Establishing a Research Institute to Address the Challenge of Creating Blockbuster Products: Ziyan Foods Accelerates “Self-Revolution”

Food R&D is different from other fields and requires attention to detail. In recent years, research and development in the food industry has been given increasing importance.

On the morning of November 17, the inauguration ceremony of the Ziyan Food Innovation Research Institute was held in Guanyun County, Lianyungang.

As a well-known brand in the braised food industry and a player in a relatively mature sector, why did Ziyan Food establish its own Innovation Research Institute? Zhong Huaijun, the Director of the Ziyan Food Innovation Research Institute, stated, “As people’s living standards continue to improve, consumers are increasingly demanding higher food quality and experiences. Ziyan Food’s establishment of a research institute is based on these market demands and development trends.” Zhong Huaijun added that Ziyan Food will continue to explore and develop the healthy food industry, ensuring that future research not only focuses on taste and safety but also on health.

It is reported that the Ziyan Food Innovation Research Institute will undertake three core functions: launching more new products that align with market trends and consumer demands, ensuring high product quality and food safety, and rapidly converting research results into productivity.

At the event, a reporter from Blue Whale Finance noticed that the Ziyan Food Innovation Research Institute had planned several functional areas, including a corporate exhibition area, product tasting area, flavor technology research area, sensory evaluation area, and instrument analysis area. Ziyan Food has also optimized and upgraded its existing product R&D center in terms of both software and hardware, for instance, by purchasing a series of leading domestic and international food processing and testing equipment and bringing in professional flavor researchers and high-tech talent.

According to available information, Ziyan Food is a large-scale producer of braised food in China, focusing on the R&D, production, and sales of braised products. The company’s main products include “Husband and Wife Lung Slices,” “Baiwei Chicken,” and “Tengjiao Chicken,” which are made from poultry such as chicken, duck, beef, pork, as well as vegetables, seafood, and soy products. These products are primarily used as side dishes with meals, supplemented by casual consumption, with the main brand being “Ziyan.”

Despite having a diverse product line, the flagship product “Husband and Wife Lung Slices” remains a strong sales driver. According to Ziyan Food’s 2023 semi-annual report, fresh products contributed 86.08% of the company’s main business revenue, with the “star” product “Husband and Wife Lung Slices” generating sales of 543 million yuan, accounting for 31.59%.

“We have always been trying to create more star products like ‘Husband and Wife Lung Slices’ and ‘Tengjiao Chicken.’ For example, this year we launched products such as Refreshing Beef, Refreshing Pork Feet, Bobo Chicken Slices, and Crispy Shreds. But it’s actually very challenging to surpass these two products, because our customers usually think of Tengjiao Chicken and Husband and Wife Lung Slices first, and then buy some others. We’ve racked our brains trying to outdo ourselves, and often things don’t go as planned, but we must keep launching products with vitality,” Zhong Huaijun said. “I often say it’s like how WeChat surpassed QQ; can we create another one and revolutionize ourselves?”

It is reported that Ziyan Food has established long-term, stable partnerships with large suppliers like Wens Foodstuff Group, New Hope Group, and COFCO Group for the supply of key raw materials such as whole chickens, beef, and duck by-products. This allows the company to source fresh, high-quality ingredients from the origin and, relying on its five production bases, form an all-round supply chain system with the optimal cold chain delivery distance as the radiation radius, fast supply, and maximum freshness. Orders placed the previous day are produced the same day and delivered to stores on the same or the next day, ensuring the freshness of the products.

It is noteworthy that the upgrade of Ziyan Food’s supply chain has also optimized its cost side. Ziyan Food stated in its financial report that the prices of raw materials are close to the range of previous years, and the company has strengthened supply chain optimization, improved production processes, and upgraded technology, resulting in significant improvements in net profit.

According to Ziyan Food’s 2023 third-quarter report, the company achieved operating revenue of approximately 882 million yuan in the first three quarters. The company’s gross profit margin was 24.19%, up 6.69 percentage points year-on-year; the net profit margin was 12.06%, up 3.94 percentage points year-on-year. Looking at the single-quarter indicators, in the third quarter of 2023, the company’s gross profit margin was 29.17%, up 11.07 percentage points year-on-year and 6.18 percentage points quarter-on-quarter; the net profit margin was 15.15%, up 5.38 percentage points year-on-year and 1.67 percentage points quarter-on-quarter.

Moreover, expanding its market segment is one of Ziyan Food’s revenue-increasing strategies. Following its strategic investment in Lao Han Bian Chicken in June, Ziyan Food made another move in September by strategically investing in Jing Cui Xiang. Ziyan Food Chairman Ge Wuchao stated that steadfastness and diversified exploration are two inseparable aspects of enterprise development. Steadfastness is the foundation of the company’s development; since the company’s establishment, we have been deeply engaged in the side dish braised food market, committed to consolidating our leading position in the industry. However, with changes in the market environment and the diversification of consumer needs, we also see the necessity of exploring new opportunities for development on the existing foundation. The company continues to explore diversified development paths by launching several sub-brands, such as “Feng Si Niang Qiaojiao Beef,” “Shaguo Zhuangyuan,” and “Jiaoyan Jiaoyu,” covering categories like casual dining and casual braised food, as well as strategic partnerships with food brands such as Lao Han Bian Chicken and Jing Cui Xiang. This strategy opens up broader growth opportunities for the company. Through diversified strategic layout, the company can quickly respond to market changes, enhance overall competitiveness, and further consolidate its industry-leading position to achieve long-term development.

On the other hand, with the strong momentum of the restaurant industry’s recovery, competition has also become more intense. Ge Wuchao admitted that after the pandemic, consumer demand has changed, with increased focus on food safety and health. Additionally, as consumers’ purchasing power recovers, it may attract more competitors into the market. Therefore, Ziyan Food needs to strengthen brand building and marketing efforts to enhance brand influence and market share to maintain its industry-leading position. Further strengthening product R&D and quality control to provide safer, healthier products that better meet consumer needs is essential.

Recently, Qingcheng District hosted the “Qingyuan Chicken” Industry High-Quality Development Promotion Meeting, where four companies were awarded the “Qingyuan Chicken” Geographical Indication Special Mark. Vice Mayor Lei Huankun presented plaques to Guangdong Tian Nong Food Group, Qingyuan Sanyuan Qingyuan Chicken Breeding, Guangdong Tian Nong Ecological Food, and Guangdong Dongfeng Agricultural Development.

A geographical indication signifies the unique quality of a product related to its origin. Qingcheng District’s Market Supervision Bureau provided “one-on-one” support to ensure companies met criteria for using the “Qingyuan Chicken” mark, including on-site inspections, origin verification, and product quality testing. Additionally, a campaign was launched to protect the geographical indication through random checks and inter-departmental collaboration, safeguarding against unauthorized use.

In 2022, companies marked with “Qingyuan Chicken” in Qingcheng District reached a total output value of 3.015 billion yuan, a 130% year-on-year increase, with revenues hitting 1.213 billion yuan. Qingcheng District focuses on a comprehensive development framework, integrating seed breeding, technological R&D, deep processing, logistics, and brand sales to enhance the Qingyuan Chicken industry.

Looking ahead, Qingcheng District aims to boost the “Qingyuan Chicken” brand as part of the “Hundred-Thousand-Ten Thousand Project.” Efforts will include strengthening genetic resource protection, improving quality management, expanding deep processing, and promoting the cultural significance of Qingyuan Chicken to achieve high-quality industry growth and solidify its status as a city icon.

Hemei Agriculture (833515) announced its plan to establish a wholly-owned subsidiary in Chongzuo City, Guangxi Province, with an investment of 10 million yuan. This move aligns with the company’s future development strategy to optimize resource allocation and enhance competitiveness. The new subsidiary will focus on the production, sales, processing, transportation, and storage of agricultural products, along with other services like food sales, supply chain management, and warehousing.

Main Business Activities:

The subsidiary will engage in:

Investment Purpose:

The investment aims to expand Hemei Agriculture’s supply chain layout, enhance centralized procurement and management, and improve overall profitability and competitiveness. This strategic move will further strengthen long-term regional partnerships and explore new market opportunities.

Risk and Impact Assessment:

The company states that this investment carries minimal risk, given its alignment with Hemei Agriculture’s strategic goals. Enhanced internal controls, clear business strategies, and a strong management team will be established to safeguard shareholder interests. The investment is expected to positively impact the company’s consolidated financial statements and future financial condition.

Hemei Agriculture specializes in providing “one-stop cold chain logistics and distribution services for fresh agricultural and sideline products,” serving clients including educational institutions, military organizations, and public institutions.

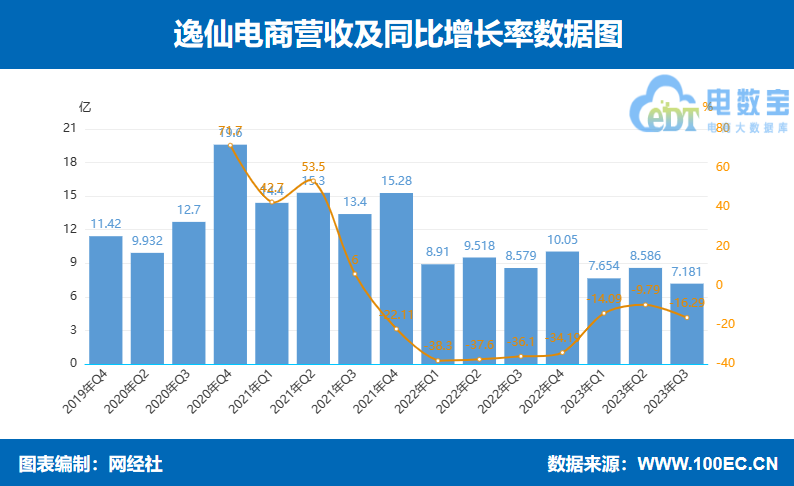

Yatsen E-commerce has released its financial report for the third quarter ending September 30, 2023. The company reported total net revenue of RMB 718.1 million, marking a year-on-year decrease of 16.3%. Despite the decline in revenue, Yatsen’s net loss was reduced by 6.1% year-on-year to RMB 197.9 million. On a non-GAAP basis, however, the net loss expanded by 3.0% year-on-year to RMB 130.2 million. Gross profit for the quarter was RMB 512.8 million, down 13.3% year-on-year, with a gross margin of 71.4%, compared to 68.9% in the same period in 2022.

Total operating expenses for Yatsen stood at RMB 744.3 million, a 13.1% decrease year-on-year. Fulfillment expenses were reduced to RMB 56 million from RMB 63.8 million in the same period in 2022. Sales and marketing expenses also saw a reduction, dropping to RMB 511.7 million from RMB 564.8 million. General and administrative expenses decreased to RMB 151.8 million, while R&D expenses declined to RMB 24.7 million. The operating loss narrowed by 12.9% to RMB 231.5 million, though on a non-GAAP basis, it expanded by 1.2% to RMB 164.6 million.

Yatsen E-commerce’s founder, Chairman, and CEO, Huang Jinfeng, stated: “In the third quarter, the company’s three major skincare brands experienced steady growth. Meanwhile, Yatsen’s flagship brand, Perfect Diary, continued to enhance its brand strength through a new visual identity and the launch of major new products. We are optimistic about the future, and according to the company’s Q4 performance guidance, total revenue is expected to grow year-on-year.”

Founded in 2016, Guangzhou Yatsen E-commerce Co., Ltd. was recognized as a “Unicorn” innovative enterprise in Guangzhou in 2019, making it the city’s only e-commerce unicorn at the time.

Other Listed Digital Retail Companies in China

By focusing on strategic brand development and enhancing its market presence, Yatsen aims to navigate the challenges in the competitive e-commerce landscape.

As of the close on November 22, Dingdong Maicai’s stock price stood at $2.07 per share, representing a year-to-date decline of 51.52%, with a current total market value of $491 million.

Researcher Zhuoma, The Investment Times

Dingdong Maicai recently released its unaudited financial results for the third quarter of 2023, which ended on September 30.

The financial report shows that Dingdong Maicai achieved total revenue of 5.14 billion yuan in the third quarter of this year, a year-on-year decrease of 13.51%. The Gross Merchandise Volume (GMV) reached 5.67 billion yuan, a quarter-on-quarter increase of 6.4%. The company posted a net profit of 2.1 million yuan, compared to a loss of 345 million yuan in the same period last year. The Non-GAAP (Non-Generally Accepted Accounting Principles) net profit was 16 million yuan, compared to a loss of 285 million yuan in the same period last year. Notably, this marks the fourth consecutive quarter that Dingdong Maicai has achieved Non-GAAP profitability since the fourth quarter of 2022.

Dingdong Maicai’s founder and CEO, Liang Changlin, stated during the earnings call that the continuous profitability was due to the company’s strategy of “prioritizing efficiency and maintaining a moderate scale.” He also mentioned that Dingdong Maicai was one of the earliest companies in the industry to achieve profitability, describing the journey as “a long and challenging one.”

Profitability has long been a significant challenge for many fresh food e-commerce platforms, and stabilizing profitability is an issue that many companies must address. Amidst the backdrop of declining capital inflows, increased market competition, and rising costs, Dingdong Maicai has adopted a series of measures, including withdrawing from certain cities, reducing costs, and improving efficiency, sacrificing scale for sustainable profitability. These efforts seem to be bearing fruit so far.

However, in terms of stock price, the market has not yet recognized Dingdong Maicai’s efforts. As of the close on November 22, Dingdong Maicai’s stock price stood at $2.07 per share, representing a year-to-date decline of 51.52%, with a current total market value of $491 million.

Dingdong Maicai’s Stock Price Performance Since Listing (USD)

Source: Wind

Revenue Declined Year-on-Year in the Third Quarter

The financial report shows that Dingdong Maicai achieved total revenue of 5.14 billion yuan (RMB, the same below) in the third quarter of this year, compared to 5.943 billion yuan in the same period last year, a decrease of 13.51% year-on-year. GMV for the quarter was 5.67 billion yuan, a quarter-on-quarter increase of 6.4%.

Dingdong Maicai attributed the revenue decline to its withdrawal from multiple cities and sites in 2022 and the second quarter of this year. Additionally, the significant increase in consumer travel activities and offline consumption post-pandemic contributed to the year-on-year decline in Dingdong Maicai’s third-quarter sales.

Regarding the GMV growth, the company stated that it was due to a quarter-on-quarter increase in order volume and average order value (AOV) of 6.0% and 0.5%, respectively. The increase in order volume was mainly driven by higher monthly order frequency and rapid growth in orders from the Jiangsu and Zhejiang regions.

In terms of revenue composition, Dingdong Maicai’s income is derived from product revenue and service revenue, with product revenue being the primary source.

In the third quarter, Dingdong Maicai’s product business generated 5.083 billion yuan in revenue, compared to 5.872 billion yuan in the same period last year, a year-on-year decrease of 13.45%. This decline in product revenue was the main reason for the overall revenue drop in the third quarter. During the same period, service business revenue was 57 million yuan, compared to 70 million yuan in the same period last year, a year-on-year decrease of 18.45%, mainly due to a temporary surge in membership numbers in 2022 during the pandemic.

The financial report also shows that Dingdong Maicai’s total operating costs and expenses for the third quarter of this year amounted to 5.164 billion yuan, a year-on-year decrease of 17.62% from 6.268 billion yuan in the same period last year. Specifically, the company’s cost of sales for the quarter was 3.577 billion yuan, down 13.94% year-on-year from 4.157 billion yuan in the same period last year. The cost of sales as a percentage of total revenue also decreased from 70.0% last year to 69.6% this quarter.

Meanwhile, the company’s delivery expenses for the third quarter were 1.199 billion yuan, compared to 1.595 billion yuan in the same period last year, a year-on-year decrease of 24.82%. The delivery expenses as a percentage of total revenue also dropped from 26.8% in the same period last year to 23.3%.

Additionally, Dingdong Maicai’s third-quarter sales and marketing expenses were 98 million yuan, a year-on-year decrease of 22.75% from 127 million yuan in the same period last year, mainly due to the company’s withdrawal from a few cities in 2022 and the second quarter of this year. General and administrative expenses were 89 million yuan, a year-on-year decrease of 33.0% from 133 million yuan in the same period last year, mainly due to improved employee efficiency. Product development expenses were 199 million yuan, a year-on-year decrease of 21.84% from 255 million yuan in the same period last year, mainly due to increased efficiency among the company’s R&D personnel.

In terms of profitability, Dingdong Maicai achieved a net profit of 2.1 million yuan in the third quarter of this year, compared to a loss of 345 million yuan in the same period last year. The Non-GAAP net profit was 16 million yuan, compared to a loss of 285 million yuan in the same period last year. The gross profit margin for the quarter slightly increased from 30.0% in the same period last year to 30.4%.

As of the end of September this year, Dingdong Maicai had cash and cash equivalents and short-term investments totaling 5.632 billion yuan, compared to 6.493 billion yuan at the end of December 2022.

Four Consecutive Quarters of Non-GAAP Profitability

Dingdong Maicai was founded in 2017 and went public on the New York Stock Exchange in June 2021.

Previous financial reports and the prospectus showed that Dingdong Maicai had been in a long-term loss-making state. From 2019 to 2021, Dingdong Maicai generated total revenue of 3.88 billion yuan, 11.336 billion yuan, and 20.121 billion yuan, respectively, with corresponding net losses of 1.873 billion yuan, 3.177 billion yuan, and 6.429 billion yuan.

In 2022, Dingdong Maicai’s performance saw a turning point, with Non-GAAP profitability of 116 million yuan in the fourth quarter of that year. In the first and second quarters of this year, Dingdong Maicai achieved Non-GAAP net profits of 6.1 million yuan and 7.5 million yuan, respectively. With the third quarter included, Dingdong Maicai has now achieved Non-GAAP profitability for four consecutive quarters.

During the earnings call, Liang Changlin emphasized that the company’s continuous profitability was due to its strategy of “prioritizing efficiency and maintaining a moderate scale.” He also stated, “It has been a long and challenging journey to get here, but our adherence to our principles and vision has kept us on the right path.” Additionally, regarding this year’s performance, Liang Changlin expressed confidence in achieving Non-GAAP profitability in the fourth quarter and the entire year of 2023.

Pinecone Finance News: On November 23, Juewei Foods announced on its investor interaction platform that its plan to list in Hong Kong is currently on hold. Previously, Juewei Foods had publicly announced its intention to pursue a Hong Kong IPO, stating that the move was intended “to accelerate the company’s internationalization strategy, enhance its overseas financing capabilities, and further strengthen its capital base and overall competitiveness.”

In its response, Juewei Foods did not provide a detailed explanation for the postponement of its Hong Kong listing plan. However, the company’s Secretary of the Board mentioned that Juewei Foods will continue to advance its investment planning based on its established strategic guidelines and business objectives. The company has already seen initial success in its food ecosystem initiatives. Leveraging its long-term industry experience, as well as its expertise in cold chain distribution networks and chain store management, Juewei Foods is fully supporting its ecosystem partner companies in standardizing production, improving efficiency, and achieving high levels of coordination. Adhering to the principles of “project-centered, service-driven, and result-oriented” industrial layout, Juewei Foods aims to face challenges, pursue development, and create value together with its ecosystem partners.

China Economic Herald and China Development Network Report by Pi Zehong: The variety of ingredients on Chinese family dining tables today has undergone a dramatic transformation compared to a decade ago. Imported ingredients like New Zealand Zespri kiwifruit, Italian extra virgin olive oil, and Ecuadorian white shrimp have become essential components of daily meals for Chinese families. This change is driven by the rapid growth of global fresh agricultural trade and the rise of Chinese e-commerce platforms.

Benlai Life was one of the first platforms in China to sell imported fresh foods like cherries and durians online. As a pioneer in direct procurement from production regions, this unique model has also been applied to the construction of its overseas supply chain. Over the past 11 years, the platform has continuously optimized and integrated its global supply chain, offering domestic consumers a wider variety of imported products. At the same time, it has leveraged its product strength, channel strength, brand strength, and resource strength to empower overseas brands to expand and develop in the Chinese market.

Today, imported goods from more than 50 countries around the world have reached Chinese consumers’ tables through Benlai Life. Products like New Zealand Weebiz pasteurized fresh milk and air-freighted cherries from the United States have become top choices for users seeking a high-quality lifestyle.

Behind the “ultimate freshness” lies the discerning eye and craftsmanship of buyers, as well as the support of a highly efficient “air cold chain.” The international “fresh” chain that stretches from overseas origins to Chinese dining tables ensures that Benlai Life users can enjoy fresh global products with zero time lag.

New Zealand to China: High-Quality Pasteurized Milk’s 72-Hour Cross-Border Journey

The New Zealand pasteurized milk brand Weebiz has been available on Benlai Life for eight years. As one of the earliest imported fresh milk brands to enter China, it has become a quality choice for millions of families.

New Zealand is globally recognized as a premium source of milk, thanks to its unique geographic location, which preserves an unspoiled, pollution-free natural environment and isolates it from common animal diseases found in other regions. Local dairy farmers use traditional grazing methods, allowing cows to naturally feed on lush grass, ensuring the cows’ healthy growth and the purity and safety of the milk.

Milk typically enters the market in two forms: fresh milk and ambient milk. Fresh milk undergoes pasteurization, which retains the maximum nutritional value and natural flavor of the milk but also contains a small amount of harmless or beneficial microorganisms, resulting in a shorter shelf life and the need for refrigeration.

Xing Yan, a senior dairy buyer at Benlai Life, is well-versed in the global dairy supply chain and brands. She carefully selected Weebiz, a premium brand co-produced by New Zealand’s renowned organic dairy farm Marphona and Green Valley Dairies Limited, the country’s second-largest milk processor. This product undergoes pasteurization at the golden standard of 72°C for 15 seconds and continues to be upgraded under natural, additive-free conditions, with a milk protein content of 3.6g/100ml, higher than the EU standard.

With a shelf life of just 15 days, pasteurized milk needs to be stored in a cold chain environment, which imposes high demands on logistics capabilities. Benlai Life’s Weebiz delivery service covers first-tier cities such as Beijing, Shanghai, Guangzhou, and Shenzhen, as well as several other cities. Every bottle of Weebiz pasteurized milk is produced, packaged, sterilized, and tested in New Zealand before being loaded onto a cold chain flight directly to China. It is then delivered to users’ hands only after passing the stringent inspections of the China National Inspection and Quarantine Bureau, customs, and Benlai Life’s rigorous quality control monitoring.

“To improve logistics efficiency, we applied for green channel clearance for Weebiz milk. After production on Sunday at the New Zealand farm, the milk is first sent for local inspection and then flown to China on Monday. Customs officials retain four boxes from each batch for inspection, allowing the rest to clear customs and be stored,” Xing Yan explained.

With the support of Benlai Life’s highly efficient global supply chain system, Weebiz pasteurized milk can be airfreighted from New Zealand to Chinese city dining tables in as little as 72 hours.

United States to China: The Thousand-Mile Freshness Rules for Delicate Cherries

In recent years, cherries have become the “top trend” in the domestic fruit market. Benlai Life introduced imported cherries as early as 2013.

An interesting product selection story once circulated within the company. When cherries first became popular, a group of discerning long-time Benlai Life users developed a preference for “yellow cherries” (golden cherries) due to their unique taste, despite their higher price compared to the more common “red cherries.” These users also had higher expectations for Benlai Life, demanding that the platform carefully select the origins and brands of the “yellow cherries” while further refining the selection of the best varieties and quality products for the “red cherries” globally.

To meet users’ quality demands for imported cherries, Benlai Life has, since 2016, introduced carefully selected “yellow cherries” and “red cherries” from premium regions in the United States. The company partnered with China Eastern Airlines to launch the industry’s first crowdfunded charter flight model. After being harvested, the cherries are pre-cooled, sorted, and packaged in U.S. orchards, then airfreighted directly to China by China Eastern Airlines, delivering the freshest cherries to domestic users.

To bring these delicate cherries to users, Benlai Life adopted a pre-sale order model, where supply is determined by sales. This sales model may seem simple, but it demands extreme precision in the complex process of importing fresh products.

The first challenge is weather conditions. Usually, Benlai Life receives tens of thousands of cherry orders a week before harvest. However, if it rains during harvest, the cherries cannot be picked because they are prone to mold and rot after picking. If the cherries absorb too much water, they can crack and burst when exposed to sunlight after rain, significantly reducing their quality. This requires the buying team to conduct thorough preliminary work, carefully study the local climate, and closely monitor weather conditions in the growing regions.

Additionally, throughout the airfreight, customs clearance, and transportation to the warehouse, the temperature must be “precisely controlled.” If the temperature fluctuates by more than 5°C, condensation will form on the cherries’ surface, leading to a decline in quality.

The final stage is delivery. Finding the right product is just the first step; completing the delivery process thoroughly is essential. Benlai Life ensures that different specifications of cherries are delivered through different cold chain methods to prevent them from losing freshness. Additionally, to avoid damage or spoilage, Benlai Life strictly prohibits rough handling during the delivery process.

This series of meticulous steps is ultimately rooted in Benlai Life’s commitment to building the shortest international “fresh” chain. “We aim to ensure fresh quality by using the most precise and efficient logistics, delivering the cherries to users with green stems and plump, tender fruit, rather than using other methods to significantly extend their shelf life,” said Maomao, a fruit buyer at Benlai Life.

Today, imported cherries from the United States have become a must-have summer fruit for Benlai Life users. Cherries from other top regions, such as Chile, are also delivered to users at the peak of freshness and efficiency in different seasons through direct charter flights and shipments.

The ideal of “buying globally and selling globally” is becoming a reality once again. More and more “Made for China” delicacies are becoming the new trend, while “Made in China” fresh products are also seeing new opportunities.

Benlai Life’s applet has launched national-themed sections such as the “New Zealand Pavilion,” “Chile Pavilion,” “Thailand Pavilion,” and “Italy Pavilion,” allowing users to experience a variety of international flavors and the diverse cultures of different regions worldwide in one place. As Benlai Life’s international “fresh” chain continues to develop rapidly, with the platform expanding its global “circle of friends” and deepening cooperation with quality partners, more premium products from around the world will reach Chinese city dining tables with better quality and more competitive prices.

Missfresh announced that the business acquisition under the equity financing and share purchase agreement previously announced on August 3, 2023, as well as the transaction under the share transfer agreement announced on August 7, 2023, have been terminated. On November 15, the Nasdaq Hearing Panel notified Missfresh that it had decided to delist the company’s securities from Nasdaq Stock Market LLC and suspend trading of those securities effective at the open of business on Friday, November 17. After the expiration of the applicable appeal period, Nasdaq will file a Form 25 delisting notification with the U.S. Securities and Exchange Commission to complete the delisting process.

Recently, at the warehouse entrance of a technology company in Mazhu Town, Yuyao, Ningbo, over 3,000 medical cold cabinets of various models were fully assembled and ready for shipment, destined to be exported to the U.S. market.

“Many pharmaceuticals and vaccines require cold chain transportation and storage. Our company specializes in the research, development, and production of medical cold chain products. In recent years, the medical cold chain industry has seen new growth opportunities, and our company’s annual output value has maintained a growth rate of 15%. This year, we expect our output value to reach 80 million yuan,” said Sun Ming, the company’s general manager.

The company has been deeply involved in the refrigeration system production and R&D industry for nearly 40 years, initially focusing on producing refrigeration components such as condensers and evaporators. After restructuring in 1999, the company became a technology enterprise integrating R&D, production, sales, and service, with an annual production capacity of over 100,000 units of special cold chain products. It has established production bases in places like Jiangxi.

After years of development, the company’s medical cold chain products have become well-known OEM (Original Equipment Manufacturer) suppliers in the field, recognized by medical institutions in developed countries such as Europe and the United States. With a strong market reputation and high product quality, the products are exported to more than 60 countries and regions. While maintaining its focus on the medical cold chain market, the company has also expanded into the research, development, and production of commercial and rural cold chain products, continuously improving its economic benefits.

Quality and integrity are the foundations of the company’s survival. In recent years, the company has successively passed certifications such as the U.S. UL, ETL, European CE, and Japan’s SG certifications. It strictly adheres to the ISO9001 quality management system and ISO14000 environmental management system for product quality management.

“Compared to household and commercial refrigerators, medical cold chain products require more precise temperature control, smaller temperature fluctuations, and greater technical difficulty in the quality of the refrigeration system and refrigerant ratios,” said Sun Ming. After assembly, each product undergoes a series of stringent quality control measures, including vacuum extraction, refrigerant addition, and over four hours of power-on testing, ensuring no loopholes in any production process. Notably, the company developed a medical refrigerator that can reach temperatures as low as -86°C, primarily used in research institutions and laboratories. This product has become a bestseller in over 10 countries and regions.

Technology and talent are vital sources of the company’s core competitiveness. Currently, the company holds over 60 intellectual property rights, including domestic and international patents and software copyrights. It has been recognized as a National High-Tech Enterprise, a National Technology-Based SME, and a Provincial “Specialized, Refined, and New” SME. The company invests 6% to 10% of its annual output value in technological research and development. Over the past three years, it has invested over 10 million yuan in technological transformation projects, achieving more stable product quality and significantly improved production efficiency. The company has also implemented a solar photovoltaic project, which saves more than 40% of the company’s energy annually.

On the foundation of establishing an innovation team, the company continues to increase its efforts to attract innovative talent, actively collaborating with universities such as Shanghai Jiao Tong University, Zhejiang Sci-Tech University, and China Jiliang University on industry-university-research partnerships to jointly establish research institutions and engineering technology centers.

The company is committed to enhancing its competitiveness through digital transformation. Its next step is to invest over 3 million yuan to implement a 5G green intelligent factory transformation and upgrading project, aiming to create an advanced modern intelligent factory that will drive the company’s development with renewed energy.

Recently, the E-Commerce and Informatization Department of the Ministry of Commerce issued a document recognizing the enterprises selected as “2023 National E-Commerce Demonstration Enterprises.” Suzhou-based Shixiang Fresh Produce (Jiangsu Suiyi Information Technology Co., Ltd.) was listed among the honorees. On November 23, the 2023 China Jiangsu E-Commerce Conference, themed “Deepening Digital-Physical Integration to Promote Industrial Revitalization,” was held in Kunshan. During the conference, a certification ceremony was held for 12 Jiangsu enterprises, including Shixiang Fresh Produce, which is also the only Suzhou enterprise to be named on the 2023 list.

This selection was initiated by the Ministry of Commerce with the aim of identifying a group of “E-Commerce Demonstration Enterprises” that have achieved outstanding results in promoting integration, enhancing public welfare, driving development, revitalizing industries, improving the environment, and fostering openness. After evaluation, 132 e-commerce demonstration enterprises were selected and publicly recognized.

This marks the fourth consecutive year that Shixiang Fresh Produce has been named a National E-Commerce Demonstration Enterprise, highlighting the company’s sustainable, stable, and rapid development in the e-commerce sector and its role as a leader in the industry. This recognition from the Ministry of Commerce also affirms Shixiang Fresh Produce’s 11 years of dedication to supply chain management, its mature digital operation capabilities, and its refined cold chain delivery system. Additionally, Shixiang Fresh Produce has served as a positive example in upgrading e-commerce quality, innovating public services, promoting rural revitalization, and contributing to the establishment of national industry standards.

As a comprehensive operator of urban digital “vegetable baskets,” Shixiang Fresh Produce provides citizens with diversified, personalized, and high-quality fresh food services. The company’s fresh food delivery service covers 3,000 community sites in Suzhou, Wuxi, Nantong, and other areas, with a total of 190,000 community fresh food smart lockers, becoming a convenient facility within community living circles. The smart locker delivery model used by Shixiang Fresh Produce is currently regarded as the first profitable fresh food e-commerce model in China, offering advantages of replicability, scalability, and sustainable development.

Tailoring its operations to urban living characteristics and consumer demands, Shixiang Fresh Produce has developed a mature digital “vegetable basket” comprehensive operation system. This system integrates four-dimensional consumption service scenarios: C-end digital fresh retail, B-end major clients, offline community stores, and digital farmers’ markets. Through digital platforms and end-to-end cold chain facilities, the company has bridged the “last mile” in the distribution of fresh agricultural products, enhancing circulation efficiency and supply quality. The National Development and Reform Commission has praised it as a “truly meaningful urban ‘vegetable basket.’”

The Shixiang Fresh Produce platform offers over 14,000 products across 23 major categories, including vegetables, fruits, meat, poultry, eggs, seafood, dairy, baked goods, grains, oils, and snacks, providing consumers with a wide range of choices. The platform has fully digitalized its operations across procurement, supply, purchase, sales, and distribution, offering users a high-quality fresh food shopping experience. Since its establishment in 2012, Shixiang Fresh Produce has upheld its mission of “ensuring every family can eat safe food.” Over the past decade, the company has strictly controlled quality and safety, improved its cold chain delivery and safety traceability systems, and built a trusted public “vegetable basket.” It has become the top choice for Suzhou citizens when buying groceries via mobile devices.

Being named a “National E-Commerce Demonstration Enterprise” is another new milestone for Shixiang Fresh Produce. The company will continue to leverage the new economic advantages of the Internet+Agriculture model, deepen cooperation with agricultural product bases, and continually enhance its digital capabilities to promote high-quality development. Shixiang Fresh Produce is also committed to fully embracing oversight from the government, society, and its users, constantly improving its quality and service levels, and making greater contributions to the development of the public’s “vegetable basket.”