La logistique de la chaîne du froid pharmaceutique fait référence au stockage et au transport spécialisés de médicaments sensibles à la température., vaccins, produits biologiques et thérapies géniques. Dans 2025 les enjeux sont plus élevés que jamais: les médicaments biologiques et les thérapies cellulaires sont en plein essor, la surveillance réglementaire se renforce et les perturbations induites par le climat se multiplient. Le marché mondial de la logistique de la chaîne du froid lui-même valait environ USD 436.3 milliards en 2025, et les analystes s'attendent à ce qu'il grimpe à USD 1.36 mille milliards par 2034, en expansion à un taux de croissance annuel composé (TCAC) de 13.46%. En même temps, la recherche suggère jusqu'à 50% des vaccins sont gaspillés dans le monde car la chaîne du froid se rompt lors du transport ou du stockage. Autrement dit, une gestion efficace de la chaîne du froid n’est pas seulement une opportunité commerciale : elle est essentielle pour la santé publique. Ce guide explique comment le industrie logistique de la chaîne du froid pharmaceutique évolue dans 2025, quels défis persistent et comment vous pouvez vous adapter.

Pourquoi la logistique de la chaîne du froid est-elle si cruciale pour les vaccins, produits biologiques et thérapies géniques?

Quelles sont les tendances du marché et les moteurs de croissance les plus importants en 2025?

Quelles technologies – des capteurs IoT à l’intelligence artificielle – transforment la logistique pharmaceutique?

Comment les entreprises peuvent-elles se conformer aux bonnes pratiques de distribution (PIB) tout en réduisant l'empreinte carbone?

Quelles sont les étapes pratiques pour élaborer une stratégie de chaîne du froid pharmaceutique résiliente?

Comprendre la chaîne du froid pharmaceutique: Taille et importance du marché

La chaîne du froid pharmaceutique se développe rapidement. Selon la recherche prioritaire, le marché mondial de la logistique de la chaîne du froid – qui inclut les produits alimentaires, produits pharmaceutiques et autres produits à température contrôlée – est évalué à USD 436.30 milliards en 2025 et devrait atteindre USD 1.359 mille milliards par 2034. Au sein de ce marché plus large, le le segment de la logistique pharmaceutique était valorisé en USD 66.39 milliards en 2024 et devrait atteindre USD 98.09 milliards en 2025, puis USD 140.13 milliards 2032. D'autres chercheurs estiment que la logistique de la chaîne du froid pharmaceutique à elle seule a atteint le dollar 18.61 milliards en 2024 et pourrait grandir jusqu'à USD 27.11 milliards 2033. L'écart entre les rapports reflète des définitions et une segmentation différentes, mais la trajectoire est claire: les services de chaîne du froid pour les médicaments se développent considérablement.

Pourquoi la chaîne du froid est-elle importante pour les produits pharmaceutiques?

Les médicaments sensibles à la température perdent rapidement leur efficacité lorsqu'ils sont exposés à des températures en dehors de leur plage spécifiée.. Par exemple, les vaccins doivent généralement être conservés entre 2 °C et 8 °C et doit maintenir cette fourchette à chaque étape de la chaîne d'approvisionnement; certains produits biologiques et les thérapies cellulaires et géniques nécessitent des conditions ultra basses, souvent entre –20 °C et –80 °C. Si ces conditions ne sont pas remplies, le médicament se dégrade et devient dangereux. Recherche du Programme des Nations Unies pour l'environnement (PNUE) note que jusqu'à 50% des vaccins sont gaspillés chaque année dans le monde en grande partie dû à un mauvais contrôle de la température et à une logistique défaillante. Des études suggèrent également que à propos 20% des expéditions de produits biologiques sont perdues chaque année en raison de défaillances de la chaîne du froid, tandis que jusqu'à 20% de tous les produits pharmaceutiques sensibles à la température peuvent être compromis pendant le transport. Ces échecs gaspillent non seulement des milliards de dollars, mais retardent également l’accès des patients à des traitements vitaux..

Secteurs clés de la chaîne du froid pharmaceutique

La chaîne du froid pharmaceutique dessert une gamme de produits, chacun avec des exigences de température distinctes:

Vaccins et immunothérapies: La plupart des vaccins doivent être conservés entre 2 et 8 °C. Les nouveaux médicaments amaigrissants basés sur des analogues du GLP-1 entrent également dans cette catégorie et doivent être maintenus dans des limites étroites pour rester efficaces..

Produits biologiques et anticorps monoclonaux: Ces médicaments à grosses molécules sont sensibles aux fluctuations de température et nécessitent souvent une réfrigération (2–8 ° C). Quelques nouveaux produits biologiques, comme les vaccins à ARNm et les thérapies géniques, besoin stockage ultra froid (–60 °C à –80 °C).

Thérapies cellulaires et géniques (CGT): Parce que ces traitements impliquent des cellules vivantes, ils nécessitent généralement des températures cryogéniques, parfois en dessous de –150 °C pendant le transport. Le marché de la CGT est en plein essor; GlobalData estime que le secteur dépasser le dollar 81 milliards 2029, rendre essentielle une infrastructure de chaîne du froid robuste.

Intermédiaires biopharmaceutiques et API: Ces produits peuvent nécessiter une température ambiante contrôlée (15–25 ° C) ou des conditions réfrigérées. Selon la recherche prioritaire, la logistique biopharmaceutique tierce valait USD 152.89 milliards en 2025 et devrait atteindre USD 271.76 milliards 2034.

Conséquences d'une rupture de la chaîne du froid

Les défaillances de la chaîne du froid ont des conséquences considérables. Au-delà de la perte de produits et de l’érosion des revenus, ils peuvent déclencher des sanctions réglementaires et éroder la confiance du public. Par exemple, Organisation Mondiale de la Santé (OMS) les estimations montrent qu'avant COVID, jusqu'à 50% des vaccins ont été perdus en raison d’un mauvais contrôle de la température et d’une mauvaise logistique. Pendant la pandémie, seulement 14% des vaccins prévus contre la COVID-19 ont atteint les pays les plus pauvres en raison des goulots d'étranglement de la chaîne d'approvisionnement et des contraintes de fabrication. De la même manière, l'Association du transport aérien international a noté que autour 20% des expéditions de produits biologiques sont perdues chaque année des défaillances de la chaîne du froid. Ces statistiques soulignent les enjeux élevés de la logistique pharmaceutique : chaque excursion de température a des conséquences humaines.

Composants d’une chaîne du froid pharmaceutique fiable

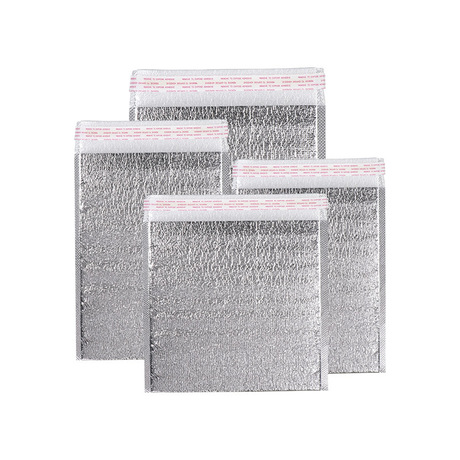

Emballage et isolation à température contrôlée

Choisir le bon emballage est la première ligne de défense contre les écarts de température. L’emballage doit maintenir la plage de température spécifiée du produit pendant le transport, y compris les retards imprévus. Les innovations incluent des matériaux à changement de phase qui maintiennent la température plus longtemps, panneaux isolés sous vide pour une protection thermique légère, et expéditeurs thermiques réutilisables qui réduisent les déchets. Le marché de l’emballage logistique sous chaîne du froid pharmaceutique a atteint USD 5.48 milliards en 2024 et devrait dépasser USD 13.64 milliards 2034, grandir à un TCAC de 9.55%. L’essentiel de la croissance est tiré par la demande de produits durables, emballages réutilisables et par le volume croissant de produits biologiques et de vaccins. Lors du choix de l'emballage, considérer la durée (court contre. long-courrier), conditions ambiantes et logistique de retour des conteneurs réutilisables.

Modes et équipements de transport

Les produits pharmaceutiques circulent par voie aérienne, route, ferroviaire et maritime. Chaque mode présente des risques uniques – choc thermique lors du chargement du fret aérien, retards liés aux embouteillages routiers, ou retenues douanières aux frontières. Bonne pratique de distribution (PIB) exige que les véhicules de transport soient validés et équipés de systèmes de réfrigération calibrés. Precedence Research note que le transport réfrigéré devrait croître à un TCAC de 13.0% entre 2025 et 2034. Les entreprises utilisent de plus en plus packs de glace carbonique et de gel pour les envois congelés, et certains déploient expéditeurs de vapeur sèche d'azote liquide pour les thérapies cellulaires. Adoption de camions frigorifiques autonomes et unités frigorifiques électriques augmente alors que les flottes visent à réduire les émissions.

Infrastructure de stockage et automatisation des entrepôts

L'infrastructure de l'entrepôt doit offrir un contrôle constant de la température, isolation robuste, alimentation de secours et séparation des produits par zone de température. De nombreuses installations s'appuient encore sur des processus manuels; des études montrent environ 80% des entrepôts restent non automatisés. Cependant, l’automatisation s’accélère 2025 à mesure que les entreprises déploient systèmes automatisés de stockage et de récupération (AS/RS), des déplaceurs de palettes robotisés et des systèmes de gestion d'entrepôt activés par l'IA. L'automatisation améliore le débit et réduit les coûts de main-d'œuvre, remédier aux pénuries de main-d’œuvre dans l’industrie. Il assure également un contrôle constant de la température en minimisant les ouvertures de porte et en rationalisant la manipulation des produits..

Surveillance environnementale et enregistrement des données

Une surveillance continue n'est pas négociable. Les lignes directrices du PIB exigent enregistreurs de données calibrés et surveillance de la température en temps réel. Pourtant, de nombreux systèmes reposent encore sur des enregistreurs manuels examinés après la livraison., qui est réactif. Des solutions modernes intégrées Capteurs IoT dans l'emballage, palettes ou véhicules; ces appareils diffusent la température, humidité, données de choc et de localisation vers les plateformes cloud. Si les températures s'écartent, des alertes sont envoyées aux équipes logistiques pour intervenir immédiatement. Les plateformes cloud génèrent rapports prêts à l'audit, soutenir la conformité réglementaire et assurer une traçabilité complète. Les analystes prédisent que 75% des expéditions pharmaceutiques utiliseront le suivi basé sur l'IoT par 2030 – un bond spectaculaire par rapport aux taux d’adoption actuels.

Bonne pratique de distribution (PIB) et systèmes de qualité

Le PIB est la pierre angulaire de la conformité réglementaire. Il exige le maintien de l’intégrité des médicaments tout au long de leur distribution., avec une documentation rigoureuse et des systèmes de qualité. Les principes clés comprennent:

Contrôle de la température: La plupart des produits pharmaceutiques sous chaîne du froid doivent être conservés entre 2 °C et 8 °C; les produits nécessitant d'autres gammes doivent être clairement étiquetés.

Matériel qualifié: Véhicules frigorifiques, les entrepôts à température contrôlée et les enregistreurs de données doivent être validés et régulièrement calibrés.

Surveillance et documentation continues: Les relevés de température doivent être enregistrés tout au long du stockage et du transport..

Gestion des risques: Les entreprises doivent identifier les risques potentiels (Par exemple, pannes de courant, retards de douane) et mettre en œuvre des plans d'urgence.

Formation du personnel: Tout le personnel impliqué doit être formé aux exigences du GDP et aux procédures d'urgence..

En pratique, la conformité implique de développer procédures opérationnelles standard (Sops), vérifier les fournisseurs et les transporteurs, utiliser des emballages validés et réaliser des audits réguliers. Les lignes directrices actualisées de l’Union européenne en matière de PIB (mis en œuvre dans 2014) Et les États-Unis. Loi sur la sécurité de la chaîne d'approvisionnement en médicaments (DSCSA) nécessiter une sérialisation, traçabilité et documentation électronique tout au long de la chaîne d'approvisionnement. La conformité peut sembler fastidieuse, mais il protège les entreprises des répercussions juridiques et garantit que les patients reçoivent des médicaments sûrs.

Les innovations technologiques façonnent la chaîne du froid pharmaceutique 2025

Surveillance en temps réel avec des capteurs IoT

Internet des objets (IoT) la technologie a transformé la logistique de la chaîne du froid. Au lieu d'enregistreurs de données passifs examinés après le transit, lieu de systèmes modernes capteurs sans fil emballage intérieur, palettes ou véhicules. Ces capteurs mesurent la température, humidité, exposition à la lumière, choc et coordonnées GPS. Les données circulent dans plateformes cloud sécurisées qui fournissent des tableaux de bord à distance, Archives d'enregistrement conformes au RGPD et une traçabilité complète. Si un écart de température se produit, les alertes automatisées permettent une intervention rapide. Au-delà d’une surveillance immédiate, l'analyse des données à long terme permet d'identifier les points chauds des itinéraires et les transporteurs peu fiables.

La surveillance en temps réel réduit le gaspillage et améliore la conformité. Les plateformes IoT enregistrent automatiquement les données de température, générer des rapports prêts à l'audit et offrir une traçabilité numérique. Cela prend en charge les cadres réglementaires tels que la FDA 21 Partie CFR 11, PIB de l’UE et lignes directrices de l’OMS. À long terme, l'analyse prédictive prévoira les pannes d'équipement ou les retards d'itinéraire, permettre une atténuation proactive des risques.

Intelligence artificielle et analyse prédictive

L’IA passe d’un mot à la mode à un outil pratique dans la logistique pharmaceutique. En analysant les données historiques et les flux de capteurs en temps réel, Algorithmes d'IA optimiser les itinéraires, prévision de la demande et prévoir les besoins de maintenance des équipements. L'IA peut identifier des modèles suggérant des écarts de température ou des retards et recommander des actions correctives avant que les produits ne se détériorent.. Par exemple, Les systèmes de planification d'itinéraire basés sur l'IA évaluent les modèles de trafic, prévisions météorologiques et exigences réglementaires, puis proposez le plus rapide, route la plus sûre. Les algorithmes de maintenance prédictive analysent les performances des unités de réfrigération pour planifier l'entretien avant les pannes.. Ces capacités réduisent les déchets et améliorent la fiabilité.

Robotique et automatisation d'entrepôt

L'automatisation s'étend au-delà de la fabrication pour s'étendre à l'entreposage et à l'exécution des commandes.. Systèmes automatisés de stockage et de récupération (AS/RS) et manipulation robotisée sont de plus en plus courants dans les entrepôts frigorifiques. Les robots minimisent les erreurs humaines dans le suivi des stocks et la manipulation des produits, tandis que les convoyeurs automatisés réduisent les ouvertures de porte, maintenir la stabilité de la température. La robotique contribue également à remédier aux pénuries de main-d’œuvre et à réduire les coûts. Avec environ 80% des entrepôts manquent encore d’automatisation, le potentiel de gains d’efficacité est important.

Blockchain et jumeaux numériques

Les technologies émergentes telles que la blockchain et les jumeaux numériques promettent une plus grande transparence et une plus grande modélisation des risques.. La blockchain fournit des enregistrements immuables de chaque transaction, garantir l’intégrité de la chaîne de traçabilité. Les jumeaux numériques – modèles virtuels d'actifs physiques – permettent aux équipes logistiques de tester des scénarios et d'optimiser les performances du système sans risquer les produits réels.. Gartner prédit que d'ici 2030, 75% des expéditions pharmaceutiques utiliseront le suivi IoT; l'intégration de la blockchain améliorera encore la confiance et la conformité réglementaire. Entre-temps, les jumeaux numériques peuvent simuler les profils de température sur les itinéraires, aider à planifier les stratégies d’emballage et de transport des nouvelles thérapies.

Emballage intelligent et matériaux durables

La durabilité est une valeur fondamentale dans 2025. Les consommateurs et les régulateurs attendent des entreprises qu’elles réduisent leurs émissions de carbone et leurs déchets. Les innovations incluent matériaux biodégradables et recyclables pour emballage thermique, expéditeurs multi-usages réutilisables et étiquettes intelligentes qui changent de couleur si les seuils de température sont dépassés. Systèmes de réfrigération économes en énergie, la production d'énergie renouvelable sur site et une isolation améliorée réduisent l'impact environnemental. Les constructeurs développent également emballage intelligent autorégulant avec capteurs intégrés et unités de micro-réfrigération, amélioration supplémentaire du contrôle de la température.

Cadres réglementaires et conformité mondiale

La chaîne du froid pharmaceutique s’étend sur plusieurs juridictions, chacun avec des réglementations uniques. Naviguer dans ce patchwork est complexe mais essentiel.

Union européenne

Les lignes directrices de l’UE en matière de PIB, mis à jour dans 2013 et appliqué par l'Agence européenne des médicaments (Ema), nécessitent un contrôle strict de la température, documentation et chaîne de contrôle. Les entreprises doivent valider tous les équipements, effectuer des évaluations des risques et assurer une traçabilité complète du fabricant à la pharmacie. Les lignes directrices mettent l'accent sur la qualification des équipements de la chaîne du froid et des conditions de transport., y compris les expéditions d'essai et l'analyse des itinéraires saisonniers.

États-Unis

Aux États-Unis, le Loi sur la sécurité de la chaîne d'approvisionnement en médicaments (DSCSA) mandate la sérialisation et la documentation des transactions électroniques. Cette loi vise à détecter et prévenir les médicaments contrefaits en suivant les produits tout au long de la chaîne d'approvisionnement.. Les délais de conformité s’étendent jusqu’à 2025. NOUS. les directives mettent également l'accent sur le stockage validé, surveillance continue de la température et planification d'urgence.

Autres régions

Organisation centrale indienne de contrôle des normes pharmaceutiques (CDSCO) est conforme aux directives de l'OMS et nécessite un étiquetage et une documentation spécifiques. De nombreux pays d’Asie et d’Amérique latine manquent de réglementations harmonisées, obliger les entreprises à s’adapter aux règles locales et à maintenir de multiples systèmes qualité. Une collaboration entre les régulateurs et l'industrie est en cours pour aligner les exigences et réduire la complexité.

Assurance qualité et audits

Quelle que soit la juridiction, l'assurance qualité s'articule autour audits réguliers, documentation et entraînement. Les entreprises doivent auditer leurs fournisseurs et partenaires de transport pour vérifier la conformité au BPD. Les programmes de formation doivent couvrir la gestion de la température, procédures d'intervention d'urgence et de documentation. Exécution outils d'audit numérique, tels que les codes QR liés à la blockchain sur les packages, peut rationaliser les inspections et réduire les erreurs humaines.

Moteurs de croissance et dynamique du marché

Demande croissante de produits biologiques, vaccins et thérapies personnalisées

Les produits biologiques et les thérapies géniques représentent certains des segments du secteur de la santé qui connaissent la croissance la plus rapide.. Selon GlobalData, autour 20% des nouveaux médicaments en cours de développement sont des thérapies géniques et cellulaires. Ces thérapies nécessitent souvent un stockage ultra-froid et ont une durée de conservation courte, stimuler la demande de logistique spécialisée sous la chaîne du froid. Le marché de la CGT devrait dépasser le dollar 81 milliards 2029. Entre-temps, la popularité des médicaments amaigrissants GLP 1 et des vaccins à ARNm continue de croître, renforcer la demande de logistique réfrigérée.

Mondialisation des chaînes d'approvisionnement pharmaceutiques

Les produits pharmaceutiques voyagent souvent à travers les continents, en passant par plusieurs prestataires logistiques et régimes réglementaires. Le le marché de la logistique pharmaceutique devrait dépasser le dollar 135.5 milliards 2025, avec la logistique de la chaîne du froid qui devrait stimuler la croissance. Plus que 30% des produits pharmaceutiques mondiaux nécessitent une manipulation sous chaîne du froid, reflétant la part croissante des produits biologiques et des vaccins dans le portefeuille global de médicaments. L’Asie-Pacifique devrait tirer la croissance, soutenu par la fabrication nationale et les investissements dans les infrastructures de la chaîne du froid. L’Amérique du Nord et l’Europe restent dominantes en termes de volume et de rigueur réglementaire.

Expansion du commerce électronique et livraison directe aux patients

La pandémie a accéléré le commerce électronique et les modèles de prestation directe aux patients. Par conséquent, la logistique de la chaîne du froid s'étend désormais au-delà de la distribution en gros jusqu'à la livraison du dernier kilomètre. Ventes mondiales de commerce électronique atteintes USD 870 milliards aux États-Unis. dans 2021, avec des dépenses d'épicerie en ligne qui grimpent en flèche 30% en Chine. Les consommateurs s’attendent à une livraison pratique à domicile de médicaments sensibles à la température, pousser les prestataires logistiques à développer des, solutions traçables du dernier kilomètre.

Pressions en matière de durabilité et incitations réglementaires

Les préoccupations environnementales poussent les entreprises à adopter des pratiques plus vertes. La chaîne du froid alimentaire mondiale représente environ 2% des émissions totales de CO₂, et les pertes alimentaires dues au manque de réfrigération contribuent de manière significative aux gaz à effet de serre. De nombreux gouvernements proposent désormais des incitations pour les systèmes de réfrigération économes en énergie, emballages réutilisables et intégration des énergies renouvelables. Par exemple, les énergies renouvelables et l’isolation améliorée réduisent l’exposition aux coûts énergétiques volatils. Les entreprises qui investissent dans le développement durable réduisent non seulement leur empreinte carbone, mais renforcent également la réputation de leur marque et se conforment aux réglementations environnementales émergentes..

Renforcement de l’application de la réglementation

Les régulateurs renforcent les contrôles sur les produits sensibles à la température. Inspections GDP plus strictes et application des délais de sérialisation DSCSA aux États-Unis. pousser les entreprises à investir dans la traçabilité et la documentation numérique. La non-conformité peut entraîner des rappels de produits, amendes et atteinte à la réputation. Cette surveillance accrue conduit également à l'adoption de technologies telles que la blockchain et les capteurs IoT pour fournir des enregistrements inviolables..

Les défis auxquels est confrontée la logistique de la chaîne du froid pharmaceutique

Excursions dans la chaîne du froid et perte de produits

Malgré les avancées technologiques, les excursions dans la chaîne du froid restent courantes. Jusqu'à 20% des expéditions de produits biologiques sont perdues en raison de défaillances du contrôle de la température, et à propos 20% des produits pharmaceutiques sensibles à la température peuvent être compromis en transit. Les excursions peuvent résulter de retards de circulation, les douanes tiennent, panne d'équipement ou erreur humaine. Même un 30un écart infime par rapport à 2 La plage °C – 8 °C peut rendre les vaccins inutilisables. La livraison du dernier kilomètre est particulièrement vulnérable, car les coursiers peuvent manquer d’équipement spécialisé et de formation.

Réglementations fragmentées et complexité de la conformité

La logistique pharmaceutique mondiale doit se conformer à une mosaïque de réglementations. PIB européen, NOUS. Les règles DSCSA et spécifiques à la région diffèrent dans les formats de documentation, Exigences d'étiquetage et normes de sérialisation. Les entreprises opérant dans le monde entier ont besoin de plusieurs systèmes qualité et doivent former leur personnel pour répondre aux exigences spécifiques à chaque région.. Des réglementations fragmentées peuvent entraîner des retards aux douanes et augmenter les coûts administratifs. L'harmonisation des réglementations est un effort continu mais reste un défi.

Lacunes en matière d’infrastructures et pénuries de main-d’œuvre

De nombreuses régions ne disposent pas d’infrastructures de stockage frigorifique adéquates, en particulier sur les marchés émergents. Les zones rurales peuvent ne pas disposer d'une alimentation électrique stable ni de personnel qualifié pour gérer les opérations de la chaîne du froid.. Même dans les pays développés, autour 80% des entrepôts ne sont pas automatisés, conduisant à des inefficacités. L'industrie est également confrontée à une pénurie de travailleurs qualifiés formés au PIB et à la gestion de la température., risque exacerbant d’erreur humaine.

Pressions sur les coûts et consommation d’énergie

Le maintien de la chaîne du froid est énergivore et coûteux. Équipement de réfrigération, isolation, le carburant et les procédures de conformité augmentent les coûts. Precedence Research note que les coûts énergétiques élevés et les investissements en capital constituent des contraintes importantes pour l'industrie de la chaîne du froid. La hausse des prix du carburant et la nécessité de réduire les émissions de carbone ajoutent une pression supplémentaire. Pour rester compétitif, les entreprises doivent équilibrer la rentabilité avec la conformité réglementaire et la durabilité.

Contrefaçon et sécurité de la chaîne d'approvisionnement

Les médicaments contrefaits constituent une menace croissante. Les médicaments amaigrissants et les produits biologiques populaires sont particulièrement ciblés, et les criminels exploitent souvent la faiblesse des contrôles de la chaîne du froid. En réponse, les prestataires logistiques utilisent des emballages inviolables, sérialisation et blockchain pour garantir l'intégrité de la chaîne de traçabilité. Le maintien de la sécurité nécessite une collaboration étroite entre les fabricants, transporteurs et organismes de réglementation.

Construire une stratégie résiliente de chaîne du froid pharmaceutique

Évaluez les exigences de votre produit

Commencez par cartographier la plage de température de chaque produit, durée de conservation, et sensibilité aux vibrations ou à la lumière. Les vaccins nécessitent une réfrigération constante, alors que les thérapies cellulaires exigent des conditions cryogéniques. Comprendre les exigences réglementaires pour chaque produit et région.

Choisir des solutions de conditionnement et de transport adaptées

Matériaux à changement de phase et isolés sous vide: Pour les envois nécessitant une protection thermique étendue. Ces matériaux maintiennent la température pendant les délais et réduisent le besoin de glace carbonique.

Conteneurs réutilisables: Réduire les déchets et les coûts. Veiller à ce que la logistique de retour soit efficace.

Véhicules validés: Assurer que les camions, les conteneurs et les avions répondent aux normes GDP en matière de contrôle de la température. Sélectionnez des transporteurs avec des performances et une couverture d'assurance éprouvées.

Mettre en œuvre une surveillance en temps réel

Déployer des capteurs IoT dans les emballages, conteneurs et véhicules pour capter la température, humidité, données de localisation et de choc en temps réel. Intégrez ces données dans un tableau de bord central pour identifier les anomalies et intervenir rapidement. Configurez des alertes automatisées pour avertir les équipes logistiques lorsque les conditions s'éloignent des plages acceptables..

Tirez parti de l’IA pour la planification prédictive

Utilisez des algorithmes d'IA pour optimiser les itinéraires en fonction du trafic, météo, restrictions réglementaires et données en temps réel. L'analyse prédictive peut également prévoir les pannes d'équipement, permettant une maintenance préventive et réduisant les temps d’arrêt.

Élaborer des plans d’urgence

Préparez-vous aux pannes de courant, retards douaniers ou pannes de véhicules. Identifier des itinéraires alternatifs, emballage de secours et transporteurs d'urgence. Maintenir des réserves supplémentaires de glace carbonique ou d'unités de réfrigération alimentées par batterie pour gérer les retards imprévus. Former le personnel pour mettre en œuvre ces plans rapidement et maintenir la documentation.

Former et auditer régulièrement

S'assurer que tout le personnel comprend les exigences du BPD, procédures de manipulation appropriées et protocoles d'urgence. Mener régulièrement des audits internes et des évaluations par des tiers pour identifier les faiblesses. Encourager une culture d’amélioration continue et de conformité.

Investir dans la durabilité

Adopter une réfrigération économe en énergie, Éclairage LED et sources d'énergie renouvelables. Utiliser des emballages recyclables ou biodégradables. Optimiser les itinéraires pour réduire la consommation de carburant et les émissions de CO₂. Envisager des programmes de compensation carbone pour neutraliser les émissions restantes. Les pratiques durables réduisent non seulement l'impact environnemental, mais réduisent également les coûts d'exploitation au fil du temps..

Collaborer tout au long de la chaîne d’approvisionnement

Former des partenariats stratégiques avec les fabricants, fournisseurs d'emballages, opérateurs et fournisseurs de technologie. La collaboration améliore la visibilité et garantit que toutes les parties adhèrent aux mêmes normes de qualité. La standardisation des données et les conteneurs intelligents améliorent l'intégration tout au long de la chaîne d'approvisionnement.

2025 Tendances et perspectives d'avenir

L'automatisation et la robotique occupent une place centrale

L’automatisation transforme les installations de stockage frigorifique. Systèmes automatisés de stockage et de récupération (AS/RS), les robots de manutention de palettes et les bandes transporteuses rationalisent les opérations, réduire les coûts de main d’œuvre et minimiser les erreurs. Avec 80% des entrepôts toujours non automatisés, il y a une marge importante pour l'adoption. Attendez-vous à une accélération des investissements dans la robotique alors que les pénuries de main-d’œuvre persistent.

La durabilité comme valeur fondamentale

Les préoccupations environnementales et les réglementations plus strictes placent la durabilité au premier plan. Réfrigération économe en énergie, les sources d’énergie renouvelables et les emballages recyclables ne sont plus facultatifs. La chaîne mondiale du froid alimentaire contribue actuellement à environ 2% des émissions mondiales de CO₂. La réduction de l'empreinte carbone grâce aux améliorations technologiques et à la réduction des déchets sera une priorité majeure..

Visibilité de bout en bout et suivi en temps réel

Les appareils IoT avancés offrent une visibilité continue sur l'emplacement, température et autres paramètres. Le suivi en temps réel permet d'optimiser les itinéraires, réduit la détérioration et garantit la conformité réglementaire. Le matériel domine le marché du suivi et de la surveillance de la chaîne du froid, holding sur 76.4% de part de marché. Attendez-vous à une intégration plus poussée des capteurs, plateformes cloud et analyse prédictive.

Moderniser les infrastructures

De nombreuses installations de stockage frigorifique sont vieillissantes et énergivores. La modernisation comprend l’amélioration de l’isolation, systèmes de réfrigération, collecte de données et énergie renouvelable sur site. L'investissement dans des infrastructures modernes réduit les coûts énergétiques et améliore la constance de la température. Les mises à niveau intègrent également des capteurs et une automatisation pour surveiller les performances en continu.

Croissance de la chaîne du froid pharmaceutique

Le secteur pharmaceutique reste un moteur clé de l’expansion de la chaîne du froid. Demande de produits biologiques, les vaccins et les thérapies géniques continuent de croître, et 20% des nouveaux médicaments sont des thérapies géniques et cellulaires nécessitant un stockage ultra froid. Les analystes s'attendent à ce que le marché mondial de la chaîne du froid pharmaceutique atteigne USD 1.454 mille milliards par 2029, Grandir à un TCAC de 4.71% depuis 2024 à 2029. Les investissements dans l’infrastructure de la chaîne du froid pour les produits pharmaceutiques resteront robustes.

Investissement dans la logistique des produits frais et la livraison du dernier kilomètre

Bien que cet article se concentre sur les produits pharmaceutiques, il convient de noter que les investissements dans la chaîne du froid des produits frais et dans la livraison du dernier kilomètre s’accélèrent également.. Le marché nord-américain de la logistique de la chaîne du froid alimentaire devrait atteindre USD 86.67 milliards en 2025. La croissance des commandes en ligne a augmenté directement vers les ventes aux consommateurs, obliger les entrepôts et les détaillants à repenser leurs stratégies du dernier kilomètre. Les leçons du secteur alimentaire – telles que l’optimisation des itinéraires et les innovations en matière d’emballage – sont transférables à la logistique pharmaceutique.

Partenariats stratégiques et intégration de la chaîne d’approvisionnement

La collaboration tout au long de la chaîne d’approvisionnement est essentielle pour la résilience. Des partenariats entre constructeurs, les fournisseurs d’emballages et les entreprises technologiques facilitent le développement de produits et rationalisent les opérations. La standardisation des données et les conteneurs intelligents permettent une intégration transparente. Par 2025, les chercheurs s'attendent à 74% des données logistiques à normaliser, améliorer la transparence et la collaboration.

Questions fréquemment posées

Q1: Pourquoi les vaccins et les produits biologiques nécessitent-ils une logistique sous chaîne du froid?

Les vaccins et les médicaments biologiques sont sensibles aux variations de température. Beaucoup doivent rester entre 2 °C et 8 °C; les thérapies géniques peuvent nécessiter conditions ultra froides (–60 °C ou moins). Le maintien de ces plages tout au long du transport préserve la puissance et la sécurité, réduire les déchets et prévenir les dommages aux patients.

Q2: Comment la surveillance en temps réel améliore-t-elle les performances de la chaîne du froid?

La surveillance en temps réel utilise des capteurs IoT pour suivre en continu la température, humidité et emplacement. Quand les conditions s’écartent, des alertes automatisées avertissent les équipes logistiques d'intervenir immédiatement. Cette approche proactive évite la détérioration, assure la conformité réglementaire et fournit une documentation prête à l’audit.

Q3: Quelles sont les bonnes pratiques de distribution (PIB) exigences pour les produits pharmaceutiques?

Les directives du PIB exigent que les médicaments sensibles à la température soient stockés et transportés dans les plages spécifiées., généralement 2 ° C - 8 ° C. L'équipement doit être validé et calibré, et une surveillance continue avec une documentation appropriée est requise. Le personnel manipulant les produits doit être formé aux exigences du GDP.

Q4: Quels facteurs de marché stimulent la croissance de la logistique de la chaîne du froid pharmaceutique ??

La croissance provient de la part croissante des produits biologiques et des thérapies géniques, mondialisation des chaînes d'approvisionnement pharmaceutiques, expansion du commerce électronique et livraison directe aux patients, et une application plus stricte de la réglementation. Les rapports indiquent que plus que 30% des produits pharmaceutiques mondiaux nécessitent une manipulation sous chaîne du froid et que le marché pourrait dépasser USD 135.5 milliards 2025.

Q5: Comment les entreprises peuvent-elles rendre leurs opérations de chaîne du froid plus durables?

Adopter des systèmes de réfrigération économes en énergie, sources d'énergie renouvelables, et emballages recyclables ou réutilisables. Optimiser les itinéraires pour réduire la consommation de carburant et les émissions de carbone. Investissez dans l'automatisation et les capteurs IoT pour minimiser les déchets et éviter les excursions de température.

Q6: Quel rôle joue l’IA dans la logistique de la chaîne du froid?

L'IA analyse les données historiques et en temps réel pour optimiser les itinéraires, prévoir la demande et prévoir la maintenance des équipements. Il peut identifier les risques à un stade précoce, comme des retards de circulation ou des dysfonctionnements de la réfrigération, et recommander des actions correctives. Les systèmes basés sur l'IA améliorent l'efficacité, réduire les déchets et améliorer la prise de décision.

Résumé et recommandations

Une logistique efficace de la chaîne du froid pharmaceutique est essentielle pour fournir en toute sécurité des thérapies qui sauvent des vies., fiable et durable. Le marché se développe rapidement, avec des estimations allant de USD 98 milliards en 2025 à USD 1.36 mille milliards par 2034. Demande croissante de produits biologiques, les thérapies géniques et les vaccins stimulent la croissance, tandis que la mondialisation et le commerce électronique ajoutent à la complexité. En même temps, les défaillances de la chaîne du froid peuvent gaspiller jusqu'à 50% de vaccins et 20% des expéditions de produits biologiques. Pour réussir dans cet environnement, les organisations doivent investir dans des emballages à température contrôlée, transport validé, surveillance en temps réel et analyses basées sur l'IA. Le respect du PIB et des réglementations régionales n'est pas négociable; des audits et des formations réguliers sont essentiels. La durabilité doit être intégrée dans chaque décision, de la réfrigération économe en énergie aux emballages recyclables. Enfin, la collaboration tout au long de la chaîne d’approvisionnement débloquera l’efficacité opérationnelle et la résilience.

Prochaines étapes réalisables

Réaliser un audit de la chaîne du froid: Cartographier tous les produits sensibles à la température, conditions de stockage et itinéraires de transport. Identifier les lacunes en matière de conformité et de surveillance.

Mettre à niveau les systèmes de surveillance: Déployez des capteurs IoT et des tableaux de bord cloud pour une visibilité en temps réel et des alertes automatisées.

Formez votre équipe: Développer des programmes de formation couvrant le PIB, intervention d'urgence et fonctionnement de l'équipement.

Collaborer avec des partenaires: Établir des accords de qualité clairs avec les transporteurs, fournisseurs d'emballages et entrepôts. Partagez des données pour améliorer les performances.

Investissez dans des solutions durables: Optez pour des emballages réutilisables, réfrigération économe en énergie et optimisation des itinéraires. Surveiller l’empreinte carbone et fixer des objectifs de réduction.

À propos du tempk

Tempk est une entreprise technologique spécialisée dans les solutions de chaîne du froid pour les produits pharmaceutiques et les sciences de la vie. Nous fournissons systèmes de surveillance en temps réel, services de conseil en emballage et logistique validés pour aider les clients à maintenir la conformité et à protéger l’intégrité des produits. Nos solutions intègrent Capteurs IoT et analyses IA, permettant une gestion proactive des risques et des rapports réglementaires transparents. Avec un réseau mondial de partenaires et un engagement envers le développement durable, Tempk aide les organisations à fournir des médicaments vitaux de manière sûre et efficace.

Appel à l'action: Si vous êtes prêt à moderniser votre logistique pharmaceutique, contactez-nous pour une évaluation gratuite. Nos experts analyseront vos processus actuels et recommanderont une stratégie de chaîne du froid sur mesure pour améliorer la fiabilité., réduire les déchets et améliorer la conformité.