packaging market | USD 5.93 B (2024) | USD 6.36 B (2025)→USD 11.50 B (2034) | Investieren Sie in wiederverwendbare Verpackungen; Nordamerika hält derzeit 32.02 % Aktie. |

| General cold chain logistics market | USD 324.85 B (2024)→USD 862.33 B (2032) | CAGR ~13 % | Expect more competition and consolidation across logistics providers. |

| Jobs and patents | 576 300+ employees; 2 Über 800 Patente | Employment and innovation continue to rise | Develop workforce skills and protect intellectual property. |

| Healthcare logistics market | USD 93.59 B in 2024 | CAGR 9.2 % to reach USD 197.3 B von 2032 | Partnership opportunities expand across warehousing, software and last mile delivery. |

Praktische Tipps und Anregungen

Monitor demand drivers: Biologics and personalised medicines will continue to require stringent temperature control. Align your infrastructure investments with the rise of these products.

Scale infrastructure: Expand your refrigerated fleet and warehouse capacity. Im Mai 2025, DP World opened a 110 000 sq ft cold chain facility in India, and DHL invested EUR 500 million to build an 8 200 m² pharma hub in Singapore. Use these examples as benchmarks.

Diversify geographically: Regional hubs such as the US, Indien, China, the UK and Canada are key innovation centers. Position facilities near these markets to reduce transit times.

Engage in workforce development: With thousands of new jobs created, invest in training programmes for temperature management, digital tools and compliance.

Fallbeispiel: A logistics startup specialising in sustainable refrigerants secured funding of around USD 56.2 million and built lightweight insulated containers with IoT monitoring. This innovation helped the company quickly capture market share and reduce spoilage.

Real-world insight: Die USA. FDA notes that über 40 % neuer Medikamente in 2023 waren Biologika, highlighting why pharmaceutical cold chains must handle ultra cold shipments. Companies that scaled up their ultra cold storage during the COVID 19 vaccine rollout now serve emerging cell and gene therapy markets.

How Do Emerging Technologies Enhance Cold Chain Efficiency?

Technological innovation is revolutionising cold chain logistics. Unlike traditional cold chain operations that relied on manual checks and paper logs, wireless IoT sensors now transmit temperature and location data in real time, triggering instant alerts during excursions. Diese Lösungen, combined with AI and blockchain, reduce waste and improve compliance.

Ai, Blockchain & IoT Solutions: Vorteile & Anwendungsfälle

KI und Predictive Analytics: Advanced algorithms analyse traffic and weather data to generate optimal delivery routes, cutting fuel consumption and ensuring on time deliveries. Predictive maintenance models reduce equipment downtime by up to 50 % und niedrigere Reparaturkosten um 10–20 %.

Rückverfolgbarkeit der Blockchain: Blockchain liefert unveränderliche Temperaturaufzeichnungen, humidity and travel history, simplifying audits and deterring tampering. In 2025, the cold chain market sees increasing adoption of blockchain enabled tracking platforms for end to end visibility.

IoT-Überwachung: Drahtlose Sensoren messen die Temperatur, Luftfeuchtigkeit und Standort kontinuierlich überwachen. Smart reefers with integrated sensors automatically regulate temperature but may increase energy consumption. IoT enabled monitoring is a key trend in the healthcare cold chain logistics market.

Automatisierung und Robotik: Automated cold storage systems with controlled access, redundancy and validated warehouse management systems (WMS) entstehen. Modular freezer units allow rapid capacity scaling.

| Technologie | Beschreibung | Vorteile für Sie |

| KI-Routenoptimierung | Algorithmen berücksichtigen den Verkehr, Wetter- und Lieferfenster | Reduziert die Kraftstoffkosten; sorgt für eine pünktliche Lieferung, Vermeidung von Temperaturschwankungen. |

| IoT -Sensoren | Geräte messen die Temperatur, Luftfeuchtigkeit und Standort in Echtzeit | Immediate alerts reduce spoilage and improve compliance. |

| Blockchain | Immutable ledger records each temperature reading | Vereinfacht Audits; increases transparency and regulatory trust. |

| Automated cold storage | Robotic systems manage inventory and ensure redundancy | Steigert die Effizienz, reduces human error and supports scalability. |

Practical Tips for Implementing Technology

Start with monitoring: Install IoT sensors in containers and warehouses to gain real time visibility. Pair sensors with predictive analytics to anticipate failures.

Integrate blockchain selectively: Use blockchain for high value or sensitive shipments to ensure end to end traceability. Ensure that your systems can interface with regulators’ verification requirements.

Trainiere dein Team: New technologies require new skills. Develop training programmes on AI dashboards, analytics tools and data interpretation.

Evaluate energy costs: Smart reefers may increase power consumption; plan accordingly and invest in energy efficient refrigeration equipment.

Fallbeispiel: A large biopharma company implemented IoT enabled monitoring and predictive analytics across its US distribution network. Temperature excursions dropped by 45 %, and response times improved dramatically. Real time data allowed rerouting shipments around extreme weather events.

Actual data: StartUs Insights found that the cold chain sector recorded über 1 880 Finanzierungsrunden Und mehr als 2 800 Patente. This surge in investment and intellectual property underscores the importance of innovation in meeting future demands.

What Regulatory and Compliance Trends Should You Watch?

Regulations continue to tighten as governments prioritise patient safety and supply chain transparency. Gute Vertriebspraxis (BIP), WHO cold chain guidelines and country specific mandates govern temperature sensitive shipments. In 2025, Mehrere Trends zeichnen sich ab:

Stricter traceability requirements: Implementation of the US Drug Supply Chain Security Act (DSCSA) und die europäische Fälschungsschutzrichtlinie (FMD) requires unit level traceability and chain of custody verification. Logistics providers must invest in digital technologies to meet these requirements.

Tariff and trade policy shifts: New tariffs on imported packaging materials and refrigeration equipment in 2025 affect procurement costs. Companies are adopting local sourcing and modular container designs to mitigate risks.

Regional compliance differences: North America remains the largest healthcare logistics market due to its advanced infrastructure and strict regulations. Europe emphasises GDP compliance, and Asia Pacific countries are harmonising standards while rapidly expanding their cold chain networks.

Focus on biologics: As biologics account for over 40 % von neu zugelassenen Medikamenten, regulators demand robust validation of ultra cold equipment and continuous monitoring.

Environmental sustainability mandates: Regulations increasingly restrict high global warming potential refrigerants and encourage natural refrigerants or renewable energy solutions【814164895374848†L422-L432】 (see technology options below).

Navigating Regional Requirements and Tariffs

Use the following table to compare regulatory and market conditions across regions.

| Region | Wichtige Vorschriften & Trends | Praktische Auswirkungen |

| Nordamerika | Strict GDP compliance; DSCSA mandates unit level traceability; biologics account for >40 % neuer Medikamente | Invest in digital verification systems; expand ultra cold storage. |

| Europa | EU-BIP-Richtlinien; centralised distribution via EMA; strong biotech sector | Harmonise operations across member states; focus on documentation and temperature mapping. |

| Asien-Pazifik | Harmonisation efforts; rapid investment in cold chain infrastructure; APAC expected to contribute 42.6 % of pharmaceutical logistics growth | Build capacity near manufacturing hubs; prepare for regulatory fragmentation. |

| Naher Osten & Afrika | Emerging regulations; investment in cold chain capacity to support vaccine distribution | Partner with local logistics providers; adapt to infrastructure constraints. |

| Lateinamerika | Expanding vaccine programmes and clinical trials; diverse regulatory environment | Develop regional expertise; plan for longer transit times and varied compliance regimes. |

Praktische Tipps zur Compliance

Entwickeln Sie eine Compliance-Roadmap: Align your logistics processes with GDP, DSCSA, FMD and local regulations. Conduct regular audits and maintain detailed documentation.

Arbeiten Sie mit spezialisierten 3PLs zusammen: Third party logistics providers often have dedicated compliance teams and advanced systems. Partnerships can reduce costs and improve performance.

Monitor trade policies: Stay informed about tariffs and import restrictions. Consider domestic sourcing or modular packaging to avoid supply disruptions.

Leverage digital platforms: Implement unified systems for traceability, Temperaturüberwachung und Dokumentation. Blockchain and IoT solutions can automate compliance reporting.

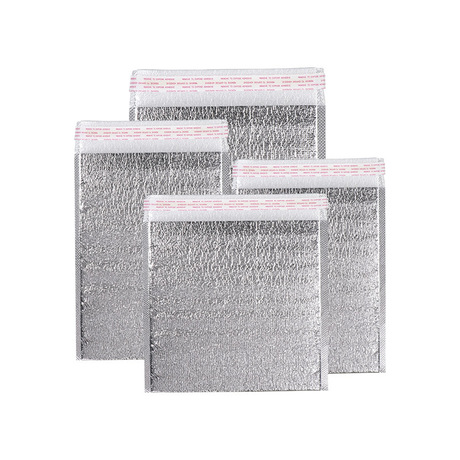

Why Does Sustainable & Temperature Controlled Packaging Matter?

Packaging plays a crucial role in maintaining temperature integrity, reducing waste and supporting sustainability goals. The global pharmaceutical temperature controlled packaging solutions market was valued at USD 5.93 Milliarden in 2024 and is predicted to increase from USD 6.36 Milliarden in 2025 in USD 11.50 Milliarden von 2034 (CAGR 6.8 %). Zu den wichtigsten Trends gehören:

Reusable solutions dominate: Reusable packaging captured 65.34 % der Einnahmen In 2024. Reusing insulated containers reduces costs and waste.

Temperature sensitive segment leads: The temperature sensitive pharmaceutical segment accounted for 60.09 % des Marktanteils, reflecting demand for biologics and vaccines.

Regionale Dynamik: Nordamerika gehalten 32.02 % des Marktes in 2024, while Asia–Pacific is projected to expand at a CAGR von 8.08 %.

KI-Integration: Advanced monitoring and predictive analytics are transforming packaging solutions, enabling proactive management and automation.

Trends in Pharmaceutical Packaging Solutions

| Packaging Trend | Beschreibung | Praktischer Nutzen |

| Reusable insulated shippers | Durable materials and phase change components allow multiple uses | Cuts long term costs, reduces waste and meets sustainability goals. |

| Smart packaging with sensors | Sensors embedded in packages record temperature history | Provides verifiable proof of compliance and reduces liability. |

| Natural refrigerants and eco friendly materials | Regulations encourage replacing HFCs with natural refrigerants【814164895374848†L422-L432】 | Lower environmental impact and compliance with sustainability mandates. |

| Modular packaging | Stapelbar, scalable containers adapt to different shipment sizes | Improves flexibility and reduces storage costs. |

Praktische Tipps zum Verpacken

Wählen Sie die richtige Isolierung: Match packaging to required temperature range (2–8 °C for refrigerated, –20 °C im gefrorenen Zustand, –80 °C for ultra cold). Phase change materials maintain stability.

Implement reusable programs: Track reusable containers using RFID or barcodes. Clean and refurbish between shipments to ensure performance.

Integrieren Sie intelligente Sensoren: Use packaging with embedded sensors to provide end to end temperature data and support blockchain verification.

Evaluate recyclability: Select materials that are recyclable or biodegradable to meet consumer expectations and regulatory pressures.

Fallbeispiel: A pharmaceutical distributor switched from single use polystyrene boxes to reusable vacuum insulated panels. Over one year, the company cut packaging waste by 40 % and saved USD 0.5 million in materials, unter Beibehaltung der Temperaturkonformität.

2025 Latest Developments and Future Trends

Trendübersicht

2025 is a pivotal year for the cold chain. Der globale Markt für Kühlkettenlogistik wird voraussichtlich ab USD wachsen 324.85 Milliarden in 2024 in USD 862.33 Milliarden von 2032, eine CAGR von ca 13 %. In der Zwischenzeit, the cold chain sector added over 26 800 new jobs and filed more than 2 800 patents in the past year. Zu den wichtigsten Entwicklungen gehören:

Blockchain-fähige Tracking-Plattformen: Research and Markets notes that blockchain is being integrated across cold chain networks to increase transparency and compliance.

KI-gestützte Routenoptimierung: AI analyses traffic and weather data to generate optimal delivery routes. Companies implementing AI reduce fuel consumption and delays.

Ultra cold storage expansion: Many biologics now require –80 °C or colder storage. Companies are investing in modular ultra cold capacity and cryogenic freezers.

Nachhaltigkeitsinitiativen: Umweltfreundliche Verpackung, solar powered refrigeration and natural refrigerants are reducing the environmental footprint of cold chains.

Widerstandsfähigkeit der Lieferkette: Investment in regional hubs and diversified transport modes helps mitigate geopolitical risks and tariffs.

Aktuelle Fortschritte auf einen Blick

Markterweiterung: Healthcare logistics market predicted to double from USD 93.59 Milliarden in 2024 in USD 197.3 Milliarden von 2032 (CAGR 9.2 %).

Biologics growth: Über 40 % neuer Medikamente in 2023 waren Biologika, increasing demand for cold chain capabilities.

Infrastructure investments: DP World opened a 110 000 sq ft facility in India and DHL invested EUR 500 million in Singapore. UPS Healthcare added over 200 temperature controlled vehicles in Europe.

Digitale Transformation: RFID tagging, AI based inventory planning, GPS tracking and blockchain systems are becoming standard across healthcare logistics.

Regionale Highlights: North America leads market share; Asien-Pazifik ist die am schnellsten wachsende Region. China and India produce over 60 % of global active pharmaceutical ingredients.

Markteinsichten

The combination of rising biologics, globalised supply chains and regulatory pressures is reshaping cold chain logistics. Innovations in sensors, AI and blockchain are no longer optional; they are necessary to maintain compliance and minimise losses. Investments by logistics giants demonstrate confidence in sustained growth. Jedoch, companies must address sustainability, energy consumption and workforce training to remain competitive. Regional diversification and flexible packaging will be crucial as global trade policies and environmental regulations evolve.

FAQ

- What is pharma cold chain logistics and why is it important?

Pharma cold chain logistics refers to the end to end transport and storage of temperature sensitive medicines, Impfstoffe und Biologika. Maintaining strict temperature ranges ensures product efficacy, patient safety and compliance with regulations. Über 40 % of new drugs are biologics requiring cold storage, making robust cold chain logistics vital. - How can my company ensure compliance with GDP and other regulations?

Develop a compliance roadmap covering Good Distribution Practice (BIP), DSCSA and regional guidelines. Use IoT monitoring and blockchain to create auditable records. Partnering with experienced third party logistics providers can simplify compliance and reduce risk. - What technologies should I prioritise to modernise my cold chain?

Start with real time IoT sensors and predictive analytics to monitor shipments and predict failures. Add blockchain for high value products and use AI route optimisation to reduce delays. Evaluate automated cold storage and robotic systems for scalability. - How do reusable packaging solutions help my bottom line?

Reusable packaging comprises über 65 % der Einnahmenin the temperature controlled packaging market. Investing in durable insulated containers reduces material costs, cuts waste and improves sustainability. Track your containers with RFID to manage returns and reduce loss. - What regions offer the best growth prospects?

North America currently holds the largest share of the pharmaceutical packaging market, Aber Asia–Pacific is expected to grow at a CAGR of 8.08 %due to expanding manufacturing and healthcare demand. Establish hubs near these regions to capitalise on growth.

Anregung

Key Takeaways:

Schnelles Marktwachstum: Pharma cold chain logistics is expanding quickly, with the market growing from USD 8.85 Milliarden in 2024 in USD 10.04 Milliarden in 2025 und voraussichtlich erreichen USD 18.20 Milliarden von 2030.

Biologics and Vaccines Drive Demand: Über 40 % of new drugs are biologics, requiring precise temperature control and ultra cold storage.

Technological Innovation is Crucial: IoT-Überwachung in Echtzeit, AI route optimisation and blockchain enhance visibility and reduce spoilage.

Regulatory Landscape Tightens: BIP, DSCSA, FMD and regional guidelines demand comprehensive traceability and compliance.

Sustainable Packaging Matters: Reusable insulated containers and eco friendly materials dominate the packaging market, reflecting environmental and economic priorities.

Empfohlene Aktionen:

Bewerten Sie Ihre aktuelle Kühlkettenbereitschaft: Conduct a gap analysis of your temperature control, monitoring and documentation systems.

Investieren Sie in intelligente Technologien: Deploy IoT sensors and predictive analytics to gain real time visibility. Erwägen Sie Blockchain für Sendungen mit hohem Wert.

Expand and diversify infrastructure: Build or lease facilities in growth regions, and invest in ultra cold capacity.

Enhance training and compliance: Implement continuous training for staff and update processes to comply with evolving regulations.

Setzen Sie auf nachhaltige Verpackungen: Transition to reusable insulated containers and natural refrigerants to reduce waste and meet regulations.

Über Tempk

Tempk ist spezialisiert auf Kaltkettenverpackungslösungen für Arzneimittel, Lebensmittel- und Biotechindustrie. Wir entwickeln Isolierboxen, Gelpackungen, phase change materials and smart sensors that keep products within tight temperature ranges. Unser r&D centre focuses on sustainable materials and reusability to reduce environmental impact. With a history of quality certification and Sedex membership, we aim to build trust through transparent operations and rigorous testing.

Aufruf zum Handeln

Bereit, Ihre Kühlkette zu optimieren? Contact the Tempk team for personalised advice on packaging solutions, monitoring systems and compliance strategies. Our experts will help you evaluate your needs and implement systems that align with the latest market trends.