How Will the Cold Chain Market Evolve by 2030?

Updated on November 10, 2025

The cold chain market—covering temperature controlled storage, transport and packaging—underpins the safety of food, pharmaceuticals and biologics. Globally, the market is US $372.2 billion in 2025 and forecast to reach US $919.9 billion by 2032, a 13.8 % compound annual growth rate (CAGR). Such rapid expansion reflects the world’s appetite for fresh produce, biologics, and on demand meals delivered to your door. This article explains what the cold chain market encompasses, why it matters and how you can adapt to its accelerating growth.

What is the cold chain market and why is it growing? – definitions, scope and the economic forces behind temperature controlled logistics.

How large will the cold chain market become by 2030? – market size, key segments and regional shares.

What trends are shaping the cold chain in 2025? – IoT, AI, blockchain, sustainability and the rise of direct to consumer (DTC) delivery.

How do technology and regulations influence cold chain operations? – compliance, safety and traceability requirements such as FSMA 204 and BRC standards.

What practical steps can you take? – able tips, decision tools and case studies to reduce spoilage and build resilience.

What Is the Cold Chain Market and Why Is It Growing?

Cold chain market defined: At its core, the cold chain market refers to the network of temperature controlled storage, transportation and packaging solutions that keep perishable goods safe from origin to consumption. These goods include fresh produce, meat and seafood, dairy, vaccines, biologics, flowers and even cosmetics. The market spans infrastructure (refrigerated warehouses, reefer containers), services (logistics providers, last mile delivery) and materials (insulated packaging, phase change materials).

Growth drivers: The surge in demand stems from several converging trends:

Perishable food demand: Global food trade reached US $1.8 trillion in 2023. Consumers expect year round access to fresh fruits, vegetables and meat, which require careful temperature control during storage and transport. Ready to eat and convenience foods are growing even faster; they recorded a 16.54 % CAGR in the food cold chain segment.

Biologics and pharmaceuticals: Vaccines, biologics and cell and gene therapy products demand tight temperature ranges, often at –20 °C to –80 °C. These products account for over 32 % of cold chain revenue and the sector is expanding as new therapies enter the market.

E commerce and DTC distribution: The shift from business to business to direct to consumer models during the pandemic continues. Food service distributors have embraced meal kits and home delivery, requiring efficient, temperature controlled logistics.

Regulatory pressure: New food safety laws such as the U.S. Food Safety Modernization Act (FSMA) Section 204, which mandates comprehensive traceability for high risk foods by January 2026, compel companies to invest in digital monitoring and documentation.

Global infrastructure investment: Government programs like India’s National Cold Chain Development Program and China’s 14th Five Year Plan emphasise building cold chain bases and connecting production to sales.

How Large Will the Cold Chain Market Become by 2030?

A market worth hundreds of billions: Persistence Market Research projects the global cold chain market to grow from US $372.2 billion in 2025 to US $919.9 billion by 2032 at a 13.8 % CAGR. Other analysts estimate similar high growth; the food cold chain alone will reach US $121.77 billion by 2030, up from US $70.55 billion in 2025, representing an 11.53 % CAGR.

Market segments and their shares

The cold chain market breaks down into several components:

| Segment | Market Share (2024–2025) | Why It Matters |

| Storage (refrigerated warehouses, cold rooms) | ~51.8 % of the total cold chain market | Essential for holding perishable goods between production and distribution; investment in automated, energy efficient storage is growing. |

| Transportation (refrigerated trucks, containers, last mile delivery) | Fastest growing segment; road transport holds 60.55 % of the food cold chain market | Rising demand for reefer trucks and containers supports cross border food trade and vaccine distribution. |

| Monitoring & tech (RFID, IoT, telematics) | Represented 42.14 % of 2024 base; IoT telematics expected to log 15.78 % CAGR | Enables real time tracking and compliance with FSMA, EU, WHO regulations; supports predictive analytics and route optimisation. |

| Applications | Pharmaceuticals (32 % of revenue), meat & seafood, fruits & vegetables (fastest growing) | Demand for safe vaccine transport and fresh produce drives investments; ready to eat meals segment grows at 16.54 % CAGR. |

| Regions | North America holds 38.5 % share in 2025; Asia Pacific is the fastest growing region | Advanced infrastructure and strict regulations fuel North American dominance. Rapid urbanisation and investment in China and India drive Asia Pacific growth. |

Regional insights: North America leads due to advanced infrastructure, high demand for processed foods and pharmaceuticals, and strict safety standards. Asia Pacific grows fastest thanks to urbanisation, rising middle class incomes, and government investment in cold chain infrastructure. Europe, Latin America and the Middle East are also investing heavily to meet regulatory requirements and support growing exports of fresh produce and seafood.

What Trends Are Shaping the Cold Chain in 2025?

Technological innovations: IoT, AI and blockchain

Real time monitoring: Modern cold chains rely on IoT sensors to monitor temperature, humidity and vibration throughout storage and transit. These smart devices provide continuous data, alerting stakeholders when conditions deviate from set parameters so they can take corrective s. Companies can track shipments in real time, optimise routes and proactively monitor equipment performance, which increases transparency and customer satisf.

Predictive analytics: Artificial intelligence transforms raw sensor data into able insights. By analysing historical trends and real time conditions, AI systems forecast demand and help companies adjust shipping schedules, reducing waste and stockouts. Large retailers using smart sensors and machine learning algorithms have reduced spoilage by 30 %.

Blockchain for traceability: Blockchain offers an immutable ledger of every trans in the supply chain. It enhances transparency, allowing companies to trace products from farm to fork and quickly identify where a temperature excursion occurred. This capability is invaluable for compliance with food safety and pharmaceutical regulations and for reassuring consumers that their products are authentic and handled safely.

Demand drivers: e commerce, DTC and fresh foods

Direct to consumer expansion: During the pandemic, food service distributors pivoted to direct to consumer meal kits. This shift persists, requiring logistics providers to handle smaller, more frequent shipments with diverse temperature requirements. Effective cold chain management ensures that home delivered meal kits and groceries remain fresh and safe.

Rise of perishable foods and organics: Consumers increasingly demand fresh and organic products, which require precise temperature control. Urban professionals view minimally processed foods as essential rather than premium, creating opportunities for cold chain operators who can maintain nutritional integrity from production to consumption.

Explosive growth of ready to eat meals: The ready to eat meal segment is the fastest growing within food cold chain logistics, projected to grow at 16.54 % CAGR. These products often require multiple temperature zones within the same facility, pushing for innovations in packaging and facility design.

Sustainability and energy efficiency

Eco friendly packaging: Companies are adopting biodegradable and recyclable materials to reduce waste This includes plant based foams, edible films and reusable insulated containers. Such packaging not only aligns with corporate sustainability goals but also improves brand perception among eco conscious consumers.

Energy efficient operations: Cold chain logistics consume substantial energy. Innovative technologies such as solar powered cold boxes, hydrogen powered refrigeration vehicles and eco friendly refrigerants like CO₂ and ammonia are reducing carbon footprints. Transitioning frozen storage from –18 °C to –15 °C can cut energy consumption by up to 10 %, illustrating how small temperature shifts yield significant savings.

Renewable energy integration: The International Energy Agency projects that 5,500 GW of new renewable energy capacity will be added globally between 2024 and 2030. Off grid solar and hybrid systems allow cold chain operators in remote areas to maintain temperature control without relying on unstable grids.

Regulatory compliance and evolving standards

Food safety legislation: The FSMA Section 204 requires companies to maintain records of critical tracking events for foods on the Food Traceability List by January 2026. This mandates digital traceability and encourages adoption of IoT sensors and blockchain.

New warehousing standards: Retailers are shifting from older certification programs like AIB to rigorous standards such as SQF and BRC. These standards emphasise food safety, quality management and traceability. Warehouses must feature advanced temperature control, automated tracking and documented risk management protocols to maintain certification.

Cross border trade regulations: China’s Ministry of Commerce aims to achieve 25 % cold chain circulation for fruits and vegetables and 45 % for meat by 2027. Such national mandates, along with EU and WHO guidelines, are spurring investment in cold chain infrastructure, especially in developing regions.

How to Prepare Your Business for the Cold Chain Market’s Future

The cold chain market’s evolution requires proactive strategies. Here are three domains to focus on:

Invest in digital and predictive technologies

Deploy IoT sensors and telematics: Implement temperature, humidity and vibration sensors across storage and transportation assets to gain real time visibility. Choose systems that integrate with GPS for route optimisation and send alerts when conditions deviate from setpoints.

Adopt AI driven analytics: Analyse sensor data and historical demand patterns to forecast inventory needs and avoid stockouts. Predictive tools help schedule maintenance, anticipate delays and reduce spoilage.

Leverage blockchain for compliance: Use blockchain platforms to create immutable records of product origin, handling and temperature events. This fosters trust among partners and streamlines regulatory reporting.

Build sustainable infrastructure and packaging

Implement renewable energy: Incorporate solar panels, wind turbines or hybrid systems into facilities to reduce reliance on fossil fuels. Off grid solutions are especially valuable in regions with weak grid infrastructure.

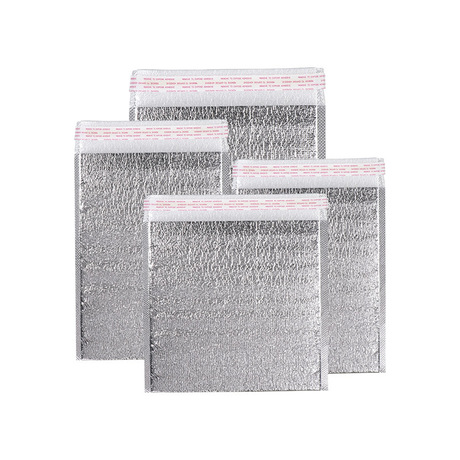

Choose eco friendly refrigerants and packaging: Transition from high GWP refrigerants to natural options like CO₂ and ammonia. Use biodegradable insulation and reusable containers to minimise waste.

Optimize storage temperatures: Explore storing frozen products at –15 °C instead of –18 °C to cut energy use without compromising safety.

Strengthen compliance and workforce capabilities

Track regulations: Stay abreast of emerging food safety and pharmaceutical guidelines (e.g., FSMA 204). Implement digital record keeping and traceability systems to demonstrate compliance during audits.

Pursue certification: Upgrade facilities to meet SQF, BRC or similar standards. Certifications improve credibility and unlock partnerships with major retailers.

Train your team: Invest in continuous education on handling temperature sensitive products, operating digital tools and responding to temperature excursions.

Mini Assessment: Is Your Cold Chain Future Ready?

Use this simple checklist to gauge your readiness. For each statement, answer Yes or No.

We monitor temperature and humidity across all assets in real time.

Our forecasting system uses historical data and AI to optimise inventory.

We can trace every shipment’s temperature history and handling events.

Our packaging is reusable, recyclable or biodegradable.

We use renewable energy or have a plan to adopt it within 12 months.

We understand and comply with FSMA 204, BRC or relevant local standards.

If you answered “No” to more than three statements, consider partnering with a cold chain expert to close those gaps.

Case Study: A large grocery retailer integrated smart sensors and machine learning algorithms across thousands of locations to track freshness levels. By doing so, they reduced spoilage rates by 30 % annually and improved regulatory compliance. This demonstrates how digital investments translate directly into cost savings and customer satisf.

2025 Cold Chain Market Trends and Future Outlook

A snapshot of upcoming innovations

Autonomous vehicles and drones: Automated delivery vehicles and drones are being tested for last mile delivery of temperature sensitive products. They reduce human error and enable quick, contactless delivery in urban areas.

Robotics and automation: Robotics in warehouses improves picking accuracy and reduces exposure to warm air. Automated storage and retrieval systems maintain temperature zones more efficiently.

Smart packaging: Packaging equipped with time temperature indicators, RFID tags and even tiny printable temperature sensors will allow consumers and regulators to verify product integrity at a glance.

Hydrogen powered refrigeration: Early trials of hydrogen fuel cells in refrigerated trucks aim to provide zero emission cooling. While still experimental, these solutions align with decarbonization goals.

Predictive analytics expansion: The predictive analytics market is expected to grow from US $10.2 billion in 2023 to US $63.3 billion by 2032. Cold chain operators will increasingly rely on data driven insights for decision making.

Market insights: drivers and challenges

The cold chain will continue to be shaped by a combination of drivers and restraints:

Drivers: Rising global consumption of frozen and perishable foods, growth in biologics and vaccines, cross border food trade and expansion of organized retail. Urbanization and the middle class expansion in Asia and Africa will boost demand for safe, fresh food.

Challenges: High energy consumption and operational costs for refrigeration equipment; lack of infrastructure in developing regions; and the environmental impact of refrigerants and emissions. Cold chain operators must balance reliability with sustainability and cost control.

Opportunities: Investments in sustainable technologies such as solar-powered cold boxes, eco-friendly refrigerants and renewable energy show promise. Government incentives and consumer demand for sustainable products will encourage widespread adoption.

FAQ

- What is the projected size of the cold chain market by 2032?

The global cold chain market is expected to reach US $919.9 billion by 2032with a 13.8 % CAGR, reflecting sustained demand for perishable foods and biologics. - How do IoT sensors improve cold chain efficiency?

IoT sensors provide real time temperature and humidity monitoring, alerting operators to deviations and enabling immediate corrective . When combined with AI, they support predictive analytics that reduces waste and optimises routes. - Why is sustainable packaging important in the cold chain?

Eco friendly packaging reduces waste and carbon emissions while protecting product integrity. Biodegradable materials and reusable containers lower environmental impact, and natural refrigerants like CO₂ and ammonia decrease global warming potential. - What regulations should cold chain operators watch in 2025?

Operators must prepare for the FSMA Section 204 traceability mandatestaking effect in January 2026. Retailers are also moving to stricter standards such as BRC and SQF, and China’s targets for cold chain circulation rates are reshaping cross border logistics. - How can small businesses afford cold chain technology?

Start with scalable solutions: deploy affordable data loggers and reusable insulated containers, partner with third party logistics providers that offer shared cold storage, and prioritise compliance for high risk products. Phase in advanced systems like IoT and AI as your business grows.

Suggestion

The cold chain market is entering a period of unprecedented growth. Driven by global demand for fresh foods, biologics and on demand deliveries, the market will surpass US $919 billion by 2032. Storage remains the largest segment, but transportation and digital monitoring are expanding rapidly. Trends like IoT, AI, blockchain, sustainable packaging and strict regulations are reshaping operations. To thrive, businesses must invest in technology, adopt sustainable practices, comply with evolving standards and foster a culture of continuous learning.

Conduct a cold chain audit: Evaluate your current infrastructure, monitoring systems and compliance status against the mini assessment above.

Develop a technology roadmap: Prioritise IoT sensors, AI analytics and blockchain to enhance traceability and predictive capabilities.

Invest in sustainability: Choose eco friendly packaging, transition to natural refrigerants and integrate renewable energy sources.

Engage with experts: Consult with cold chain specialists and join industry associations to stay informed about regulatory changes and emerging best practices.

Act now: With regulations tightening and consumer expectations rising, there is no better time to future proof your cold chain operations.

About Tempk

Tempk is a technology driven company specialising in sustainable cold chain solutions. We develop insulated boxes, phase change materials and reusable packaging that maintain precise temperature ranges for pharmaceuticals and food shipments. Our research and development centre focuses on eco friendly materials and smart sensors, ensuring that our products not only protect your goods but also align with environmental goals. We pride ourselves on flexible, customised solutions, from small parcel shippers to large pallet systems, and we back our products with robust technical support.

Action: Ready to upgrade your cold chain? Contact Tempk’s experts for a personalised consultation or explore our range of eco friendly insulated boxes and ice packs today. Empower your business with technology and sustainability.