Cost Dry Ice Pack Sheet: 2025 Budget & Sizing Guide

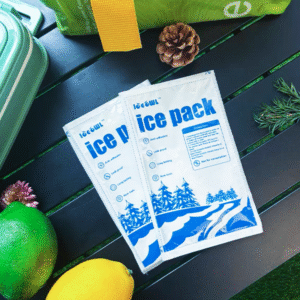

If you’re planning cold shipments in 2025, a cost dry ice pack sheet can trim fees, simplify compliance, and stabilize temps. This guide shows how to price the sheet, size it to your lane, and model true landed cost. Example market bundles span small multi‑packs to bulk cartons, with unit prices dropping sharply at volume—vital context when you ship weekly or scale seasonally.

-

Cost drivers: Materials, size, and volume that shape a cost dry ice pack sheet price.

-

When to choose it: Use cases where sheets beat gel packs or dry ice pellets.

-

Sizing & validation: Pack‑out templates and a quick cost model you can copy.

-

Trends 2025: What’s changing in refrigerants, compliance, and sensors.

What drives a cost dry ice pack sheet budget in 2025?

Short answer: Materials and order size dominate your cost dry ice pack sheet budget. SAP resin and nonwoven media set the base price, while films, assembly, QA, and packaging add smaller shares. Unit cost falls 30–60% when you move from retail multi‑packs to pallet buys. For planning, expect reusables at a higher sticker price but lower cost‑per‑use over time.

Cost_Dry_Ice_Pack_Sheet_2025

Why it matters to you: You pay for absorbency, durability, and format. Twenty‑four‑cell blankets wrap products and reduce hot spots, cutting product loss. Reusable sheets spread cost across dozens of turns. Disposable, two‑ply options favor one‑way lanes. Typical 2025 examples: six‑pack ≈ US$32.95; twelve‑pack ≈ US$59.95; 250‑pack ≈ US$759; 428‑count two‑ply ≈ US$435.99. Use these as reference points when benchmarking quotes.

Cost_Dry_Ice_Pack_Sheet_2025

Materials that shift a cost dry ice pack sheet price

Details: SAP (super‑absorbent polymer) drives water uptake and cold release. PP nonwoven adds strength and wicking. Outer films improve seal integrity and puncture resistance. Reusable, multi‑layer constructions cost more upfront but survive washing and refreezing, lowering cost per cycle—useful for closed‑loop routes.

Cost_Dry_Ice_Pack_Sheet_2025

| Bill of Materials & Signals | Typical share | 2025 notes | What it means for you |

|---|---|---|---|

| SAP resin (sodium polyacrylate) | 35–55% | Pay for capacity and grade | High SAP share → price sensitivity |

| Nonwoven substrate | 15–25% | Spunbond PP is common | Impacts durability and wicking |

| Films/lamination | 10–20% | PE/PET blends | Affects leak resistance, printability |

| Assembly & QA | 5–10% | Heat sealing, inspection | Tighter QA reduces failures |

| Packaging/logistics | 3–10% | Cartons, inbound freight | Pallet buys drop unit cost |

Practical tips and quick wins

-

For one‑way lanes: Pick disposable two‑ply sheets to cut retrieval logistics.

Cost_Dry_Ice_Pack_Sheet_2025

-

For steady routes: Standardize on a 24‑cell reusable and buy by pallet to reduce changeovers and unit price.

Cost_Dry_Ice_Pack_Sheet_2025

-

Freeze only what you need: Align water load and freeze time to lane dwell; it trims energy and labor.

Real case: A seafood DTC brand replaced 5 lb dry ice with two 24‑cell blankets. Hazmat labels went away, seasonal CO₂ surcharges dropped, and product stayed under 5 °C for 32 h on a +25 °C lane.

Cost_Dry_Ice_Pack_Sheet_2025

When should you choose a cost dry ice pack sheet over gel packs or dry ice?

Short answer: Choose a cost dry ice pack sheet for 2–8 °C or frozen lanes up to ~48 h where you want predictable cooling, no CO₂ off‑gassing, and simpler training. Gel packs are cheaper for short, chilled trips. Dry ice pellets still win for ultra‑cold (< −40 °C) or extreme ambient heat but add hazmat labels and handling limits under air rules.

Cost_Dry_Ice_Pack_Sheet_2025

Why it helps you: Sheets hydrate in minutes, freeze quickly, and conform to product shapes. That reduces thermal dead zones and the number of refrigerant units you need. Teams also avoid CO₂ exposure management common with dry ice and streamline SOPs for pack rooms.

Cost_Dry_Ice_Pack_Sheet_2025

Sizing a cost dry ice pack sheet to your payload

Step‑by‑step: Match sheet size and water load to product mass and container volume. Start with a single 24‑cell for 1–3 kg food kits, two sheets for 4–8 kg proteins, and medical‑grade variants for 2–8 °C pharma routes. Validate with 2–3 loggers, a heat‑ramp, and a door‑open test. Record “time‑in‑range” and adjust sheet count, not carton size.

Cost_Dry_Ice_Pack_Sheet_2025

| Use case | Typical lane | Starting point | What it means for you |

|---|---|---|---|

| 1–3 kg meal kits | 24–36 h parcel, 0–5 °C | 24‑cell, ~500–700 g water | Conforms to trays; fewer hot spots |

| 4–8 kg proteins | 36–48 h parcel, 0–5 °C | 2× 24‑cell, 700–900 g each | Redundant coverage for longer lanes |

| Vaccines (2–8 °C) | 24 h air | 16‑cell medical‑grade | Validated SOPs reduce excursions |

| Frozen desserts | 24–36 h, −10 to −18 °C | 24‑cell + EPS liner | Maintains frozen without CO₂ |

Compliance snapshot you should know

-

Air shipping with dry ice triggers UN1845/Class 9 labeling and weight marks; sheets avoid that paperwork.

-

Workplace CO₂ exposure limits still require ventilation and training—irrelevant for sheets, relevant for pellets.

-

Document your validation; it protects service levels and claims.

How do you model total landed cost for a cost dry ice pack sheet?

Quick answer: Add sheet price, water, energy, labor, packaging, inbound freight, and any outbound weight deltas—then subtract compliance admin you avoid. Use the same model across vendors so quotes are comparable.

Self‑check (score 0–3 each):

-

Do you buy by pallet?

-

Are pack‑outs standardized by lane?

-

Do you log “time‑in‑range” on every PQ?

7–9: You’re optimized. 4–6: Pilot changes. 0–3: Start with sizing and pallet buys.

2025 trends shaping your cost dry ice pack sheet plan

Trend overview: In 2025, teams dual‑spec sheets and dry ice to ride CO₂ supply swings, while reusable, multi‑layer sheets gain share for closed‑loop routes. Affordable data loggers and simple IoT beacons make “time‑in‑range” audits routine, improving right‑sizing and lowering over‑packing. Sustainability pushes mixed solutions: recyclable insulation plus validated pack sheets.

Cost_Dry_Ice_Pack_Sheet_2025

What’s new at a glance

-

Smarter validation: Low‑cost loggers make abuse tests part of weekly SOPs.

Cost_Dry_Ice_Pack_Sheet_2025

-

Reusables rise: Multi‑layer sheets last longer and cut waste per order.

Cost_Dry_Ice_Pack_Sheet_2025

-

Mixed refrigerants: Sheets plus PCMs balance chilled and frozen SKUs in one shipper.

Cost_Dry_Ice_Pack_Sheet_2025

Market insight: Bulk buys compress unit price; example bundles show ~US$5 per sheet in 12‑packs dropping to nearly US$3 in 250‑packs, while disposable two‑ply options approach ~US$1—useful for one‑way lanes.

Cost_Dry_Ice_Pack_Sheet_2025

Frequently Asked Questions

1) Is a cost dry ice pack sheet actually “dry ice”?

No. It’s a water‑activated, frozen blanket—not solid CO₂—so it avoids CO₂ off‑gassing and hazmat labels.

Cost_Dry_Ice_Pack_Sheet_2025

2) How long does a cost dry ice pack sheet stay cold?

For chilled lanes, often 24–48 h when sized correctly; frozen lanes need liners and sometimes additional sheets. Validate with data loggers.

Cost_Dry_Ice_Pack_Sheet_2025

3) Reusable or disposable for my route?

Frequent shippers benefit from reusables; one‑way or remote deliveries lean disposable to avoid returns.

Cost_Dry_Ice_Pack_Sheet_2025

4) How many sheets do I need?

Start with one sheet per ~6–7 L of interior volume, then tune by season and product mass. Log “time‑in‑range.”

Cost_Dry_Ice_Pack_Sheet_2025

5) Any safety notes if I still use pellets?

Train on PPE and ventilation; CO₂ exposure limits apply. Sheets remove those steps for many lanes.

Cost_Dry_Ice_Pack_Sheet_2025

Summary & Recommendations

Key points: A cost dry ice pack sheet lowers hazmat friction, improves thermal coverage, and gets cheaper at volume. Reusables win on cost‑per‑use in closed loops; disposables fit one‑way lanes. Standardize pack‑outs by lane and measure “time‑in‑range” to right‑size refrigerant.

Cost_Dry_Ice_Pack_Sheet_2025

Next steps:

-

Pick your “primary” sheet (e.g., 24‑cell) and validate three lanes.

-

Model landed cost with the formula and compare vendors.

-

Move to pallet buys and add a weekly abuse test.

CTA: Need a validated template? Request a lane‑specific pack‑out from our team.

About Tempk

We design and validate pack‑out solutions—cost dry ice pack sheet formats, gel packs, insulated shippers, and data‑driven SOPs—for food, life sciences, and e‑commerce. Our lab work meets real‑lane data, so you get fewer hot spots, fewer chargebacks, and lower total cost. Two practical advantages: repeatable validation and pallet‑level pricing to scale without surprises.

Ready to optimize? Contact Tempk for a lane‑specific pack‑out and a cost model you can share with procurement.