The world of cold chain packaging is rapidly evolving. Cold chain packaging companies design and manufacture specialized containers, shippers, refrigerants and monitoring tools that protect temperature sensitive products from the factory floor to the end customer. These solutions are vital for vaccines, biologics, fresh produce, seafood, dairy and specialty chemicals. Analysts estimate the global cold chain packaging market could be worth around USD 18.7 billion in 2025 and grow to USD 36.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.9 %. Other studies report even higher numbers: some value the market at USD 30.23 billion in 2024 with a projection to reach USD 74.38 billion by 2033 (CAGR ≈ 9.99 %). This guide will help you understand what cold chain packaging companies do, why their solutions matter, the latest technologies they employ, and which companies are leading the market in 2025.

What does a cold chain packaging company do? Gain clarity on the products and services these companies provide and how they differ from general packaging suppliers.

Why is specialized packaging critical for pharmaceuticals, food, and other sectors? Learn how temperature control preserves product integrity and meets regulatory requirements.

Which technologies and materials are driving innovation in 2025? Discover how phase change materials, vacuum insulated panels, IoT sensors and sustainable materials keep goods safe.

Who are the leading cold chain packaging companies and what makes them stand out? Explore key players like Sonoco Products Company, Pelican BioThermal, Cold Chain Technologies, Softbox Systems, Cryopak and others.

What are the market trends and outlook for 2025 and beyond? Compare market forecasts from different research firms and learn about opportunities in reusable packaging, IoT integration and sustainability.

What Does a Cold Chain Packaging Company Do?

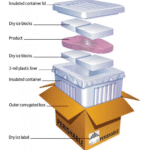

A cold chain packaging company designs, manufactures and validates solutions that keep sensitive products within specific temperature ranges during transportation and storage. These products include insulated shippers, rigid containers, pallet shippers, gel packs, refrigerants, phase change materials, vacuum insulated panels (VIPs), and data loggers. Companies also offer services such as thermal testing, route validation and packaging reuse programs. Unlike standard packaging, cold chain packaging must comply with stringent regulations and performance benchmarks. It needs to maintain temperatures from frozen (–20 °C to –80 °C) and chilled (2 °C to 8 °C) to ambient controlled (15 °C to 25 °C) or cryogenic ranges below –80 °C. These ranges correspond to the needs of vaccines, biologics, seafood, dairy, meat, chemicals and certain cosmetics.

The Role of Packaging in the Cold Chain

The cold chain is a series of temperature controlled environments through which goods move from production to consumption. Packaging sits at the core of this chain. Proper packaging ensures that products maintain their required temperature during transit, regardless of external conditions. It protects goods from vibration, shock and humidity. Packaging systems often contain phase change materials or gel packs that absorb or release heat to maintain a steady environment. High performance vacuum insulated panels provide superior thermal resistance with minimal thickness, enabling lightweight and space efficient shipments.

Companies also integrate data loggers and IoT sensors into packaging to record temperature, humidity and location. Real time monitoring alerts shippers if a container deviates from its target range, allowing interventions to prevent product loss. Leading providers may offer rental programs for reusable containers, helping clients reduce waste and operating costs while maintaining reliability.

Major Product Types and Applications

Cold chain packaging companies supply a variety of products tailored to different industries. Here are some of the main categories:

| Product Type | Typical Uses | Significance to You |

| Insulated Shippers | Single and multi use boxes used to transport vaccines, biologics and specialty foods. Often lined with EPS or VIP panels and combined with phase change materials. | Provide validated protection for shipments up to several days, ideal for sending clinical trial samples or specialty foods over long distances. |

| Insulated Containers & Pallet Shippers | Larger containers that can hold pallets or bulk products. Designed for high volume shipments in pharmaceuticals, seafood, meat and produce. | Offer robust protection and can be reused many times; pallet shippers dominate certain regions due to their large capacity. |

| Refrigerants & Gel Packs | Single use or reusable gel packs, dry ice, or phase change refrigerants to absorb or release heat. | Ensure that products stay within their target temperature ranges during transport. Choosing the correct refrigerant prevents freezing or overheating. |

| Temperature Monitoring Devices | Data loggers, RFID tags, GPS trackers and IoT sensors integrated into packaging. | Real time monitoring helps detect temperature excursions and maintain regulatory compliance, reducing product loss and liability. |

| Reusable Systems | Durable containers designed for multiple shipping cycles, often with integrated monitoring and high performance insulation. | Reduce environmental impact and long term costs; adoption is growing due to sustainability regulations and corporate ESG goals. |

Practical Tips for Selecting Packaging

Selecting the right packaging solution depends on the product, journey length and regulatory requirements. Here are some tips:

Identify the required temperature range. Pharmaceutical products might need 2 °C–8 °C or ultra low temperatures (below –60 °C for mRNA vaccines). Seafood requires –20 °C to –80 °C, while produce often requires 2 °C–4 °C. Match packaging to these requirements.

Consider trip duration and route. Long haul shipments may need VIP insulation and high capacity refrigerants. Short trips or last mile deliveries can use lightweight passive systems like gel packs or foam bricks.

Evaluate reusability. Reusable containers may cost more upfront but save money over multiple cycles and reduce waste. Many companies offer rental services with pre qualified containers.

Check regulatory compliance. Ensure packaging meets FDA, EMA or WHO guidelines for temperature control and documentation. Pre qualified systems have been tested across various temperature profiles.

Use data logging. Real time monitoring devices provide evidence of compliance, help you respond to excursions, and give customers confidence in product quality.

Case example: A biopharmaceutical company shipping cell therapy products integrated IoT enabled pallet shippers. Real time temperature monitoring allowed the shipper to respond to a refrigeration unit failure and reroute the shipment, avoiding product loss. The reusable containers saved costs over multiple shipments and reduced packaging waste.

Why Are Cold Chain Packaging Companies Important Across Sectors?

Cold chain packaging companies play a central role in maintaining product quality and safety across industries. Without proper packaging, temperature fluctuations can degrade drugs, spoil food, reduce seed viability or alter chemical properties. The result is financial loss, reputational damage and potential harm to end users. Below we explore how different sectors rely on cold chain packaging solutions.

Pharmaceuticals and Biotechnology

The global pharmaceutical industry relies heavily on cold chain packaging to transport vaccines, insulin, oncology drugs, biologics and emerging cell and gene therapies. Biologics account for nearly 30 % of all drugs, and many require ultra low temperature storage and shipment. Companies such as Sonoco ThermoSafe and Cold Chain Technologies design thermal containers with phase change materials and vacuum insulation to maintain stable conditions for up to five days or more. Pelican BioThermal focuses on reusable systems with validated thermal stability, while va Q tec provides containers using vacuum insulation panels and rental services that support cross continent distribution.

Strict regulatory standards set by agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency require comprehensive temperature monitoring, validation and documentation. If a shipment deviates from its permitted range, it may need to be destroyed, resulting in high costs and potential treatment delays. Packaging companies support compliance by offering pre qualified solutions and integrated data logging. Real time temperature monitoring alerts shipping personnel to deviations, enabling corrective action.

Food, Meat, Seafood and Produce

Fresh food supply chains are among the largest users of cold packaging. Meat, seafood and dairy are particularly sensitive to temperature changes. Insulated containers and boxes accounted for 55.2 % of the U.S. market’s revenue in 2024, reflecting their importance in protecting temperature sensitive goods. Cold packs are expected to grow at 17.6 % CAGR through 2030 due to rising demand for meal kit delivery and online grocery shopping. Fish, meat and seafood require strict low temperatures; failure to maintain them results in bacterial growth and spoilage. Cold chain packaging companies provide insulated shippers with gel packs or dry ice to keep products frozen or chilled until they reach consumers.

Consumers increasingly prefer fresh and organic foods, with e commerce and meal kit services driving demand for reliable cold packaging. Towardspackaging’s report notes that the cold chain packaging market is expected to grow from USD 34.28 billion in 2024 to USD 89.84 billion by 2034, with North America dominating due to strong demand from the food & beverage sector and expanded polystyrene (EPS) leading the material segment. Asia Pacific will show significant growth because of rising incomes and expanding cold storage infrastructure.

Chemicals and Industrial Goods

Certain chemicals, including industrial adhesives, resins and specialty polymers, degrade at high temperatures or when exposed to moisture. Cold chain packaging ensures these materials remain stable and safe during transit. Companies supply insulated drums, containers and phase change thermal covers to maintain product integrity. The cold chain packaging market for chemicals remains smaller than food or pharma but is expanding with the growth of specialty chemicals and precision manufacturing.

Life Sciences, Clinical Trials and Biobanking

Clinical trials often involve the shipment of blood samples, tissue specimens and investigational drugs. These materials can be highly sensitive to temperature and time. Cold chain packaging companies offer pre qualified shippers that maintain defined ranges (e.g., 2 °C–8 °C or –70 °C) with built in data logging. Companies such as Intelsius and CSafe Global provide specialized packaging solutions for clinical trials and biobanking, ensuring samples remain viable and data are accurate.

Cosmetics and Personal Care

Premium cosmetics and personal care products, especially those containing natural or probiotic ingredients, can degrade if exposed to heat. Packaging companies supply insulated containers and gel packs for shipping temperature sensitive creams, serums and fragrances. As the market for clean and natural cosmetics grows, so does the need for reliable packaging. Moreover, consumers expect eco friendly materials, driving innovation in compostable and recyclable insulation.

Technologies and Materials Driving Innovation in 2025

Advancements in insulation, refrigerants and monitoring technology are transforming cold chain packaging. Companies that adopt these innovations can deliver better performance, reduce waste and improve sustainability.

Phase Change Materials (PCMs) and Gel Packs

Phase change materials absorb or release heat as they change phase (solid to liquid or vice versa). This property allows them to maintain a constant temperature for extended periods without external power. According to Future Market Insights, cold chain companies are increasingly adopting PCM formulations to extend thermal protection and differentiate their products. PCM based shippers can be calibrated for 2 °C–8 °C, –20 °C or other ranges, offering flexible solutions for pharmaceuticals and frozen food. Gel packs and foam bricks continue to be widely used, with innovations focusing on longer duration and leakage prevention.

Vacuum Insulated Panels (VIPs) and Hybrid Materials

Vacuum insulated panels offer high thermal resistance in slim profiles. By creating a vacuum between panel layers, heat transfer is greatly reduced. Companies like va Q tec integrate VIPs into containers for improved insulation. Hybrid solutions combining VIPs with PCMs provide both long term insulation and temperature stabilization. The use of composite insulation and eco friendly materials, including seaweed based bioplastics, is also growing.

Sustainable Materials and Reusable Systems

Environmental concerns are prompting companies to develop sustainable packaging materials. Biodegradable foams, compostable films and recycled polymers reduce plastic waste. Expanded polystyrene (EPS) still dominates the market, but polyurethane (PUR), vacuum panels and natural materials like cotton are gaining traction. Reusable containers are another sustainability trend. Reports indicate the reusable cold chain packaging market is expected to grow from around USD 4.97 billion in 2025 to USD 9.13 billion by 2034. Reusable systems are durable, hygienic and designed for multiple cycles; they often include IoT integration and real time tracking.

IoT and Real Time Monitoring

Integrated sensors and IoT devices capture data on temperature, humidity, shock and location. These devices can transmit real time information to cloud dashboards, allowing companies to respond quickly to deviations. Temperature loggers and RFID tags help prove compliance with regulatory requirements and reduce liability. For example, Candor Food Chain in the United States uses reusable packaging with IoT sensors and real time GPS tracking to maintain shipments for up to nine days without dry ice, reducing costs and emissions. Predictive analytics built into IoT platforms can forecast when refrigeration units may fail, enabling proactive maintenance.

Artificial Intelligence and Automation

Artificial intelligence (AI) enhances route planning, temperature control and asset management. AI analyses weather patterns, traffic conditions and power availability to optimize delivery routes, reduce fuel consumption and maintain temperature stability. Machine learning algorithms predict temperature excursions and automate corrective actions. Robotics and drones inspect packaging for leaks, damage or contamination, and may even perform inventory checks in cold warehouses. AI is also improving data analysis from sensors, helping companies identify patterns and adjust packaging or operations accordingly.

Company Specific Innovations

Leading cold chain packaging companies invest heavily in R&D. Here are examples of their innovations:

Sonoco ThermoSafe: Offers a comprehensive range of passive and active systems, focusing on the ThermoSafe brand for pharmaceuticals. The company also invests in cutting edge machinery and automation to expand production capacity.

Pelican BioThermal: Specializes in reusable containers and validated thermal shippers. Its Credo™ series provides long duration temperature control and is widely used for biologics and cell therapies.

Cold Chain Technologies (CCT): Known for innovative phase change material solutions and pre qualified pharmaceutical packaging systems. In 2023, CCT acquired Exeltainer, expanding its capabilities in isothermal packaging.

va Q tec AG: Utilizes vacuum insulation panel technologies and offers rental containers. Its solutions provide long term temperature stability and are popular for international shipments.

Softbox Systems: Focuses on sustainable packaging with thermal liners and integrates IoT monitoring into containers. Softbox’s emphasis on sustainability aligns with corporate ESG goals and regulatory trends.

Cryopak: Provides specialized refrigerants, gel packs and monitoring devices for pharmaceuticals and biotech shipments. Cryopak also serves food and electronics industries.

CSafe Global: Known for active thermal containers with battery powered cooling systems and real time telemetry. These containers are used for high value biologics and long duration shipments.

Other notable players include Intelsius, Envirotainer, Sancell, Polar Tech Industries, Orora Group, CREOPACK, Sofrigam, Sealed Air Corporation, Sonoco ThermoSafe, CSafe, CoolPac, Nordic Cold Chain Solutions, Tempack, Softbox Systems, and Cryopak. Each company brings unique designs and technologies, from recyclable EPS containers to bulk shippers with integrated sensors.

Leading Cold Chain Packaging Companies and Their Differentiators

The landscape of cold chain packaging is competitive, with numerous players offering specialized solutions. Below are profiles of several companies and what sets them apart.

Sonoco Products Company (ThermoSafe)

Sonoco Products Company, through its ThermoSafe division, is one of the largest cold chain packaging providers. The company offers a wide range of insulated shippers, pallet shippers and refrigerants for pharmaceutical, biotech and food applications. Sonoco leads the market by combining validated passive systems with active systems, offering clients flexibility. Its investments in automation and state of the art machinery aim to enhance production efficiency and meet growing demand.

Pelican BioThermal

Pelican BioThermal specializes in reusable packaging solutions. Its Credo™ series includes high performance shippers built from durable materials that maintain temperature for extended durations. Pelican’s focus on reusability aligns with sustainability goals and reduces total cost of ownership for customers. The company also provides rental programs and digital tracking for each container, ensuring compliance and reducing waste.

Cold Chain Technologies (CCT)

CCT delivers innovative phase change material solutions and custom thermal designs that help clients meet regulatory requirements. Its pre qualified pharmaceutical packaging systems come with validated temperature profiles, saving time and cost for customers who need to prove compliance. The acquisition of Exeltainer in 2023 expanded CCT’s capabilities in isothermal packaging. The company also works on smart shippers that integrate IoT sensors and predictive analytics.

va Q tec AG

va Q tec is renowned for vacuum insulated panels and rental container services. These technologies provide long duration temperature control with minimal thermal mass, ideal for long haul shipments and high value pharmaceuticals. The company’s rental model gives customers flexibility without large capital investment and ensures containers are maintained to strict standards.

Softbox Systems

Softbox Systems focuses on sustainable cold chain packaging. Its solutions incorporate thermal liner technologies, phase change materials and IoT monitoring. The company designs packaging with recyclable materials and offers return programs to minimize waste. Softbox’s commitment to sustainability and performance has made it a preferred supplier for environmentally conscious companies.

Cryopak

Cryopak produces specialized refrigerants and gel packs along with insulated containers. The company caters to pharmaceutical, food and electronic industries, offering packaging solutions that protect goods during transit while providing efficient temperature control. Cryopak also provides data loggers and RFID tags for real time monitoring.

Other Noteworthy Companies

The cold chain packaging market features many other players, each bringing unique strengths:

Sancell manufactures EPS containers and sustainable shippers widely used in food and healthcare.

Polar Tech Industries produces PUR containers and gel packs known for durability.

Orora Group and CREOPACK provide regional expertise and custom designs.

Sofrigam and Intelsius specialise in high performance solutions for clinical trials.

Sealed Air Corporation and CSafe deliver active refrigeration systems and integrated tracking.

CoolPac, Nordic Cold Chain Solutions, Tempack, TOWER Cold Chain, Envirotainer and DGP Intelsius each offer niche solutions and have broad geographic reach.

The competition encourages continuous innovation, driving companies to improve performance, sustainability and cost efficiency.

Challenges and Strategies for Cold Chain Packaging Companies

Although demand is booming, packaging companies face significant challenges. Understanding these obstacles can help you select providers that anticipate and mitigate risks.

Stringent Regulations and Validation Requirements

Pharmaceutical shipments must comply with Good Distribution Practice (GDP), Food and Drug Administration (FDA) rules, and European Union guidelines. For food, safety rules like the Food Safety Modernization Act (FSMA) require documented temperature control. Packaging must be validated to maintain defined temperature profiles, and companies must maintain thorough documentation. Third party audits and requalification of reusable containers add complexity. Companies that offer pre qualified solutions reduce the burden on shippers.

Temperature Excursions and Risk Management

Even with advanced insulation, temperature excursions can occur due to delays, equipment failure or human error. A single excursion can invalidate a pharmaceutical shipment or spoil perishable food. Companies must design packaging with sufficient thermal buffering and provide real time monitoring. Cryogenic ranges, necessary for mRNA vaccines and cell therapies, demand specialized packaging with dry ice or liquid nitrogen. These packaging systems must allow venting to prevent pressure buildup while maintaining ultra low temperatures.

Cost and Supply Chain Complexity

High quality insulation materials, IoT sensors and validation processes increase costs. The global supply chain is fragmented, with multiple parties involved in production, distribution and transport. Packaging must be durable enough for the rigours of international shipping while still cost effective. Reusable systems reduce long term costs but require reverse logistics and cleaning protocols. Companies are investing in automation, predictive analytics and digital platforms to streamline operations and reduce labour costs.

Sustainability and Environmental Pressures

Governments and consumers demand eco friendly packaging. Single use plastics and non recyclable insulation face increasing scrutiny. Companies must adopt sustainable materials (e.g., compostable foams, recycled polymers, plant based plastics) and implement take back programs. Reusable containers and rental services help reduce waste. Balancing performance and sustainability remains an ongoing challenge.

Digital Integration and Data Security

Integrating IoT sensors and cloud platforms introduces cybersecurity risks. Packaging companies must secure data and comply with privacy regulations. Interoperability between shippers, carriers and monitoring platforms can be challenging. Open standards and collaboration across the supply chain are essential.

Market Trends and Outlook for 2025 and Beyond

Market research firms agree that cold chain packaging is on an upward trajectory, although forecasts vary due to differences in methodology and segmentation.

Global Market Growth

| Source | Market Size Estimates and Forecasts | Key Drivers |

| Future Market Insights | Market valued at USD 18.7 billion in 2025; expected to reach USD 36.4 billion by 2035 (CAGR 6.9 %). Pharmaceuticals & healthcare lead with a 46.5 % share. | Increasing demand for biologics, adoption of phase change materials, validated shippers, reusable systems and IoT integration. |

| Fortune Business Insights | Market valued at USD 28.14 billion in 2024, projected to USD 30.88 billion in 2025 and USD 64.49 billion by 2032 (CAGR 11.09 %). Europe held 33.58 % share in 2024. | Dominance of refrigerated transportation; growth of pharmaceuticals and biologics; expansions in Europe and Asia; innovations in packaging materials and design. |

| IMARC Group | Market worth USD 30.23 billion in 2024; expected to reach USD 74.38 billion by 2033 (CAGR 9.99 %). Europe has 33.7 % share. | Demand for fresh and frozen foods, strict regulations, advanced logistics infrastructure, sustainability initiatives and technology adoption like GPS, IoT and smart packaging. |

| Towards Packaging | Market size at USD 34.28 billion in 2024; projected to USD 89.84 billion by 2034 (CAGR 11.3 %). Expanded polystyrene (EPS) leads material segment; insulated containers dominate product segment. | Rising demand for temperature sensitive goods; technological advancements such as time temperature indicators and RFID; growth of reusable packaging; emphasis on sustainability. |

| Precedence Research (Temperature Controlled Packaging Solutions) | Market size USD 16.68 billion in 2025, forecast to USD 36.35 billion by 2034 (CAGR 9.04 %). North America holds 36.49 % share in 2024; insulated shippers account for 55.83 % share. | Growth driven by rising demand for fresh and frozen foods, pharmaceutical products, and rapid expansion of cold chain infrastructure. Major investors include Sonoco Products Company, Pelican Products Inc., AptarGroup Inc. and Danaher Corporation. |

Regional Highlights

North America: Strong demand from pharmaceuticals and food sectors drives growth. U.S. market size was USD 7.97 billion in 2024 and is projected to grow at 15.6 % CAGR between 2025 and 2030. Insulated containers led with 55.2 % share and cold packs are growing at 17.6 % CAGR.

Europe: Largest market share (around 33 %) due to strict food safety and pharmaceutical regulations, advanced logistics and sustainability initiatives.

Asia Pacific: Rapid growth driven by expanding cold storage infrastructure, rising disposable incomes and increasing demand for fresh produce and biologics. Countries like China and India invest in advanced packaging technologies.

Latin America and MEA: Emerging markets with growing cold chain infrastructure. Adoption of reusable packaging and IoT solutions is rising due to cost considerations and sustainability goals.

Emerging Trends and Opportunities

Reusable Packaging Expansion: Businesses increasingly adopt reusable shippers to reduce costs and waste. The reusable cold chain packaging market is projected to grow from USD 4.97 billion in 2025 to USD 9.13 billion by 2034.

Smart Packaging and AI: IoT sensors, time temperature indicators and AI algorithms enable real time monitoring, predictive maintenance and optimized routes.

Sustainable Materials: Companies develop biodegradable foams, seaweed based bioplastics and recyclable insulation to meet ESG goals. Regulatory pressure to reduce single use plastics drives this trend.

Phase Change and Vacuum Insulation Innovations: Advanced PCMs and hybrid VIP/PCM combinations extend thermal protection and reduce packaging weight.

Regional Expansion and Vertical Integration: Packaging companies expand into emerging markets like Asia Pacific and Latin America, often combining packaging with logistics and monitoring services. Some providers integrate warehousing, transport and packaging under one contract, simplifying customer relationships.

Strategic Acquisitions: Companies like Cold Chain Technologies acquiring Exeltainer and UPS acquiring cold chain logistics firms illustrate market consolidation.

Frequently Asked Questions

What’s the difference between cold chain packaging and regular packaging? Cold chain packaging is designed to maintain specific temperature ranges (e.g., frozen, chilled, ambient or cryogenic) throughout the shipping process, using insulated materials, refrigerants and monitoring devices. Regular packaging focuses on protecting products from physical damage and may not include thermal control.

How do I choose the right cold chain packaging company? Identify your product’s temperature requirements and shipment duration. Look for companies that offer pre qualified solutions, strong regulatory compliance, integrated monitoring and sustainability options. Evaluate whether you need reusable systems or single use shippers, and consider region specific capabilities and customer service.

Which companies lead the cold chain packaging market? Key players include Sonoco Products Company, Pelican BioThermal, Cold Chain Technologies, va Q tec AG, Softbox Systems, Cryopak, Sancell, Polar Tech Industries, CSafe, Sealed Air Corporation, Sofrigam, Intelsius, Orora Group, CREOPACK, Tempack, CoolPac, Nordic Cold Chain Solutions, Envirotainer and DGP Intelsius.

Why is reusability important? Reusable systems reduce waste and total cost of ownership over multiple shipments. They offer consistent performance and are often integrated with tracking technology. Adoption is growing as companies commit to sustainability goals and seek to minimize environmental impact.

How does IoT improve cold chain packaging? Sensors and real time data enable proactive interventions, reducing spoilage and ensuring regulatory compliance. Predictive analytics can detect potential failures and optimize routes, while smart labels provide instant temperature history.

Summary and Recommendations

Cold chain packaging companies are essential for protecting temperature sensitive products across pharmaceuticals, food, chemicals and life sciences. They design and supply insulated shippers, containers, refrigerants and monitoring devices that maintain temperature ranges from frozen to cryogenic levels. Market forecasts suggest rapid growth: estimates range from USD 18.7 billion in 2025 to over USD 89 billion by 2034, with CAGR values between 6.9 % and 11.3 %. Key drivers include increasing demand for biologics, vaccines, fresh foods, stricter regulations and technological innovations like PCMs, VIPs, IoT sensors and AI. Sustainable materials and reusable systems are gaining prominence as companies respond to environmental pressures and cost considerations.

Actionable advice:

Audit your product requirements and shipping lanes. Determine temperature ranges, transit times and regulatory obligations. Select packaging accordingly, balancing cost, performance and sustainability.

Engage with leading providers. Partner with reputable companies offering pre qualified solutions, integrated monitoring, and strong customer support. Evaluate their track record in your industry.

Invest in technology. Adopt IoT sensors, data logging and predictive analytics to monitor shipments, detect risks and optimize routes. Technology investments reduce waste and compliance burdens.

Consider reusable systems. Evaluate the total cost of ownership and environmental benefits of reusable containers. Use rental programs to trial reusable packaging without large capital outlays.

Stay informed on regulatory changes. Monitor updates to FDA, EMA and WHO guidelines. Work with suppliers who maintain up to date compliance and provide documentation.

About Tempk

Tempk is a trusted provider of cold chain logistics and packaging solutions. We specialize in designing and supplying temperature controlled packaging, including insulated shippers, refrigerated containers, phase change materials and monitoring devices. Our team of experts combines industry knowledge with the latest technology to ensure your products remain safe throughout the supply chain. We prioritize sustainability by offering reusable containers and eco friendly materials, helping clients reduce waste and meet ESG goals. With a global network and deep technical expertise, we help you navigate complex regulations, optimize operations and deliver critical goods with confidence.

Ready to improve your cold chain packaging? Contact our experts today to discuss customized solutions that fit your products and market. Whether you are shipping vaccines, gourmet seafood or cutting edge biologics, Tempk offers the support and technology you need to protect your shipments and grow your business.