How Does Cold Chain Frozen Food Logistics Keep Products Safe in 2025?

Last updated: 30 November 2025

Maintaining a robust cold chain frozen food logistics system has never been more important. In 2025 the global cold chain market is forecast to reach about USD 252.89 billion and the food and beverage segment alone could expand from roughly USD 90.81 billion in 2025 to USD 219.44 billion by 2034. Yet poor temperature control still causes roughly 14 % of the world’s food to be lost between harvest and retail. This guide explains how cold chain logistics protect frozen foods, outlines the latest market and technology trends, and provides practical steps to help you build a resilient supply chain. All recommendations are based on current research and regulatory guidance for 2025, so you can confidently safeguard quality and comply with evolving standards.

What cold chain frozen food logistics means and why it matters: learn how temperature controlled stages from harvest to retail preserve quality and reduce waste.

Temperature categories and food safety ranges: discover the differences between deep freeze, frozen, chilled and ambient zones and which foods they suit.

Market size, growth drivers and regulations: explore market projections, regional trends and the 2025 regulatory landscape including FSMA 204 and HACCP.

Technologies transforming frozen food logistics: compare IoT sensors, RFID, GPS and AI powered tools for real time visibility and predictive analytics.

Sustainability and future trends: see how green logistics, the move to −15 °C and plant based products are reshaping the industry.

Step by step best practices: follow actionable guidance for receiving, storing, packaging, transporting and monitoring frozen foods.

FAQs and recommendations: find answers to common questions and practical tips to improve your operations.

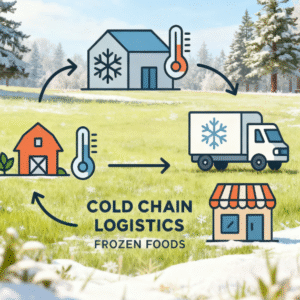

What Is Cold Chain Frozen Food Logistics and Why Is It Critical?

Cold chain frozen food logistics refers to a coordinated system of temperature controlled processes—from harvest and pre cooling to storage, transportation and delivery—that preserves the quality, safety and nutritional value of frozen foods. Without continuous temperature control, products thaw, microbes multiply and nutrient loss accelerates. MarketDataForecast estimates that nearly 14 % of global food is lost due to inadequate temperature management. The U.S. Census Bureau reported that more than USD 2.7 trillion worth of temperature controlled goods were shipped by truck in 2022, representing 90 % of all temperature controlled shipments—underscoring the scale and importance of cold chain logistics.

How the Cold Chain Works

At its core, cold chain logistics functions like a relay race: each stage must maintain the baton (temperature control) without delay. Typical stages include:

| Stage | What Happens | Why It Matters |

| Harvest & Pre cooling | Products are harvested or processed and quickly cooled to ideal storage temperatures. Pre cooling halts respiration and microbial growth. | Delays at this stage lead to rapid spoilage and quality losses. |

| Cold Storage | Goods are stored in refrigerated warehouses or distribution centres. In 2024, cold storage represented 55.66 % of the food cold chain market. | Provides bulk inventory buffer for meat, seafood and produce; improper storage causes hotspots and condensation. |

| Transportation | Products travel via refrigerated trucks, sea containers, railcars and air cargo. Real time monitoring ensures temperatures stay within set limits during multimodal transfers. | Any break in the chain leads to thawing, refreezing and product loss. |

| Distribution & Retail | Goods are unloaded, stored in staging areas and transferred to retail freezers. Consumer handling completes the chain. | Final transit must be quick to avoid thermal shock; labeling and documentation ensure traceability. |

Temperature Categories and Food Safety

Different foods require specific temperature ranges to maintain quality. Understanding these categories helps you choose the right equipment and packaging:

| Category | Range (°C/°F) | Typical Foods | What It Means for You |

| Deep freeze | Below −25 °C (−13 °F) | Ice cream, sushi grade seafood | Prevents ice crystals and preserves texture. |

| Frozen | −10 °C to −20 °C (−14 °F to 0 °F) | Frozen vegetables, meats | Maintains texture and prevents microbial growth. |

| Chilled | 2 °C to 4 °C (35 °F to 39 °F) | Fresh produce, dairy | Maintains crispness and inhibits bacterial growth. |

| Banana (special) | 12 °C to 14 °C (53 °F to 57 °F) | Bananas | Avoids browning and ensures quality. |

| Refrigerated | 2 °C to 7 °C (35 °F to 45 °F) | Fruits, dairy | Preserves freshness; maintain humidity to prevent dehydration. |

| Controlled ambient | 10 °C to 21 °C (50 °F to 70 °F) | Chocolate, wine | Prevents melting or chemical changes. |

Tips for maintaining temperature control:

Pre cool goods before loading. Reefer trailers maintain rather than create cold temperatures.

Control humidity. Monitor humidity to prevent condensation on produce and packaging.

Use validated thermal packaging. Gel packs, phase change materials and insulated containers maintain target temperatures.

Implement multi zone trailers. Separate compartments keep chilled and frozen items at distinct temperatures.

Stack products properly. Ensure airflow by leaving space around packages and avoiding blocked vents.

Equip monitoring devices. Temperature indicators and smart tags provide visual alerts if thresholds are exceeded.

Real world example: A citrus exporter installed insulated packaging and IoT sensors in reefer containers. Temperature data alerted staff when a truck door was left open, preventing spoilage and saving the shipment.

How Big Is the Market and Which Segments Are Growing?

The cold chain logistics sector is booming. Research from Custom Market Insights cited by Food Shippers of America notes that the global cold chain logistics market was valued at over USD 321 billion in 2023, projected to exceed USD 368 billion in 2024, and could surpass USD 1.245 trillion by 2033, reflecting a 14.5 % compound annual growth rate (CAGR). Fortune Business Insights provides a similar view: the market was USD 293.58 billion in 2023, is expected to reach USD 324.85 billion in 2024 and USD 862.33 billion by 2032 with a 13 % CAGR.

Market Drivers

Several factors fuel this growth:

Expanding global food trade: Demand for perishable foods and globalization require robust cold chain infrastructure to preserve quality.

E commerce and online grocery retail: More consumers order fresh and frozen foods online, increasing demand for temperature sensitive transportation and warehousing.

Technological advances: Blockchain traceability, IoT monitoring, advanced refrigeration and smart packaging improve transparency and reduce spoilage.

Emerging markets and urbanization: Rising incomes and urban populations in Asia and Latin America create opportunities for cold chain logistics.

Tightening regulations: FSMA, HACCP and similar rules impose stricter temperature monitoring and record keeping requirements.

Market Segmentation and Trends

Cold chain revenues come from both storage and transportation. In 2024 cold storage facilities commanded about 55.66 % of the food cold chain market. However, transportation is growing faster as providers invest in multi temperature fleets and last mile networks. Other notable trends include:

Chilled foods dominated revenue in 2024 with a 60.15 % share, while frozen foods are projected to see 15.49 % CAGR to 2030.

Regional growth: North America currently accounts for the largest share of cold chain logistics revenue, but Asia Pacific markets are expected to grow at more than 16 % CAGR due to rising incomes and e commerce adoption.

Plant based and specialty foods: A Maersk report notes that plant based protein products could capture 7.7 % of the global protein market by 2030 with a value over USD 162 billion. These products often come from small and medium producers that need reliable cold chain partners.

Pharmaceutical growth: Approximately 20 % of new drugs under development are gene and cell based therapies requiring ultra cold storage, and the pharmaceutical cold chain market may reach USD 1.454 trillion by 2029.

Investment in fresh food logistics: North America’s food cold chain logistics market is expected to reach USD 86.67 billion in 2025, reflecting the surge in direct to consumer delivery and last mile logistics.

What Regulations and Standards Govern Frozen Food Logistics in 2025?

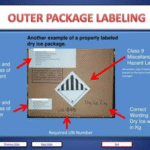

Regulatory compliance ensures both food safety and consumer confidence. The Food Safety Modernization Act (FSMA) Rule 204, Hazard Analysis and Critical Control Points (HACCP), Good Distribution Practices (GDP) and ISO 9001/22000 quality standards form the backbone of compliance. FSMA 204—also known as the Traceability Final Rule—requires companies handling high risk foods to record key tracking events (harvesting, packing, shipping, receiving) and key data elements (what, where, when, who), maintain digital records for at least two years and provide them to regulators within 24 hours. The compliance date, originally January 2026, was extended by 30 months to allow time for digital systems.

Key Regulatory Requirements

Record keeping: Maintain digital records of critical tracking events and provide data within 24 hours when requested.

Traceability lot codes: Assign unique codes to foods on the FDA’s Food Traceability List to enable rapid recalls.

HACCP plans: Identify hazards, establish critical temperature/time limits and develop corrective actions.

Documentation and vendor audits: Keep transaction history and audit suppliers to ensure temperature requirements are met.

Staff training: Train personnel on temperature control, documentation and emergency procedures.

Quality management systems (QMS): Document responsibilities, procedures and continuous improvement processes.

Complying with these regulations fosters transparency, reduces liability and helps companies qualify for government and retailer contracts.

Which Technologies Are Transforming Frozen Food Logistics?

The digital transformation of cold chain logistics centres on real time visibility and predictive analytics. Traditional monitoring relied on battery powered data loggers that record conditions for later retrieval, providing historical data but failing to prevent incidents. Modern systems integrate IoT based sensors, RFID, GPS tracking, BLE beacons and smart reefers that transmit data continuously via Wi Fi, cellular or LoRaWAN networks.

Comparing Monitoring Technologies

| Monitoring Method | Key Features | Limitations | Practical Use |

| Data loggers | Affordable devices record temperature and humidity; data downloaded via USB or NFC. | No real time alerts; manual retrieval delays response. | Good for compliance records and as backup in areas lacking connectivity. |

| IoT sensors | Send continuous data via wireless networks; integrate with cloud platforms for analytics. | Require robust network; higher costs and cybersecurity considerations. | Ideal for high value shipments needing proactive alerts. |

| RFID sensors | Passive tags with embedded temperature sensors; scanned at checkpoints. | Limited range; signal interference from metals or liquids. | Useful for pallet level tracking in warehouses. |

| GPS trackers | Combine location and temperature monitoring; provide route visibility and cargo security. | Require power and incur transmission costs. | Best for long haul shipments and theft prevention. |

| BLE sensors | Low energy devices transmit data to nearby gateways or smartphones. | Short range (30–100 m) and interference issues. | Cost effective for warehouses and last mile monitoring. |

| Smart reefers | Refrigerated containers with automated cooling and monitoring systems. | High energy consumption and maintenance costs. | Provide stable temperatures for ocean transport of pharmaceuticals and seafood. |

Benefits of real time monitoring: Continuous data allows operators to intervene when temperature excursions occur. Over 25 % of temperature excursions happen during last mile delivery, so real time alerts are crucial. The global cold chain monitoring market is forecast to grow from USD 6.8 billion in 2025 to USD 13.4 billion by 2032 (12.1 % CAGR).

Artificial Intelligence, Robotics and Predictive Analytics

Digitalization extends beyond sensors. AI and predictive analytics optimize routing, forecast demand and anticipate equipment failures. The Trackonomy report notes that automated storage and retrieval systems and robotic handlers reduce labour costs and errors, yet about 80 % of warehouses remain un automated. AI driven demand forecasting helps companies allocate inventory effectively, while predictive maintenance prevents costly equipment breakdowns. These technologies integrate with IoT data to refine decision making and deliver a holistic view of the supply chain.

Blockchain and Cloud Platforms

Blockchain enhances traceability by recording immutable transactions for each critical tracking event. Coupled with cloud platforms, blockchain enables secure sharing of temperature and location data across stakeholders. For example, a produce distributor used blockchain to assign lot codes and capture key data elements at harvest, packing and shipping. The company reduced recall response time from days to hours and satisfied auditors.

How Are Sustainability and Green Logistics Shaping the Frozen Food Chain?

Cold chain operations consume significant energy. Refrigeration accounts for roughly 15 % of global energy use, and the food cold chain infrastructure contributes around 2 % of global CO₂ emissions. With climate change intensifying and regulations tightening, sustainability has become a core priority.

Innovations in Green Logistics

The Emergent Cold LatAm report highlights that sustainability is no longer optional: cold chain operators must adopt greener practices, reduce carbon footprints and improve energy efficiency. Key initiatives include:

Renewable energy and energy management: Warehouses integrate solar panels and wind turbines; fleets adopt biofuels and electric vehicles.

Green refrigerants: Natural refrigerants such as CO₂ and ammonia replace high global warming potential HFCs. Regulatory phase outs accelerate conversions.

The Move to –15 °C initiative: A coalition of companies promotes increasing frozen food storage temperatures from −18 °C to −15 °C. Research suggests this shift could reduce energy consumption by around 10 % but may shorten shelf life by about 30 % and require thicker packaging.

Reusable and recyclable packaging: The reusable cold chain packaging market is projected to grow from USD 4.97 billion in 2025 to USD 9.13 billion by 2034, with companies deploying pallet shippers, insulated totes and collapsible crates. Sustainable materials like biodegradable films and recycled plastics reduce waste.

Reducing Food Loss and Waste

Each year more than 1 billion tons of food is wasted, contributing 8 10 % of global greenhouse gas emissions. Cold chain logistics plays a crucial role in preserving food quality and reducing losses. Effective practices—such as maintaining proper temperatures, controlling humidity, minimizing dwell time and integrating real time monitoring—help curb waste at every stage. Investing in modernized facilities and training also enhances resilience against extreme weather events and geopolitical disruptions.

Built to Suit Solutions and Resilience

High infrastructure and maintenance costs make outsourcing cold storage attractive. Built to suit (BTS) facilities tailor design to operational needs, optimizing efficiency and costs. Meanwhile, maintaining strategic stock and diversifying supply chains are essential to mitigate risks from shipping disruptions and port restrictions.

2025 and Beyond: Key Trends Shaping Frozen Food Logistics

Looking ahead, several trends will define the frozen food cold chain landscape:

Market changes and geopolitical pressures: Geopolitical unrest affects transit times and capacity availability; however, industry leaders report that cold chain logistics are becoming more resilient.

Stronger visibility: Investment in software that improves end to end visibility will continue, allowing companies to monitor shipments in real time and respond quickly to disruptions.

New products and plant based foods: Plant based, gluten free and organic products require specialized storage and transportation; small and medium producers seek logistics partners with strong networks and innovation capabilities.

Upgraded facilities: Ageing cold storage built 40–50 years ago is being replaced by modern, automated facilities with energy efficient systems and natural refrigerants. Regulatory phase outs of HFC refrigerants drive this upgrade.

Better distribution and last mile solutions: Proximity to customers—whether port centric for exports or closer to production areas—remains vital. Investments in large, automated facilities and last mile networks will grow to meet direct to consumer demand.

Automation and robotics: Warehouses are increasingly deploying automated storage and retrieval systems, robotic handlers and automated palletizers to address labour shortages and improve throughput.

End to end visibility and real time tracking: Wider adoption of IoT enabled tracking devices, cloud platforms and predictive analytics provides better control of location, temperature and humidity.

Modernizing infrastructure and energy efficiency: Investments in insulation, data collection, renewable energy and natural refrigerants upgrade ageing infrastructure.

Growth in pharmaceutical cold chain: Demand for biologics and gene/cell therapies drives expansion of ultra cold logistics.

Strategic partnerships and data integration: Collaboration among food manufacturers, packaging suppliers and technology providers enhances product development and resilience. By 2025, 74 % of logistics data is expected to be standardized, facilitating seamless integration.

Best Practices for Frozen Food Logistics

Ensuring product quality requires careful management at every stage of the supply chain. The following step by step guide synthesizes proven best practices from research and industry guides.

Receiving and Inspection

Inspect incoming goods: Check temperature and physical condition upon receipt; reject loads outside specified ranges.

Use temperature controlled staging areas: Keep a chilled staging area near loading docks to minimize exposure during transfer.

Label accurately: Include product type, lot code, storage requirements and expiration date.

Storage and Inventory

Zone warehouses: Separate storage areas by temperature category (chill, frozen, deep frozen).

Rotate inventory: Follow first in, first out (FIFO) principles to minimize aging stock.

Monitor humidity: Maintain humidity to prevent dehydration and condensation.

Implement warehouse management systems (WMS): Track inventory location, temperature and status in real time.

Packaging and Preparation

Select packaging based on journey: Choose active (mechanical cooling) or passive (gel packs, dry ice) solutions; hybrid approaches often work best.

Ensure sealing integrity: Use heat sealing or ultrasonic techniques calibrated for low temperatures to prevent freezer burn.

Control moisture: Dehydration or excess moisture can damage food; controlled humidity and faster freezing (e.g., IQF) minimize ice crystal formation.

Choose temperature resistant materials: Polyethylene and polypropylene blends offer flexibility and resistance to cracking; multi layer films add barriers against oxygen and moisture.

Keep packaging areas cool: Maintain lower ambient temperatures to reduce thermal shock when products exit freezers.

Loading and Transportation

Perform pre trip inspections: Drivers should verify reefer settings, fuel levels, door seals and sensor functionality.

Use multi zone or partitioned vehicles: Keep different foods at their specific temperatures.

Integrate route optimization: Use software to minimize transit time and avoid traffic; adjust for weather and road conditions.

Provide real time updates: Communicate estimated arrival times to customers and share alerts for any deviations.

Carry backup supplies: Include spare gel packs, dry ice and portable generators for emergencies.

Monitoring and Record Keeping

Employ layered monitoring: Combine IoT sensors for real time alerts with data loggers for backup records.

Leverage predictive analytics: Analyse temperature trends to forecast equipment failures and plan maintenance.

Integrate blockchain or cloud platforms: Ensure that temperature and location data are immutable and interoperable across partners.

Document breaches: If temperature excursions occur, document the duration, cause and corrective actions to support traceability.

Train staff: Provide role specific training on monitoring technologies, emergency procedures and regulatory requirements.

Continuous Improvement

Audit vendors: Conduct regular audits to verify supplier compliance and equipment calibration.

Review and update protocols: Periodically evaluate your quality management system and update procedures to incorporate new technologies and regulations.

Invest in infrastructure upgrades: Modernize insulation, refrigeration systems and data collection devices; consider renewable energy and natural refrigerants.

Build strategic partnerships: Collaborate with packaging suppliers, technology providers and third party logistics partners to broaden market reach and resilience.

Practical case study: A dairy processor reduced product returns by installing humidity sensors in refrigerated trailers. Monitoring moisture prevented condensation that caused labels to deteriorate, improving product appearance and customer satisfaction.

2025 Developments and Trends: A Quick Look

The table below summarises notable 2025 developments, innovations and their practical implications.

| Trend | Description | Practical Significance |

| Automation & Robotics | Adoption of automated storage and retrieval systems, robotic handling and palletizing. | Addresses labour shortages, reduces errors and improves throughput; 80 % of warehouses still lack automation. |

| Real Time Tracking & Visibility | Wider use of IoT sensors, cloud platforms and predictive analytics provides continuous monitoring. | Reduces spoilage and improves compliance; 25 % of temperature excursions occur in last mile delivery. |

| Sustainable Practices | Renewable energy, natural refrigerants, reusable packaging and the Move to −15 °C initiative. | Cuts energy consumption (10 % savings at −15 °C) but requires careful shelf life management. |

| Plant Based & Specialty Foods | Growing market for plant based, gluten free and organic foods; 7.7 % share of global protein market by 2030. | Requires cold chain partners experienced with small producers and specialized storage conditions. |

| Pharmaceutical Cold Chain | Rising demand for biologics and gene/cell therapies; market expected to reach USD 1.454 trillion by 2029. | Drives investments in ultra cold storage and precise temperature control. |

| Built to Suit & Resilience | Customised facilities and diversified supply chains mitigate disruptions. | Offers flexibility, cost optimisation and buffer against geopolitical or climate related shocks. |

FAQs About Cold Chain Frozen Food Logistics

Q1: What are the typical temperature ranges for frozen and deep frozen foods? Frozen products are kept between −10 °C and −20 °C (14 °F to 0 °F), while deep frozen goods like ice cream and seafood require temperatures below −25 °C. Maintaining these ranges prevents ice crystal formation and preserves texture.

Q2: How does the move from −18 °C to −15 °C affect frozen foods? Research suggests that increasing storage temperature to −15 °C can reduce energy consumption by about 10 % but may shorten shelf life by around 30 % and necessitate thicker packaging. Companies should evaluate product sensitivity and consider differentiated approaches for low , medium and high sensitivity foods.

Q3: Why is real time monitoring better than traditional data logging? Traditional loggers record temperature and humidity for later retrieval, whereas IoT sensors transmit data continuously and trigger alerts when temperatures drift outside acceptable ranges. Real time visibility allows immediate intervention, reducing spoilage and ensuring regulatory compliance.

Q4: What regulations apply to frozen food logistics in 2025? The FSMA 204 traceability rule, HACCP, GDP and ISO standards require digital record keeping, unique traceability codes, hazard analysis and staff training. Companies must maintain records for at least two years and provide data to regulators within 24 hours.

Q5: How can small producers benefit from cold chain logistics? Small and medium producers—particularly those in plant based or niche markets—can leverage third party cold chain providers with advanced monitoring and distribution networks. Strategic partnerships provide expertise, extend market reach and ensure compliance.

Summary and Recommendations

Cold chain frozen food logistics underpin food safety, quality and market expansion. Key takeaways include:

Invest in comprehensive temperature management. Implement pre cooling, multi zone storage and validated packaging to maintain safe temperature ranges.

Leverage digital technologies. Use IoT sensors, GPS, RFID and cloud platforms for real time monitoring and predictive analytics; supplement with data loggers for redundancy.

Stay compliant. Adopt FSMA 204 traceability measures, HACCP plans and ISO based quality systems; maintain digital records and train staff.

Pursue sustainability. Upgrade facilities with renewable energy and green refrigerants; consider the Move to –15 °C while evaluating product specific impacts.

Plan for resilience. Diversify supply chains, invest in built to suit facilities and adopt automation to withstand geopolitical and climatic disruptions.

Actionable Next Steps

Map your product needs by listing all items and their ideal temperature and humidity requirements.

Assess your infrastructure and plan upgrades (insulation, refrigeration, renewable power). Evaluate new packaging solutions for durability and sustainability.

Pilot a monitoring system using IoT sensors integrated with your WMS or TMS; start with a high value product line to demonstrate ROI.

Train your team on proper loading, monitoring and record keeping. Develop contingency plans for equipment failure or delays.

Consult experts for built to suit facilities or to design custom cold chain solutions. Collaborative partnerships can unlock new markets and build resilience.

About Tempk

Tempk is a global innovator in cold chain solutions, offering reusable insulation systems, ice packs and smart packaging designed to keep products at precise temperatures. Our research and development centre focuses on eco friendly cold chain products and we are certified under Sedex and other quality programs. Our solutions are used across food, pharmaceutical and biotech industries, helping clients reduce waste, comply with regulations and improve customer satisfaction.

Call to Action: Interested in enhancing your cold chain operations? Contact Tempk’s experts for a custom assessment and discover how our reusable packaging and smart monitoring systems can protect your frozen foods.