Continuando la guerra de descuentos: La empresa matriz de RT-Mart informa una pérdida de 378 Millones en medio año, con casi 100,000 Miembros que pagan

Continuando la guerra de descuentos: La empresa matriz de RT-Mart informa una pérdida de 378 Millones en medio año, con casi 100,000 Miembros que pagan

En los últimos seis meses, Gome al por menor (06808.Hong Kong), la empresa matriz de RT-Mart, ha enfrentado desafíos importantes mientras se enfoca en expandir sus tiendas de membresía y responder a las guerras de precios.

En la tarde de noviembre 14, Gome Retail publicó su informe financiero intermedio del primer semestre del año fiscal 2024, terminando en septiembre 30. El informe mostró que los ingresos de la empresa eran 35.768 mil millones de yuanes, abajo 11.9% año tras año, mientras que registró una pérdida de 378 millones de yuanes, un aumento sustancial desde el 87 millones de RMB de pérdida en el mismo período del año pasado. La pérdida neta atribuible a los accionistas de la empresa fue 359 millones de yuanes, comparado con una pérdida de 69 millones de RMB en el año anterior.

Gome Retail atribuyó la ampliación de las pérdidas a varios factores, incluida la contracción estratégica de su negocio de cadena de suministro, una disminución en su negocio de garantía de suministro, y desempeño inferior al esperado. Además, este año la empresa implementó varios ajustes operativos, como aumentar los descuentos y ampliar nuevos formatos minoristas, lo que añadió importantes presiones de costos a corto plazo.

Como comercio electrónico de alimentos frescos, tiendas de membresía, y las tiendas de descuento crecen, Las empresas de supermercados se enfrentan a una competencia más intensa.. Después de que Freshippo iniciara la guerra de precios en la industria de los supermercados en agosto, Muchas empresas de supermercados respondieron adoptando una estrategia "orientada a los descuentos".. En el mismo mes, RT-Mart lanzó su campaña “No Negociación”, ofreciendo precios en productos como mochi, croissants, leche fresca, y salmón que eran más bajos que los de Sam's Club.

en octubre, RT-Mart actualizó su campaña “Sin negociación” a la promoción “Precios honestos”, cubriendo más de 1,000 productos en todas las categorías, incluidos los lácteos, bocadillos, cuidado personal, limpieza del hogar, granos, aceites, y bebidas. Gome Retail dijo a Time Finance que la iniciativa “Precios Honestos” continuará, y la empresa mejorará la competitividad de los precios mediante la consolidación de productos y proveedores y mejorando la eficiencia digital..

Sin embargo, si RT-Mart no puede reducir los costos de la cadena de suministro y depende únicamente de bajar los precios de los productos, Puede que no resuelva el problema de la disminución de las ganancias..

Actualmente, Los esfuerzos de RT-Mart en la cadena de suministro se reflejan principalmente en sus productos de marca blanca.. Durante el período del informe, la empresa lanzó 170 SKU bajo su marca privada RT100, que incluye productos desarrollados exclusivamente por RT-Mart o en asociación con fabricantes. La promoción de marcas privadas generó cierta expectación en RT-Mart en octubre, con su pan de patata de desarrollo propio ganando popularidad en las plataformas de redes sociales.

Gome Retail afirmó que el desempeño de su negocio principal en el segundo trimestre mostró una reducción significativa de la brecha en comparación con el período anterior..

A diferencia de los supermercados Yonghui y el supermercado Bubugao, que cerró tiendas para reducir pérdidas, Gome Retail ha seguido acelerando la expansión de sus tiendas, agregando algunas presiones de costos. Durante el período del informe, Gome Retail incurrió en gastos de capital de 440 millones de yuanes, arriba de 258 millones de RMB en el mismo período del año pasado, principalmente debido al desarrollo de nuevas tiendas, renovaciones de tiendas, y actualizaciones digitales.

En el primer semestre del año fiscal 2024, Gome Retail abrió tres nuevas tiendas RT-Mart y aceleró la expansión de sus tiendas de gama media RT-Mart formato Super y membresía M como parte de la segunda estrategia de crecimiento de la compañía. RT-Mart Super abrió siete nuevas tiendas en Jinan, Tangshan, Songyuan en Jilin, Changchún, Lanzhou, Dongguan, y otros lugares, y se espera que siete más abran al final del año fiscal.

Después de abrir su primera tienda nacional de membresía M en Yangzhou en abril de este año, el número de miembros que pagan ha alcanzado casi 100,000. Está previsto que se abran nuevas tiendas en Changzhou y Nanjing en diciembre y enero del próximo año., respectivamente. Para construir una base de membresía temprana, Las dos ubicaciones lanzaron operaciones en línea durante el Double de este año. 11 festival de compras.

Gome Retail reveló que las tiendas de membresía M ya comenzaron los preparativos para su cuarta y quinta tienda, incluyendo el reclutamiento y contratación de nuevos miembros, y se espera que abran tres nuevas tiendas para finales del año fiscal 2024. Actualmente, Las tiendas de membresía M se centran principalmente en segunda- y ciudades de tercer nivel, con ubicaciones en el centro de las ciudades y un formato comunitario que evita la competencia directa con Sam's Club y Freshippo X Membership Store durante la fase de crecimiento inicial.. Sin embargo, Tomará algún tiempo demostrar si la estrategia de Gome Retail de tiendas con membresía y precios “orientados a descuentos” puede revertir sus pérdidas actuales..

En el negocio B2C online, después de que el crecimiento de los ingresos superó 15% en el año fiscal 2023, la primera mitad del año fiscal 2024 vio un crecimiento continuo de 4.7%, con el volumen de pedidos aumentando en 8.9%. La proporción de ingresos de este segmento aumentó de 18.9% a 22.6%. Entre los canales online de RT-Mart, incluyendo la aplicación RT-Mart Fresh, ele.me, y taoxianda, la aplicación RT-Mart Fresh ahora representa más de un tercio de las ventas.

Gome Retail afirma que la temporada alta de ingresos y beneficios del grupo se produce en el cuarto trimestre del año fiscal, que incluye días festivos clave como Año Nuevo, Festival de Primavera, y el año nuevo lunar. La compañía planea mejorar su oferta de productos diferenciados., optimizar la eficiencia operativa, y aprovechar la temporada navideña para mejorar el rendimiento.

Cabe señalar que en marzo 28, después de que Alibaba iniciara la reestructuración organizacional “1+6+N”, Gome Retail se integró al segmento “N” de otras unidades de negocio, mientras freshippo, que también opera en el comercio minorista fuera de línea, anunció planes para realizar una oferta pública inicial (IPO).

Cuando se le preguntó si el posicionamiento estratégico y el estatus de Gome Retail dentro de Alibaba se han visto afectados., Gome Retail respondió a Time Finance diciendo que Gome Retail siempre ha sido una empresa que cotiza en bolsa independiente, con Alibaba como su accionista mayoritario, Y la cooperación con otras unidades de negocios de Alibaba siempre ha seguido los principios del mercado..

Al cierre de operaciones de noviembre 15, El precio de las acciones de Gome Retail subió 2.53%, cierre en HKD 1.62 por acción, con un valor de mercado total de HKD 15.454 mil millones.

Ziyan Foods profundiza su enfoque en el conveniente segmento de comidas, Se expande en alimentos prepreparados, Y logra un crecimiento innovador.

A medida que el ritmo de la vida continúa acelerando, El estilo de vida de los jóvenes ha sufrido una serie de cambios.. La gente busca más tiempo para experimentar cosas diferentes., y por lo tanto, Buscan aumentar la eficiencia en todos los aspectos de sus vidas.. Dado que cenar es una parte esencial de la vida diaria, Mejorar la eficiencia de las comidas se ha convertido en una demanda común entre el público.. Alimentos Ziyan, una marca reconocida en la industria de alimentos marinados, tiene productos que satisfacen esta necesidad de cenar cómodamente. La compañía ha innovado continuamente en esta área y el año pasado se aventuró en un nuevo segmento de comidas convenientes: alimentos preparados.. Esta medida tiene como objetivo brindar a los consumidores mayor tranquilidad y opciones gastronómicas más convenientes..

Profundamente arraigado en la industria de los alimentos marinados

Alimentos Ziyan, una cadena nacional especializada en alimentos listos para comer, Originario de Sichuan, creció en Jiangsu, y ahora tiene su sede en Shanghai. A lo largo de los años, Ziyan Foods ha aprovechado su amplia línea de productos, gestión de la cadena de suministro, y desarrollo de infraestructura para establecer un sistema de gestión estandarizado. Este sistema cubre todo, desde la adquisición de materia prima y la trazabilidad., control de procesos de producción, gestión de puntos críticos de peligro, inspección del producto, y distribución de cadena de frío. Con ingredientes cuidadosamente seleccionados, recetas unicas, y meticulosa artesanía, Ziyan Foods ha creado más de cien platos especiales, incluyendo sus platos estrella como el pollo Baiwei, Rebanadas de pulmón de pareja, Pollo A La Pimienta De Sichuan, y ziyan ganso. La marca se ha ganado una sólida reputación por su calidad., delicias, y salud bajo el nombre de “Pollo Ziyan Baiwei”.

Ingresando al segmento de alimentos preparados

Como una marca que durante mucho tiempo ha brindado opciones gastronómicas convenientes., Ziyan Foods ha observado la creciente demanda e interés de la nueva generación de consumidores por las comidas preparadas.. Aprovechando su R&Fortalezas de D y años de conocimiento del consumidor, Ziyan Foods ha lanzado más 40 platos preparados. Estos platos han sido constantemente elogiados tanto por su sabor como por su calidad después de haber sido probados por el mercado y los consumidores.. Por ejemplo, El pollo Lotus Leaf de Ziyan Foods está hecho de tamaño uniforme, Pollos de alta calidad criados en granjas ecológicas.. Después del sacrificio, Los pollos se limpian a fondo para eliminar impurezas y olores.. Luego se marinan con una mezcla cuidadosamente elaborada de más de diez ingredientes naturales., especias autenticas, libre de aditivos y colorantes artificiales, Preservando los sabores originales de los ingredientes.. Los pollos se marinan durante 12 horas para permitir que los sabores se desarrollen completamente, envuelto en grueso, hojas de loto verdes vibrantes que sellan el aroma natural de la carne, y luego cocido al vapor a altas temperaturas. Cada bocado de pollo queda tierno., jugoso, y sabroso, con la fresca fragancia de la hoja de loto impregnando la carne hasta el hueso, Satisfacer la búsqueda de excelencia culinaria de los consumidores..

En un entorno de vida acelerado, una cena cómoda seguramente atraerá más atención. Como marca establecida desde hace mucho tiempo en la industria., Se espera que Ziyan Foods siga innovando en sus platos, aprovechando sus fortalezas y su rica experiencia. La empresa tiene como objetivo ofrecer a los consumidores más opciones novedosas de alimentos preparados, asegurando que incluso en un estilo de vida agitado, las personas pueden disfrutar de una comida que combina sabor y comodidad.

El helado Magnum admite la iniciativa de "reducción de plástico" con envases verdes, Premio a la innovación de envases gana

Dado que las paredes de la marca de Unilever ingresaron al mercado chino, Su helado magnum y otros productos han sido amados constantemente por los consumidores.. Actualizaciones más allá de los sabores, Empresa matriz de Magnum, Uneilever, ha implementado activamente el concepto de "reducción de plástico" en su empaque, cumplir continuamente las diversas demandas de consumo verde de los clientes. Recientemente, Unilever ganó el premio Silver en la Conferencia Internacional de Innovación de Empacaciones IPIF y los CPI 2023 Premio Lion en el 14th China Packaging Innovation and Sostenible Development Forum (CPIS 2023) por sus esfuerzos creativos de innovación y reducción de plástico que contribuyen a la protección del medio ambiente.

Unilever Ice Cream Packaging gana dos Premios de Innovación de Embalaje

Desde 2017, Uneilever, la empresa matriz de paredes, ha estado transformando su enfoque de envasado de plástico con un enfoque en "reducir, optimizar, y eliminar el plástico "para lograr el desarrollo sostenible y el reciclaje de plástico. Esta estrategia ha arrojado resultados significativos, incluyendo la innovación de diseño de los envases de helados que ha convertido la mayoría de los productos bajo el Magnum, Cuerno, y las marcas de las paredes a las estructuras en papel. Además, Magnum ha adoptado materiales reciclados como relleno en cajas de transporte, reduciendo el uso de 35 toneladas de plástico virgen.

Reducción de plástico en la fuente

Los productos de helados requieren entornos de baja temperatura durante el transporte y el almacenamiento, Hacer de la condensación un problema común. El empaque de papel tradicional puede húmedo y suavizado, Afectando la apariencia del producto, que requiere una alta resistencia al agua y resistencia al frío en los envases de helado. El método prevalente en el mercado es usar papel laminado, lo que garantiza un buen rendimiento impermeable, pero complica el reciclaje y aumenta el uso de plástico..

Unilever y Upstream Supply Partners desarrollaron una caja exterior no laminada adecuada para helado de transporte de cadena fría. El principal desafío fue garantizar la resistencia y apariencia del agua de la caja exterior.. Embalaje laminado convencional, Gracias a la película de plástico, evita que la condensación penetre las fibras de papel, preservar así las propiedades físicas y mejorar el atractivo visual. El embalaje no laminado, sin embargo, Tuve que cumplir con los estándares de resistencia al agua de Unilever mientras mantenía la calidad y apariencia de la impresión. Después de múltiples rondas de pruebas extensas, incluyendo comparaciones de uso real en congeladores de pantalla, Unilever validó con éxito el barniz hidrofóbico y los materiales de papel para este envasado no laminado.

Mini Cornetto usa barniz hidrofóbico para reemplazar la laminación

Promover el reciclaje y el desarrollo sostenible

Debido a la naturaleza especial del helado Magnum (envuelto en recubrimiento de chocolate), Su embalaje debe ofrecer alta protección. Previamente, EPE (polietileno expandible) El relleno se usó en la parte inferior de las cajas exteriores. Este material estaba tradicionalmente hecho de plástico virgen., Aumento de los desechos plásticos ambientales. La transición del relleno EPE de Virgin a Plastic reciclado requirió múltiples rondas de pruebas para garantizar que el material reciclado cumpliera los requisitos de rendimiento de protección durante la logística. Además, controlar la calidad del material reciclado fue crucial, Requerir una supervisión estricta de materias primas y procesos de producción. Unilever y los proveedores realizaron varias discusiones y optimizaciones para garantizar el uso adecuado de materiales reciclados, resultando en una reducción exitosa de aproximadamente 35 toneladas de plástico virgen.

Estos logros se alinean con el plan de vida sostenible de Unilever (USLP), que se centra en "menos plástico, mejor plástico, y no hay objetivos de plástico ". Walls está explorando más instrucciones de reducción de plástico, como el uso de películas de embalaje en papel en lugar de plástico y adoptar otros materiales individuales fácilmente reciclables.

Mirando hacia atrás en los años desde que Walls ingresó a China, La compañía ha innovado constantemente para satisfacer los gustos locales con productos como Magnum Ice Cream. Alineado con la estrategia de transformación verde y baja de carbono en curso de China, Walls ha acelerado su transformación digital mientras continúa implementando estrategias de desarrollo sostenibles. El reciente reconocimiento con dos Premios de Innovación de Packaging es un testimonio de sus logros de desarrollo verde.

FERIA DE ALTA TECNOLOGÍA | ESTIMULAR LA VITALIDAD DE LA INNOVACIÓN, MEJORAR LA CALIDAD DEL DESARROLLO

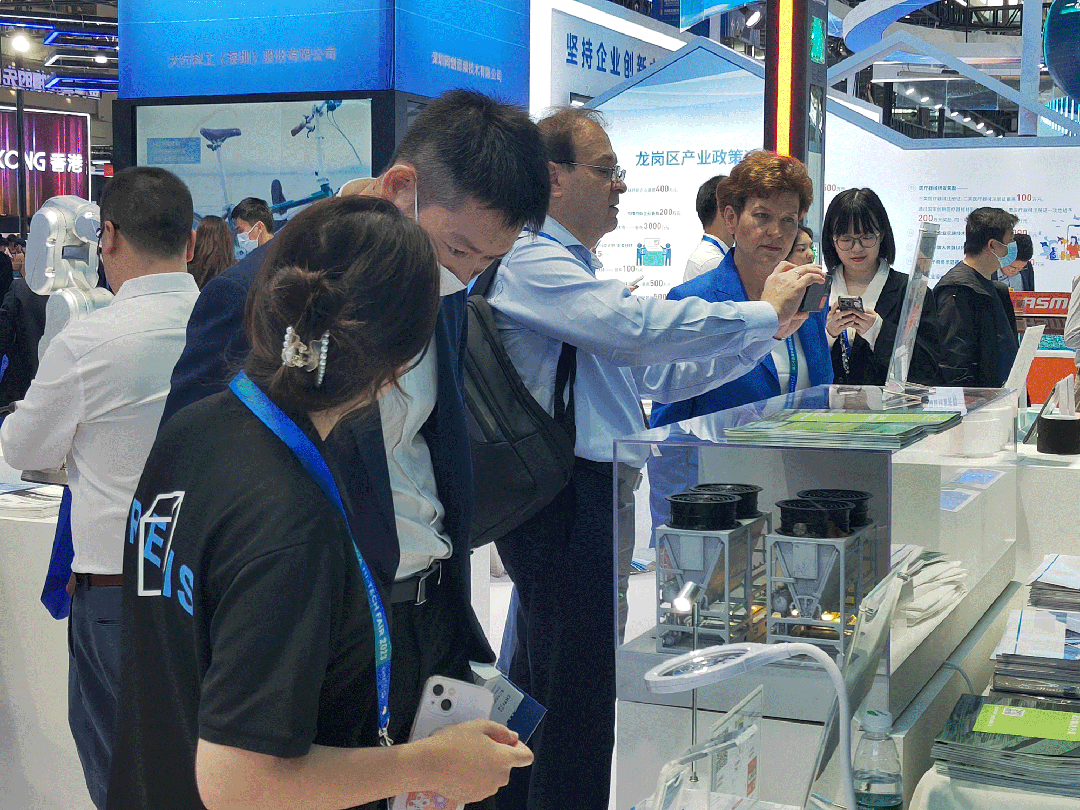

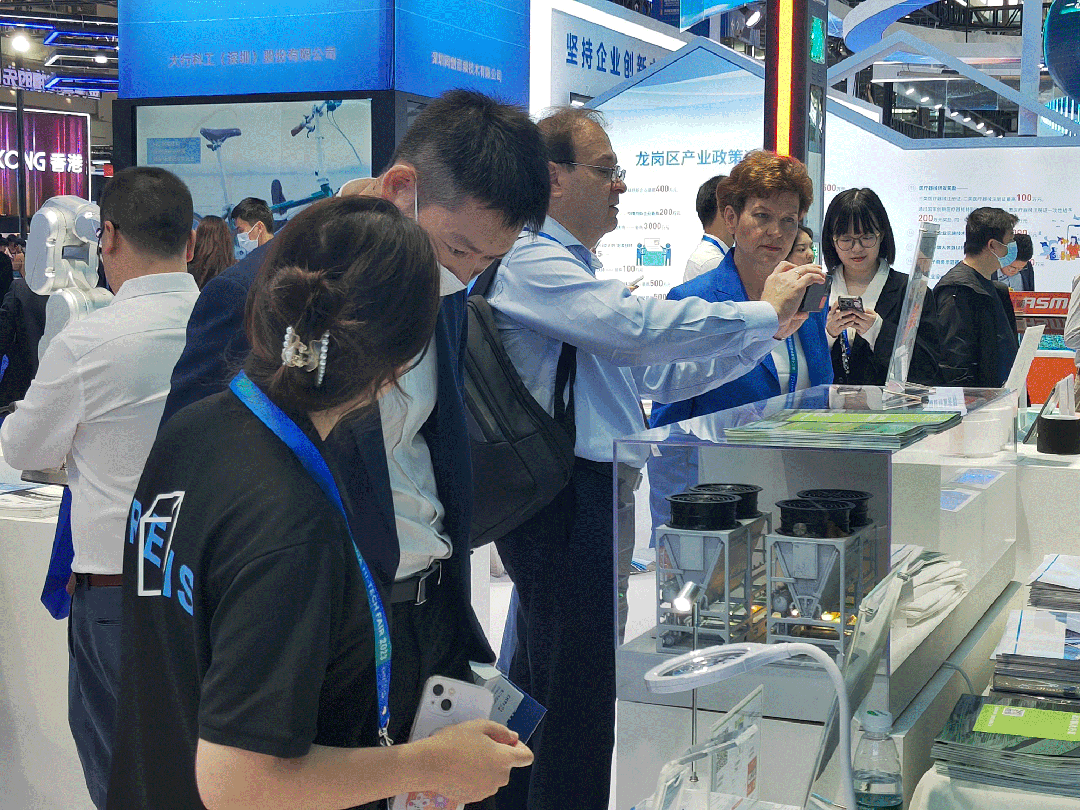

Hoy, la 25ª Feria de Alta Tecnología de China (CHTF) inaugurado oficialmente en Shenzhen, trayendo un internacional, evento profesional de alta tecnología a la vanguardia. El CHTF de este año se celebrará en dos ubicaciones: el Centro de Convenciones y Exposiciones de Shenzhen (futiano) y la Exposición Mundial de Shenzhen & Centro de Convenciones (Bao'an). El evento cuenta con una completa exposición., exposiciones especializadas, conferencias, foros, y varias otras actividades. Según los organizadores, el evento ha atraído la participación de más 100 países y regiones, con más de 4,000 empresas que exponen en un área total de 500,000 metros cuadrados, convirtiéndola en la más grande en la historia de la feria, con un número récord de países y regiones participantes.

Imagen

Por invitación de la Oficina de Innovación Científica y Tecnológica del distrito de Bao'an, Nuevos materiales de Chun Jun (Shenzhen) Co., Limitado., Representar a las empresas especializadas e innovadoras del distrito de Bao'an., está participando en la exposición. Del 15 al 19 de noviembre, Chun Jun New Materials muestra sus logros de investigación de vanguardia en el stand 1D38 del pabellón 1 del Centro de Convenciones y Exposiciones de Shenzhen (futiano).

Imagen

(Segundo desde la derecha: Wang Lide, alcalde del distrito de Bao'an; primero desde la izquierda: Shen Yan, director de la Oficina de Innovación Científica y Tecnológica del distrito de Bao'an; primero desde la derecha: Wang Heng, director del Centro de Servicios de Innovación Científica y Tecnológica del distrito de Bao'an, visitando el stand de Chun Jun para obtener orientación)

En la CHTF de este año, Chun Jun New Materials expone sus productos y soluciones de control de temperatura en la cadena de frío, refrigeración líquida, y campos TEC. La exposición atrajo a numerosos líderes y pares de la industria nacionales y extranjeros., que participaron en debates sobre el desarrollo de la tecnología de control de temperatura y sus aplicaciones innovadoras en diversos campos.

Imágenes

En el campo de la refrigeración líquida, Chun Jun presentó su solución de refrigeración líquida inmersiva bajo su marca “Chun Jun Opti-Cool”. En los últimos años, La demanda de potencia informática ha aumentado., con un solo gabinete, la potencia aumenta rápidamente. Al mismo tiempo, Los estándares nacionales para PUE de centros de datos. (Eficacia del uso de energía) se han vuelto cada vez más estrictos, planteando desafíos importantes para los centros de datos. La solución de refrigeración líquida por inmersión “Chun Jun Opti-Cool” aborda estos desafíos de la industria al reducir el valor PUE a tan solo 1.1 al mismo tiempo que garantiza una excelente capacidad informática a través de un control eficiente de la temperatura. Notablemente, El refrigerante CJF1 de desarrollo propio de Chun Jun ofrece un alto rendimiento de disipación de calor y una importante ventaja de precio, reducir los costos de refrigerante para los clientes al 40%.

Imágenes

La tecnología Micro-TEC de Chun Jun, a diferencia de los TEC ordinarios, Se puede miniaturizar a tamaños de nivel milimétrico., con requisitos de proceso y rendimiento de materiales extremadamente exigentes. Del lado de los materiales, Los telururos de bismuto tipo N y P de desarrollo propio de Chun Jun se encuentran entre los mejores de la industria. Del lado del producto, Micro-TEC de Chun Jun logra avances en miniaturización al tiempo que ofrece una alta eficiencia de enfriamiento y un control preciso de la temperatura. El rendimiento superior del Micro-TEC de Chun Jun tiene un gran potencial para reemplazar las importaciones en campos como los módulos ópticos y LiDAR..

Imágenes

La innovación es el principal motor del desarrollo.. Con el tema “Estimular la vitalidad de la innovación, Mejorar la calidad del desarrollo,“El CHTF de este año reúne recursos de innovación de alta calidad.. Sirve como una plataforma dinámica para la implementación en profundidad de la estrategia de desarrollo impulsada por la innovación., el cumplimiento integral de tareas de desarrollo de alta calidad, y la mejora continua del ecosistema de innovación. El evento encarna la creencia de que “centrarse en la innovación es centrarse en el desarrollo, y perseguir la innovación es perseguir el futuro”.

Chun Jun New Materials da una calurosa bienvenida a sus pares de la industria para que visiten nuestro stand de exposición, donde pretendemos demostrar los avances tecnológicos, crear conexiones de valor, y fortalecer la confianza en las tecnologías materiales de China.

Deseamos un gran éxito a la 25ª Feria de Alta Tecnología de China!

China Life Investment se asocia con GLP para acelerar el lanzamiento del Fondo de Colocación Estratégica REITS.

Con el establecimiento del primer Fondo de Colocación Estratégica de REITS, China Life Investment está implementando rápidamente sus planes de inversión relacionados.

en noviembre 14, China Life Investment y GLP alcanzaron una asociación estratégica integral, Centrarse en las áreas centrales de la cadena de suministro de GLP, grandes datos, y nueva inversión en infraestructura energética y desarrollo de ecosistemas industriales. Notablemente, La colaboración implicará explorar oportunidades clave de inversión regional y de mercado, incluido el uso de productos financieros innovadores como REIT, para expandir el alcance y la forma de cooperación de inversión y financiamiento.

Este movimiento se ve dentro de la industria como una señal positiva de que las dos partes pueden estar preparando para lanzar nuevos REIT.. Si se implementa con éxito, Podría convertirse en el primer proyecto bajo el Fondo de Colocación Estratégica REITS de China Life Investment.

Comienzan las iniciativas de la logística y el almacenamiento de la inversión

Según el plan de China Life Investment para el Fondo de Colocación Estratégica de REITS, El Fondo participará principalmente en la emisión de REIT público en sectores como la infraestructura del consumidor, energía verde, y logística de alta gama. Parece que la inversión del fondo se centra en el sector logístico de alta gama puede ser el primero en comenzar.

La logística y el almacenamiento han sido tradicionalmente áreas de inversión activa para el capital de seguros. Entre los 29 REIT que cotiza en bolsa, REIT GLP, Representando REIT de almacenamiento, se ha convertido en el REIT público con la mayor colocación estratégica por el capital de seguros. Fondos de seguro Cuenta de 30.17% de su colocación estratégica, con seis de los diez principales titulares como entidades de seguros, incluyendo la vida de Taikang, Vida hengqin, Dajia Holdings, Nueva vida de China, Fondo de inversión de seguros de China, y propiedad de Guoren & Seguro de víctimas.

Los analistas creen que la logística y los REIT de almacenamiento son favorecidos por el capital de seguros debido a su fuerte potencial de crecimiento y estabilidad, que se alinean con las necesidades de inversión a largo plazo de los fondos de seguro.

Con recuperación económica y el rápido desarrollo del mercado de comercio electrónico, Las perspectivas de bienes raíces de logística continúan mejorando. Un informe reciente de CBRE señaló que se espera que el índice de alquiler de almacén nacional crezca por 0.6% en 2023, ascendido a 1.0% en 2024. Ciudades de primer nivel, así como ciudades de segundo nivel limitadas por suministro como Dongguan, Hangzhou, y wuxi, se espera que vean aumentos anuales de alquiler de 2%-4%. Mientras tanto, Se espera que la tasa de vacantes del almacén nacional disminuya a 13.2% A finales de septiembre, en comparación con las tasas de vacantes de 15%-20% para bienes raíces comerciales como edificios de oficinas.

El aumento continuo de los ingresos operativos también traerá rendimientos considerables a los inversores.. Por ejemplo, GLP REIT ha completado cinco distribuciones de dividendos desde su listado, totalizando aproximadamente 580 millones de yuanes, con la cantidad de dividendo aumentando constantemente. Los dos primeros dividendos por acción estaban alrededor 0.05 RMB, Levantándose a Over 0.08 RMB desde la tercera distribución en adelante. Claramente, Vale la pena invertir los reits de almacenamiento.

China Life Investment probablemente se haya beneficiado de su inversión en GLP REIT. Aunque China Life Investment o su principal accionista, Vida de China, no figura entre los titulares, El Fondo de Inversión de Seguros de China, uno de los titulares, fue establecido conjuntamente por China Insurance Investment Co., Limitado., Seguro de vida de China (Grupo) Compañía, China Life Insurance Co., Limitado., y el reaseguro de China (Grupo) Corporación.

La colaboración entre China Life Investment y GLP en REIT no se trata solo de pasar de "detrás de escena" a "Center Stage" o asegurar más tenencias; También puede implicar una planificación estratégica más profunda.

Por qué elegir GLP?

Además de invertir en GLP REIT, China Life Investment ya ha realizado varias inversiones en el sector de logística y almacenamiento. Estos incluyen:

● Establecer un 1.8 Billion RMB Fondo de capital privado en asociación con Caixin Life, Manulife-Sinochem, y Cainiao Post, Centrado en proyectos de almacenamiento moderno de alto estándar en poder de Cainiao Network y sus afiliados.

● Colaboración con China Merchants Capital y Baowan Logistics en adquisiciones de activos logísticos y fusiones.

● Configurar conjuntamente un 10 Billion RMB Fondo de mejora del ingreso con GLP para invertir en activos logísticos de valor agregado en ciudades clave, Participando en inversiones estratégicas en GLP, y promover proyectos del centro de logística de cadena fría.

Sin embargo, En las colaboraciones antes mencionadas, La inversión de China Life participó principalmente como un "inversor".

En marzo de este año, Las intercambios de valores de Shanghai y Shenzhen publicaron los "requisitos relevantes para las empresas de gestión de activos de seguros que realizan negocios de titulización de activos (Ensayo),"Expandir el alcance de la titulización de activos y el fondo fiduciario de inversión inmobiliaria (REIT) Entidades comerciales para incluir empresas de gestión de activos de seguros con un gobierno corporativo sólido, controles internos estandarizados, y capacidades de gestión de activos sobresalientes. Desde entonces, El capital de seguros ha hecho la transición de ser un inversor a ser un gerente de titulización de activos.

Este desarrollo significa que el capital de seguros ahora puede trabajar con socios desde el inicio de los proyectos REIT para identificar posibles activos de alta calidad., incubarlos, y finalmente llevarlos al mercado a través de REIT. Este proceso también permite que China Life Investment desarrolle un plan estratégico centrado en los reits públicos.

Actualmente, La tarea más apremiante para la inversión de China Life es seleccionar los socios adecuados e identificar activos de alta calidad adecuados.

GLP China, Como el mayor proveedor de instalaciones de almacenamiento en el país, es un socio ideal, especialmente dada la larga cooperación entre las dos partes. El éxito del primer GLP REIT también ha reforzado la confianza de China Life Investment en las capacidades operativas de GLP.

Según las divulgaciones, Los activos de infraestructura de GLP REIT actualmente consisten en diez parques de almacenamiento y logística ubicados en regiones económicas clave como el área de Beijing-Tianjin-Hebei, el delta del río Yangtze, el borde bohai, El área de Great Bay de Guangdong-Hong Kong-Macao, y el círculo económico Chengdu-Chongqing. Estos activos cubren un área de construcción total de aproximadamente 1.1566 millones de metros cuadrados.

Los datos recientes muestran que el rendimiento operativo de estos activos sigue siendo estable. A finales de septiembre, La tasa promedio de ocupación de punto en el tiempo fue 88.46%, y la tasa de ocupación, incluidas las áreas arrendadas aún por comenzar, era 90.78%. El alquiler promedio efectivo por metro cuadrado por mes para las tarifas de servicio de alquiler y administración de propiedades (excluyendo impuestos) era 37.72 RMB.

Además, GLP tiene una gran cartera de activos de logística y almacenamiento, con 450 Instalaciones de logística e infraestructura industrial en China, cubriendo más de 50 millones de metros cuadrados. Esta cartera incluye activos maduros como los parques de tecnología, centros de datos, e infraestructura energética, que podría ser candidatos para futuros listados.

El desafío para China Life Investment y GLP en el futuro será seleccionar lo mejor de un gran grupo de recursos, incubar y operar con éxito estos activos, y llévelos al mercado a través de REIT.

El ritmo de los nuevos listados de REIT se ha acelerado recientemente. Actualmente, Ocho productos están bajo revisión, con más de 100 Reserve proyectos en la tubería. Se espera que el mercado REIT se expanda aún más en escala y alcance. El mercado ya está anticipando más avances de GLP en el espacio REITS.

SF EXPRESS LAUNCHES INTERNATIONAL FRESH FOOD EXPRESS SERVICE FOR INDIVIDUALS

"SF Express lanza el servicio internacional de alimentos frescos para individuos"

en noviembre 7, SF Express anunció oficialmente el lanzamiento de su servicio internacional Express para envíos personales de alimentos frescos.

Previamente, La exportación de frutas se realizó típicamente a través de un modelo de empresa a empresa, Requerir que los exportadores tengan calificaciones de exportación y proporcionen una gama de procedimientos de inspección y cuarentena, Lo que dificulta a las personas enviar frutas al extranjero. Para permitir que más consumidores internacionales disfruten de las frutas chinas, SF Express ha simplificado el proceso para envíos personales este año. Implementando medidas previas a la declaración y otros procedimientos, SF Express ahora permite que las frutas estables a temperatura se envíen internacionalmente a través de servicios de Express Personal, Llegando a destinos internacionales en justo 48 horas.

SF Express asegura la seguridad y la frescura de las frutas estables a temperatura a través del embalaje profesional, transporte de cadena de frio, y monitoreo visual de procesamiento completo, Construyendo así un "puente internacional de Sky" para las nuevas exportaciones de alimentos de China y mejor satisfacer las necesidades de envío internacional.

SF Express Couriers empacando frutas

Fuente: Cuenta oficial de SF Express International WeChat

este año, SF Express ha ampliado agresivamente sus operaciones internacionales, incluido el lanzamiento de nuevas rutas aéreas a nivel mundial. En agosto 20, SF Airlines abrió una ruta de carga internacional desde Shenzhen a Port Moresby, La capital de Papua Nueva Guinea, y planea invertir en el desarrollo de la infraestructura local. La ruta "Shenzhen = Port Moresby" es la primera ruta de SF Airlines a Oceanía.

Recientemente, SF Express también abrió varias rutas de carga desde Ezhou a otros países. Entre octubre 26 y 28, Nuevas rutas que incluyen "Ezhou = Singapur,"" Ezhou = Kuala Lumpur,"Y" ezhou = Osaka "se lanzaron oficialmente. El número total de rutas de carga internacionales que operan en el aeropuerto de Ezhou Huahu ahora ha excedido las diez. Además, El volumen de carga acumulativo en el aeropuerto de Ezhou Huahu ha superado 100,000 montones, con contabilidad internacional de carga casi 20%.

SF Express lanza la ruta "Shenzhen = Port Moresby"

Fuente: Oficial de SF Express Group

Notablemente, En mayo de este año, SF Express describió su estrategia comercial internacional en una actividad de relaciones con los inversores. La compañía priorizó los mercados emergentes del sudeste asiático debido a las mayores inversiones de China en la región y las ventajas de SF Express en las redes de transporte aéreo. La compañía planea expandirse aún más a Medio Oriente y América del Sur..

SF Express continúa enfocándose en mejorar su logística de comercio electrónico expreso y transfronterizo en el sudeste asiático, enfatizando el desarrollo de "Air, aduanas, y redes básicas de última milla ". Actualizando las operaciones de ruta, expandiendo la red aérea, Invertir en recursos de aduanas centrales, e integrar recursos de última milla, SF Express tiene como objetivo construir una red global estable y eficiente, Mejorar la experiencia del cliente y proporcionar servicios confiables. La compañía se compromete a crear un servicio de extremo a extremo perfecto., Fortalecer su ventaja de servicio en el sudeste asiático y la región de Asia y el Pacífico, y apoyar negocios transfronterizos estables para empresas.

Zhongnong Modern ha sido galardonado con el cargo de Vicepresidente de la Unidad de la Alianza de Parques de la Industria de Alimentos Pre-Preparados por China.

en noviembre 9, la Tercera Conferencia sobre Desarrollo de Innovación en la Industria de Alimentos Preparados de China “Defining Category · Envisioning Mindshare” y la Primera Selección del Premio de Oro de la Cena de Nochevieja en el Delta del Río Yangtze & La Conferencia Inaugural de la Alianza del Parque de la Industria de Alimentos Preparados de China se inauguró grandiosamente en el Centro Internacional de Exposiciones de Shanghai. La conferencia fue guiada por el Instituto de Procesamiento de Agroproductos., Academia China de Ciencias Agrícolas, y el Comité de Profesionales de Alimentos Preparados de la Alianza Nacional de Innovación Científica y Tecnológica de la Industria Procesadora de Productos Agrícolas, y organizado por el Proyecto de Desarrollo de Innovación del Parque de la Industria de Alimentos Preparados de China y Shanghai Bohua International Exhibition Co., Limitado. La conferencia se centró en el desarrollo de alta calidad y la construcción de estándares digitales en la industria de alimentos preparados., compartiendo las últimas tendencias del mercado, innovaciones tecnológicas, y necesidades del consumidor. Exploró la práctica y los métodos del “desarrollo de alta calidad”. + promoción del consumo + digitalización + Modelo de “cluster industrial” en el parque industrial de alimentos preparados, con el objetivo de crear un nuevo ecosistema para el desarrollo de alimentos preparados. El evento invitó a cientos de empresas de la industria de alimentos preparados y su upstream, centro de la corriente, río abajo, y sectores afines a participar. Zhongnong Moderno, como empresa dentro del ecosistema industrial, fue invitado a asistir a la conferencia.

En la conferencia, se anunció el establecimiento de la Alianza del Parque de la Industria de Alimentos Preparados de China, que tiene como objetivo promover la iniciativa P500+ a nivel nacional, creación de una red de parques industriales de alimentos preparados compuesta por más 500 nodos. Zhongnong Moderno, con más de una década de profunda participación en la industria agrícola, recibió el puesto de “Vicepresidente de la Unidad de la Alianza del Parque de la Industria de Alimentos Preparados de China”. La empresa, junto con otras unidades participantes, iniciarán conjuntamente el desarrollo de infraestructura digital para la industria de alimentos preparados y construirán y compartirán de manera colaborativa un marco y una plataforma de servicios para la industria digital.

Wang Zhenyu, Vicepresidente de Zhongnong Modern Group y jefe de la división de desarrollo de la industria de alimentos preparados, realizó una presentación titulada “La importancia y el impacto del desarrollo a largo plazo de parques industriales de alimentos preparados” y compartió el trazado industrial estratégico del grupo. Señaló que el No. 1 Documento Central define claramente los alimentos preparados y su estrategia de desarrollo, enfatizando que la cadena de la industria de alimentos preparados involucra múltiples segmentos, incluyendo la producción agrícola, procesamiento y distribución, servicios de catering, y consumo de mercado. Representa un nuevo modelo de negocio para la transformación y modernización agrícola., así como un nuevo canal para aumentar los ingresos y la prosperidad de los agricultores. El desarrollo de la industria de alimentos preparados juega un papel crucial en la mejora de la conveniencia., ampliar las opciones de alimentos, y promover la industrialización agrícola. También significa innovación en la industria alimentaria., transformación en la restauración, y ajuste de la estructura agrícola. Mirando hacia el futuro, El desarrollo de la industria de alimentos preparados pondrá mayor énfasis en la seguridad y salud de los alimentos., con un enfoque personalizado, personalizado, y crecimiento de la marca basado en la demanda de los consumidores. La industria también alcanzará mayores niveles de digitalización y pondrá mayor énfasis en la protección del medio ambiente para el desarrollo sostenible..

En la presentación estratégica del grupo, Se destacó que Zhongnong Modern, como uno de los diez principales operadores del mercado agrícola mayorista de China y uno de los principales 100 empresas de la cadena de suministro de productos agrícolas, Tiene una cobertura integral desde la adquisición de la cadena de suministro ascendente hasta varios canales de ventas y sistemas de soporte posteriores.. Actualmente, el grupo ha establecido 20 modernos parques industriales agrícolas en toda China, cubriendo 4 millones de metros cuadrados, y está acelerando la construcción de bases de parques industriales de alimentos preparados, formando gradualmente una red de parques industriales.

Actualmente, La construcción y el desarrollo de parques industriales de alimentos preparados se han convertido en importantes vectores para la implementación de políticas nacionales.. El desarrollo de la división de comida preparada del grupo está impulsado por el objetivo estratégico de convertirse en "el principal operador integral de China en la industria de comida preparada". La empresa apuesta por la innovación basada en la tecnología., construyendo parques digitalizados, y opera con una estrategia centrada en la marca, enfoque estandarizado. Pretende fortalecer la industria de alimentos preparados a través de la agrupación industrial, Proporcionar un servicio completo e integral desde el suministro de materia prima., producción y procesamiento, configuración estándar, trazabilidad de seguridad, almacenamiento en cadena de frio, logística de cadena de frío, al marketing de marca. El apoyo industrial maduro en los parques permite a las empresas de comida preparada mejorar la calidad, Reducir los costos, y aumentar la eficiencia, mientras que el análisis de big data potencia la producción, suministrar, y venta de alimentos preparados, Creando un nuevo modelo para el desarrollo industrial integrado.. La compañía también colabora profundamente con el gobierno para incubar marcas públicas de alimentos preparados y transformar las ventajas regionales en ventajas industriales..

En el futuro, Zhongnong Modern aprovechará plenamente su papel como “Vicepresidente de la Unidad de la Alianza de Parques de la Industria de Alimentos Preparados de China” para acelerar la construcción de parques industriales de alimentos preparados en todo el país.. La empresa integrará recursos de la industria, construir plataformas de desarrollo industrial, definir categorías segmentadas, e incubar productos alimenticios preparados de gran éxito, Contribuir al desarrollo sostenible de las empresas de alimentos preparados., la integración de la primaria, secundario, e industrias terciarias, revitalización industrial rural, y el logro de la prosperidad común.

Foshan gana otra potencia alimentaria pre-preparada de alta gama doméstica.

en noviembre 13, Guangdong Haizhenbao Food Development Co., Limitado. (En adelante, denominado "Haizhenbao") Operaciones oficialmente iniciadas en Chencun, Jumor. La primera fase de la compañía cubre un área de aproximadamente 2,000 metros cuadrados, con una capacidad de producción anual de 800 montones. Haizhenbao se centra en procesar alimentos prepreparados de alta gama, como el abulón en salsa de abulón, Poon Choi, pepinos de mar, y fauces de peces, ofreciendo comidas listas para calentar. La instalación tiene como objetivo ser una planta moderna de procesamiento de mariscos que integra el almacenamiento de la cadena de frío, investigación científica, visualización de productos, transmisión en vivo de comercio electrónico, y experiencias inmersivas.

Los datos muestran que el tamaño del mercado de la industria alimentaria preparada de China ha estado creciendo constantemente en los últimos años. En 2023, Se espera que el mercado llegue 516.5 mil millones de yuanes. En los próximos tres años, Se proyecta que el mercado crecerá a una alta tasa anual de alrededor 20%, potencialmente convirtiéndose en el próximo mercado de billones de yuanes.

Para integrar mejor los recursos, Xinguotong Group y Guangdong Tangxianglou han establecido conjuntamente Haizhenbao. “Mejoraremos aún más la cadena de suministro, expandirse a los sectores de la corriente intermedia, y producir meticulosamente de alta calidad, productos de mariscos saludables,"Dijo Zhu Ang, Presidente de Guangdong Tangxianglou y Haizhenbao. Haizhenbao tiene como objetivo convertirse en una empresa impulsada por el conocimiento, Construir un sistema de investigación "tres en uno" que combina "investigación e industria,"" Doctores y chefs,"Y" laboratorios y cocinas,"Para promover el desarrollo de la industria de mariscos de alta gama y llevar adelante la cultura culinaria tradicional china.

“Algunos alimentos prepreparados de alta gama que requieren habilidades de cocina avanzadas, son lentos y de trabajo intensivo, pero tienen un alto valor nutricional, como el abulón en la salsa de abulón, pepinos de mar, y fauces de pescado: son cada vez más populares en el mercado,"Dijo Zheng Jiayuan, Gerente General de Xinguotong Group. Agregó que las dos compañías trabajarán en estrecha colaboración para desarrollar Haizhenbao en una de las empresas de referencia en la industria alimentaria preproteada de alta gama de China, Contribuyendo activamente al objetivo de Shunde de convertirse en la "capital nacional de los alimentos preparados" y un modelo para el desarrollo de alta calidad en la industria alimentaria pre-preparada nacional.

Tan Fengxian, Director de la Oficina de Agricultura y Asuntos Rurales del Distrito de Shunde, señaló que Shunde actualmente tiene más de 40 Empresas a gran escala en la industria alimentaria preparada, con ingresos alcanzando 8.7 mil millones de yuanes. Shunde está implementando completamente los "cientos, Miles, y decenas de miles de iniciativa, Posicionar la industria alimentaria preparada como un sector clave para fortalecer el distrito y enriquecer a las personas, promoviendo la integración de primaria, secundario, e industrias terciarias, y esforzarse por convertirse en un área de demostración central nacional para la industria alimentaria preparada.

Baozheng presenta "almacén de cadena de frío lácteo y solución de distribución" en 2023 CIIE

Como el nuevo desarrollo de China ofrece nuevas oportunidades para el mundo, La sexta Expo de importación internacional de China (CIIE) se lleva a cabo según lo programado en el Centro Nacional de Exposición y Convenciones. En la mañana del 6 de noviembre, Baoozheng (Llevar a la fuerza) Supply Chain Management Co., Limitado. organizó un nuevo lanzamiento de productos y ceremonia de firma de cooperación estratégica para su solución de cadena de frío lácteos en el CIIE.

Los asistentes incluyeron líderes del Comité de la Cadena Cold de la Federación de Logística de China & Adquisitivo, Expertos en la cadena de frío de la Escuela de Ciencias de los Alimentos de la Universidad de Shanghai Ocean, así como ejecutivos de compañías como Arla Foods Amba, China Nongken Holdings Shanghai Co., Limitado., Productos lácteos de Eudorfort (Llevar a la fuerza) Co., Limitado., Queso doctor (Llevar a la fuerza) Technology Co., Limitado., Foods xinodis (Llevar a la fuerza) Co., Limitado., Bailaoxi (Llevar a la fuerza) Food Trading Co., Limitado., y plataforma abierta de flujo E G7.

Señor. Cao lata, Presidente de la cadena de suministro de Baozheng, pronunció el discurso de apertura, Presentación de cómo la empresa aprovecha sus propias ventajas para ayudar a los clientes a resolver sus problemas de cadena de frío lácteos desde la perspectiva del cliente. Señor. CAO explicó que Baozheng integra su tecnología digital, equipo profesional, y una amplia experiencia de gestión para construir su propio almacenamiento en frío y desarrollar este nuevo producto: el almacén de la cadena de frío lácteos y la solución de distribución, con el objetivo de garantizar una pérdida de temperatura cero para los productos lácteos de los clientes.

Durante el evento, Señor. Liu fei, Secretario General Adjunto Ejecutivo del Comité de la Cadena Cold, Dio un discurso de apertura titulado "Construcción de la cadena de frío lácteos: Un largo camino por delante ". Señor. Liu introdujo vívidamente la industria láctea, Análisis de mercado de la logística de la cadena de frío, y características actuales de las cadenas de frío lácteos desde la perspectiva de una asociación de la industria, ofreciendo varias recomendaciones para el desarrollo de cadenas de frío lácteos. En una entrevista de los medios, Señor. Liu instó a expertos en cadena de frío como Baozheng a participar activamente en el desarrollo de los estándares de la cadena de frío lácteos y promover conceptos de cadena de frío, Uso de plataformas como la Asociación y el CIIE para avanzar en la industria de la cadena de frío.

Profesor Zhao Yong, Vicecano de la Escuela de Ciencias de la Alimentación de la Universidad de Shanghai Ocean, pronunció un discurso de apertura en "Puntos de control clave en cadenas de frío lácteos". El profesor Zhao discutió la introducción, proceso de producción, Características nutricionales, y consumo de productos lácteos, describió el proceso de deterioro, Puntos de control clave compartidos para la calidad y seguridad de la cadena de frío lácteos, y destacó cuatro grandes oportunidades para el futuro de la industria de la cadena de frío de China. En una entrevista de los medios, El profesor Zhao enfatizó la urgente necesidad de talento profesional en la industria de la cadena de frío y alentó una colaboración más estrecha entre empresas y universidades para comprender mejor las necesidades de la industria y capacitar el talento adecuado.

Señor. Zhang fujong, Director de entrega de soluciones de cadena de frío de China Oriental en G7 E-Flow, entregó una nota clave sobre "Transparencia en la gestión de la logística de la cadena de frío,"Explicando la transparencia de calidad, transparencia comercial, y transparencia de costos en la logística de la cadena de frío, y compartir vías para la gestión transparente basadas en escenarios comerciales reales.

Señor. Lei Liangwei, Director de ventas estratégicas en la cadena de suministro de Baozheng, entregó una nota clave sobre "Expertos en la cadena de frío lácteos: la cadena fría de Febaozheng: Garantizar la temperatura!"Introdujo la solución de distribución y distribución de la cadena de frío lácteo lanzada en este evento, Destacando tres productos de servicio: Almacenamiento de Baozheng: protección de la temperatura; Baozhng Transportation-cero Pérdida de temperatura, Operación totalmente visualizada; y distribución de Baozheng: protegiendo la última milla, Fresco como nuevo.

Finalmente, La cadena de suministro de Baozheng celebró una ceremonia de firma electrónica con varios socios estratégicos, incluyendo Arla, Nongken, Xinodí, Bailaoxi, Eudorfort, y queso doctor. Esta firma de cooperación estratégica solidificó aún más las relaciones cooperativas amistosas entre las partes. El CIIE proporcionó una plataforma valiosa para una colaboración más profunda y cercana entre las empresas. La cadena de suministro de Baozheng ahora es un expositor firmado para el séptimo CIIE y continuará utilizando este evento de nivel nacional para comunicación y exhibición.

La Federación de Logística y Compras de la Cadena de Compras de China asiste a la cadena de suministro Baozheng Dairy Cold Chain Evento de lanzamiento de productos de productos.

La cadena de suministro de Baozheng tiene un evento de lanzamiento de nuevos productos de la cadena fría de lácteos

En la mañana de noviembre 6, Baoozheng (Llevar a la fuerza) Supply Chain Management Co., Limitado. Realizó un evento de lanzamiento de productos nuevos en la cadena de frío en la China International Impo Expo (CIIE). Liu fei, Secretario General General Ejecutivo de la Federación de Logística de China y compra del Comité de Cadena de Cold, asistió al evento y pronunció un discurso de apertura.

El evento también contó con varios invitados distinguidos, incluido el profesor Zhao Yong, Vicecano de la Escuela de Ciencias de la Alimentación de la Universidad de Shanghai Ocean; Frede Juulsen, Categoría Global Head of the Infant Formula en Arla Foods Amba; Xu Li, Director de la cadena de suministro en China Agricultural Reclamation Holdings Shanghai Co., Limitado.; Zhu yueqiong, Gerente General de productos lácteos de Oldenburger (Llevar a la fuerza) Co., Limitado.; El ziyun, Cofundador de Cheese Doctor (Llevar a la fuerza) Technology Co., Limitado.; Zhu yijie, Gerente de importación en Sinodis Food (Llevar a la fuerza) Co., Limitado.; I, Administrador de la cadena de suministro en Bellco (Llevar a la fuerza) Food Trading Co., Limitado.; y zhang fujong, Director de entrega de soluciones de la cadena fría de China de China en G7 Yiliu.

El largo camino por delante para los estándares de la cadena de frío lácteos

Liu fei, Secretario General Adjunto Ejecutivo del Comité de la Cadena Cold

en el evento, Liu Fei pronunció un discurso de apertura titulado "La construcción de cadenas de frío lácteos: Un largo camino por delante ". Hablando desde la perspectiva de una asociación de la industria, Liu proporcionó una vívida descripción de la industria láctea, Un análisis del mercado de logística de la cadena de frío, y las características actuales de la cadena de frío lácteos. También ofreció varias recomendaciones para el desarrollo de la cadena de frío lechero..

Durante la sesión de la entrevista de los medios, Liu Fei instó a expertos en cadena de frío lácteos como Baozheng a participar activamente en la formulación de los estándares de la cadena de frío lácteos y la promoción de conceptos de cadena de frío lácteos. Hizo hincapié en la importancia de utilizar exposiciones a nivel nacional como el CIIE para promover y comunicarse sobre la industria de la cadena de frío, conduciendo así su desarrollo.

Promover el desarrollo de alta calidad en la cadena de frío lácteos

Cao lata, Presidente de la cadena de suministro de Baozheng, pronunció el discurso de apertura, Introducir cómo Baozheng ayuda a los clientes a abordar sus puntos débiles en la cadena de frío lácteos aprovechando sus propias ventajas.

CAO enfatizó que Baozheng integra recursos utilizando su tecnología digital, equipos profesionales, y una amplia experiencia de gestión para desarrollar un nuevo producto, la solución de almacenamiento y distribución de la cadena de frío lácteos, se dirigió a la garantía de desviaciones de temperatura cero para los productos de la cadena de frío lácteos de los clientes.

Cao lata, Presidente de la cadena de suministro de Baozheng

Zhang fujong, Director de entrega de soluciones de la cadena fría de China de China en G7 Yiliu, Dio un discurso de apertura titulado "Control transparente de la logística de la cadena de frío,"Donde discutió la transparencia de la calidad, operaciones, y costos en la logística de la cadena de frío. Compartió información práctica sobre el logro de la transparencia en la gestión de la logística de la cadena de frío basada en escenarios comerciales reales.

Zhang fujong, Director de entrega de soluciones de la cadena fría de China de China en G7 Yiliu

Profesor Zhao Yong, Vicecano de la Escuela de Ciencias de la Alimentación de la Universidad de Shanghai Ocean, pronunció un discurso de apertura titulado "Puntos de control clave en cadenas de frío lácteos". El profesor Zhao cubrió temas como una descripción general de los productos lácteos, procesos de producción, Características nutricionales, y tendencias del consumidor. Discutió el proceso de deterioro de los productos lácteos., puntos de control clave compartidos para garantizar la calidad de la cadena de frío lácteos y la seguridad, y describió cuatro oportunidades futuras para la industria de la cadena de frío de China.

Durante la entrevista de los medios, El profesor Zhao enfatizó la urgente necesidad de talento especializado en la industria de la cadena de frío. Alentó a las empresas a fortalecer las colaboraciones con las universidades para comprender mejor las necesidades de la industria y el talento de suministro que cumpla con los requisitos de la industria.

Zhao yong, Vicecano de la Escuela de Ciencias de la Alimentación de la Universidad de Shanghai Ocean

Lei Liangwei, Director de ventas estratégicas de la cadena de suministro de Baozheng, Dio un discurso de apertura titulado "Expertos en la cadena de frío lácteos: la cadena de frío de Febrazheng: Asegurar la temperatura adecuada!"Proporcionó una introducción detallada a la recién lanzada solución de almacenamiento y distribución de la cadena de frío de Baozheng, Destacando tres productos de servicio clave: Baozhng almacén-temperatura garantía; Transporte de Baozheng: desviación de la temperatura cero, Operaciones totalmente visualizadas; y entrega de Baozheng: protegiendo la última milla, tan fresco como siempre.

Lei Liangwei, Director de ventas estratégicas de la cadena de suministro de Baozheng

Finalmente, La cadena de suministro de Baozheng y varios socios estratégicos participaron en una ceremonia de firma digital. Los socios estratégicos incluyeron seis compañías lácteas conocidas.: Arla, Aclamación agrícola de China, Sinodis, Oldenburger, Bellco, y doctor de queso.

Esta cooperación estratégica fortalece aún más las relaciones amistosas entre las partes!

Son plataformas como el CIIE que brindan oportunidades para intercambios y cooperación más profundos y cercanos entre empresas entre empresas.