Shipping premium chocolates isn’t just about moving boxes – it’s about preserving a promise. Chilled chocolates logistics ensures that truffles and pralines arrive with the same silky texture and glossy finish they had leaving the factory. In 2025 consumers demand freshness, regulators enforce stricter standards and competition in e commerce is fierce. This article, updated in November 2025, explains how modern cold chain systems, innovative packaging, and smart technology keep temperature sensitive sweets safe from farm to table. With global chocolate sales topping US$1.11 trillion in 2023 and demand rising, understanding chilled logistics is essential for companies that want to delight customers while reducing waste.

Understand optimal temperature and humidity ranges for different types of chocolate, using industry guidelines and scientific insights.

Learn how cold chain logistics work and why they’re vital to a multi billion dollar industry.

Explore the latest trends in 2025, from AI driven route optimisation and IoT monitoring to geopolitical influences on capacity.

Discover practical packaging strategies to prevent bloom and melting.

See how Latin American supply chains illustrate both opportunity and challenge, emphasising resilient logistics and climate controlled storage.

Navigate the future of chilled chocolates logistics with sustainable practices, regulatory compliance and consumer centred innovations.

What Are the Optimal Conditions for Chilled Chocolates Logistics?

Why Temperature and Humidity Matter

Maintaining chocolate quality requires strict control over temperature and humidity. Chocolate is a delicate emulsion of cocoa butter, sugar and milk solids. When exposed to heat or moisture fluctuations, fats can migrate to the surface (fat bloom) or sugars can crystallise (sugar bloom), resulting in a dull appearance and crumbly texture. Research from cold chain specialists shows that chocolate should be stored between 54–68 °F (12–20 °C) with relative humidity kept below 50 % to prevent condensation. Dark chocolate, which contains more cocoa butter, tolerates the lower end of this range, while milk and white chocolate require slightly tighter control.

Understanding Chocolate Melting Points

Chocolate begins to soften long before it melts. Cocoa butter starts to melt around 86 °F to 90 °F (30–32 °C), meaning a single heat spike can ruin a shipment. Dark chocolate withstands slightly higher temperatures than milk or white varieties, but the difference is marginal. Knowing these thresholds helps logistics teams plan routes, choose transport modes and schedule deliveries during cooler parts of the day.

The Role of Humidity

While chocolate is less sensitive to humidity than many fresh foods, moisture becomes problematic when temperatures approach the condensing point. Relative humidity should stay below 50 %, and continuous monitoring is necessary to avoid sugar bloom. Pre cooling both the product and the packaging helps stabilise moisture levels throughout transit.

Practical Scenario: Temperature & Humidity Table

To manage chilled chocolates effectively, it helps to match temperature ranges with storage and shipping needs. The table below summarises standard cold chain categories and their implications for chocolate logistics.

| Cold Chain Category | Temperature Range (°F) | Typical Products | Impact on Chocolate Logistics |

| Ambient | 59–86 | Non perishable foods, some pharmaceuticals | Not suitable for chocolate; too warm and risk of fat bloom and melting. |

| Cool | 50–59 | Cheese, fresh produce | May be adequate for very short transfers but still above optimal chocolate range. |

| Refrigerated | 32–50 | Vaccines, dairy | The standard chilled zone for chocolates; prevents bacterial growth and maintains quality. |

| Frozen | –22–32 | Meat, frozen desserts | Too cold for chocolate; risk of sugar bloom and texture damage. |

How Do Cold Chain Logistics Work for Chocolate Shipping?

From Pre Cooling to Last Mile Delivery

Cold chain logistics encompass every step from pre cooling to delivery. After manufacturing, chocolates are cooled to the desired storage temperature (typically 18 – 20 °C) and placed in humidity controlled packaging. They are then stored in temperature controlled warehouses equipped with insulated panels, automated storage and retrieval systems and high density pallet racks. Transportation uses refrigerated trucks (reefers), insulated containers or air freight units with cryogenic cooling when necessary. Throughout transit, IoT sensors and data loggers transmit real time temperature, humidity and location data, ensuring deviations trigger corrective actions. This continuous chain maintains chocolate integrity from factory to consumer.

Global Demand & Market Significance

The chocolate industry is massive and growing. A 2023 estimate valued the global chocolate market at US$1.11 trillion. Major brands often ship chocolates worldwide, moving products from factories in Europe to retail hubs in Asia or the Americas. Such long journeys emphasise the need for optimised cold chains. Without consistent temperature control, premium truffles become unsellable, leading to lost revenue and wasted resources. Maintaining the cold chain isn’t just about quality; it’s about protecting brand reputation and customer loyalty.

Cold Chain Market Growth

Analysts estimate that the global cold chain logistics market is worth US$436.30 billion in 2025 and could exceed US$1.3 trillion by 2034, reflecting a compound annual growth rate (CAGR) of 13.46 %. This rapid expansion is driven by factors such as globalisation of food supply, growth of e commerce, technological advancements and rising demand for pharmaceuticals and plant based foods. Asia–Pacific is expected to grow at the highest regional CAGR of around 14.3 %. The chilled chocolate segment benefits from this growth because chocolates require precise cooling but cannot be frozen, making them ideal candidates for mid range cold chain solutions.

Key Trends Shaping Chilled Chocolates Logistics in 2025

AI Driven Route Optimisation and Predictive Maintenance

Artificial intelligence (AI) has moved from a buzzword to a practical tool in cold chain management. AI analyses historical and real time data to optimise delivery routes, predict equipment failures and forecast demand. Algorithms consider traffic, weather and delivery windows to minimise travel time and fuel consumption. Predictive maintenance uses sensor data to detect refrigeration issues before they cause a shipment failure. In 2025 AI helps chocolates arrive faster, reduces energy use and cuts spoilage.

Internet of Things (IoT) & Real Time Monitoring

IoT devices – from smart sensors and GPS trackers to data loggers – provide end to end visibility across the cold chain. Real time monitoring can detect temperature excursions and send instant alerts. Hardware for cold chain tracking held more than 76 % of market share in 2022, demonstrating widespread adoption. For chocolate shipments, IoT data ensures product safety and creates verifiable records for regulatory compliance and customer transparency.

Geopolitical Influences and Market Resilience

Geopolitical disruptions – from port congestions and trade wars to pandemic recovery – influence cold chain capacity. Recent geo political unrest has slowed transit times, reduced available ocean capacity and strained warehouse stocks. In 2025 new tariffs may further complicate international trade. Industry leaders report that despite these pressures the market is resilient and prepared to cope with fluctuations. For chocolate brands exporting across borders, partnering with integrated logistics providers who can manage customs and navigate disruptions is crucial.

New Products & Changing Consumer Preferences

Plant based and ethically sourced chocolates are not just trends – they’re redefining supply chains. Growing consumer interest in vegan and functional chocolates means more products requiring specialised refrigerated transport. By 2030, plant based foods could account for 7.7 % of the global protein market. Startups producing these goods often lack logistics expertise and look for partners capable of maintaining specific temperature profiles and flexible volumes.

Facility Upgrades & Sustainability

Many cold storage facilities were built decades ago and now face inefficiencies. Upgrades in 2025 focus on automation, improved visibility and sustainability, including phasing out HCFC and HFC refrigerants. Investments are directed toward modern, energy efficient warehouses with advanced insulation, solar powered systems and low GWP refrigerants. Such upgrades reduce carbon footprints and comply with stricter environmental regulations.

Better Distribution & Proximity to Customers

Port centric and production centric cold storage brings warehouses closer to either the shipping ports or the origins of goods. In 2025 facility expansions aim to be near key production areas and major consumer markets to shorten transit times and increase responsiveness. For chocolates, proximity to retail hubs ensures products spend less time in transit, reducing risk of temperature excursions.

Packaging Strategies to Prevent Blooming and Preserve Quality

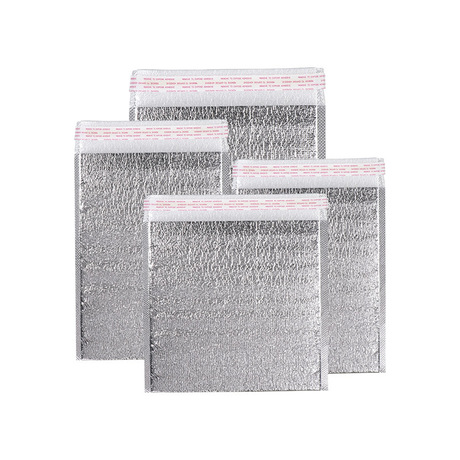

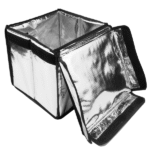

Insulation and Coolants

Proper packaging is the last line of defence against heat. Choosing the right insulation material slows heat transfer and reduces the amount of coolant needed. Common materials include expanded polystyrene (EPS) foam, cotton fibre liners, starch based foams, bubble wrap and recycled paper liners. Higher performance options like ClimaCell® combine thermal performance with sustainability. Coolants such as gel packs, dry ice and phase change materials (PCMs) absorb or release energy to maintain desired temperatures. For chocolate shipments, packers must balance insulation thickness with weight and cost, ensuring contents remain between 60 °F and 70 °F.

Primary Packaging & Moisture Control

Primary packaging must be sturdy enough for e commerce distribution and protect against condensation. Strong boxes or tins help withstand rough handling, while moisture resistant wraps prevent condensation from reaching the product. Adding desiccants or moisture absorbing liners inside the box helps avoid humidity build up.

Pre Conditioning & Pre Cooling

Temperature control starts before the truck leaves. Pre cooling chocolates to 18–20 °C and pre chilling packaging materials stabilises internal temperatures. Placing cold products into warm packaging invites condensation; conversely, pre conditioning both reduces temperature gradients and helps maintain humidity below 50 %.

Strategic Route Planning & Delivery Timing

Even the best packaging cannot compensate for poor logistics planning. Knowing melting points and weather patterns allows schedulers to ship chocolates during cooler hours and avoid routes prone to heat. Using predictive analytics and weather tracking, dispatchers adjust routes in real time to avoid heat waves or traffic delays. When possible, partnerships with carriers that specialise in temperature controlled delivery shorten transit times and reduce exposure.

Case Study: Latin American Supply Chains

Latin America produces about 20 % of the world’s cocoa, and exports of chocolate and cocoa products from the region reached US$12,142 per ton in 2024. However, delivering chocolates across the region’s diverse climates poses challenges. In Colombia, unpredictable road conditions and customs delays can slow shipments. Torrential rains in Brazil delay sugar deliveries and port congestion, while lack of climate controlled storage in Argentina risks melting. Integrated logistics providers address these issues by offering digital customs tools, climate controlled hubs and multimodal transport solutions. For example, temperature spikes in a Uruguayan boutique shipment melted an entire batch, prompting investment in climate controlled storage hubs. Last mile delivery remains difficult in mountainous areas of Chile and Venezuela, reinforcing the need for predictive analytics and resilient transport networks.

2025 Latest Developments and Trends in Chilled Chocolate Logistics

Market Growth & Regional Outlook

According to market research, the cold chain logistics market is projected to grow from US$436.30 billion in 2025 to US$1,359.78 billion by 2034. Asia Pacific leads the expansion with the highest expected CAGR, while dairy and frozen desserts currently account for the largest revenue share. The pre cooling facilities segment – which includes equipment used to chill chocolates before storage – was valued at US$204.4 billion in 2024. Dry ice technology dominated the refrigeration equipment segment, holding over 55 % share in 2024. These figures suggest strong investment in infrastructure, creating opportunities for chocolate producers to leverage new refrigeration technologies.

Post Pandemic Resilience

During the pandemic, cold chain logistics played a vital role in vaccine distribution. The crisis highlighted the importance of temperature controlled networks and accelerated investment in cold storage and transportation. As restrictions eased, demand for chilled delivery surged due to the growth of online grocery and fresh food services. Governments and industry bodies have introduced policies to expand cold chain infrastructure and reduce food waste, encouraging sustainable practices and innovation.

Five Emerging Cold Chain Trends for 2025

Market Volatility & Geopolitical Impact – Black swan events and geopolitical unrest continue to influence transit times, capacity and trade relations. Companies must build resilience through diversified routes and agile partnerships.

Enhanced Visibility – Investment in software and analytics increases supply chain visibility, enabling real time response to disruptions and improving temperature and location tracking.

Rise of New Products – Demand for plant based, gluten free and organic products with strict temperature requirements is growing rapidly, encouraging innovations in packaging and handling.

Infrastructure Modernisation – Ageing cold storage facilities are being replaced with automated, sustainable warehouses using low GWP refrigerants and renewable energy.

Strategic Distribution & Proximity – Larger, automated facilities located near production and consumption areas improve distribution efficiency and reduce transit times.

Technology Innovations: AI, IoT and Blockchain

AI enables predictive analytics for route optimisation, demand forecasting and maintenance scheduling. IoT devices provide real time visibility and compliance documentation. Emerging blockchain applications create tamper proof records of temperature data and custody transfer, enhancing traceability and trust. Combining these technologies reduces waste, improves energy efficiency and meets regulatory demands.

Sustainability & Regulations

Regulations are phasing out harmful refrigerants like HCFCs and HFCs. New guidelines encourage energy efficient equipment, eco friendly packaging and renewable energy integration. Companies adopting sustainable practices benefit from reduced operating costs and improved brand image. Consumer awareness also drives demand for ethical sourcing, recyclable packaging and carbon neutral shipping.

Frequently Asked Questions

What temperature should chocolates be stored at during shipping? Chocolates should ideally be kept between 64 °F and 68 °F (18 °C–20 °C) to maintain texture and flavour. Temperatures above 30 °C (86 °F) risk melting or fat bloom.

How do I prevent chocolate from melting during delivery? Use insulated packaging with gel packs or dry ice, pre cool products and packaging, plan routes during cooler hours and rely on experienced temperature controlled carriers.

Why is humidity important in chocolate logistics? High humidity can cause sugar bloom, where moisture condenses on the chocolate’s surface and crystallises the sugar. Maintaining humidity below 50 % and using moisture absorbing liners reduces this risk.

What technologies improve cold chain management? AI for predictive analytics, IoT sensors for real time monitoring and blockchain for traceability are transforming cold chain logistics.

How are geopolitics affecting chilled chocolates logistics? Geo political unrest, tariffs and port congestion can delay shipments and reduce capacity. Working with integrated logistics providers ensures resilience through diversified routes and digital customs solutions.

Summary & Recommendations

In 2025 chilled chocolates logistics is both an art and a science. It requires precise temperature control, humidity management and strategic planning. Market data shows the cold chain industry is expanding rapidly, with the global market reaching US$436 billion in 2025 and projected to surpass US$1.3 trillion by 2034. AI, IoT and predictive analytics are reducing spoilage and optimising routes. However, geopolitics and infrastructure challenges demand flexibility and resilience.

For chocolate manufacturers and retailers, the key takeaways are:

Adhere to strict temperature (18–20 °C) and humidity (<50 %) guidelines.

Invest in smart packaging and pre conditioning to prevent bloom and condensation.

Leverage AI and IoT for real time monitoring, route optimisation and predictive maintenance.

Partner with resilient logistics providers who can navigate geopolitical disruptions and offer climate controlled facilities.

Modernise infrastructure by adopting sustainable refrigerants and energy efficient systems.

By following these recommendations, businesses can deliver chocolate that’s as fresh and delightful as the day it was made. When done right, chilled chocolates logistics not only protects a product but also strengthens brand loyalty and supports environmental sustainability.

About Tempk

Tempk is a leader in cold chain solutions, providing innovative insulated packaging, gel packs, and IoT monitoring systems for food, pharmaceutical and specialty goods industries. We combine advanced materials with smart technology to ensure products like chocolates arrive in perfect condition. Our R&D center pioneers reusable, eco friendly cold chain products, and our global network of partners delivers reliable solutions across markets. With Tempk you benefit from cutting edge design, rigorous quality control and a commitment to sustainability.

Ready to optimise your chocolate logistics? Contact us today for a free consultation and discover how our integrated solutions can protect your products and delight your customers.