Cold Chain Vegetables Market Analysis: Win 2025?

Last updated: December 17, 2025

A cold chain vegetables market analysis is how you stop guessing and start protecting margin. Globally, about 13.2% of food is lost between harvest and retail, and fruits/vegetables have among the highest loss rates—so small fixes can create big gains. You don’t need perfection. You need repeatable control over time, temperature, humidity, and handling—lane by lane.

This article will help you:

-

Use fresh produce cold chain demand forecasting to plan lanes, capacity, and service tiers

-

Understand vegetable cold storage pricing drivers (and where you can negotiate)

-

Decide when last-mile refrigerated delivery for vegetables is worth paying for

-

Prioritize pre-cooling vegetables after harvest to cut shrink fast

-

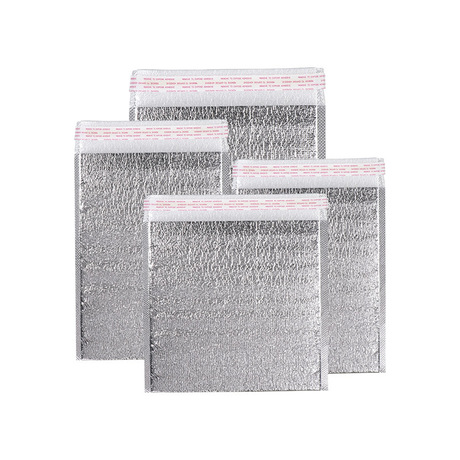

Apply reusable cold chain packaging for vegetables to stabilize quality during delays

What does a cold chain vegetables market analysis actually measure?

Core answer: A cold chain vegetables market analysis measures profit leakage, not just “temperature compliance.” It connects real-world events—warm staging, door-open loading, condensation, shocks—to shrink, markdowns, claims, and churn. If you can’t price the leak, you can’t fix it.

Think of it like a health check for your vegetable business. Your product may look fine at pickup, then arrive “tired” after a few avoidable warm minutes. A good cold chain vegetables market analysis turns that into numbers your team can act on.

The Leakage Map (the first thing you should build)

In your cold chain vegetables market analysis, label leakage at five points: field heat removal, packhouse dwell time, cold storage/staging, transport/cross-docks, and last-mile handoff.

cold chain vegetables market an…

| Leakage point | Common trigger | What you measure | What it means for you |

|---|---|---|---|

| Field heat removal | No pre-cool capacity | Time-to-cool, pulp temp | Shorter shelf life, higher shrink |

| Staging | Long waits, doors open | Warm-up minutes | Condensation + decay complaints |

| Storage | Hot spots, poor airflow | Zone deltas | “Hidden” quality variability |

| Transport | Delays, missed slots | Time above spec | Claims, rejections, refunds |

| Last mile | Doorstep exposure | Minutes in ambient | Bad reviews, repeat refunds |

Practical tips you can use this week

-

Add one KPI: “minutes from harvest to first stable chill.”

-

Track dock time: measure time outside refrigeration, not just truck setpoint.

-

Create a lane baseline: one cheap temperature logger per risky lane is enough to start.

cold chain vegetables market an…

Real-world example: A retailer found one store’s receiving dock added ~45 minutes of warm exposure daily. Fixing scheduling beat changing packaging.

cold chain vegetables market an…

How does fresh produce cold chain demand forecasting change in 2025?

Core answer: In 2025, fresh produce cold chain demand forecasting must assume tighter delivery windows, more online grocery volume, and less tolerance for “average” quality. That pushes you toward lane-level planning, not monthly averages.

Online grocery keeps reshaping fulfillment pressure. For example, Brick Meets Click reported $11.2B U.S. online grocery sales in August 2025 (about +14% YoY), which increases cold-chain exceptions simply because volume is higher. Brick Meets Click

The channel split you should use in your cold chain vegetables market analysis

-

Retail: consistency wins (appearance + predictable shelf life).

-

Foodservice: timing and format wins (cut/washed, portioned, reliable windows).

-

Export: compliance + delay math wins (border holds can erase sell window).

Mini decision tool: “Opportunity Filter” (0–10)

Score each lane 0–2:

-

Shelf-life sensitivity (leafy greens = 2)

-

Distance/time to customer

-

Buyer penalties for defects

-

Seasonality volatility

-

Last-mile exposure risk

0–3: basic controls + low-cost packaging

4–7: monitoring + tighter SOPs

8–10: premium lane (validated packout + strong proof)

Which vegetable cold storage pricing drivers hit margins hardest?

Core answer: The biggest vegetable cold storage pricing drivers are energy, labor/handling, variability (dwell time), and compliance/reporting. The silent killer is variability: the same lane can be profitable Monday and painful Friday.

In your cold chain vegetables market analysis, separate cost buckets so you stop “blaming refrigeration” for process problems.

The 4 cost buckets (don’t blend them)

-

Cooling cost: pre-cool + storage energy

-

Handling cost: touches, staging, labor

-

Transport cost: linehaul reefer + last mile

-

Packaging cost: insulation + coolant + fit

Quick “Loss-to-Profit” calculator (interactive)

Fill in rough numbers:

-

Weekly shipped volume (kg): ____

-

Gross margin per kg: ____

-

Current shrink/claims (%): ____

-

Target shrink/claims (%): ____

-

Weekly savings = Volume × Margin × (Current% − Target%)

If weekly savings are stable, your cold chain vegetables market analysis becomes a payback plan—not a debate.

Why is pre-cooling vegetables after harvest your fastest ROI lever?

Core answer: Pre-cooling vegetables after harvest removes field heat early, which slows quality decline and reduces shrink faster than “better trucks” alone. In most operations, the first hours matter more than the last miles.

Treat warm minutes like interest on a loan. Every extra warm step adds “quality debt” you pay later in claims, markdowns, and churn.

Three rules to add to your SOP (simple, not perfect)

-

Harvest-to-cool rule: reduce time to first cooling step.

-

Handoff notes: record temps at farm → hub → truck.

-

Staging discipline: never stage in sun or on hot concrete.

cold chain vegetables market an…

Real-world example: A regional distributor cut leafy-greens shrink mainly by shortening warm exposure—not by buying new trucks.

cold chain vegetables market an…

When is last-mile refrigerated delivery for vegetables worth paying for?

Core answer: Last-mile refrigerated delivery for vegetables pays off when the lane is high sensitivity, high penalty, or high exposure. It doesn’t always pay off for hardy SKUs if you can fix staging and packout first.

Amazon’s 2025 expansion of same-day grocery delivery shows where customer expectations are heading: perishable grocery same-day availability expanded across 1,000+ U.S. cities with plans to reach 2,300. Even if you don’t sell on Amazon, your customers learn “fast and fresh.” Reuters+1

A simple service-tier framework (useful in contracts)

-

Standard: basic temperature band, basic proof

-

Tight-temp: stricter windows + lane monitoring

-

Premium: validated packout + exception playbook + reporting

In your cold chain vegetables market analysis, pricing works best when proof and risk-sharing are explicit. Otherwise, “per pallet” pricing quietly becomes “you eat every mistake.”

How does reusable cold chain packaging for vegetables reduce loss?

Core answer: In a cold chain vegetables market analysis, packaging is not a cost center—it’s an insurance policy against delays, door openings, and last-mile swings. The goal is not “thicker.” The goal is “matched to the lane.”

Your packout should depend on three variables: lane time, ambient risk, and product sensitivity.

cold chain vegetables market an…

Packaging levers that usually pay back

| Packaging lever | What it changes | When it matters most | What you gain |

|---|---|---|---|

| Right-size insulation | Heat gain rate | Hot seasons, long lanes | Fewer warm events |

| Liners/barriers | Moisture migration | Cross-dock humidity swings | Better appearance |

| Venting/airflow | Respiration gas build-up | Greens, herbs | Longer freshness |

| Separation/trays | Bruising | Mixed loads | Lower damage claims |

Practical packout guidance by lane length

-

Short lane: fast handoff + consistent loading temp

-

Medium lane: insulation + monitoring to manage delay risk

-

Long lane/export: redundancy (packaging + monitoring + contingency cooling)

cold chain vegetables market an…

Real-world example: A meal-kit supplier reduced “sad greens” complaints by upgrading liners and packout discipline—without changing carriers.

cold chain vegetables market an…

What compliance and sustainability changes matter in 2025?

Core answer: Compliance pressure is rising, and refrigerant/transport rules are reshaping costs. Your cold chain vegetables market analysis should include traceability readiness and an equipment roadmap—especially for regulated corridors.

Traceability (U.S. example you should track)

The U.S. FDA has proposed extending the FSMA Food Traceability Rule compliance date by 30 months to July 20, 2028 (from January 20, 2026). U.S. Food and Drug Administration+1

Even outside the U.S., this trend matters because large buyers often copy compliance patterns.

Emissions rules (California example)

CARB’s TRU rules include a path requiring truck TRUs operating in California to be zero-emission by December 31, 2029. 加利福尼亚空气资源委员会+1

That can tighten carrier capacity and shift pricing models (more surcharges, more leasing).

Refrigerants (EU example)

The EU F-gas Regulation (EU) 2024/573 was adopted Feb 7, 2024 and applies from Mar 11, 2024. Climate Action+1

If you run cross-border operations, refrigerant pathway decisions now affect long-term serviceability and cost.

What technology pays off first in a cold chain vegetables market analysis?

Core answer: In 2025, the fastest payback usually comes from visibility and response discipline—not fancy dashboards. You need the right measurements, then a simple playbook.

cold chain vegetables market an…

Minimum viable monitoring stack (start small)

-

Lane temperature logging (baseline your riskiest routes)

-

Handoff time stamps (expose dwell time creep)

-

Exception playbook (what to do when it goes wrong)

cold chain vegetables market an…

Tip: Don’t start with 100% coverage. Start with the highest-risk lanes.

cold chain vegetables market an…

Build vs buy vs partner: how do you scale the cold chain?

Core answer: Most teams should partner first, then build selectively—especially when lanes are variable. A cold chain vegetables market analysis makes this decision measurable instead of emotional.

Decision tree (fast and practical)

-

Seasonal volume: partner, lock peak capacity early

-

Short, dense lanes: micro-hub/build can pay back sooner

-

Long, variable lanes: partner with strong coverage + strong proof requirements

cold chain vegetables market an…

What to ask partners (copy into your RFP)

-

How do you enforce pre-cooling compliance at pickup?

-

How do you control cross-dock dwell time?

-

Can you provide lane-level excursion reports by SKU class?

cold chain vegetables market an…

2025 cold chain vegetables market analysis developments and trends

Trend overview: Late 2025 is defined by faster grocery expectations, higher delivery volume, and rising proof requirements.

cold chain vegetables market an…

Operators who win will run simpler, repeatable systems—not just bigger assets.

Latest progress at a glance

-

Online grocery volume stays high: record months increase exceptions unless you standardize playbooks. Brick Meets Click

-

Same-day perishable delivery expands: customers expect speed and freshness at once. Reuters+1

-

Traceability timelines shift, but direction stays: more records, cleaner handoffs, faster root-cause. U.S. Food and Drug Administration

Market insight: A strong cold chain vegetables market analysis should assume more disputes, more audits, and more value in “proof you can show in 2 minutes.”

Frequently Asked Questions

Q1: What makes a cold chain vegetables market analysis actionable?

It ties demand to levers—time-to-cool, dwell time, packout, monitoring—so upgrades have clear payback.

Q2: Is a cold chain vegetables market analysis only for big companies?

No. Smaller operators often win faster because one bottleneck fix can cut shrink quickly.

Q3: What should I fix first: trucks, cold storage, or packaging?

Start with time-to-cool and staging discipline. Then match packaging to lane risk.

Q4: Does last-mile refrigerated delivery for vegetables always pay off?

No. It pays off on premium or high-sensitivity lanes. Otherwise, faster handoffs can be cheaper.

Q5: How often should I update my cold chain vegetables market analysis?

Quarterly, plus after seasonal shifts or route changes. Update immediately if claims spike.

Q6: What KPIs are the best “starter set”?

Shrink, claims, time-to-cool, dwell time, and temperature exceptions per lane.

Summary and recommendations

A cold chain vegetables market analysis is a roadmap to predictable quality and stable margins. Focus on the biggest leakage points: harvest-to-chill time, dock staging exposure, temperature transitions, and last-mile handling. Then use lane-based packouts and simple monitoring to stop repeat failures.

Next step (90-day plan):

-

Pick one high-loss SKU and one high-complaint lane.

-

Run a 2–4 week test with tighter SOPs + basic monitoring + lane-matched packaging.

cold chain vegetables market an…

-

Compare shrink, claims, and customer feedback.

-

Scale what works across your top 3 lanes.

About Tempk

At Tempk, we focus on practical cold chain performance—especially the “messy middle” where delays, staging, and last-mile variability damage vegetables. We help teams turn a cold chain vegetables market analysis into lane-based SOPs, packout designs, and proof-ready monitoring that reduces loss without over-engineering.

cold chain vegetables market an…

Call to action: Share your lane time, ambient season range, and your top 3 vegetable SKUs—then we’ll outline a packaging + process plan you can execute in weeks