When you start comparing ice box prices, it’s easy to fixate on the sticker. The unit cost of a cooler matters, but by 2026 the real question is: what does your insulated box actually cost you per successful delivery? You’re paying not just for foam or polypropylene but for the coolant, the tape, the labor to pack and label, the freight billed on dimensional weight, and the cost of failures when temperature control fails. Many companies discover they can save 8–15 % simply by right sizing boxes and tightening pack out processes. This guide will help you break down ice box costs like an operator. You’ll learn which factors drive expenses, how material choices like EPS, EPP, PU and VIP alter the equation, and what steps you can take to lower total cost without risking payload safety. All currency figures are based on U.S. dollars.

This Article Will Answer:

What does “ice box company cost” really include? Understand the hidden buckets of expenses beyond the box price.

Which factors drive ice box cost the most in 2026? Learn how hold time, outer dimensions, coolant, materials and compliance shape your budget.

How do different materials affect price and performance? Compare EPS, EPP, PU and VIP insulation, and know when to pay more for durability and reusability.

How do you calculate cost per shipment? Apply a simple formula to include box cost, coolant, labor, freight, failures and reverse logistics.

What strategies reduce cost without compromising temperature control? Explore right sizing, pack out discipline and reuse programs for 2026 operations.

What market trends are shaping cold chain budgets? See the latest data on cold chain logistics, cooler box market growth and regulatory developments up to January 2026.

What Does Ice Box Company Cost Really Include?

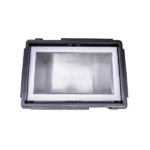

Ice box company cost is more than the purchase price of a cooler. A proper budget in 2026 includes the container, coolant, consumables, labor, freight, reverse logistics, compliance work and the cost of failures. When teams only compare unit price, they risk saving a few dollars on foam while losing much more in spoilage, re shipments or chargebacks. By mapping the entire bill of materials, you can choose the right lever to pull instead of chasing the cheapest component.

The 8 Cost Buckets

| Cost Bucket | What You’re Paying For | What Increases Cost | Significance for You |

| Container | The insulated box itself, including lid design and seals | Stronger seals, longer hold time, premium materials (EPP, PU, VIP) | Improves stability but raises upfront spend |

| Coolant | Gel packs, water packs, phase change materials, dry ice | Longer routes, hotter lanes, longer hold time | More safety but adds weight and space |

| Consumables | Liners, tape, labels, inserts | Complex pack out, multiple components | More consistency but more parts |

| Labor | Minutes per box and rework for packing | Unclear SOPs, training gaps | Hidden margin leak due to inefficiency |

| Freight | Billed weight and surcharges | Large outside dimensions, heavy coolant | Often the largest cost driver |

| Failures | Spoilage, credits, re ships | Weak design, poor pack out | A silent killer of profit |

| Reverse Logistics | Returns, cleaning, shrinkage | Weak return loop | Can erase the benefits of reuse |

| Compliance | Documentation, audits, training | Regulated lanes (e.g., pharma) | Reduces risk and rejections |

Practical Tip: Fix Hidden Costs First

Consider freight and failures before foam. If your freight line is larger than your packaging line, dimensional (DIM) weight is your first lever. If failures spike in summer, strengthen the seal, liner and packing consistency. If damage claims are common, improve outer protection. Many teams cut ice box cost by 8–15 % by right sizing and improving pack out discipline instead of downgrading insulation.

Real world example: A meal kit operator reduced outer carton size and re validated the same coolant mass. Packaging cost rose slightly, but freight fell enough to reduce total ice box cost.

What Drives Ice Box Cost the Most in 2026?

The biggest drivers of ice box cost are performance demand (hold time), outer dimensions (freight/DIM weight), insulation material, reuse lifespan, coolant mass and compliance requirements. Think of your shipper like a winter coat: thicker material keeps you warm, but the wrong size still leaves you cold. Oversized boxes create wasted void space, more coolant and higher freight bills.

Outer Dimensions & DIM Weight

Carriers often bill on the greater of actual weight or dimensional weight, which is calculated by multiplying length × width × height and dividing by a DIM divisor. A slightly larger box can jump your freight tier even if it weighs the same. To check your exposure:

Measure the outer length, width and height.

Multiply them to get cubic inches or centimeters.

Divide by the carrier’s DIM divisor (varies by service and region). For example, some domestic parcels use a divisor of 139.

Compare the resulting dimensional weight to the actual weight; you pay freight on whichever is larger.

Reducing void space lowers outer dimensions. A thicker wall may cut coolant needs but can increase size; sometimes the best move is right sizing the shipper and improving pack out geometry.

Hold Time Requirement and Coolant Mass

Hold time requirements (e.g., 24 hours vs. 96 hours) have a big impact on cost. Longer hold times require more insulation or more coolant. However, adding more coolant increases weight and volume, which can raise both the coolant and freight lines. Engineering your pack out ensures coolant placement is efficient rather than habitual.

Material and Durability

Material choice influences not only upfront box cost but also reuse potential, damage rates and regulatory compliance. We’ll compare materials in the next section.

Compliance and Documentation

Industries like pharmaceuticals face strict regulations, including continuous temperature monitoring and documentation under the U.S. Food Safety Modernization Act (FSMA) and Goods Distribution Practices (GDP). Documentation and audits add to cost but reduce risk of rejection. A robust compliance program protects shipments and can lower failure rates.

Cost Driver Summary Table

| Driver | Impact on Cost | How to Manage |

| Freight exposure | Largest cost line when outer dimensions or weight exceed carrier tiers | Right size boxes; reduce void space; choose lighter materials |

| Hold time | Longer hold requires more insulation/coolant, raising material and freight cost | Match box type to lane length; optimize pack out; use high performance materials for long routes |

| Coolant mass & placement | Habitual pack outs may add unnecessary coolant and weight | Use engineered pack outs; validate coolant quantity via thermal testing |

| Material & durability | High performance materials like EPP, PU and VIP cost more but reduce damage and enable reuse | Evaluate total cost of ownership; consider reuse cycles and damage rates |

| Reuse lifespan | Reusable boxes spread cost over multiple shipments; poor reverse logistics erase benefits | Establish return loops; track usage cycles; clean and maintain boxes |

| Compliance requirements | Documentation, audits and training add cost but prevent regulatory failures | Build compliance into workflows; leverage digital monitoring and IoT systems |

Material Choices: EPS, EPP, PU and VIP

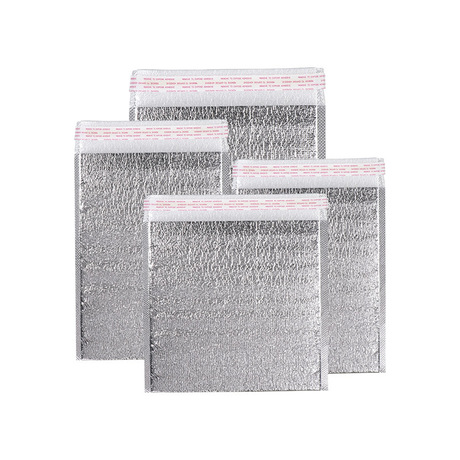

Material selection determines upfront cost, thermal performance, durability and sustainability. The common options for 2026 are EPS foam, EPP, polyurethane (PU) and vacuum insulated panels (VIP).

EPS Foam: Low Cost, Single Use Simplicity

EPS (expanded polystyrene) is a lightweight, rigid foam used in disposable coolers and insulation. It offers good thermal insulation at a low price and is easy to shape. However, EPS is brittle, not very durable and not designed for reuse. In single use lanes or low abuse shipments, EPS boxes offer a cheap solution but generate waste and may crack under stress.

EPP: Durable and Reusable

EPP (expanded polypropylene) boxes are made of closed cell polypropylene beads fused under heat and pressure. Compared with EPS, EPP offers superior shock absorption, excellent resilience and high resistance to heat, oils and chemicals. It can be reused hundreds of times and is fully recyclable. The downside is higher unit cost; EPP foam is more expensive but spreads across many turns. For high value payloads, fragile contents or companies seeking to reduce single use waste, EPP often wins on total cost of ownership.

Polyurethane (PU): Balance Between Cost and Performance

PU insulated boxes use polyurethane foam panels. They provide better thermal insulation than EPS and moderate durability. PU is often combined with EPP or corrugated shells to create hybrid boxes. It suits mid length routes where hold time is 48–72 hours. PU boxes can be reused a limited number of cycles but may degrade faster than EPP.

VIP: High Performance with High Upfront Cost

Vacuum Insulated Panels (VIP) offer thermal resistance more than twice that of common polystyrene or PU foam. By removing air from the insulation layer, VIP panels dramatically reduce heat transfer. They enable thinner walls, smaller packages and lower refrigerant usage. VIP containers are expensive; however, improved thermal efficiency and lower energy consumption can cut total cold chain transport costs by about 20 % when combined with PU. VIP containers also support reuse and sustainability initiatives.

Material Comparison Table

| Material | Upfront Cost | Durability | Reusability | Best When… |

| EPS foam | Low | Low to medium | Low | Short routes, low abuse lanes, single use. Cost sensitive shipments |

| EPP | Medium | High | High | Repeat shipments, rough handling, sustainability goals |

| Polyurethane (PU) | Medium to high | Medium | Moderate | Longer hold times (48–72 h) with moderate reuse cycles |

| VIP (vacuum insulated panels) | High | Medium | High | Ultra long hold times, tight space, regulatory compliance; cost per shipment matters more than unit price |

Bottom line: If your priority is the lowest unit cost for a one time shipment, EPS may fit. If you need durability, reuse and shock resistance, EPP is the better investment. PU balances cost and performance, while VIP excels in ultra long, high value shipments despite a higher initial expense.

Calculating Ice Box Cost Per Shipment

Understanding the true cost of an ice box means calculating cost per shipment, not per unit. The equation below sums all cost components:

Ice Box Cost per Shipment =

(Box Cost ÷ Expected Uses) +

Coolant +

Consumables +

Labor +

Freight +

Expected Failure Cost +

Reverse Logistics (if reusable)

Example Calculation

Consider a medium sized EPP box with a purchase price of $60. It is expected to be reused 60 cycles, so the box cost per use is $1.00. Add coolant ($2.50), labor and consumables ($1.20), freight ($6.00) and expected failures ($0.80). The total cost per shipment is $11.50. If you’re using a reusable box, include reverse logistics costs such as return shipping and cleaning.

Cost per Successful Delivery

Failures matter. If 5 % of shipments arrive out of temperature specification, the true cost per successful delivery equals total spend ÷ in spec deliveries. Measuring cost per successful delivery aligns finance, procurement and operations with the goal of reducing failures rather than minimizing unit price alone.

Suggested Interactive Element: Cost Calculator

To engage users and encourage action, embed a simple calculator that lets you input box price, expected uses, coolant cost, labor and freight. It can output cost per shipment and cost per successful delivery. Interactive tools increase time on page, lower bounce rate and help buyers model savings when switching materials or adjusting pack out.

Reducing Ice Box Cost Without Sacrificing Temperature

Cutting costs safely requires removing waste, not insulation. Below are proven strategies:

Right size containers: Choose a box that closely matches your payload. Reducing unused volume lowers DIM weight and coolant requirements.

Improve pack out discipline: Standardize packing procedures. Use checklists and training to ensure consistent coolant placement and minimize rework. This addresses labor leaks.

Optimize coolant: Validate the exact amount of coolant needed for your lane. Too much coolant adds weight; too little risks failure.

Enhance outer protection: Reinforce corners and edges to reduce damage claims and heat leaks.

Establish reuse loops: If using EPP, PU or VIP containers, set up return logistics with proper cleaning and tracking. Dilute cost over many turns and keep boxes in good condition.

Leverage digital monitoring: Implement IoT sensors and RFID tags to monitor temperature and location in real time. This supports compliance and reduces failure costs.

Practical case: A seafood exporter used a dual temperature VIP reefer to ship salmon and crab together. By combining products in one container, they cut shipping cost by 30 % and met different temperature requirements simultaneously.

Latest 2026 Developments and Trends

Global Cold Chain Market Growth

The global cold chain market size was $371.08 billion in 2025 and is projected to reach $1.611 trillion by 2033, growing at a 20.5 % CAGR from 2026 to 2033. This rapid expansion is driven by changing consumer preferences for fresh and frozen foods, growing e commerce sales and increased pharmaceutical demand. North America held over 33 % of revenue in 2025, reflecting robust investment in refrigerated storage and transportation infrastructure.

Cold Chain Logistics in North America

In North America, the U.S. cold chain logistics market was estimated at $91 billion in 2025 and is expected to reach $109 billion by 2030; Canada’s market will grow from $6 billion to $7 billion, and Mexico’s from $7 billion to $8 billion, yielding a combined regional market of roughly $124 billion within five years. These figures underscore the importance of efficient cold chain operations, particularly for perishable grocery delivery, foodservice distribution and biologics.

Cooler Box Market Outlook

The cooler box market reached $7.75 billion in 2025 and is on track to hit $12.83 billion by 2030, representing a 10.61 % CAGR. Growth is propelled by pharmaceutical logistics, outdoor recreation, innovations in rotomolding and insulation technologies, and regulatory shifts favoring reusable packaging. Key trends include the rise of electric/thermoelectric units (projected 10.30 % CAGR) and stainless steel hybrids expanding at 11.20 % CAGR. Personal coolers (≤ 20 qt) dominate the market with 66.50 % share in 2024, while large/commercial models (≥ 61 qt) will grow at 10.70 % CAGR.

VIP Packaging and Sustainability

The cold chain packaging market stood at $27.7 billion in 2025 and is projected to reach $102.1 billion by 2034, with a 15.6 % CAGR. VIP technology continues to gain traction due to its superior insulation and ability to reduce energy consumption by over 50 % when coupled with solar roofs. Combining VIP and polyurethane insulation can cut total transport costs by 20 % while enabling reusable containers. Regulatory frameworks such as the EU’s Ecodesign for Sustainable Products and extended producer responsibility (EPR) further encourage companies to adopt sustainable packaging solutions.

Market Drivers and Innovations

E commerce and meal kit services: As home delivery of groceries and prepared meals grows, demand for small, high performance coolers surges. Customers expect fresh deliveries; companies must invest in reliable packaging.

Pharmaceutical cold chain: Vaccine and biologic shipments require strict temperature control. The pharmaceutical cold chain was valued at $65 billion in 2025 and is expected to double over the next decade.

Digitization and automation: IoT sensors, RFID tracking and predictive analytics improve visibility and compliance, allowing companies to monitor temperature, humidity and location in real time.

Sustainability and regulations: Governments are tightening rules on single use plastics, while consumers favour environmentally friendly packaging. Reusable EPP and VIP boxes meet both cost and sustainability goals.

Investment and consolidation: Major cold storage providers like Lineage Logistics and Americold control over 50 % of U.S. cold storage capacity. New entrants such as West Coast Cold Storage, NewCold, RLS Logistics and CJ Logistics are expanding capacity with high tech warehouses. These investments improve capacity and drive down per unit costs through scale.

Frequently Asked Questions

Q1: What is the average cost of an insulated ice box?

The price of an insulated ice box varies widely by material and size. A disposable EPS cooler for a small meal kit might cost $3–$5, while a reusable mid size EPP box may run $20–$50 depending on features. High performance VIP boxes can exceed $100 per unit. Remember to calculate cost per use: an EPP box reused 60 times costs about $1.00 per shipment.

Q2: How can I calculate cold chain shipping costs?

Use the cost per shipment formula: divide the box price by expected uses and add coolant, consumables, labor, freight and expected failure costs. Don’t forget reverse logistics if the box is reusable. A calculator or spreadsheet makes this process easy.

Q3: Which insulation material is best for long distance shipments?

For long routes (72–120 hours) or temperature sensitive pharmaceuticals, VIP panels deliver the highest thermal performance, allowing smaller packages and reduced coolant. However, they come with a higher upfront cost. PU and EPP hybrids are a mid range option, while EPS suits short, low risk trips.

Q4: How do I reduce freight charges when shipping cold goods?

Focus on box size and weight. Minimize void space, choose lighter materials like EPP or VIP, and optimize coolant placement. Check dimensional weight using the carrier’s divisor and design your packaging to avoid jumping to a higher weight tier.

Q5: What are the key regulatory considerations for cold chain packaging?

In the U.S., the Food Safety Modernization Act (FSMA) requires continuous temperature monitoring and proper documentation for high risk foods. Pharmaceuticals must comply with Goods Distribution Practices (GDP) and other regional guidelines. Investing in compliant packaging and digital monitoring reduces the risk of rejection and product loss.

Summary and Recommendations

Summary: Ice box company cost goes far beyond the unit price. It includes the container, coolant, consumables, labor, freight, compliance and the cost of failures. Top cost drivers include hold time, box dimensions, insulation material, coolant mass and reuse loops. Comparing materials shows that EPP offers durability and reusability at a medium cost, PU provides balanced performance, VIP delivers superior insulation at a higher price, and EPS offers low cost but limited reuse. Calculating cost per shipment ensures that decisions align with total cost of ownership, not just the sticker price. Right sizing, pack out discipline, optimized coolant and reuse programs can reduce costs by 8–15 % without compromising safety.

Action Plan:

Map your cost buckets: List all expenses per shipment, including freight and failures. Use the formula provided to calculate cost per successful delivery.

Choose materials wisely: Evaluate total cost of ownership when deciding between EPS, EPP, PU and VIP. Consider hold time, payload value and sustainability goals.

Right size and standardize: Audit your box sizes and reduce void space. Create standard operating procedures for pack out to minimize labor and failure costs.

Invest in monitoring and compliance: Use IoT sensors and digital tracking to meet FSMA and GDP requirements and reduce failure rates.

Explore reuse and recycling programs: Implement return logistics for EPP, PU or VIP boxes and partner with suppliers that offer recycling or take back options.

By applying these steps, you’ll not only control ice box company costs but also improve service quality and sustainability in your 2026 cold chain operations.

About Tempk

Tempk is a leading provider of cold chain packaging solutions, specializing in insulated boxes, gel packs, and advanced materials like EPP, PU and VIP. We combine research and development with strict quality control to deliver reliable, reusable and environmentally friendly products. Our team supports clients across food, pharmaceutical and logistics industries with customized solutions, regulatory guidance and continuous innovation. We’re committed to helping you lower per shipment costs while ensuring temperature safety and compliance.

Call to Action: Ready to optimize your cold chain packaging? Contact our experts for a personalized cost analysis and discover how our solutions can cut your shipping expenses without compromising product integrity.