Continuing the Discount War: RT-Mart’s Parent Company Reports a Loss of 378 Million in Half a Year, with Nearly 100,000 Paying Members

Continuing the Discount War: RT-Mart’s Parent Company Reports a Loss of 378 Million in Half a Year, with Nearly 100,000 Paying Members

In the past six months, Gome Retail (06808.HK), the parent company of RT-Mart, has faced significant challenges as it focuses on expanding its membership stores and responding to price wars.

On the evening of November 14, Gome Retail released its interim financial report for the first half of fiscal year 2024, ending on September 30. The report showed that the company’s revenue was 35.768 billion RMB, down 11.9% year-on-year, while it posted a loss of 378 million RMB, a substantial increase from the 87 million RMB loss in the same period last year. The net loss attributable to the company’s shareholders was 359 million RMB, compared to a loss of 69 million RMB in the previous year.

Gome Retail attributed the expanded loss to several factors, including the strategic contraction of its supply chain business, a decline in its supply assurance business, and underperformance against expectations. Additionally, this year the company implemented several operational adjustments, such as increasing discounts and expanding new retail formats, which added significant short-term cost pressures.

As fresh food e-commerce, membership stores, and discount stores grow, supermarket companies are facing more intense competition. After Freshippo initiated the supermarket industry’s price war in August, many supermarket companies responded by adopting a “discount-oriented” strategy. In the same month, RT-Mart launched its “No Bargaining” campaign, offering prices on products such as mochi, croissants, fresh milk, and salmon that were lower than those at Sam’s Club.

In October, RT-Mart upgraded its “No Bargaining” campaign to the “Honest Prices” promotion, covering more than 1,000 products across categories including dairy, snacks, personal care, home cleaning, grains, oils, and beverages. Gome Retail told Time Finance that the “Honest Prices” initiative will continue, and the company will enhance price competitiveness through product and vendor consolidation and by improving digital efficiency.

However, if RT-Mart cannot reduce costs from the supply chain and relies solely on lowering product prices, it may not resolve the issue of declining profits.

Currently, RT-Mart’s supply chain efforts are primarily reflected in its private label products. During the reporting period, the company launched 170 SKUs under its RT100 private label, which includes products exclusively developed by RT-Mart or in partnership with manufacturers. The promotion of private labels brought some buzz to RT-Mart in October, with its self-developed potato bread gaining popularity on social media platforms.

Gome Retail stated that its core business performance in the second quarter showed a significant narrowing of the gap compared to the previous period.

Unlike Yonghui Superstores and Bubugao Supermarket, which closed stores to cut losses, Gome Retail has continued to accelerate store expansion, adding some cost pressures. During the reporting period, Gome Retail incurred capital expenditures of 440 million RMB, up from 258 million RMB in the same period last year, mainly due to new store development, store renovations, and digital upgrades.

In the first half of fiscal year 2024, Gome Retail opened three new RT-Mart stores and accelerated the expansion of its mid-range RT-Mart Super format and M membership stores as part of the company’s second growth strategy. RT-Mart Super opened seven new stores in Jinan, Tangshan, Songyuan in Jilin, Changchun, Lanzhou, Dongguan, and other locations, with seven more expected to open by the end of the fiscal year.

After opening its first national M membership store in Yangzhou in April this year, the number of paying members has reached nearly 100,000. New stores in Changzhou and Nanjing are scheduled to open in December and January next year, respectively. To build a membership base early, the two locations launched online operations during this year’s Double 11 shopping festival.

Gome Retail revealed that M membership stores have already started preparations for their fourth and fifth stores, including new member recruitment and hiring, with three new stores expected to open by the end of fiscal year 2024. Currently, M membership stores are primarily focused on second- and third-tier cities, with locations in city centers and a community-based format that avoids direct competition with Sam’s Club and Freshippo X Membership Store during the initial growth phase. However, whether Gome Retail’s strategy of membership stores and “discount-oriented” pricing can reverse its ongoing losses will take some time to prove.

In the online B2C business, after revenue growth exceeded 15% in fiscal year 2023, the first half of fiscal year 2024 saw continued growth of 4.7%, with order volume increasing by 8.9%. The proportion of revenue from this segment rose from 18.9% to 22.6%. Among RT-Mart’s online channels, including the RT-Mart Fresh APP, Ele.me, and Taoxianda, the RT-Mart Fresh APP now accounts for more than one-third of sales.

Gome Retail stated that the group’s peak season for revenue and profits is in the fourth quarter of the fiscal year, which includes key holidays such as New Year’s, Spring Festival, and the Lunar New Year. The company plans to enhance its differentiated product offerings, optimize operational efficiency, and capitalize on the holiday season to boost performance.

It is worth noting that on March 28, after Alibaba initiated the “1+6+N” organizational restructuring, Gome Retail was integrated into the “N” segment of other business units, while Freshippo, which also operates in offline retail, announced plans to pursue an IPO.

When asked whether Gome Retail’s strategic positioning and status within Alibaba have been affected, Gome Retail responded to Time Finance by saying that Gome Retail has always been an independent listed company, with Alibaba as its controlling shareholder, and cooperation with other Alibaba business units has always followed market principles.

As of the close of trading on November 15, Gome Retail’s stock price rose 2.53%, closing at HKD 1.62 per share, with a total market value of HKD 15.454 billion.

ZIYAN FOODS DEEPENS ITS FOCUS ON THE CONVENIENT DINING SEGMENT, EXPANDS INTO PRE-PREPARED FOODS, AND ACHIEVES BREAKTHROUGH GROWTH.

As the pace of life continues to accelerate, the lifestyle of young people has undergone a series of changes. People are looking for more time to experience different things, and therefore, they seek to increase efficiency in every aspect of their lives. Since dining is an essential part of daily life, improving the efficiency of meals has become a common demand among the public. Ziyan Foods, a well-known brand in the marinated food industry, has products that meet this need for convenient dining. The company has continuously innovated in this area and last year ventured into a new convenient dining segment—pre-prepared foods. This move aims to provide consumers with greater peace of mind and more convenient dining options.

Deeply Rooted in the Marinated Food Industry

Ziyan Foods, a national chain specializing in ready-to-eat foods, originated in Sichuan, grew in Jiangsu, and is now headquartered in Shanghai. Over the years, Ziyan Foods has leveraged its extensive product line, supply chain management, and infrastructure development to establish a standardized management system. This system covers everything from raw material procurement and traceability, production process control, critical hazard point management, product inspection, and cold chain distribution. With carefully selected ingredients, unique recipes, and meticulous craftsmanship, Ziyan Foods has created over a hundred specialty dishes, including its signature dishes like Baiwei Chicken, Couple’s Lung Slices, Sichuan Pepper Chicken, and Ziyan Goose. The brand has established a strong reputation for quality, deliciousness, and health under the name “Ziyan Baiwei Chicken.”

Entering the Pre-prepared Food Segment

As a brand that has long provided convenient dining options, Ziyan Foods has observed the new generation of consumers’ growing demand for and interest in pre-prepared meals. Leveraging its R&D strengths and years of consumer insights, Ziyan Foods has launched over 40 pre-prepared dishes. These dishes have been consistently praised for both taste and quality after being tested by the market and consumers. For example, Ziyan Foods’ Lotus Leaf Chicken is made from uniformly sized, high-quality chickens raised on eco-friendly farms. After slaughter, the chickens are thoroughly cleaned to remove any impurities and odors. They are then marinated with a carefully crafted blend of more than ten natural, authentic spices, free from additives and artificial colors, preserving the original flavors of the ingredients. The chickens are marinated for 12 hours to allow the flavors to fully develop, wrapped in thick, vibrant green lotus leaves that seal in the natural aroma of the meat, and then steamed at high temperatures. Each bite of the chicken is tender, juicy, and flavorful, with the fresh fragrance of the lotus leaf infusing the meat down to the bone, satisfying consumers’ pursuit of culinary excellence.

In a fast-paced living environment, convenient dining is bound to attract more attention. As a long-established brand in the industry, Ziyan Foods is expected to continue innovating its dishes, leveraging its strengths and rich experience. The company aims to provide consumers with more novel pre-prepared food options, ensuring that even in a hectic lifestyle, people can enjoy food that combines both taste and convenience.

MAGNUM ICE CREAM SUPPORTS ‘PLASTIC REDUCTION’ INITIATIVE WITH GREEN PACKAGING, WINS PACKAGING INNOVATION AWARD

Since Unilever’s brand Walls entered the Chinese market, its Magnum ice cream and other products have consistently been loved by consumers. Beyond flavor updates, Magnum’s parent company, Unilever, has actively implemented the “plastic reduction” concept in its packaging, continually meeting the diverse green consumption demands of customers. Recently, Unilever won the Silver Award at the IPIF International Packaging Innovation Conference and the CPiS 2023 Lion Award at the 14th China Packaging Innovation and Sustainable Development Forum (CPiS 2023) for its creative packaging innovation and plastic reduction efforts that contribute to environmental protection.

Unilever Ice Cream Packaging Wins Two Packaging Innovation Awards

Since 2017, Unilever, the parent company of Walls, has been transforming its plastic packaging approach with a focus on “reduce, optimize, and eliminate plastic” to achieve sustainable development and plastic recycling. This strategy has yielded significant results, including the design innovation of ice cream packaging that has converted most products under the Magnum, Cornetto, and Walls brands to paper-based structures. Additionally, Magnum has adopted recycled materials as padding in transport boxes, reducing the use of over 35 tons of virgin plastic.

Reducing Plastic at the Source

Ice cream products require low-temperature environments during transportation and storage, making condensation a common issue. Traditional paper packaging can become damp and soften, affecting product appearance, which necessitates high water resistance and cold resistance in ice cream packaging. The prevalent method in the market is to use laminated paper, which ensures good waterproof performance but complicates recycling and increases plastic use.

Unilever and upstream supply partners developed a non-laminated outer box suitable for ice cream cold chain transportation. The main challenge was ensuring the outer box’s water resistance and appearance. Conventional laminated packaging, thanks to the plastic film, prevents condensation from penetrating the paper fibers, thus preserving physical properties and enhancing visual appeal. The non-laminated packaging, however, had to meet Unilever’s water resistance standards while maintaining print quality and appearance. After multiple rounds of extensive testing, including actual use comparisons in display freezers, Unilever successfully validated the hydrophobic varnish and paper materials for this non-laminated packaging.

Mini Cornetto Uses Hydrophobic Varnish to Replace Lamination

Promoting Recycling and Sustainable Development

Due to the special nature of Magnum ice cream (wrapped in chocolate coating), its packaging must offer high protection. Previously, EPE (expandable polyethylene) padding was used at the bottom of outer boxes. This material was traditionally made from virgin plastic, increasing environmental plastic waste. Transitioning EPE padding from virgin to recycled plastic required multiple rounds of testing to ensure the recycled material met protective performance requirements during logistics. Additionally, controlling the recycled material’s quality was crucial, requiring stringent oversight of upstream raw materials and production processes. Unilever and suppliers conducted several discussions and optimizations to ensure the proper use of recycled materials, resulting in a successful reduction of about 35 tons of virgin plastic.

These achievements align with Unilever’s Sustainable Living Plan (USLP), which focuses on “less plastic, better plastic, and no plastic” goals. Walls is exploring further plastic reduction directions, such as using paper packaging films instead of plastic and adopting other easily recyclable single materials.

Looking back on the years since Walls entered China, the company has consistently innovated to cater to local tastes with products like Magnum ice cream. In alignment with China’s ongoing green and low-carbon transformation strategy, Walls has accelerated its digital transformation while continuing to implement sustainable development strategies. The recent recognition with two packaging innovation awards is a testament to its green development achievements.

HIGH-TECH FAIR | STIMULATING INNOVATION VITALITY, ENHANCING DEVELOPMENT QUALITY

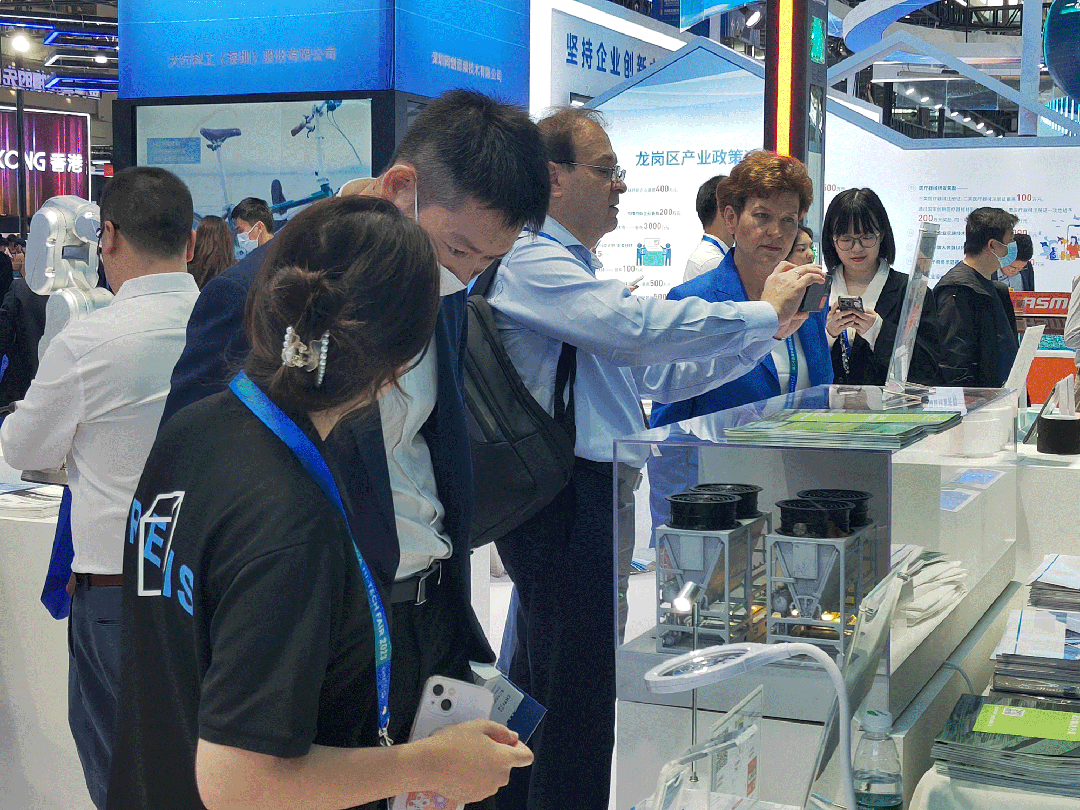

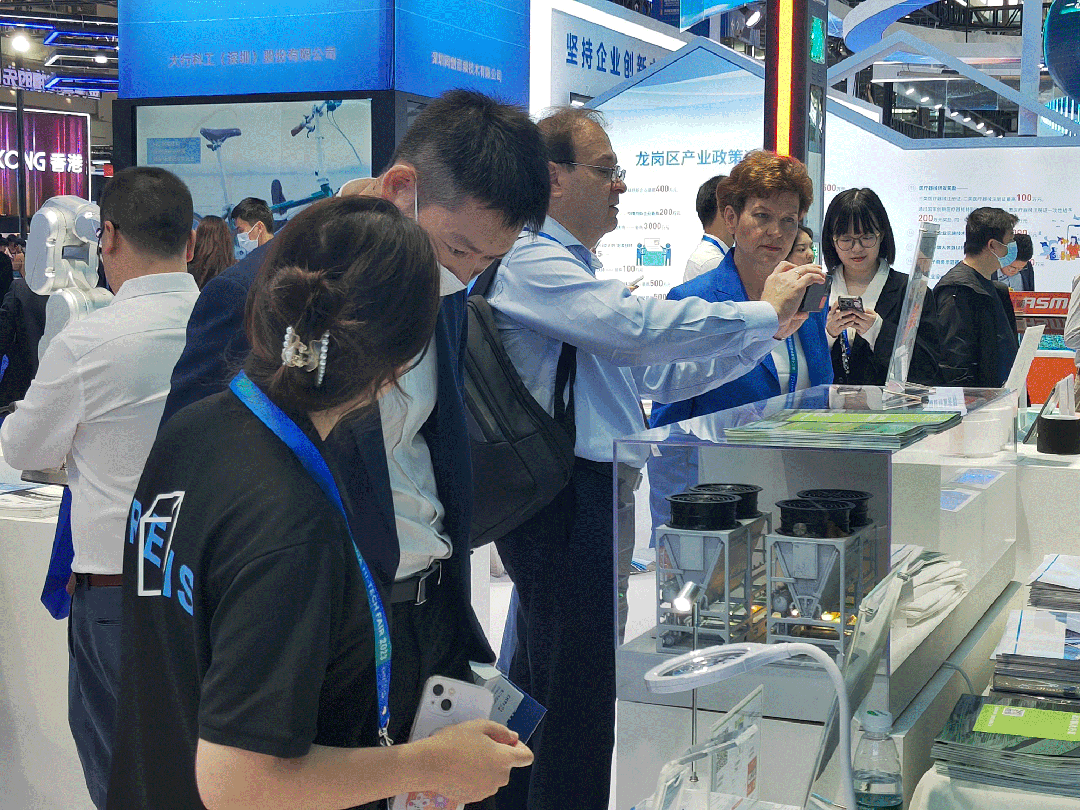

Today, the 25th China Hi-Tech Fair (CHTF) officially opened in Shenzhen, bringing an international, professional high-tech event to the forefront. This year’s CHTF is hosted in two locations: the Shenzhen Convention and Exhibition Center (Futian) and the Shenzhen World Exhibition & Convention Center (Bao’an). The event features a comprehensive exhibition, specialized exhibitions, conferences, forums, and various other activities. According to the organizers, the event has attracted participation from over 100 countries and regions, with more than 4,000 companies exhibiting across a total area of 500,000 square meters, making it the largest in the fair’s history, with a record number of participating countries and regions.

Image

At the invitation of the Bao’an District Science and Technology Innovation Bureau, Chun Jun New Materials (Shenzhen) Co., Ltd., representing Bao’an District’s specialized and innovative enterprises, is participating in the exhibition. From November 15th to 19th, Chun Jun New Materials is showcasing its cutting-edge research achievements at Booth 1D38 in Hall 1 of the Shenzhen Convention and Exhibition Center (Futian).

Image

(Second from right: Bao’an District Mayor Wang Lide; First from left: Director of Bao’an District Science and Technology Innovation Bureau Shen Yan; First from right: Director of Bao’an District Science and Technology Innovation Service Center Wang Heng, visiting the Chun Jun booth for guidance)

At this year’s CHTF, Chun Jun New Materials is exhibiting its temperature control products and solutions in the cold chain, liquid cooling, and TEC fields. The exhibition attracted numerous leaders and industry peers from home and abroad, who engaged in discussions on the development of temperature control technology and its innovative applications across various fields.

Images

In the field of liquid cooling, Chun Jun presented its immersive liquid cooling solution under its “Chun Jun Opti-Cool” brand. In recent years, the demand for computing power has surged, with single cabinet power increasing rapidly. At the same time, the national standards for data center PUE (Power Usage Effectiveness) have become increasingly stringent, posing significant challenges for data centers. The “Chun Jun Opti-Cool” immersion liquid cooling solution addresses these industry challenges by reducing the PUE value to as low as 1.1 while ensuring excellent computing capacity through efficient temperature control. Notably, Chun Jun’s self-developed CJF1 coolant offers high heat dissipation performance and a significant price advantage, reducing coolant costs for customers by 40%.

Images

Chun Jun’s Micro-TEC technology, unlike ordinary TECs, can be miniaturized to millimeter-level sizes, with extremely demanding material performance and process requirements. On the materials side, Chun Jun’s self-developed N-type and P-type bismuth telluride rank among the industry’s best. On the product side, Chun Jun’s Micro-TEC achieves breakthroughs in miniaturization while delivering high cooling efficiency and precise temperature control. The superior performance of Chun Jun’s Micro-TEC holds great potential for replacing imports in fields such as optical modules and LiDAR.

Images

Innovation is the primary driving force for development. With the theme “Stimulating Innovation Vitality, Enhancing Development Quality,” this year’s CHTF brings together high-quality innovation resources. It serves as a dynamic platform for the in-depth implementation of the innovation-driven development strategy, the comprehensive fulfillment of high-quality development tasks, and the continuous improvement of the innovation ecosystem. The event embodies the belief that “focusing on innovation is focusing on development, and pursuing innovation is pursuing the future.”

Chun Jun New Materials warmly welcomes industry peers to visit our exhibition booth, where we aim to demonstrate technological advancements, create value connections, and strengthen confidence in China’s material technologies.

We wish the 25th China Hi-Tech Fair great success!

CHINA LIFE INVESTMENT PARTNERS WITH GLP TO ACCELERATE THE LAUNCH OF REITS STRATEGIC PLACEMENT FUND.

With the establishment of the first REITs Strategic Placement Fund, China Life Investment is rapidly implementing its related investment plans.

On November 14, China Life Investment and GLP reached a comprehensive strategic partnership, focusing on GLP’s core areas of supply chain, big data, and new energy infrastructure investment and industrial ecosystem development. Notably, the collaboration will involve exploring key regional and market investment opportunities, including the use of innovative financial products such as REITs, to expand the scope and form of investment and financing cooperation.

This move is seen within the industry as a positive signal that the two parties may be preparing to launch new REITs. If successfully implemented, it could become the first project under China Life Investment’s REITs Strategic Placement Fund.

Logistics and Warehousing Investment Initiatives Begin

According to China Life Investment’s plan for the REITs Strategic Placement Fund, the fund will primarily participate in the issuance of public REITs in sectors such as consumer infrastructure, green energy, and high-end logistics. It appears that the fund’s investment focus on the high-end logistics sector may be the first to commence.

Logistics and warehousing have traditionally been active investment areas for insurance capital. Among the 29 publicly listed REITs, GLP REIT, representing warehousing REITs, has become the public REIT with the highest strategic placement by insurance capital. Insurance funds account for 30.17% of its strategic placement, with six of the top ten holders being insurance entities, including Taikang Life, Hengqin Life, Dajia Holdings, New China Life, China Insurance Investment Fund, and Guoren Property & Casualty Insurance.

Analysts believe that logistics and warehousing REITs are favored by insurance capital due to their strong growth potential and stability, which align with the long-term investment needs of insurance funds.

With economic recovery and the rapid development of the e-commerce market, the prospects for logistics real estate continue to improve. A recent report by CBRE noted that the national warehouse rental index is expected to grow by 0.6% in 2023, rising to 1.0% in 2024. First-tier cities, as well as supply-constrained second-tier cities like Dongguan, Hangzhou, and Wuxi, are expected to see annual rent increases of 2%-4%. Meanwhile, the national warehouse vacancy rate is expected to decrease to 13.2% by the end of September, compared to vacancy rates of 15%-20% for commercial real estate such as office buildings.

The continuous rise in operating income will also bring considerable returns to investors. For example, GLP REIT has completed five dividend distributions since its listing, totaling approximately 580 million RMB, with the dividend amount steadily increasing. The first two dividends per share were around 0.05 RMB, rising to over 0.08 RMB from the third distribution onward. Clearly, warehousing REITs are worth investing in.

China Life Investment has likely benefited from its investment in GLP REIT. Although China Life Investment or its major shareholder, China Life, is not listed among the holders, the China Insurance Investment Fund, one of the holders, was jointly established by China Insurance Investment Co., Ltd., China Life Insurance (Group) Company, China Life Insurance Co., Ltd., and China Reinsurance (Group) Corporation.

The collaboration between China Life Investment and GLP in REITs is not just about moving from “behind the scenes” to “center stage” or securing more holdings; it may also involve deeper strategic planning.

Why Choose GLP?

In addition to investing in GLP REIT, China Life Investment has already made several investments in the logistics and warehousing sector. These include:

● Establishing an 1.8 billion RMB private equity fund in partnership with Caixin Life, Manulife-Sinochem, and Cainiao Post, focused on high-standard modern warehousing projects held by Cainiao Network and its affiliates.

● Collaborating with China Merchants Capital and Baowan Logistics on logistics asset acquisitions and mergers.

● Jointly setting up a 10 billion RMB income-enhancing fund with GLP to invest in value-added logistics assets in key cities, participating in strategic investments in GLP, and promoting cold chain logistics center projects.

However, in the aforementioned collaborations, China Life Investment mainly participated as an “investor.”

In March of this year, the Shanghai and Shenzhen stock exchanges released the “Relevant Requirements for Insurance Asset Management Companies Conducting Asset Securitization Business (Trial),” expanding the scope of asset securitization and real estate investment trust fund (REIT) business entities to include insurance asset management companies with sound corporate governance, standardized internal controls, and outstanding asset management capabilities. Since then, insurance capital has transitioned from being an investor to also being an asset securitization manager.

This development means that insurance capital can now work with partners from the inception of REIT projects to identify potential high-quality assets, incubate them, and ultimately bring them to market through REITs. This process also allows China Life Investment to develop a strategic blueprint centered around public REITs.

Currently, the most pressing task for China Life Investment is selecting the right partners and identifying suitable high-quality assets.

GLP China, as the largest provider of warehousing facilities in the country, is an ideal partner, especially given the long-standing cooperation between the two parties. The success of the first GLP REIT has also reinforced China Life Investment’s confidence in GLP’s operational capabilities.

According to disclosures, the infrastructure assets of GLP REIT currently consist of ten warehousing and logistics parks located in key economic regions such as the Beijing-Tianjin-Hebei area, the Yangtze River Delta, the Bohai Rim, the Guangdong-Hong Kong-Macao Greater Bay Area, and the Chengdu-Chongqing Economic Circle. These assets cover a total building area of approximately 1.1566 million square meters.

Recent data shows that the operational performance of these assets remains stable. As of the end of September, the average point-in-time occupancy rate was 88.46%, and the occupancy rate, including leased areas yet to commence, was 90.78%. The effective average rent per square meter per month for contract rent and property management service fees (excluding tax) was 37.72 RMB.

In addition, GLP has a vast portfolio of logistics and warehousing assets, with over 450 logistics and industrial infrastructure facilities in China, covering more than 50 million square meters. This portfolio includes mature assets such as technology parks, data centers, and energy infrastructure, which could be candidates for future listings.

The challenge for China Life Investment and GLP moving forward will be to select the best from a large pool of resources, successfully incubate and operate these assets, and bring them to market through REITs.

The pace of new REIT listings has recently accelerated. Currently, eight products are under review, with more than 100 reserve projects in the pipeline. The REITs market is expected to expand further in both scale and scope. The market is already anticipating further advancements from GLP in the REITs space.

SF EXPRESS LAUNCHES INTERNATIONAL FRESH FOOD EXPRESS SERVICE FOR INDIVIDUALS

“SF Express Launches International Fresh Food Express Service for Individuals”

On November 7, SF Express officially announced the launch of its international express service for personal fresh food shipments.

Previously, exporting fruits was typically conducted through a business-to-business model, requiring exporters to have export qualifications and provide a range of inspection and quarantine procedures, making it difficult for individuals to send fruits abroad. To allow more international consumers to enjoy Chinese fruits, SF Express has streamlined the process for personal shipments this year. By implementing pre-declaration measures and other procedures, SF Express now enables temperature-stable fruits to be shipped internationally via personal express services, arriving at international destinations in just 48 hours.

SF Express ensures the safety and freshness of temperature-stable fruits through professional packaging, cold chain transportation, and full-process visual monitoring, thereby building a “Sky International Bridge” for China’s fresh food exports and better meeting international shipping needs.

SF Express Couriers Packing Fruits

Source: SF Express International WeChat Official Account

This year, SF Express has aggressively expanded its international operations, including launching new air routes globally. On August 20, SF Airlines opened an international cargo route from Shenzhen to Port Moresby, the capital of Papua New Guinea, and plans to invest in local infrastructure development. The “Shenzhen = Port Moresby” route is SF Airlines’ first route to Oceania.

Recently, SF Express also opened several cargo routes from Ezhou to other countries. Between October 26 and 28, new routes including “Ezhou = Singapore,” “Ezhou = Kuala Lumpur,” and “Ezhou = Osaka” were officially launched. The total number of international cargo routes operating at Ezhou Huahu Airport has now exceeded ten. Additionally, the cumulative cargo volume at Ezhou Huahu Airport has surpassed 100,000 tons, with international cargo accounting for nearly 20%.

SF Express Launches “Shenzhen = Port Moresby” Route

Source: SF Express Group Official

Notably, in May this year, SF Express outlined its international business strategy in an investor relations activity. The company prioritized Southeast Asia’s emerging markets due to China’s increased investments in the region and SF Express’s advantages in air transport networks. The company plans to expand further into the Middle East and South America.

SF Express continues to focus on enhancing its express and cross-border e-commerce logistics in Southeast Asia, emphasizing the development of “air, customs, and last-mile” core networks. By upgrading route operations, expanding the air network, investing in core customs resources, and integrating last-mile resources, SF Express aims to build a stable and efficient global network, enhancing customer experience and providing reliable services. The company is committed to creating a seamless end-to-end service, strengthening its service advantage in Southeast Asia and the Asia-Pacific region, and supporting stable cross-border business for enterprises.

ZHONGNONG MODERN HAS BEEN AWARDED THE POSITION OF VICE CHAIRMAN UNIT OF THE CHINA PRE-PREPARED FOOD INDUSTRY PARK ALLIANCE.

On November 9, the “Defining Categories · Envisioning Mindshare” Third China Pre-prepared Food Industry Innovation Development Conference and the First Yangtze River Delta New Year’s Eve Dinner Gold Award Selection & China Pre-prepared Food Industry Park Alliance Inaugural Conference grandly opened at the Shanghai International Expo Center. The conference was guided by the Institute of Agro-Products Processing, Chinese Academy of Agricultural Sciences, and the Pre-prepared Food Professional Committee of the National Agricultural Products Processing Industry Science and Technology Innovation Alliance, and organized by the China Pre-prepared Food Industry Park Innovation Development Project and Shanghai Bohua International Exhibition Co., Ltd. The conference focused on high-quality development and digital standard construction in the pre-prepared food industry, sharing the latest market trends, technological innovations, and consumer needs. It explored the practice and methods of the “high-quality development + consumption promotion + digitalization + industry cluster” model in the pre-prepared food industry park, aiming to create a new ecosystem for the development of pre-prepared foods. The event invited hundreds of companies from the pre-prepared food industry and its upstream, midstream, downstream, and related sectors to participate. Zhongnong Modern, as an enterprise within the industrial ecosystem, was invited to attend the conference.

At the conference, the establishment of the China Pre-prepared Food Industry Park Alliance was announced, which aims to promote the P500+ initiative nationwide, creating a network of pre-prepared food industry parks consisting of over 500 nodes. Zhongnong Modern, with over a decade of deep involvement in the agricultural industry, was awarded the position of “Vice Chairman Unit of the China Pre-prepared Food Industry Park Alliance.” The company, along with other participating units, will jointly initiate the development of digital infrastructure for the pre-prepared food industry and collaboratively build and share a digital industry service framework and platform.

Wang Zhenyu, Vice President of Zhongnong Modern Group and head of the pre-prepared food industry development division, gave a presentation titled “The Importance and Impact of Long-Term Development of Pre-prepared Food Industry Parks” and shared the group’s strategic industrial layout. He noted that the No. 1 Central Document clearly defines pre-prepared foods and their development strategy, emphasizing that the pre-prepared food industry chain involves multiple segments, including agricultural production, processing and distribution, catering services, and market consumption. It represents a new business model for agricultural transformation and upgrading, as well as a new channel for increasing farmers’ income and prosperity. The development of the pre-prepared food industry plays a crucial role in enhancing convenience, expanding food choices, and promoting agricultural industrialization. It also signifies innovation in the food industry, transformation in the catering industry, and adjustment in agricultural structure. Looking ahead, the development of the pre-prepared food industry will place greater emphasis on food safety and health, with a focus on personalized, customized, and branded growth based on consumer demand. The industry will also achieve higher levels of digitalization and place greater emphasis on environmental protection for sustainable development.

In the group’s strategic presentation, it was highlighted that Zhongnong Modern, as one of China’s top ten agricultural wholesale market operators and one of the top 100 agricultural product supply chain enterprises, has a comprehensive coverage from upstream supply chain procurement to various downstream sales channels and support systems. Currently, the group has established 20 modern agricultural industrial parks across China, covering over 4 million square meters, and is accelerating the construction of pre-prepared food industry park bases, gradually forming an industry park network.

At present, the construction and development of pre-prepared food industry parks have become important carriers for the implementation of national policies. The development of the group’s pre-prepared food division is driven by the strategic goal of becoming “China’s leading comprehensive operator in the pre-prepared food industry.” The company adheres to technology-led innovation, building digitalized parks, and operates with a brand-focused, standardized approach. It aims to strengthen the pre-prepared food industry through industrial clustering, providing a complete one-stop service from raw material supply, production and processing, standard setting, safety traceability, cold chain warehousing, cold chain logistics, to brand marketing. The mature industrial support in the parks allows pre-prepared food companies to improve quality, reduce costs, and increase efficiency, while big data analysis empowers the production, supply, and sales of pre-prepared foods, creating a new model for integrated industry development. The company also collaborates deeply with the government to incubate public pre-prepared food brands and transform regional advantages into industrial advantages.

In the future, Zhongnong Modern will fully leverage its role as the “Vice Chairman Unit of the China Pre-prepared Food Industry Park Alliance” to accelerate the construction of pre-prepared food industry parks nationwide. The company will integrate industry resources, build industry development platforms, define segmented categories, and incubate blockbuster pre-prepared food products, contributing to the sustainable development of pre-prepared food enterprises, the integration of primary, secondary, and tertiary industries, rural industrial revitalization, and the achievement of common prosperity.

FOSHAN GAINS ANOTHER DOMESTIC HIGH-END PRE-PREPARED FOOD POWERHOUSE.

On November 13, Guangdong Haizhenbao Food Development Co., Ltd. (hereinafter referred to as “Haizhenbao”) officially commenced operations in Chencun, Shunde. The company’s first phase covers an area of approximately 2,000 square meters, with an annual production capacity of 800 tons. Haizhenbao focuses on processing high-end pre-prepared foods, such as abalone in abalone sauce, poon choi, sea cucumbers, and fish maw, offering ready-to-heat meals. The facility aims to be a modern seafood processing plant that integrates cold chain storage, scientific research, product display, e-commerce live streaming, and immersive experiences.

Data shows that the market size of China’s pre-prepared food industry has been steadily growing in recent years. In 2023, the market is expected to reach 516.5 billion RMB. Over the next three years, the market is projected to grow at a high annual rate of around 20%, potentially becoming the next trillion-yuan market.

To better integrate resources, Xinguotong Group and Guangdong Tangxianglou have jointly established Haizhenbao. “We will further improve the supply chain, expand into midstream sectors, and meticulously produce high-quality, healthy seafood products,” said Zhu Ang, Chairman of Guangdong Tangxianglou and Haizhenbao. Haizhenbao aims to become a knowledge-driven enterprise, building a “three-in-one” research system that combines “research and industry,” “doctors and chefs,” and “laboratories and kitchens,” to promote the development of the high-end seafood industry and to carry forward traditional Chinese culinary culture.

“Some high-end pre-prepared foods that require advanced cooking skills, are time-consuming and labor-intensive, but have high nutritional value—such as abalone in abalone sauce, sea cucumbers, and fish maw—are increasingly popular in the market,” said Zheng Jiayuan, General Manager of Xinguotong Group. He added that the two companies will work closely together to develop Haizhenbao into one of the benchmark enterprises in China’s high-end pre-prepared food industry, contributing actively to Shunde’s goal of becoming the “National Capital of Pre-prepared Food” and a model for high-quality development in the national pre-prepared food industry.

Tan Fengxian, Director of the Shunde District Agriculture and Rural Affairs Bureau, noted that Shunde currently has more than 40 large-scale enterprises in the pre-prepared food industry, with revenues reaching 8.7 billion RMB. Shunde is fully implementing the “Hundreds, Thousands, and Tens of Thousands” initiative, positioning the pre-prepared food industry as a key sector for strengthening the district and enriching the people, promoting the integration of primary, secondary, and tertiary industries, and striving to become a national core demonstration area for the pre-prepared food industry.

BAOZHENG UNVEILS ‘DAIRY COLD CHAIN WAREHOUSE AND DISTRIBUTION SOLUTION’ AT 2023 CIIE

As China’s new development provides new opportunities for the world, the sixth China International Import Expo (CIIE) is being held as scheduled at the National Exhibition and Convention Center. On the morning of November 6th, Baozheng (Shanghai) Supply Chain Management Co., Ltd. hosted a new product launch and strategic cooperation signing ceremony for its dairy cold chain solution at the CIIE.

Attendees included leaders from the Cold Chain Committee of the China Federation of Logistics & Purchasing, cold chain experts from the School of Food Science at Shanghai Ocean University, as well as executives from companies such as Arla Foods amba, China Nongken Holdings Shanghai Co., Ltd., Eudorfort Dairy Products (Shanghai) Co., Ltd., Doctor Cheese (Shanghai) Technology Co., Ltd., Xinodis Foods (Shanghai) Co., Ltd., Bailaoxi (Shanghai) Food Trading Co., Ltd., and G7 E-flow Open Platform.

Mr. Cao Can, Chairman of Baozheng Supply Chain, delivered the opening speech, introducing how the company leverages its own advantages to help clients solve their dairy cold chain issues from the customer’s perspective. Mr. Cao explained that Baozheng integrates its digital technology, professional team, and extensive management experience to build its own cold storage and develop this new product—the Dairy Cold Chain Warehouse and Distribution Solution, aiming to ensure zero temperature loss for clients’ dairy products.

During the event, Mr. Liu Fei, Executive Deputy Secretary-General of the Cold Chain Committee, gave a keynote speech titled “Dairy Cold Chain Construction: A Long Road Ahead.” Mr. Liu vividly introduced the dairy industry, cold chain logistics market analysis, and current characteristics of dairy cold chains from the perspective of an industry association, offering several recommendations for the development of dairy cold chains. In a media interview, Mr. Liu urged cold chain experts like Baozheng to actively participate in the development of dairy cold chain standards and promote cold chain concepts, using platforms like the association and the CIIE to advance the cold chain industry.

Professor Zhao Yong, Vice Dean of the School of Food Science at Shanghai Ocean University, delivered a keynote speech on “Key Control Points in Dairy Cold Chains.” Professor Zhao discussed the introduction, production process, nutritional characteristics, and consumption of dairy products, described the spoilage process, shared key control points for dairy cold chain quality and safety, and highlighted four major opportunities for the future of China’s cold chain industry. In a media interview, Professor Zhao emphasized the urgent need for professional talent in the cold chain industry and encouraged closer collaboration between businesses and universities to better understand industry needs and train suitable talent.

Mr. Zhang Fuzong, East China Cold Chain Solution Delivery Director at G7 E-flow, delivered a keynote on “Transparency in Cold Chain Logistics Management,” explaining quality transparency, business transparency, and cost transparency in cold chain logistics, and sharing pathways for transparent management based on actual business scenarios.

Mr. Lei Liangwei, Strategic Sales Director at Baozheng Supply Chain, delivered a keynote on “Dairy Cold Chain Experts—Baozheng Cold Chain: Ensuring Temperature!” He introduced the dairy cold chain warehouse and distribution solution launched at this event, highlighting three service products: Baozheng Warehouse—Temperature Protection; Baozheng Transport—Zero Temperature Loss, Fully Visualized Operation; and Baozheng Distribution—Guarding the Last Mile, Fresh as New.

Finally, Baozheng Supply Chain held an electronic signing ceremony with several strategic partners, including ARLA, Nongken, Xinodis, Bailaoxi, Eudorfort, and Doctor Cheese. This strategic cooperation signing further solidified the friendly cooperative relationships between the parties. The CIIE provided a valuable platform for deeper and closer collaboration among enterprises. Baozheng Supply Chain is now a signed exhibitor for the seventh CIIE and will continue to use this national-level event for communication and display.

THE CHINA FEDERATION OF LOGISTICS AND PURCHASING COLD CHAIN COMMITTEE ATTENDS THE BAOZHENG SUPPLY CHAIN DAIRY COLD CHAIN NEW PRODUCT LAUNCH EVENT.

Baozheng Supply Chain Holds Dairy Cold Chain New Product Launch Event

On the morning of November 6, Baozheng (Shanghai) Supply Chain Management Co., Ltd. held a dairy cold chain new product launch event at the China International Import Expo (CIIE). Liu Fei, Executive Deputy Secretary-General of the China Federation of Logistics and Purchasing Cold Chain Committee, attended the event and delivered a keynote speech.

The event also featured several distinguished guests, including Professor Zhao Yong, Vice Dean of the School of Food Science at Shanghai Ocean University; Frede Juulsen, Global Head of the Infant Formula Category at Arla Foods amba; Xu Li, Supply Chain Director at China Agricultural Reclamation Holdings Shanghai Co., Ltd.; Zhu Yueqiong, General Manager of Oldenburger Dairy Products (Shanghai) Co., Ltd.; He Ziyun, Co-founder of Cheese Doctor (Shanghai) Technology Co., Ltd.; Zhu Yijie, Import Manager at Sinodis Food (Shanghai) Co., Ltd.; Huo Pei, Supply Chain Manager at Bellco (Shanghai) Food Trading Co., Ltd.; and Zhang Fuzong, East China Cold Chain Solution Delivery Director at G7 Yiliu.

The Long Road Ahead for Dairy Cold Chain Standards

Liu Fei, Executive Deputy Secretary-General of the Cold Chain Committee

At the event, Liu Fei delivered a keynote speech titled “The Construction of Dairy Cold Chains: A Long Road Ahead.” Speaking from the perspective of an industry association, Liu provided a vivid overview of the dairy industry, an analysis of the cold chain logistics market, and the current characteristics of the dairy cold chain. He also offered several recommendations for the development of the dairy cold chain.

During the media interview session, Liu Fei urged dairy cold chain experts like Baozheng to actively participate in the formulation of dairy cold chain standards and the promotion of dairy cold chain concepts. He emphasized the importance of using national-level exhibitions like the CIIE to promote and communicate about the cold chain industry, thereby driving its development.

Promoting High-Quality Development in the Dairy Cold Chain

Cao Can, Chairman of Baozheng Supply Chain, delivered the opening speech, introducing how Baozheng helps clients address their pain points in the dairy cold chain by leveraging its own advantages.

Cao emphasized that Baozheng integrates resources using its digital technology, professional teams, and extensive management experience to develop a new product— the dairy cold chain warehousing and distribution solution—aimed at ensuring zero temperature deviations for clients’ dairy cold chain products.

Cao Can, Chairman of Baozheng Supply Chain

Zhang Fuzong, East China Cold Chain Solution Delivery Director at G7 Yiliu, gave a keynote speech titled “Transparent Control of Cold Chain Logistics,” where he discussed the transparency of quality, operations, and costs in cold chain logistics. He shared practical insights into achieving transparency in cold chain logistics management based on real business scenarios.

Zhang Fuzong, East China Cold Chain Solution Delivery Director at G7 Yiliu

Professor Zhao Yong, Vice Dean of the School of Food Science at Shanghai Ocean University, delivered a keynote speech titled “Key Control Points in Dairy Cold Chains.” Professor Zhao covered topics such as an overview of dairy products, production processes, nutritional characteristics, and consumer trends. He discussed the spoilage process of dairy products, shared key control points for ensuring dairy cold chain quality and safety, and outlined four future opportunities for China’s cold chain industry.

During the media interview, Professor Zhao emphasized the urgent need for specialized talent in the cold chain industry. He encouraged enterprises to strengthen collaborations with universities to better understand industry needs and supply talent that meets industry requirements.

Zhao Yong, Vice Dean of the School of Food Science at Shanghai Ocean University

Lei Liangwei, Strategic Sales Director of Baozheng Supply Chain, gave a keynote speech titled “Dairy Cold Chain Experts—Baozheng Cold Chain: Ensuring the Right Temperature!” He provided a detailed introduction to Baozheng’s newly launched dairy cold chain warehousing and distribution solution, highlighting three key service products: Baozheng Warehouse—temperature assurance; Baozheng Transport—zero temperature deviation, fully visualized operations; and Baozheng Delivery—protecting the last mile, as fresh as ever.

Lei Liangwei, Strategic Sales Director of Baozheng Supply Chain

Finally, Baozheng Supply Chain and several strategic partners participated in a digital signing ceremony. The strategic partners included six well-known dairy companies: ARLA, China Agricultural Reclamation, Sinodis, Oldenburger, Bellco, and Cheese Doctor.

This strategic cooperation further strengthens the friendly relations between the parties!

It is platforms like the CIIE that provide opportunities for deeper and closer exchanges and cooperation between enterprises.